What is Deed?

Deeds are legal documents used to transfer property ownership from one party to another. They are essential in real estate transactions, ensuring clear title transfers. Explore state-specific templates to find what you need.

Deeds are essential legal documents for transferring property ownership. Our attorney-drafted templates are quick and easy to complete.

This package provides all necessary forms for an owner-financed real estate transaction, making the process straightforward and efficient.

This package provides all necessary forms for an owner-financed real estate transaction, making the process straightforward and efficient.

Transfer property ownership from an individual to a trust easily and effectively, ensuring clarity in asset management.

Secure a property sale with flexible payment terms, allowing buyers to purchase real estate over time instead of upfront.

Transfer property ownership easily between individuals with this straightforward document.

Transfer ownership of real property between individuals securely and effectively, ensuring the new owner has clear title devoid of claims.

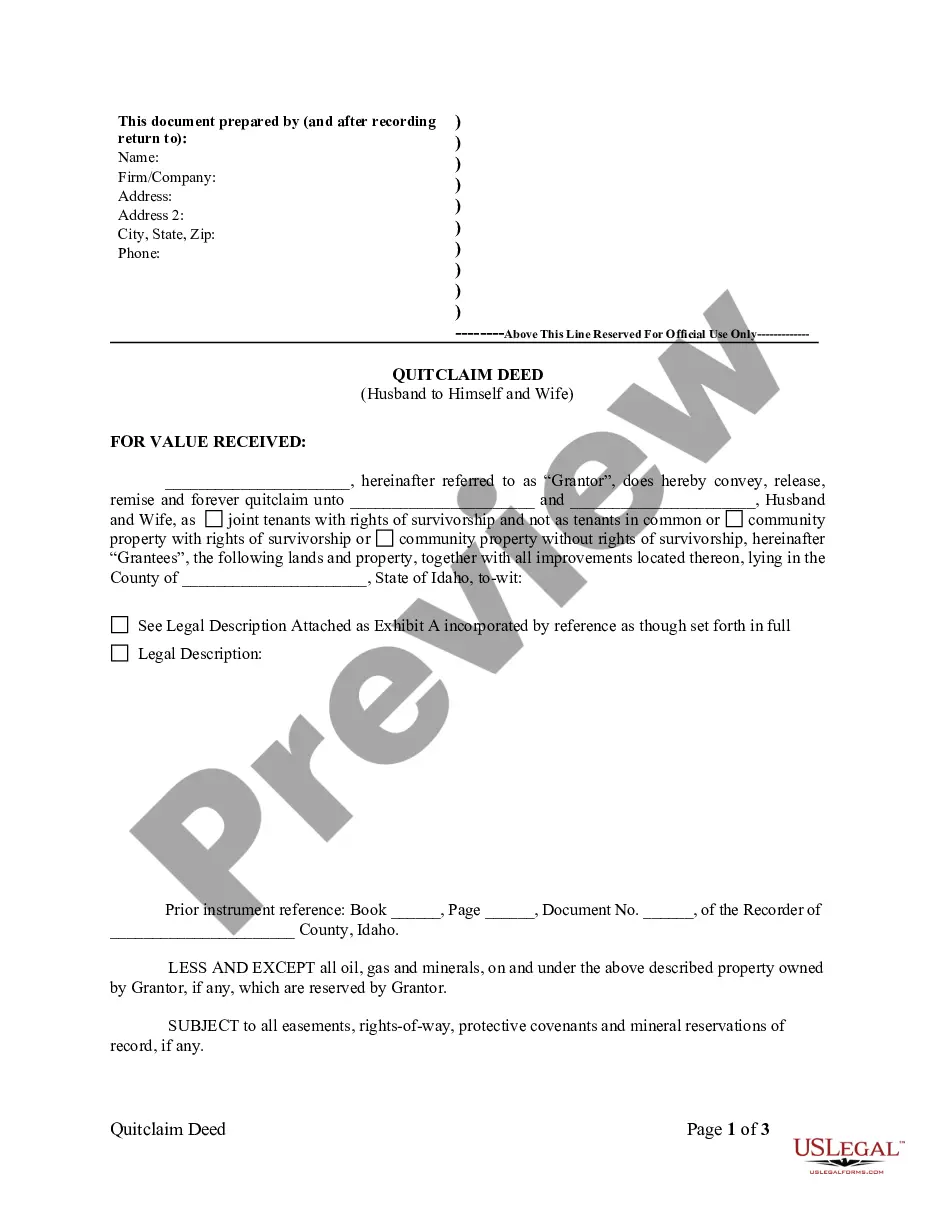

Transfer property ownership from one partner to both partners. Quick and straightforward, this form helps clarify rights in a marital context.

Transfer ownership of property from two individuals to one, simplifying the title transfer process without warranties.

Transfer property to a child while retaining rights to live there, ensuring family assets stay within the family.

Use this form to transfer property ownership with limited warranties, providing assurance against claims from the grantor's ownership period.

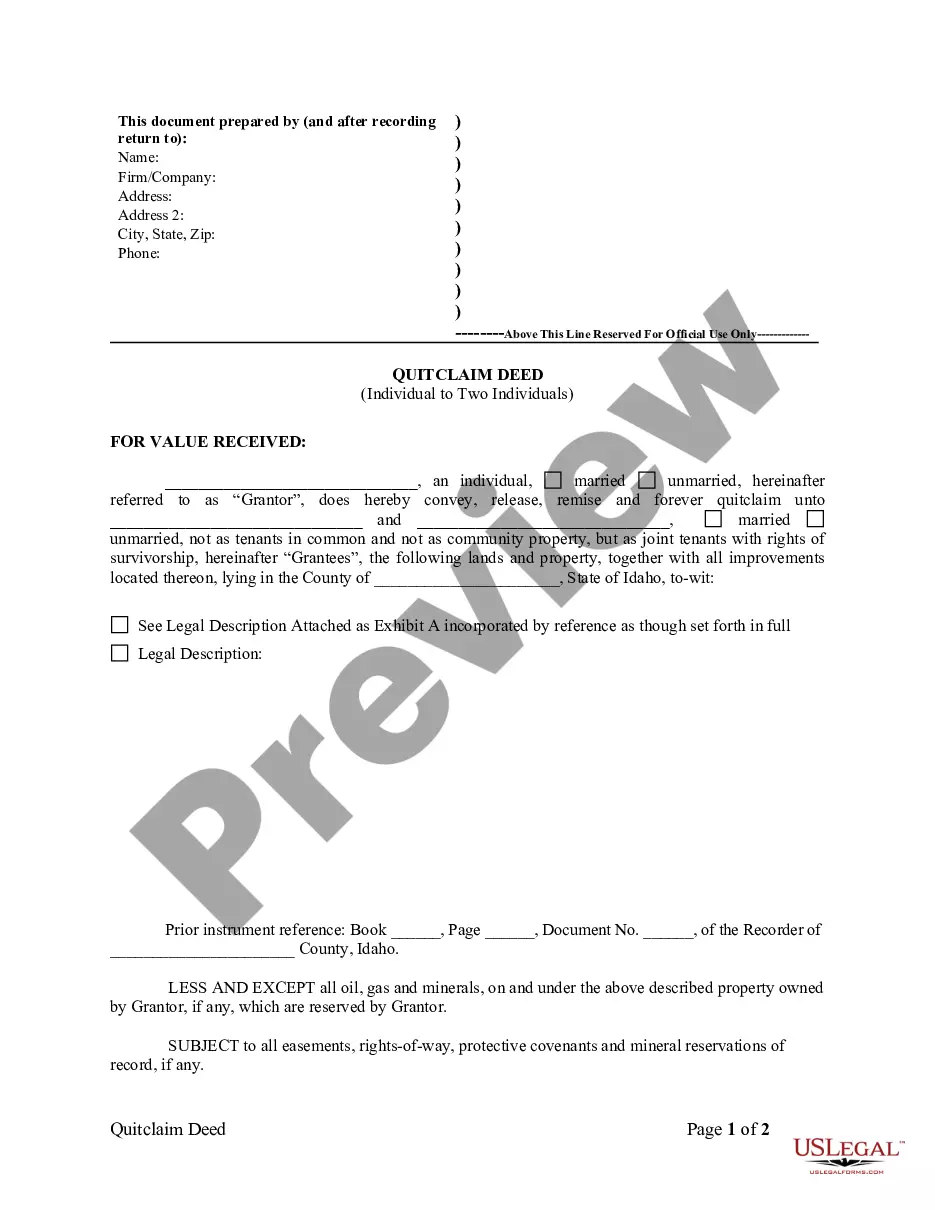

Use this document to transfer property ownership to two individuals as joint tenants, ensuring rights of survivorship.

Deeds are crucial for transferring property ownership legally.

Most deeds require notarization or witness signatures.

Different types of deeds serve different purposes in real estate.

A clear title is vital for property transactions.

Deeds can be revoked or modified under certain conditions.

Understanding deed types helps in choosing the right one for your situation.

Deeds are public records and can be accessed for verification.

Begin your journey with these simple steps.

Not necessarily. A will outlines your wishes, while a trust can manage assets during your lifetime.

Your assets may be distributed according to state laws, which may not reflect your wishes.

It's advisable to review your plans regularly, especially after major life changes.

Beneficiary designations typically override wills, so they should align with your overall estate plan.

Yes, you can designate different individuals for financial and healthcare decisions in your documents.