An amendment to a document is a change in a legal document made by adding, altering, or omitting a certain part or term. Amended documents, when properly executed (signed by all parties concerned), retain the legal validity of the original document.

California Amended and Restated Deed of Trust Securing a Debt between Individuals

Description

Key Concepts & Definitions

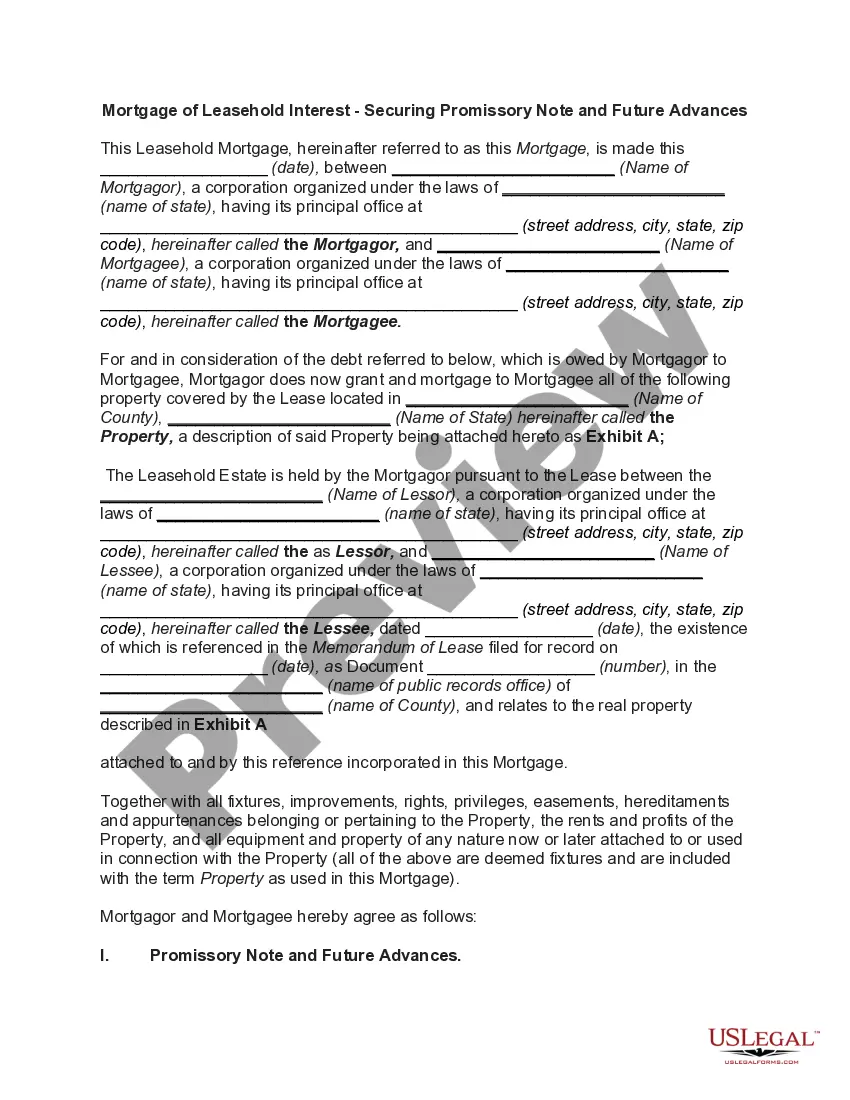

Amended and Restated Deed of Trust Securing a Debt: This is a legal document that modifies and replaces a previously recorded deed of trust. It outlines the terms of a mortgage loan secured by real estate property. When conditions or parties change, such as in a trust modification, this instrument allows the changes to be officially incorporated into the trust deed. Common related keywords include: deed trust, trust securing debt, amended restated, and securing debt individuals.

Step-by-Step Guide to Amending and Restating a Deed of Trust

- Review Current Deed: Obtain a copy of the current deed of trust and review its terms and obligations.

- Determine Changes: Identify necessary changes such as adjustments to the loan amount, repayment schedule, or parties to the deed.

- Engage Legal Help: Consult with a real estate attorney in Corona, California, or wherever the property is located, to help draft the amended and restated deed that complies with local laws.

- Sign New Deed: Have all parties sign the new deed in the presence of a notary.

- Record the Deed: File the amended and restated deed with the appropriate local government office to make it official.

Risk Analysis

- Legal Risks: If the amended deed is not correctly drafted, signed, or recorded, it could be deemed invalid, which might lead to serious legal complications.

- Financial Risks: Incorrect terms might result in unfavorable conditions that could affect the financial health of the individuals securing debt.

- Credit Risks: Errors or misrepresentations in the credit information that affects the mortgage loan could impact credit ratings negatively.

Best Practices

- Accuracy of Information: Ensure all credit information and legal descriptions in the deed are accurate.

- Use of Professionals: Engage professionals proficient in real estate laws in the local area, particularly if altering property deeds in specialist regions like Corona, California.

- Website Traffic Considerations: When recording changes in trust deeds, maintain private and confidential information securely, especially when transacting or communicating over the internet.

Common Mistakes & How to Avoid Them

- Misunderstanding Terms: Fully understand the terms of the original and amended deeds to avoid conflicts and errors. Consider professional legal guidance.

- Delay in Recording: Quickly record any amendments to avoid legal issues related to property claims or discrepancies.

- Ignoring State Laws: Since real estate laws vary significantly across states, always verify the specific requirements for amending and restating deeds in your state or locality.

How to fill out California Amended And Restated Deed Of Trust Securing A Debt Between Individuals?

If you are looking for exact copies of the California Amended and Restated Deed of Trust Securing a Debt between Individuals, US Legal Forms is exactly what you need; find documents created and reviewed by state-authorized legal professionals.

Utilizing US Legal Forms not only alleviates concerns regarding legal documentation; you also conserve time, effort, and financial resources! Downloading, printing, and submitting a professional form is significantly less expensive than hiring legal counsel to do it for you.

And that is all. In just a few simple steps, you will have an editable California Amended and Restated Deed of Trust Securing a Debt between Individuals. Once you create your account, all future purchases will be processed even more easily. After obtaining a US Legal Forms subscription, simply Log In to your profile and click the Download button you see on the form's page. Then, when you need to access this document again, you will always be able to find it in the My documents menu. Don't waste your time and energy comparing countless forms across various sites. Purchase accurate copies from a single reliable platform!

- To begin, complete your registration process by providing your email and creating a secure password.

- Follow the instructions below to set up your account and obtain the California Amended and Restated Deed of Trust Securing a Debt between Individuals template to address your needs.

- Utilize the Preview option or examine the document description (if available) to ensure that the template is the one you require.

- Verify its applicability in your jurisdiction.

- Click Buy Now to place your order.

- Select a preferred pricing plan.

- Create your account and pay via your credit card or PayPal.

- Choose an appropriate format and save the document.

Form popularity

FAQ

When a trust is amended and restated, it involves making changes to the original trust document while incorporating all modifications into a single new document. This process allows for better clarity and updated terms that reflect the current intentions of the trust creator. It simplifies administration and helps avoid confusion with multiple amendments. Utilizing a California Amended and Restated Deed of Trust Securing a Debt between Individuals can streamline this process and ensure all parties understand the current obligations.

An invalid deed means that the document does not create a legal transfer of property ownership. This may occur due to errors in the deed, lack of consent from the parties involved, or failure to follow necessary legal formalities. When a deed is declared invalid, it can create significant complications regarding property rights and interests. Therefore, ensuring that a California Amended and Restated Deed of Trust Securing a Debt between Individuals is properly executed is essential for avoiding such issues.

When the debt secured by a deed of trust is satisfied, the lender must officially release the lien on the property. This process typically involves recording a document called a 'Reconveyance,' which removes the deed of trust from public records. Once the reconveyance is filed, the borrower gains full ownership of the property without any claims from the lender. A California Amended and Restated Deed of Trust Securing a Debt between Individuals highlights this crucial step to ensure clear property title.

A trust in California can be invalidated for several reasons, such as lack of proper execution or failure to meet legal requirements. If the trust document does not comply with state laws or if the trust creator lacked the mental capacity to create the trust, it can also be deemed invalid. Moreover, if the trust is established under fraudulent circumstances, such as coercion or undue influence, it may be invalidated. Understanding these factors is crucial when dealing with a California Amended and Restated Deed of Trust Securing a Debt between Individuals.

A deed of trust can be deemed invalid in California for several reasons, including lack of proper execution or failure to meet legal requirements. If the California Amended and Restated Deed of Trust Securing a Debt between Individuals is not signed by all necessary parties, or if essential disclosures are missing, this can invalidate the deed. Additionally, improper notarization or failure to record the deed could also lead to challenges in its validity. Ensuring compliance with all regulations is crucial for safeguarding your interests.

A trust in California can avoid property tax reassessment by adhering to specific rules established under Proposition 13. Generally, if the property remains within the trust and is transferred solely to eligible beneficiaries, reassessment is not triggered. Engaging legal guidance on utilizing a California Amended and Restated Deed of Trust Securing a Debt between Individuals can help you navigate these regulations seamlessly.

In California, a trustee may sell trust property to himself, but this transaction requires transparency and careful adherence to the law. The trustee must disclose all relevant information to the beneficiaries and obtain their consent. This ensures fairness and prevents any conflicts of interest. If you are navigating such situations, consider using a California Amended and Restated Deed of Trust Securing a Debt between Individuals for clearer arrangements.

Transferring assets out of an irrevocable trust can be challenging, as the terms of the trust usually prevent changes once established. However, under certain circumstances, you may be able to access funds or assets if the trustee agrees. Consulting legal experts about a California Amended and Restated Deed of Trust Securing a Debt between Individuals may offer insights on handling specific situations regarding trust assets.

In California, the trustee manages the property in a trust on behalf of the beneficiaries. While the trust holds legal title to the property, the actual ownership belongs to the beneficiaries as outlined in the trust document. It’s essential to clarify these terms to avoid misunderstandings about property rights. A California Amended and Restated Deed of Trust Securing a Debt between Individuals can help clarify ownership and responsibilities.

To transfer property from a trust to an individual in California, you typically need to prepare a deed that correctly describes the property. You will then sign the deed in front of a notary and record it with the county recorder's office. This process ensures the transfer is legally recognized. Utilizing a California Amended and Restated Deed of Trust Securing a Debt between Individuals can help simplify this process.