What is Deed?

Deeds are legal documents used to transfer ownership of real property. They establish who owns the property and the terms of the transfer. Explore state-specific templates for your needs.

Deeds are essential documents for transferring property ownership. Our attorney-drafted templates are quick and simple to fill out.

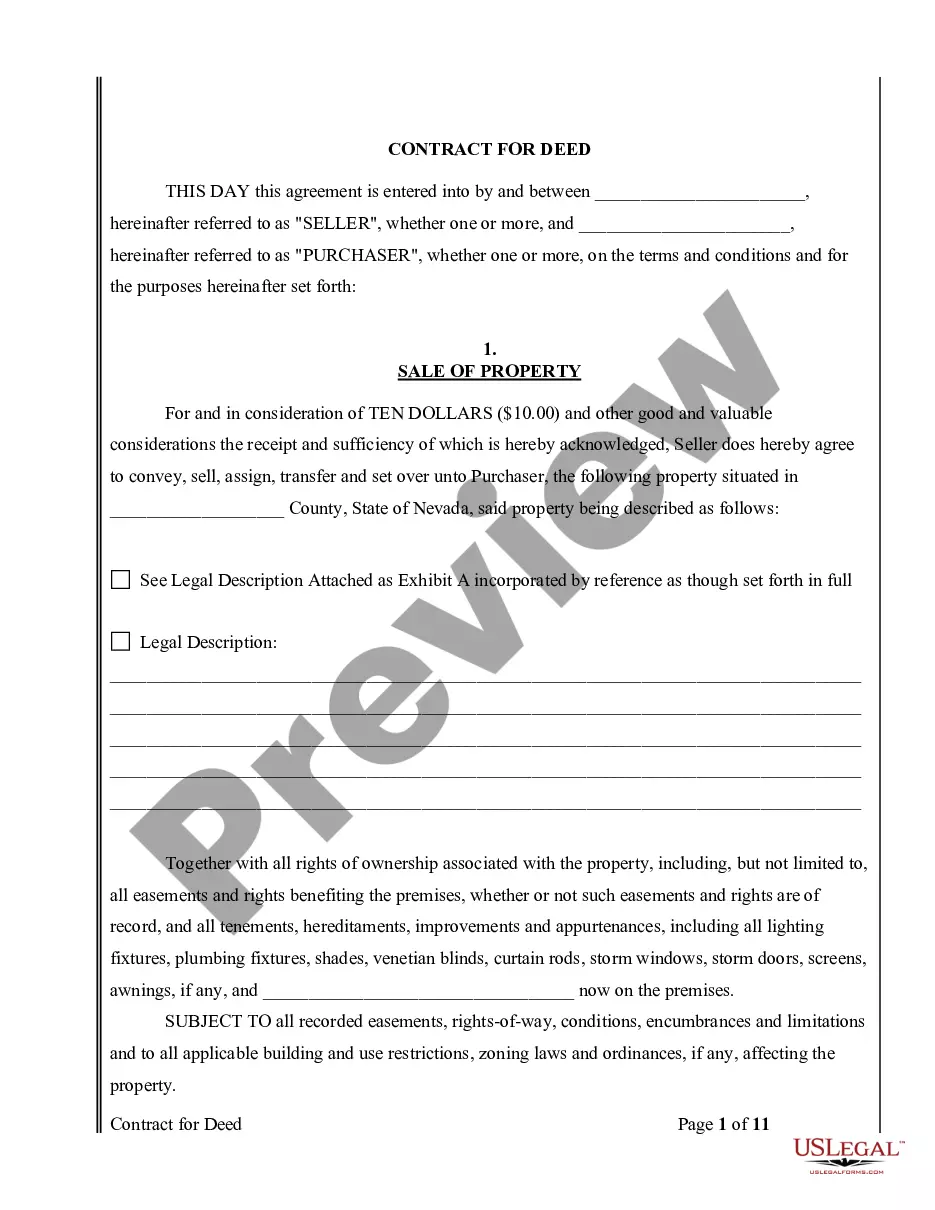

Get the essential forms for an owner-financed real estate transaction all in one package, ensuring a smooth process and legal clarity.

Get the essential forms for an owner-financed real estate transaction all in one package, ensuring a smooth process and legal clarity.

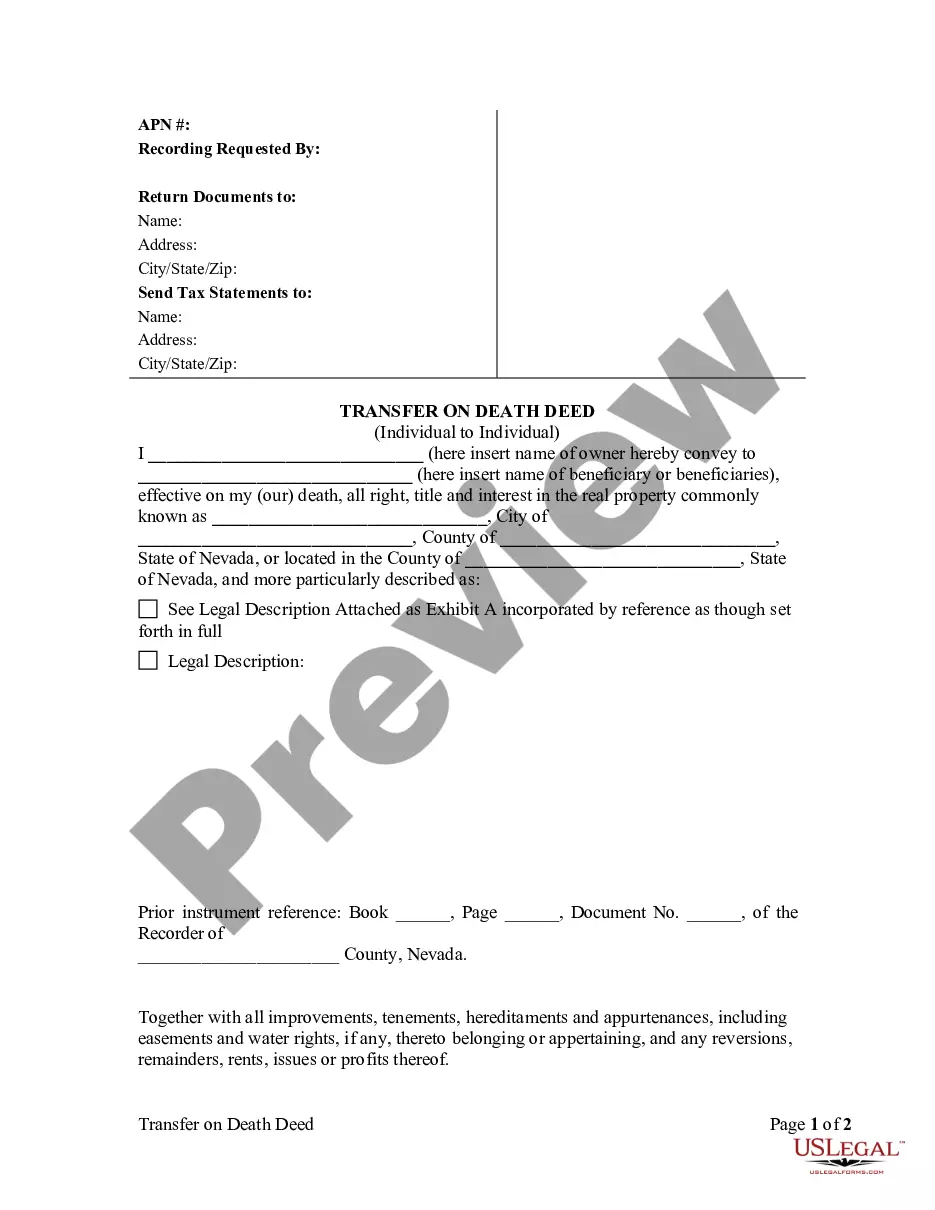

Simplify estate planning by ensuring property transfers to designated beneficiaries after death, without immediate ownership transfer.

A key solution for buyers and sellers detailing terms and conditions of a property sale while securing financing options.

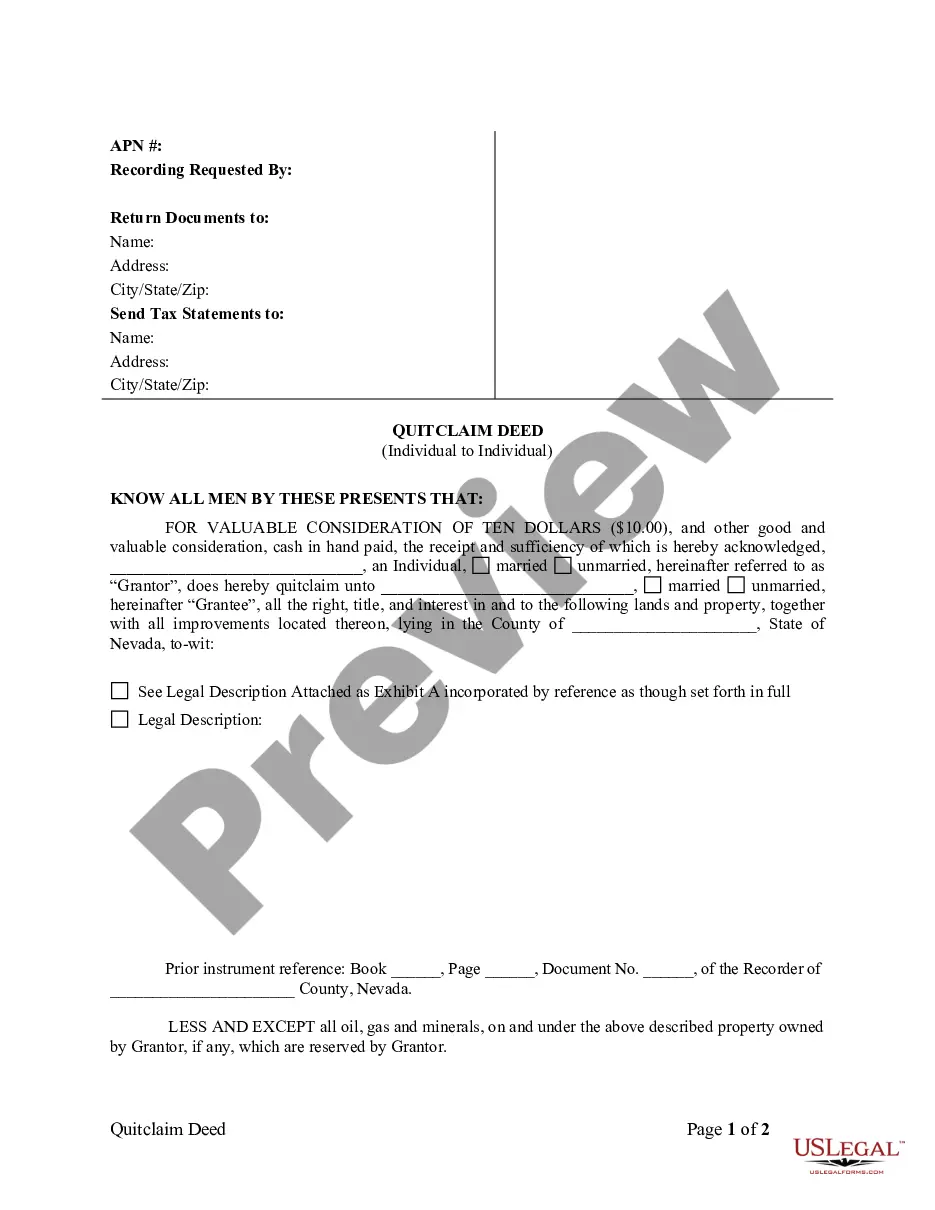

Transferring property ownership without warranties is straightforward with this essential document. Perfect for individuals wanting to officially release claims.

Use this document to legally transfer property ownership from two sellers to three buyers, ensuring all rights and interests are accurately conveyed.

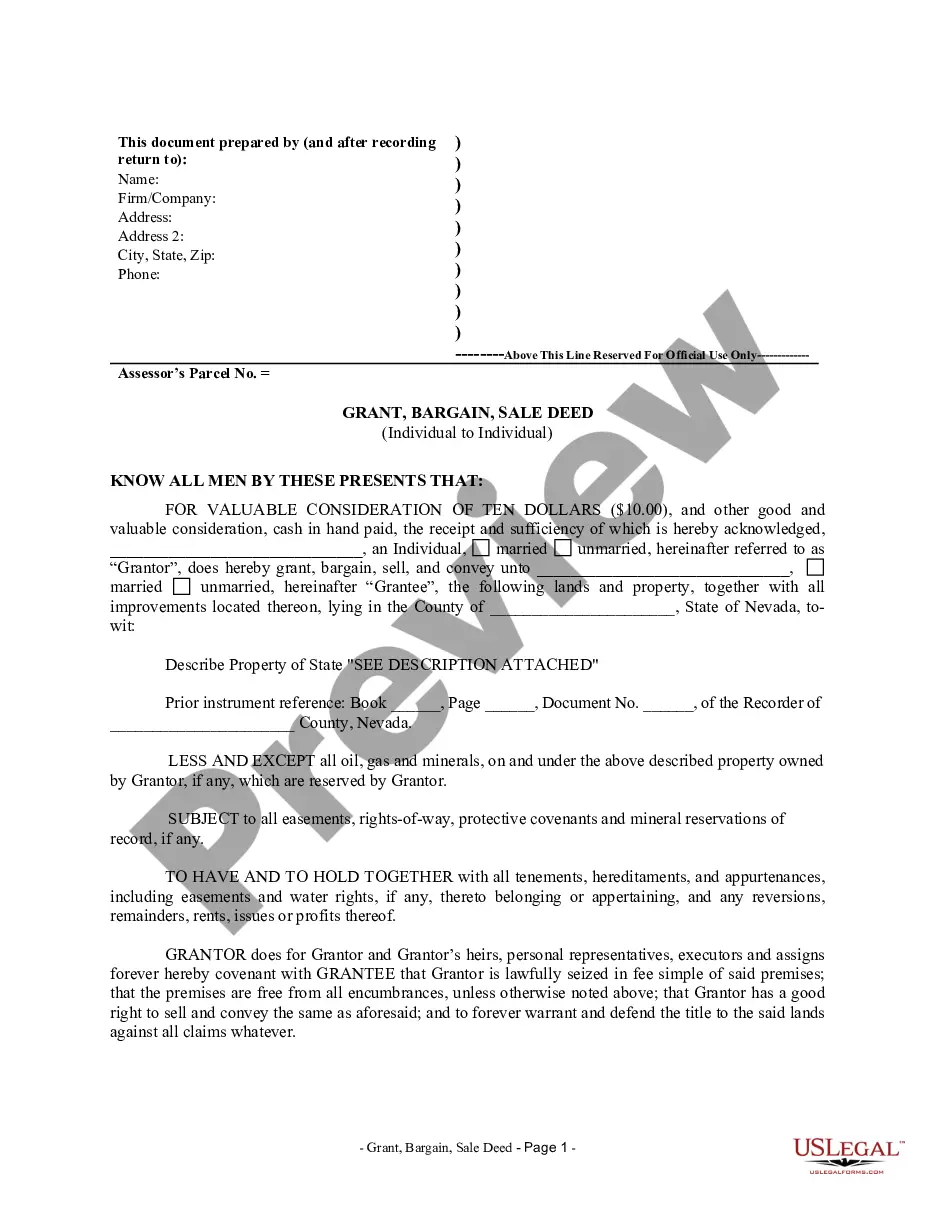

Use this document to officially transfer property ownership between individuals, ensuring clear terms and protections for both parties involved.

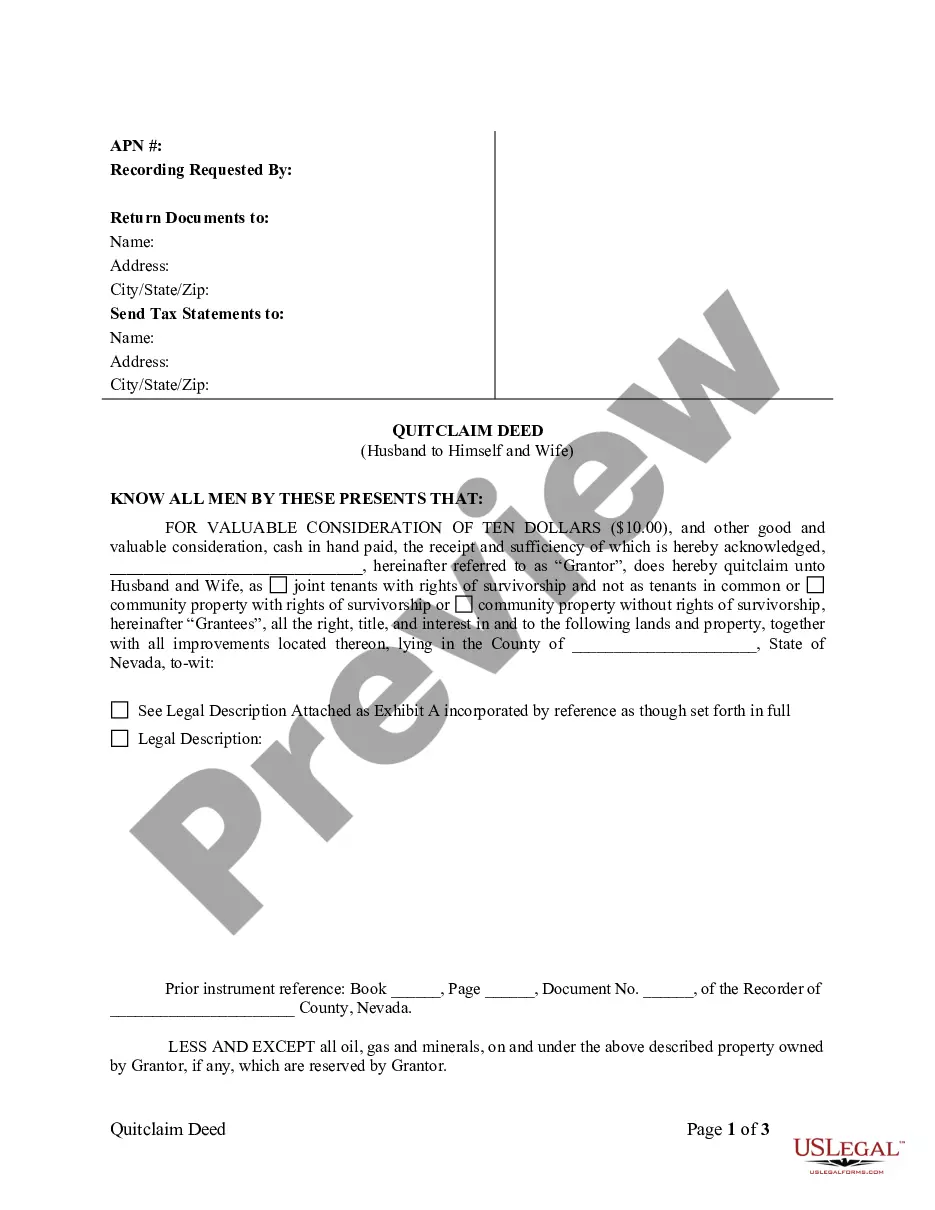

Easily transfer property from one owner to multiple owners, protecting both partners' interests without complicated processes.

Transfer property ownership from three individuals to one efficiently with a legally binding quitclaim deed.

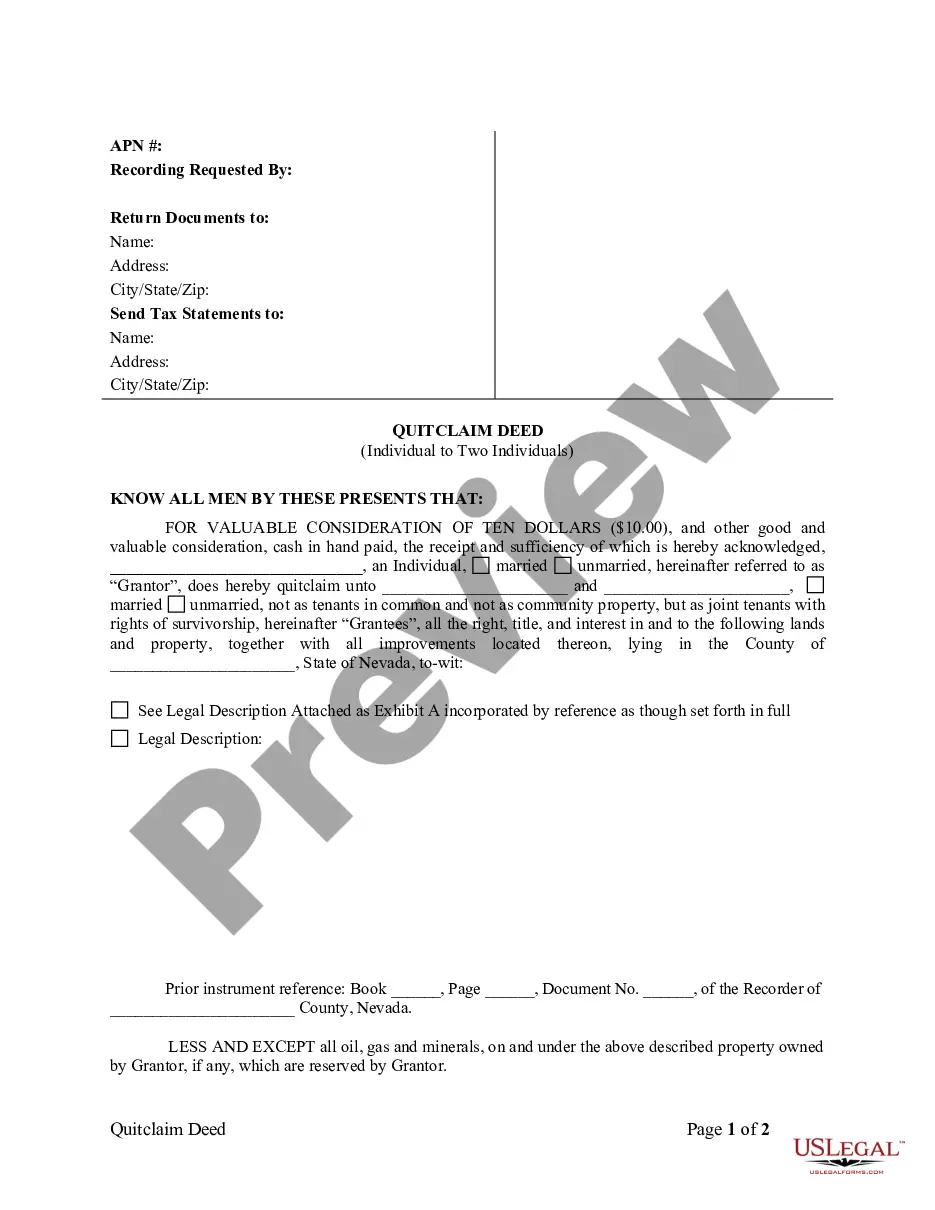

Transfer property between individuals as joint tenants, ensuring rights of survivorship and an easy transition of ownership.

Essential for executors and trustees to transfer property held in a fiduciary capacity.

Deeds are crucial for property ownership transfer.

Notarization or witnesses may be needed for many deeds.

Different deeds serve different purposes depending on the transfer type.

Property can be transferred between individuals or entities.

Understanding the type of deed is important for legal clarity.

Specific terms can vary by state, affecting deed usage.

Deeds must be filed with local authorities to be effective.

Begin your process with these straightforward steps.

A trust can help manage assets during your lifetime and after death, while a will only takes effect after death.

If no action is taken, property may pass according to state laws, which could differ from your wishes.

It's wise to review your property documents every few years or after major life changes.

Beneficiary designations can override instructions in wills, impacting asset distribution.

Yes, you can assign separate individuals to manage financial and health care decisions.