Promissory Note Template Arizona With Notary

Description

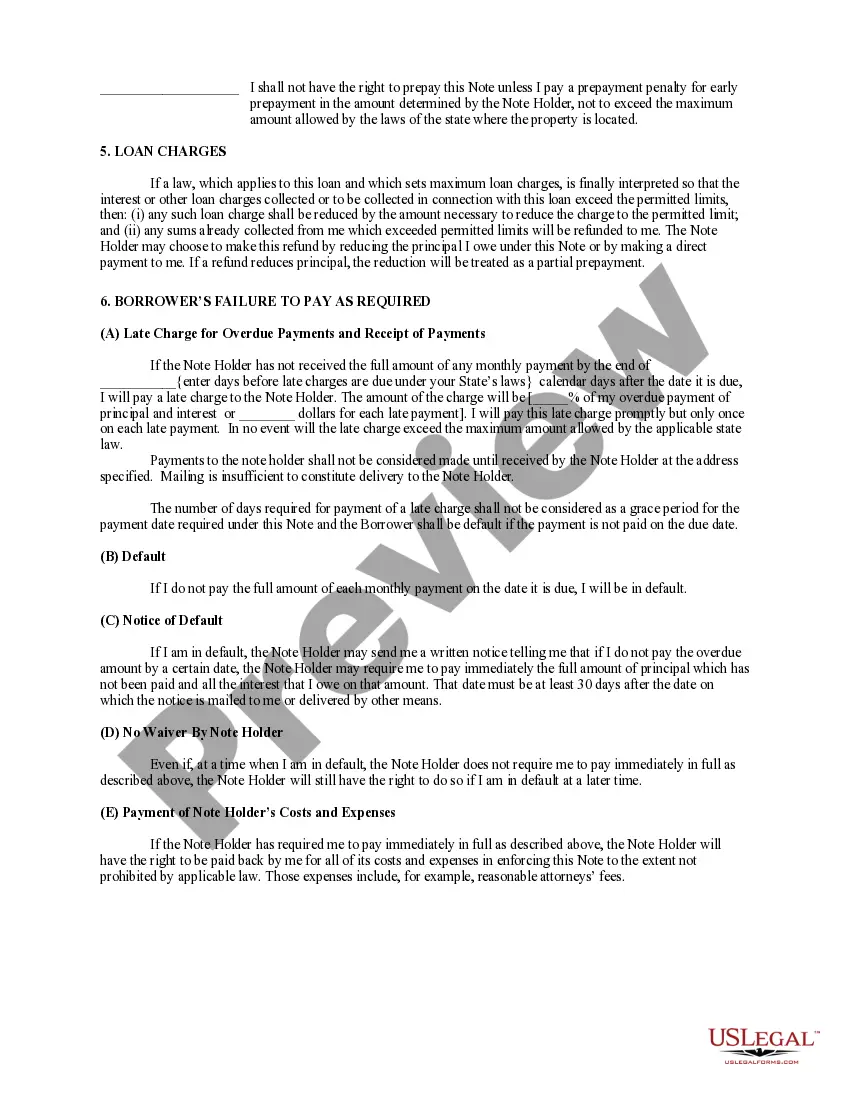

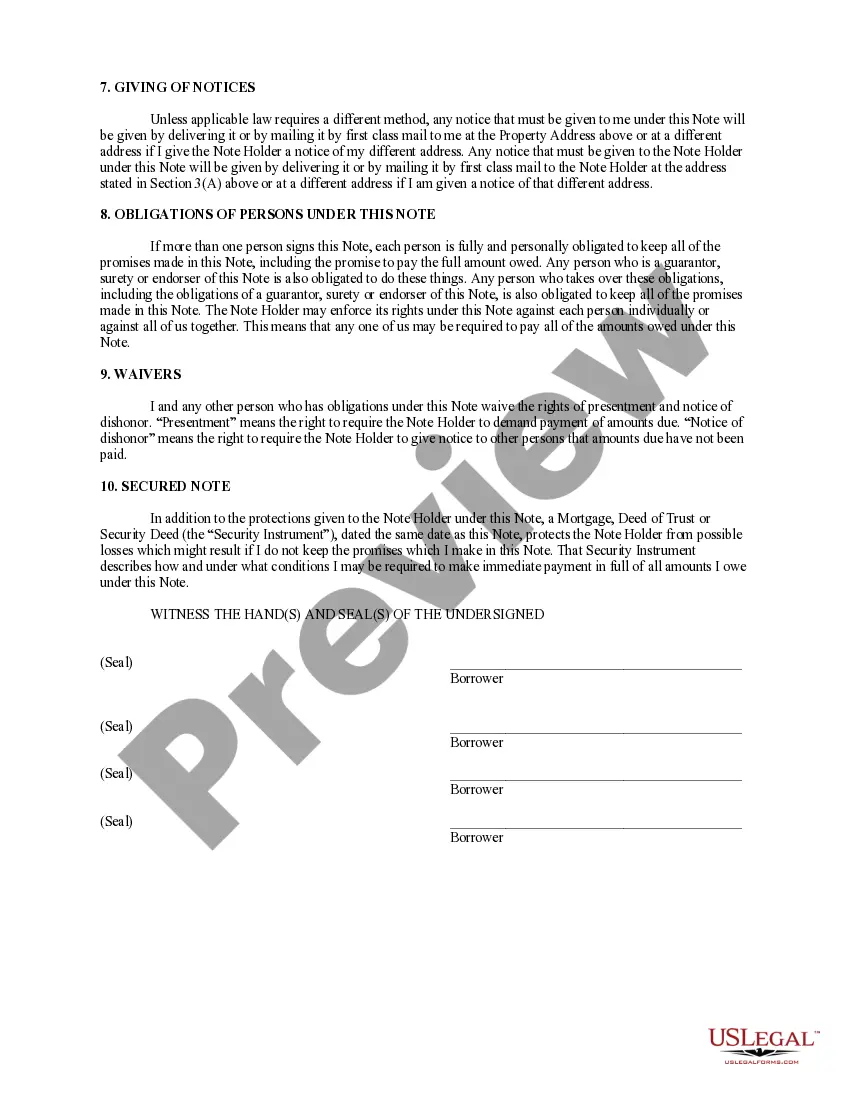

How to fill out Arizona Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Whenever you are required to submit a Promissory Note Template Arizona With Notary that conforms to your local state's statutes and regulations, there can be many alternatives to select from.

There’s no requirement to scrutinize every form to ensure it meets all the legal stipulations if you are a subscriber of US Legal Forms.

It is a dependable service that can assist you in obtaining a reusable and current template on any topic.

Utilizing expertly composed official documents is seamless with US Legal Forms. Moreover, Premium users can also take advantage of the robust integrated tools for online PDF editing and signing. Try it out today!

- US Legal Forms is the most extensive online repository with a collection of over 85k ready-to-use documents for business and individual legal matters.

- All templates are verified to adhere to each state’s regulations.

- Thus, when downloading Promissory Note Template Arizona With Notary from our platform, you can be assured that you have a valid and current document.

- Obtaining the necessary sample from our portal is very straightforward.

- If you already possess an account, simply Log In to the system, verify your subscription status, and save the selected file.

- Later, you can access the My documents tab in your profile to retain access to the Promissory Note Template Arizona With Notary at any time.

- If it’s your initial encounter with our library, please follow the steps below.

- Examine the recommended page and verify it for alignment with your specifications.

Form popularity

FAQ

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

In any event, a promissory note does not have to be notarized to be binding. The private respondents have admitted signing the two notes and they have not succeeded in proving that they did so "under duress, fear and undue influence."

There is no legal requirement for a promissory note to be witnessed or notarized in Arizona. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.