Cosigner Finder With Mortgage

Description

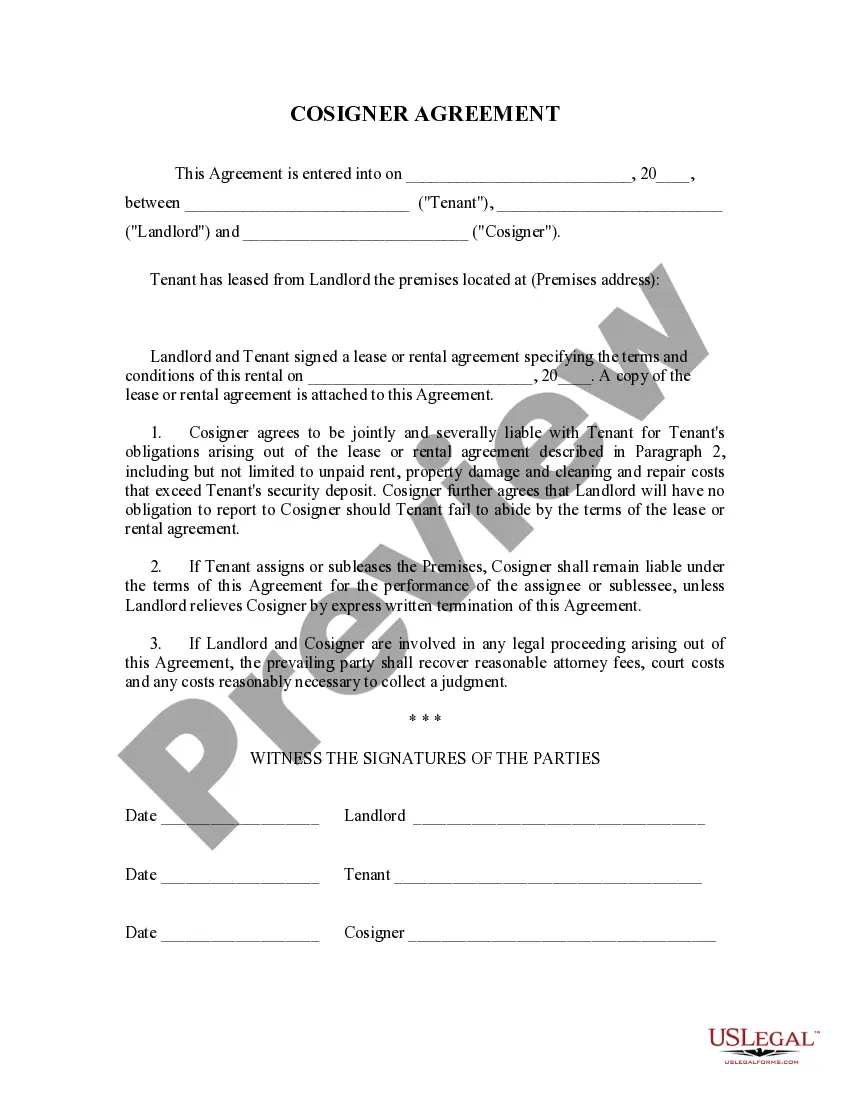

How to fill out Alabama Landlord Tenant Lease Co-Signer Agreement?

Creating legal documents from the ground up can frequently feel a bit daunting.

Some situations might necessitate extensive research and significant expenses.

If you’re looking for a simpler and more affordable method of crafting a Cosigner Finder With Mortgage or any other paperwork without the hassle, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal templates covers nearly every aspect of your financial, legal, and personal matters.

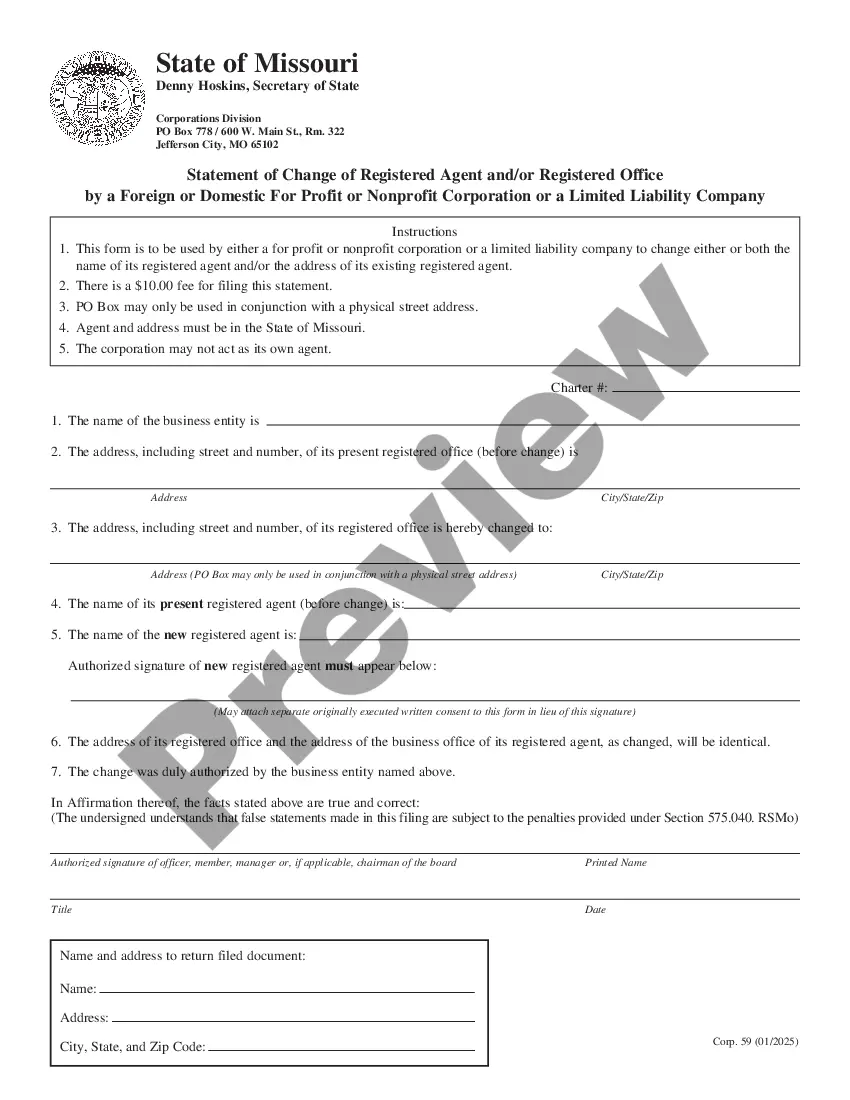

Verify the form preview and descriptions to ensure you’re on the correct form. Ensure the template you select meets the standards of your state and county. Opt for the appropriate subscription plan to obtain the Cosigner Finder With Mortgage. Download the document, then complete, endorse, and print it out. US Legal Forms holds an excellent reputation and boasts over 25 years of experience. Join us now and simplify your form completion process!

- With just a few clicks, you can swiftly access state- and county-specific forms meticulously prepared for you by our legal experts.

- Utilize our website whenever you require dependable and trustworthy services to quickly locate and download the Cosigner Finder With Mortgage.

- If you’re familiar with our services and have previously established an account with us, simply Log In to your account, choose the template, and download it or re-download it any time from the My documents section.

- Not registered yet? No issue. It takes just a few minutes to sign up and explore the library.

- But before immediately proceeding to download the Cosigner Finder With Mortgage, consider these suggestions.

Form popularity

FAQ

Main Elements of a Confidentiality Agreement The agreement will name the party or parties involved, the items subject to non-disclosure, the duration of the agreement and the obligations of the recipient(s) of confidential information.

How to Write an NDA (6 steps) Choose Your NDA Template. Select a Type of NDA: Unilateral or Mutual. Define ?Confidential Information? Enter the Consequences of a Breach. Sign the Non-Disclosure Agreement. Disclose the Information.

Consult With a Lawyer A confidentiality agreement must comply with specific legal requirements, such as state and federal laws, to be valid and enforceable. A lawyer can ensure the contract meets all necessary legal requirements and is compliant with the applicable laws.

You do not need a lawyer to create and sign a non-disclosure agreement. However, if the information you are trying to protect is important enough to warrant an NDA, you may want to have the document reviewed by someone with legal expertise.

Five other key features must be included in your NDA to ensure it's legally binding, including a description of confidential information, obligations of the parties involved, any exclusions, the term of the agreement and consequences of a breach.

To be valid, a Non-Disclosure Agreement only needs two signatures ? the disclosing party and the receiving party. It doesn't need to be notarized or filed with any state or local administrative office.

Starting at $1,500.00 for basic Non Disclosure Agreement. More complex matters may range from $5,000.00-$10,000.00. An NDA is a contract by which one or more parties agree not to disclose confidential information that they have shared with each other as a necessary part of doing business together.