Cosigner Finder With Lender

Description

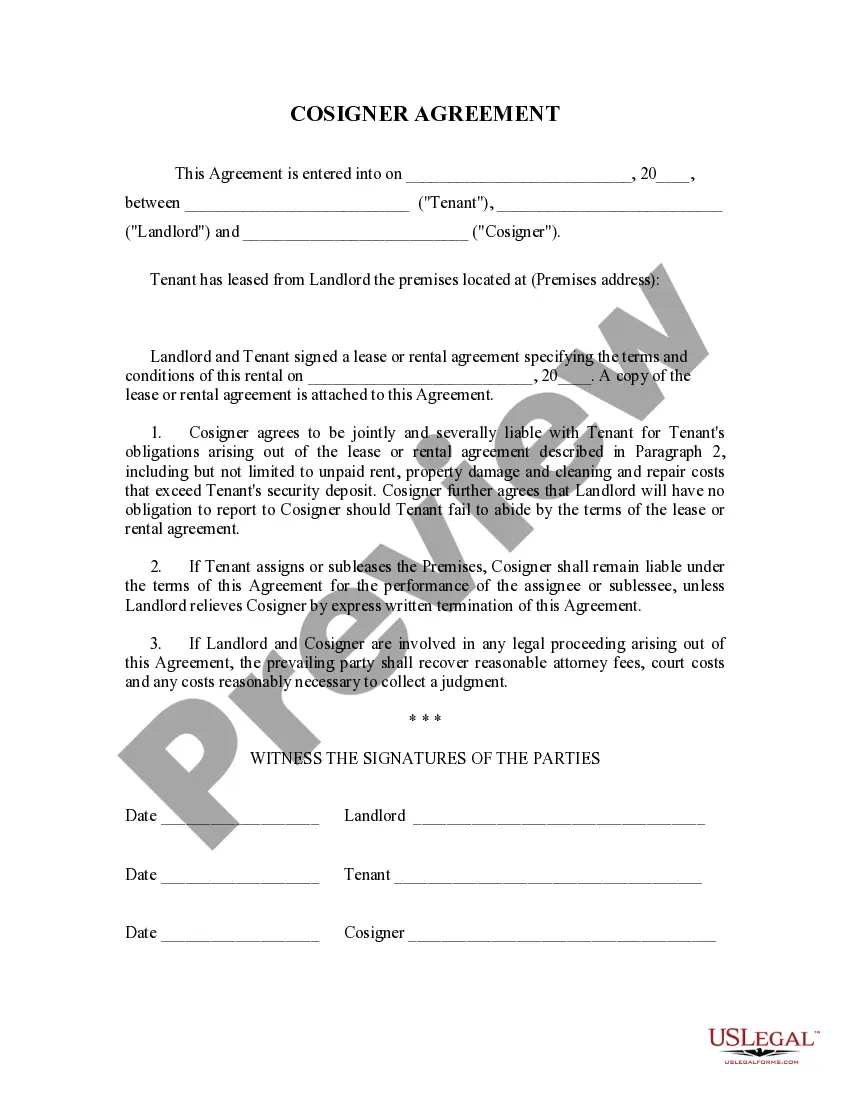

How to fill out Alabama Landlord Tenant Lease Co-Signer Agreement?

When you must complete the Cosigner Finder With Lender that aligns with your local state's requirements, there can be many alternatives to choose from.

There's no necessity to review every document to ensure it satisfies all the legal stipulations if you are a US Legal Forms member. It is a trustworthy resource that can assist you in obtaining a reusable and current template on any topic.

US Legal Forms is the largest online directory with a compilation of over 85k ready-to-use documents for business and personal legal matters. All templates are verified to comply with each state's regulations. Thus, when downloading Cosigner Finder With Lender from our platform, you can be confident that you possess a valid and current document.

Choose the most appropriate subscription plan, Log In to your account, or create one. Pay for a subscription (PayPal and credit card options are available). Download the sample in your desired file format (PDF or DOCX). Print the document or complete it electronically in an online editor. Acquiring properly drafted official documents becomes effortless with US Legal Forms. Furthermore, Premium users can also benefit from advanced integrated solutions for online document editing and signing. Try it out today!

- Obtaining the required sample from our platform is extremely simple.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save the selected file.

- In the future, you can access the My documents tab in your profile and maintain access to the Cosigner Finder With Lender at any moment.

- If it's your inaugural experience with our site, please follow the guide below.

- Browse the suggested page and verify it for alignment with your needs.

- Utilize the Preview mode and examine the form description if available.

- Find another template via the Search bar in the header if necessary.

- Click Buy Now once you locate the suitable Cosigner Finder With Lender.

Form popularity

FAQ

Yes, it is possible to have an international cosigner, but it depends on the lender's policies. Many lenders prefer cosigners who reside in the US, as this often eases the process and ensures legal compliance. However, using our cosigner finder with lender feature can help you identify lenders that accept international cosigners. Explore your options carefully to find a solution that works for your needs.

To get approved without a co-signer, begin by researching lenders who specialize in no-cosigner loans. Provide documentation that demonstrates your creditworthiness, such as proof of income and employment. Utilizing a cosigner finder with lender services can also help you identify lenders who value autonomy and independence in borrowers.

If you cannot secure a cosigner, it's essential to look for loans that don't require one. Some lenders, including those found through a cosigner finder with lender services, offer personal loans or credit options that don't necessitate a cosigner. Focus on improving your credit score and financial stability to make yourself a more attractive borrower.

If you can't find a cosigner, consider exploring other financing options. Many lenders provide programs for individuals without a cosigner, especially if you have a solid credit history. Additionally, using a cosigner finder with lender services can help connect you with potential cosigners who may be open to assisting you.

If you cannot find a cosigner, your options may become limited, but not impossible. You may need to look for lenders that offer loans without a cosigner, although you might face higher interest rates. Alternatively, consider enhancing your credit score or looking for additional income sources to strengthen your application. Our cosigner finder with lender can provide valuable resources and connections that may lead to securing a cosigner.

Lenders often ask about a cosigner because they want to assess the risk associated with lending to you. A cosigner can improve your chances of approval by providing additional security against default. If you have a cosigner, lenders see it as a sign of assurance and may offer better terms. Using a cosigner finder with lender can help you connect with someone who can support your application.