Alabama Resale Certificate With Example

Description

How to fill out Alabama Sale Of A Business Package?

Regardless of whether it's for corporate needs or private matters, everyone must confront legal matters at some stage in their lifetime.

Completing legal documents requires meticulous care, beginning with selecting the appropriate form example.

With an extensive catalog of US Legal Forms available, you won’t need to waste time hunting for the right template online. Utilize the library's user-friendly navigation to discover the suitable template for any circumstance.

- For example, if you select an incorrect version of an Alabama Resale Certificate With Example, it will be rejected upon submission.

- Thus, it is vital to obtain a trustworthy source of legal documents like US Legal Forms.

- If you need an Alabama Resale Certificate With Example template, adhere to these straightforward steps.

- Utilize the search box or the directory to find the template you require.

- Review the description of the form to ensure it suits your situation, state, and locality.

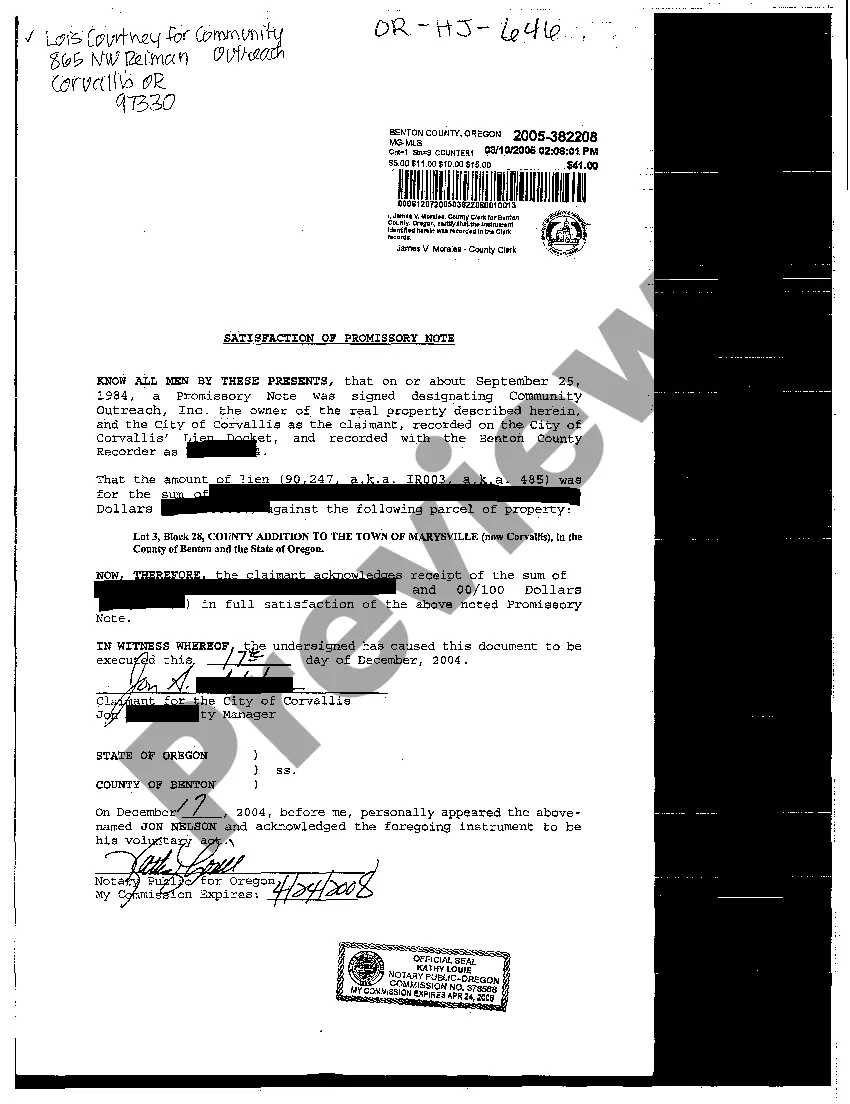

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search feature to find the Alabama Resale Certificate With Example template you need.

- Download the file if it aligns with your requirements.

- If you possess a US Legal Forms account, click Log in to access documents you have previously saved in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Select the appropriate payment option.

- Complete the profile registration form.

- Choose your payment method: credit card or PayPal account.

- Select the desired format of the document and download the Alabama Resale Certificate With Example.

- After downloading, you can complete the form using editing software or print it out to fill it in manually.

Form popularity

FAQ

Alabama requires you to register for a sales tax permit in order to purchase items in-state tax free for resale unless you are a dropshipper. If you are dropshipping, Alabama will accept your home-state exemption certificate.

In the state of Alabama, it is not required to complete a resale certificate form. Instead, it is only necessary to provide a copy of the Alabama Sales Tax Permit. Register for an Alabama Sales Tax License Online by filling out and submitting the ?State Sales Tax Registration? form.

Alabama Visit My Alabama Taxes. Click ?Verify a Resale Certificate? Choose whether to enter your customer's Federal Employee ID Number (FEIN), Individual Tax ID Number (ITIN), or Social Security Number (SSN) and enter it. Enter the customer's Exempt Sales Account Number.

Alabama. Resale certificates in Alabama are available using the Alabama Certificate of Exemption (Form ST-EX-A1). Expiration Date:Does not expire unless there is a change in operations.

Unlike other states where you have to apply for and obtain a resale certificate to present to vendors and suppliers to receive tax-free goods, you just need to provide a copy of your current sales tax permit. However, while most vendors will waive Alabama taxes, the state does not require them to do so.