Resale Certificate For Alabama

Description

How to fill out Alabama Sale Of A Business Package?

Legal documents handling may be daunting, even for experienced experts.

When you are looking for a Resale Certificate For Alabama and don't have the opportunity to dedicate time to find the accurate and updated version, the process can be taxing.

Access a resource library of articles, guides, and materials related to your situation and needs.

Conserve time and effort in locating the documents you require, and leverage US Legal Forms’ sophisticated search and Preview feature to find Resale Certificate For Alabama and download it.

Select Buy Now when you are ready. Choose a monthly subscription plan. Locate the file format you desire, and Download, complete, eSign, print, and deliver your documents. Benefit from the US Legal Forms online catalog, backed by 25 years of experience and reliability. Simplify your daily document management into a straightforward and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to see the documents you have previously stored and organize your folders as necessary.

- If this is your first experience with US Legal Forms, create a no-cost account and gain unlimited access to all features of the platform.

- Here are the steps to follow after obtaining the form you need.

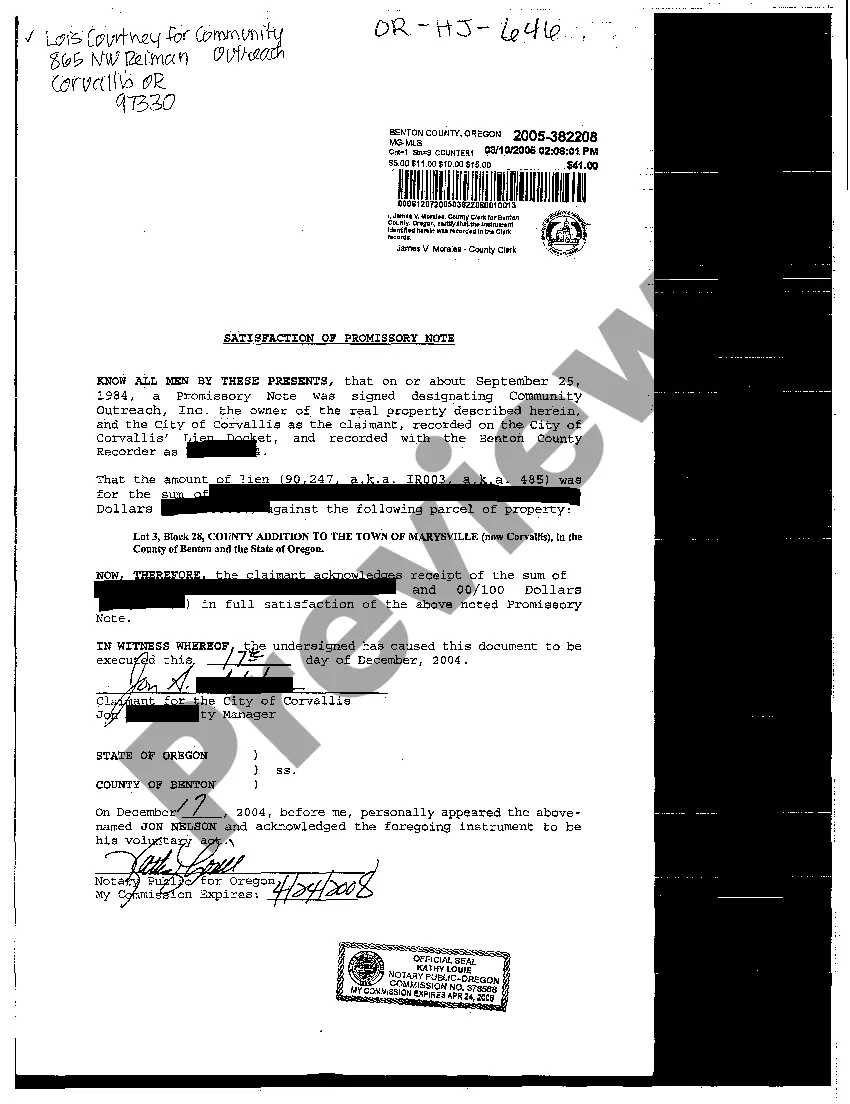

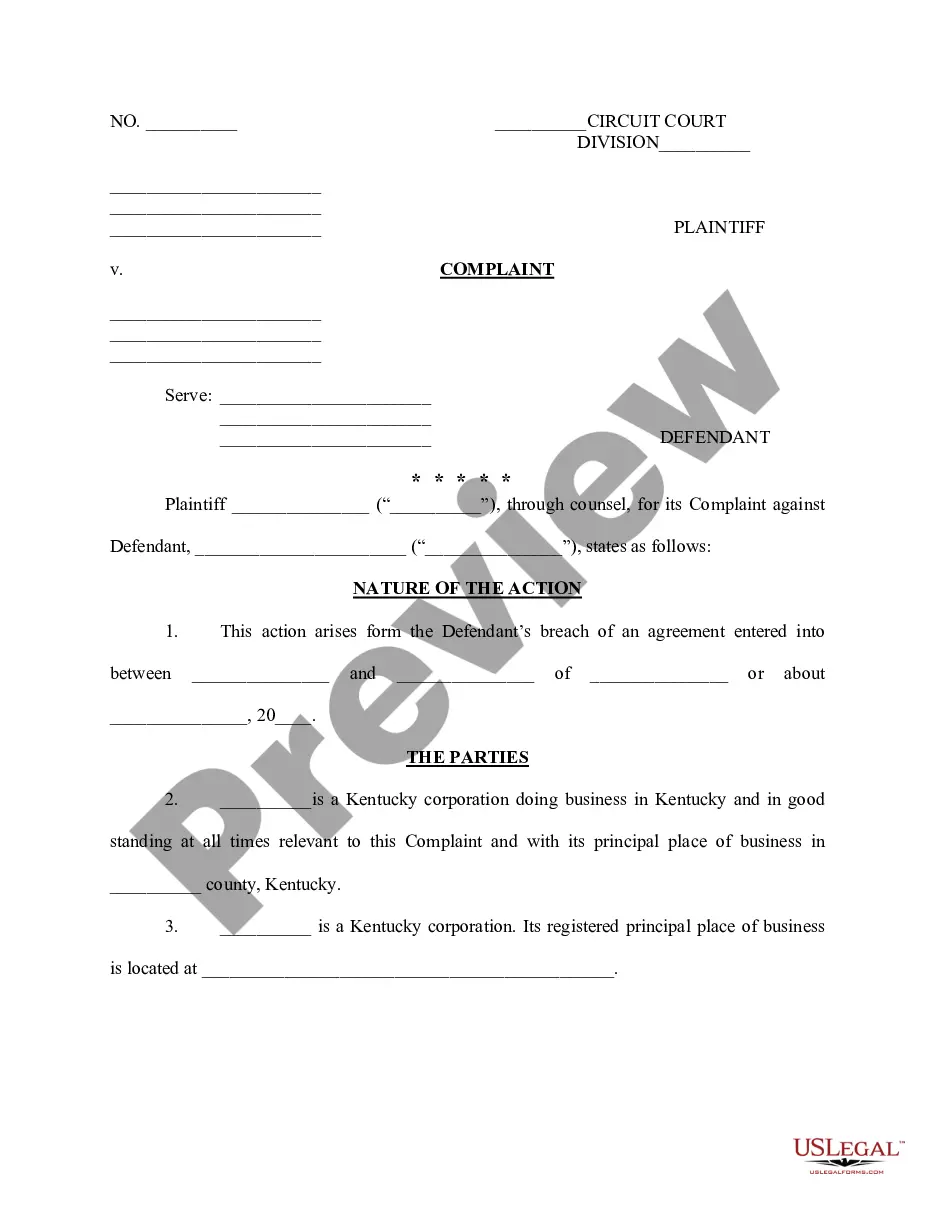

- Verify that this is the correct document by previewing it and reviewing its description.

- Ensure that the template is recognized in your state or county.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any requirements you might have, from personal to professional paperwork, all in one location.

- Utilize advanced tools to complete and manage your Resale Certificate For Alabama.

Form popularity

FAQ

You must complete the appropriate application found on the website at .revenue.alabama.gov. The applicable form will be ST: EX-A1 (For Wholesalers, Manufacturers, and Other Product Based Exemptions) or ST: EX-A1-SE (For Statutorily Exempt Entities).

Alabama Visit My Alabama Taxes. Click ?Verify a Resale Certificate? Choose whether to enter your customer's Federal Employee ID Number (FEIN), Individual Tax ID Number (ITIN), or Social Security Number (SSN) and enter it. Enter the customer's Exempt Sales Account Number.

Alabama. Resale certificates in Alabama are available using the Alabama Certificate of Exemption (Form ST-EX-A1). Expiration Date:Does not expire unless there is a change in operations.

Unlike other states where you have to apply for and obtain a resale certificate to present to vendors and suppliers to receive tax-free goods, you just need to provide a copy of your current sales tax permit. However, while most vendors will waive Alabama taxes, the state does not require them to do so.

To get a resale certificate in Alabama, you may complete the Alabama Application for Certificate of Exemption (Form ST-EX-A1).