California Llc Foreign Registration

Description

How to fill out California Limited Liability Company LLC Formation Package?

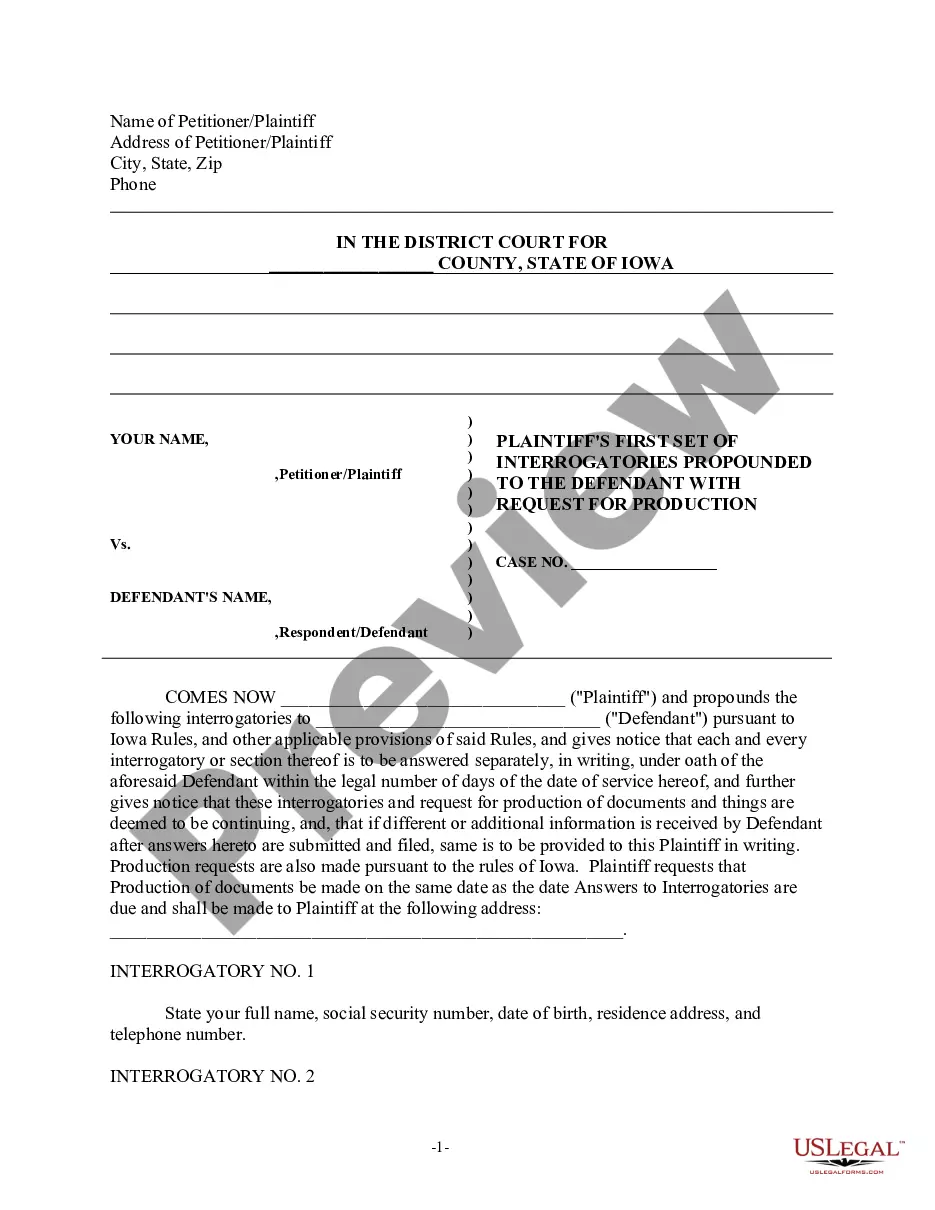

The California LLC Foreign Registration displayed on this page is a reusable legal document created by experienced attorneys in compliance with federal and state laws.

For over 25 years, US Legal Forms has served individuals, businesses, and legal experts with more than 85,000 validated, state-specific forms for every business and personal scenario. It’s the fastest, easiest, and most reliable method to acquire the documents you require, as the service ensures the utmost level of data protection and antivirus security.

Subscribe to US Legal Forms to have authenticated legal templates ready for all of life's scenarios.

- Examine the document you require and review it.

- Browse the sample you searched for and preview it or read the form description to confirm it meets your requirements. If it doesn’t, utilize the search feature to find the correct one. Click Buy Now when you have found the template you need.

- Register and Log In.

- Choose the pricing option that fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the editable template.

- Select the format you wish for your California LLC Foreign Registration (PDF, DOCX, RTF) and save the document to your device.

- Fill out and sign the document.

- Print the template to fill it out by hand or use an online multi-functional PDF editor to quickly and accurately complete and sign your form.

- Re-download your documentation as needed.

- Use the same document again when required. Open the My documents section in your profile to retrieve any previously purchased forms.

Form popularity

FAQ

California's LLC Act requires foreign LLCs to register with California if they transact business within the state. When a company has a physical presence in the state, it must collect sales tax on its sales to residents of that state.

Fees for Foreign LLCs in California The Franchise Tax Board requires a minimum yearly tax of $800 to be paid by LLCs in California. All LLCs must file a tax return with the state of California and pay this tax if they are determined to be transacting business in California, as explained earlier.

You can register a foreign (out-of-state) corporation in California by filing a Statement and Designation by Foreign Corporation (Form S&DC-S/N), along with a Certificate of Good Standing, to the Secretary of State's office. The fee is normally $100.

You will need a Certificate of Good Standing from your home state in order to register a foreign LLC in California. The Certificate must be current (no older than six months). You can obtain a Certificate from your local Secretary of State's office.