Right Of Survivorship In Joint Tenancy

Description

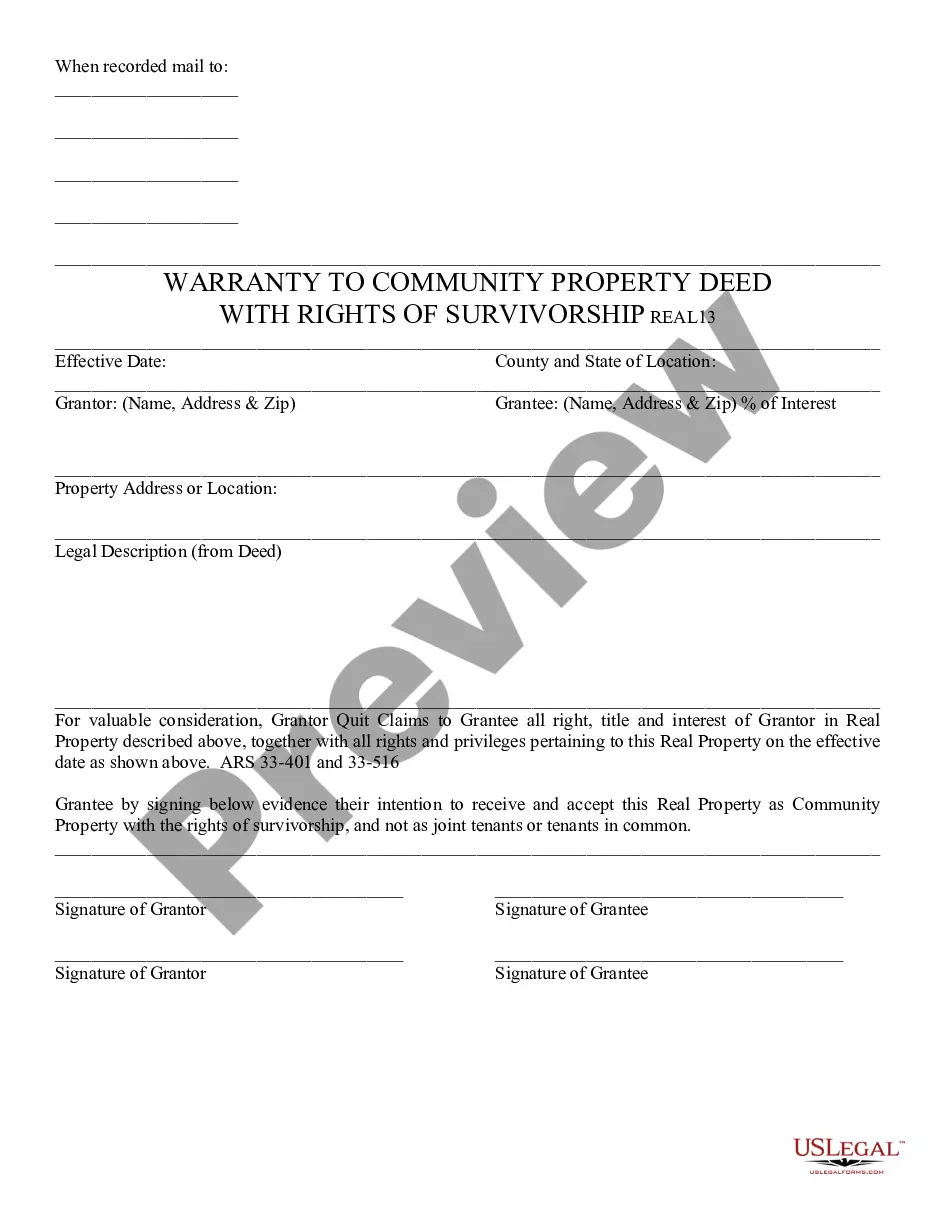

How to fill out Arizona Warranty Deed To Community Property With Rights Of Survivorship?

The Right Of Survivorship In Joint Tenancy you see on this page is a multi-usable legal template drafted by professional lawyers in accordance with federal and local laws and regulations. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the quickest, most straightforward and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Right Of Survivorship In Joint Tenancy will take you just a few simple steps:

- Search for the document you need and review it. Look through the sample you searched and preview it or check the form description to confirm it satisfies your needs. If it does not, utilize the search option to find the appropriate one. Click Buy Now when you have found the template you need.

- Sign up and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Choose the format you want for your Right Of Survivorship In Joint Tenancy (PDF, Word, RTF) and save the sample on your device.

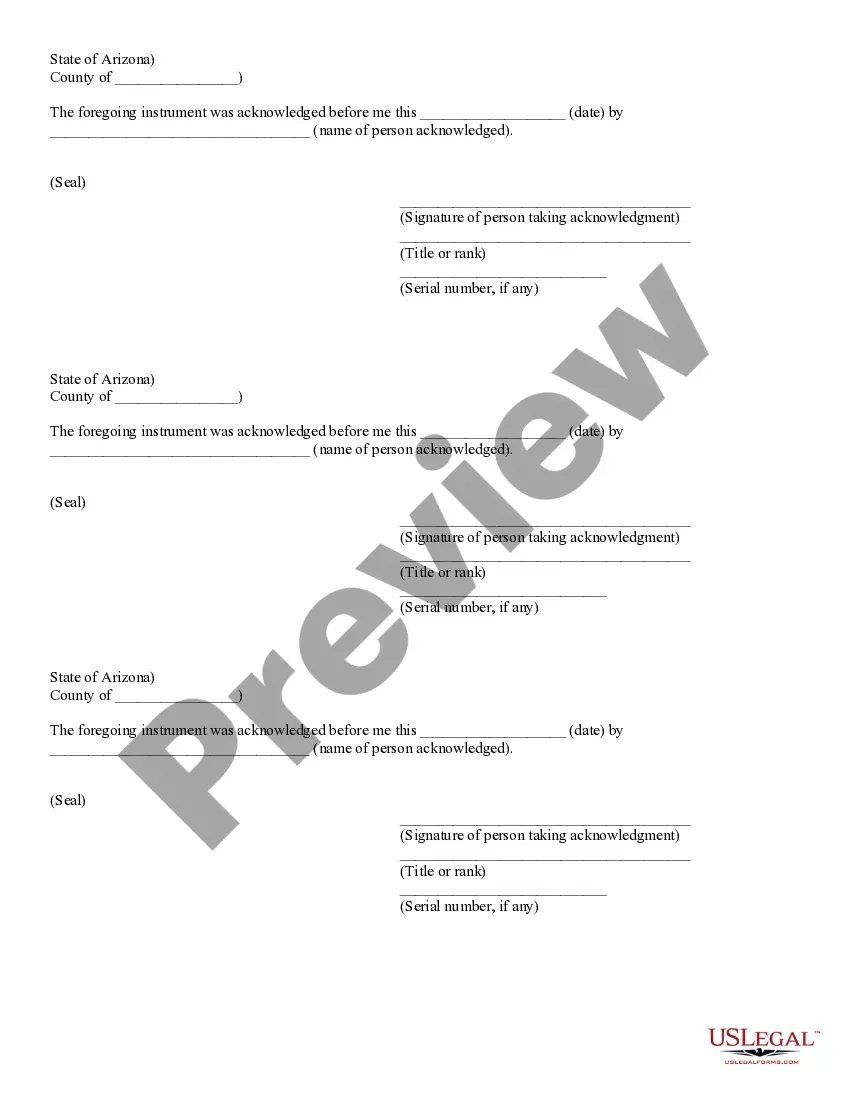

- Complete and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a valid.

- Download your papers one more time. Make use of the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

For spouses: Assets in JTWROS accounts may get a step-up on cost basis when either spouse passes away. This can help reduce capital gains taxes when selling a property, but you can only step-up half of the full value of the asset. This 50% step-up represents the portion owned by the joint owner who died.

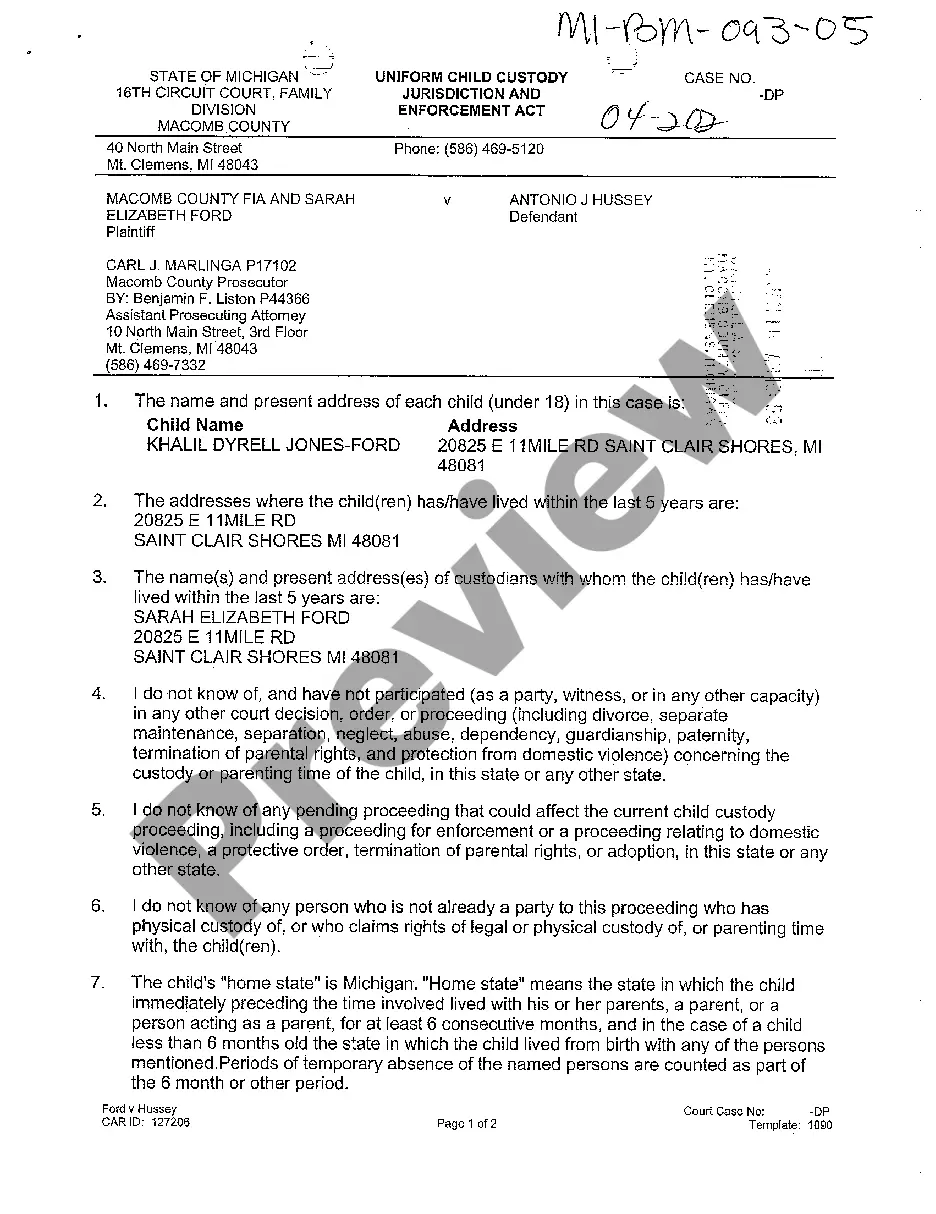

Under the right of survivorship, each tenant possesses an undivided interest in the whole estate. When one tenant dies, the tenant's interest disappears and the others tenants' shares increase proportionally and obtain the rights to the entire estate.

It provides several advantages, such as automatic transfer of ownership, equal ownership, protection of property, and tax benefits. However, disadvantages include limited applicability, no control over inheritance, the potential for disputes, and limited flexibility.

For example, if two people, Mark and Amanda, own a property together and Mark dies, then Amanda will become to sole owner of the property even if this is not detailed in the will because the two of them purchased the property together.

With joint tenancy? the right of survivorship is implied, so if one joint tenant dies, the other joint tenant or tenants automatically become the owners of the deceased tenant's interest in the property without the property having to pass through probate.