Small Estate In Pa

Description

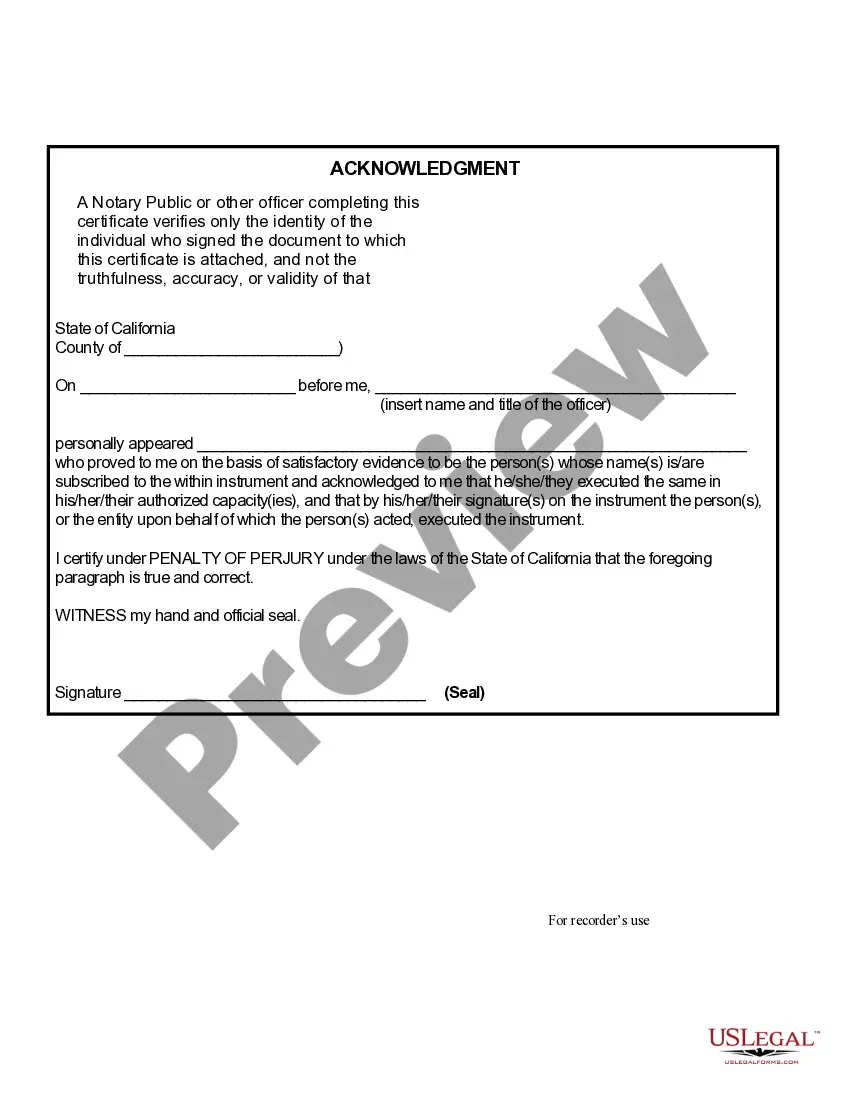

How to fill out California Affidavit For Collection Of Personal Property - Probate Code Section 13100 - Small Estates Under $208,850?

Locating a reliable source for obtaining the most up-to-date and pertinent legal templates constitutes a significant part of navigating bureaucracy. Securing the appropriate legal documents demands accuracy and careful attention, which is why it's essential to obtain samples of Small Estate In Pa exclusively from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and prolong the issue you face. With US Legal Forms, you can rest easy. You have the ability to review all the specifics regarding the document’s applicability and importance for your circumstances and within your state or county.

Follow these steps to complete your Small Estate In Pa.

Eliminate the complications associated with your legal documentation. Explore the extensive collection at US Legal Forms to find legal templates, assess their relevance to your case, and download them instantly.

- Utilize the catalog browsing or search option to locate your sample.

- Examine the form’s details to determine if it meets the criteria of your state and county.

- Preview the form, if available, to confirm that the template is indeed what you are looking for.

- Return to the search and find the suitable template if the Small Estate In Pa does not align with your needs.

- If you are confident about the form’s applicability, download it.

- As an authorized user, click Log in to verify and access your selected forms in My documents.

- If you lack an account, click Buy now to acquire the form.

- Select the pricing plan that best fits your requirements.

- Proceed with the registration to complete your purchase.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Select the file format for downloading Small Estate In Pa.

- After obtaining the form on your device, you can modify it with the editor or print it out to fill in manually.

Form popularity

FAQ

A small estate in Pennsylvania qualifies if the total value of the assets is $50,000 or less, excluding real estate. This amount encompasses all personal belongings, bank accounts, and other assets. Beneficiaries can leverage the small estate procedure to expedite asset access, minimizing delays. Understanding these qualifications is vital for those dealing with a small estate in PA.

When someone dies without a will in Pennsylvania, their estate is distributed according to state intestacy laws. Generally, this means assets go to the closest relatives, starting with the spouse and children. If there are no direct heirs, the estate can pass to further relatives. In any case, navigating this process may require guidance, and US Legal Forms can assist you with the necessary forms.

Non-probate property in Pennsylvania includes assets that transfer directly upon death and do not require probate. Common examples include life insurance policies, retirement accounts, and jointly owned real estate with rights of survivorship. This type of property simplifies the transition of assets and can be a significant part of a small estate in PA. Understanding what qualifies as non-probate property can help you plan more effectively.

Yes, an estate can often be settled without probate in Pennsylvania if it qualifies under the small estate rule. If the total assets are below $50,000, heirs can utilize an Affidavit of Small Estate to claim assets directly. This avoids the lengthy probate process and ensures a quicker resolution. US Legal Forms provides resources to guide you through this process effectively.

Creating an estate isn't always necessary when someone passes away in Pennsylvania. If the deceased's assets fall within the small estate rule, beneficiaries can often access the property without formal estate creation. However, if the assets exceed the small estate limit, an estate must be established to handle the legal distribution. Always assess the estate's total value before determining your next steps.

The small estate rule in Pennsylvania allows for an expedited process for estates valued under $50,000. This rule simplifies the legal requirements, making it easier to transfer assets without going through full probate. This is particularly beneficial for families looking to settle a small estate in PA quickly and efficiently. By using this rule, you can access the deceased's funds with minimal hassle.

In Pennsylvania, the threshold for probate is typically set at $50,000 for estates without real estate. This means, if the total value of the estate is below this amount, you may qualify for simplified estate processing. By staying under this limit, you can save time and potentially reduce costs associated with a traditional probate process. Understanding this threshold is crucial for navigating a small estate in PA smoothly.

To fill out an affidavit of inheritance, provide the details of the deceased, including their name, date of death, and last known address. Next, list the heirs and their relationships to the deceased. This form declares to the court that you are entitled to inherit, streamlining the asset transfer process. USLegalForms offers convenient templates to assist you in completing this document accurately.

A small estate in PA is defined as one that meets specific value limits, allowing for a simpler transfer of assets without the lengthy probate process. In contrast, a probate estate must undergo formal court procedures to validate the will and oversee the distribution of assets. Understanding this difference can help you decide the best course of action for your situation.

To fill out an affidavit example, begin by stating your name and address at the top. Then, provide facts relating to your claim, referencing any relevant documents that support your statements. Remember to sign and date the affidavit in front of a notary. For more tailored examples regarding small estate matters in PA, check available resources on USLegalForms.