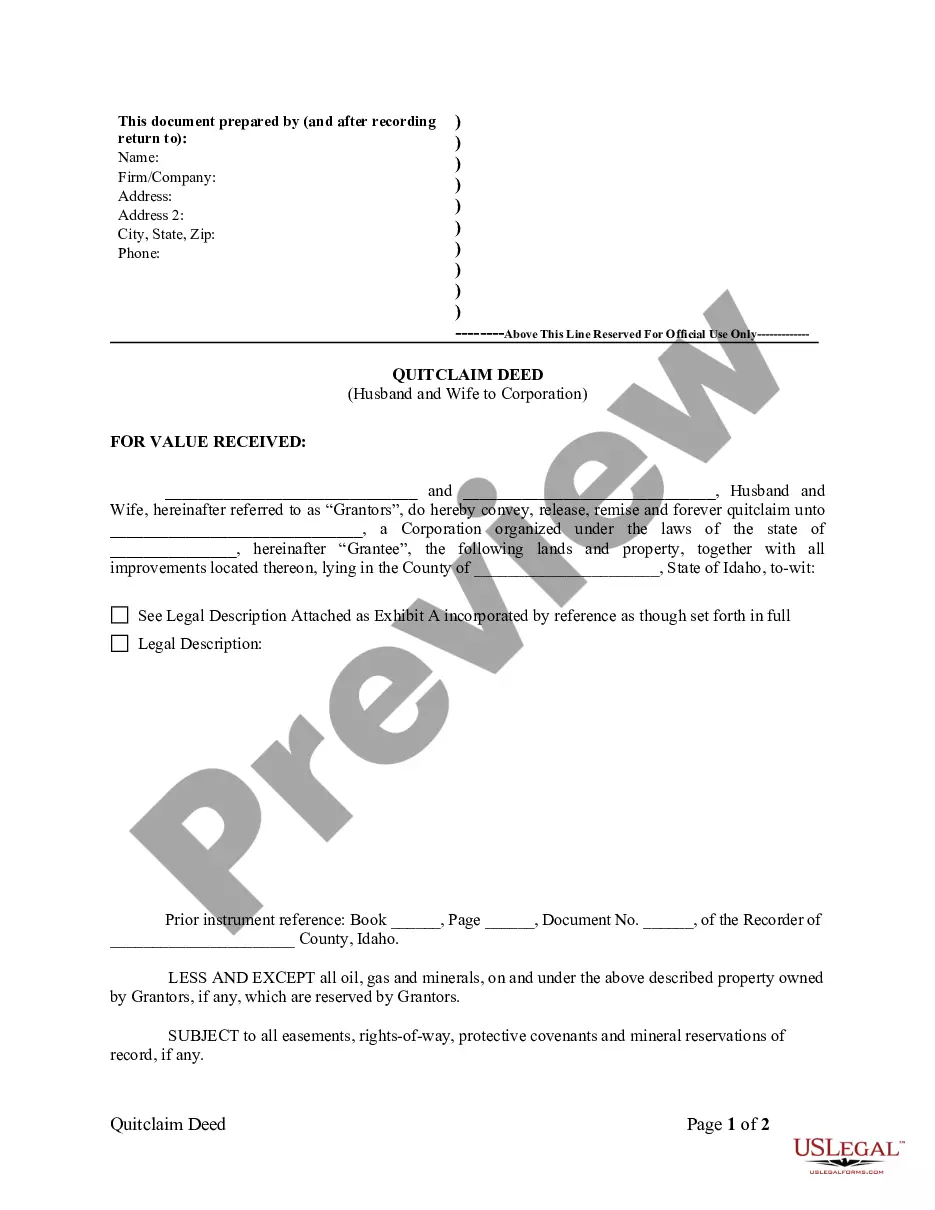

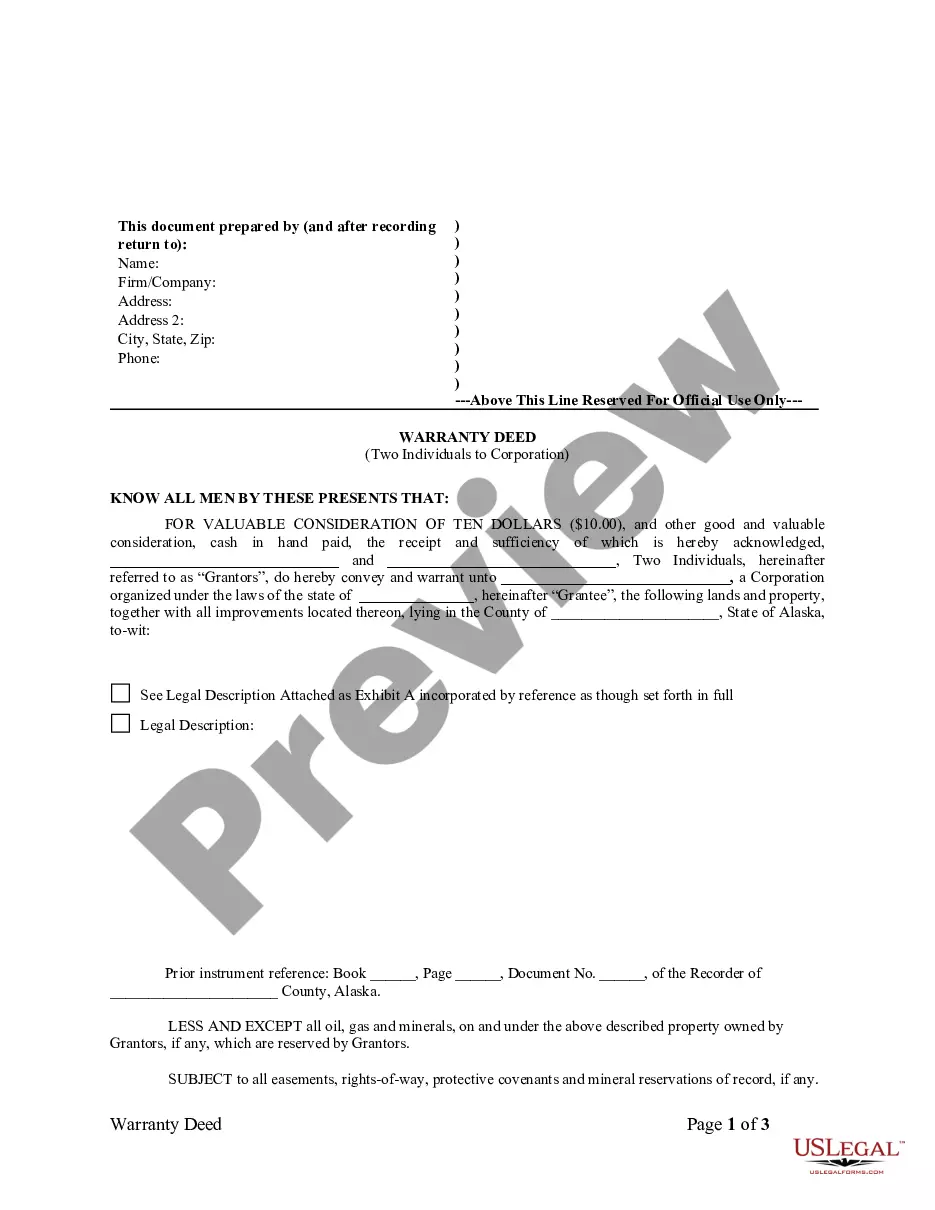

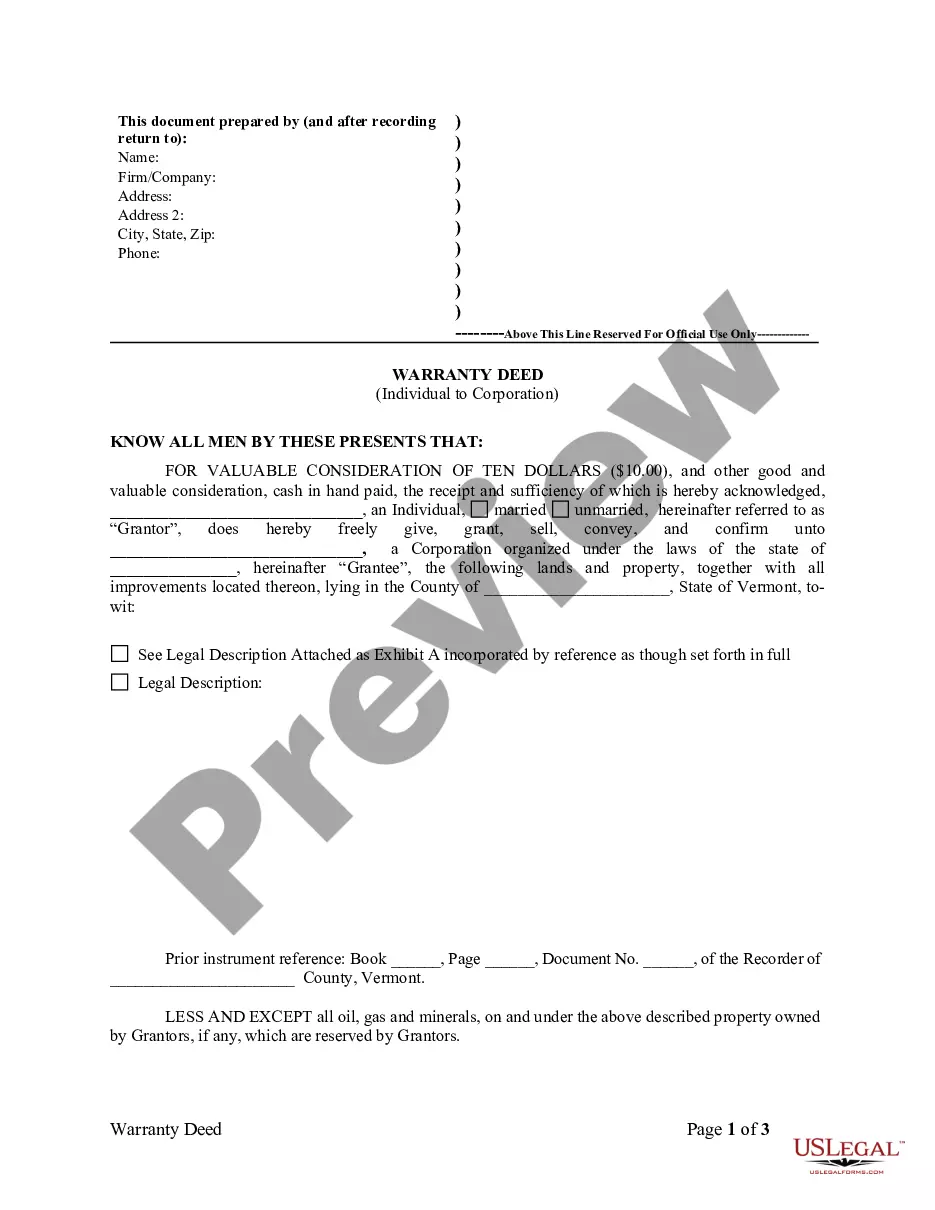

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Idaho Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out Idaho Quitclaim Deed From Husband And Wife To Corporation?

Obtain entry to one of the most extensive collections of sanctioned documents.

US Legal Forms is fundamentally a resource to locate any state-specific paperwork in just a few clicks, including Idaho Quitclaim Deed from Husband and Wife to Corporation specimens.

No need to squander your hours searching for a legally acceptable document.

Utilize the Preview option if available to inspect the content of the document. If everything appears accurate, click Buy Now. After selecting a pricing plan, create an account. Make payment via credit card or PayPal. Download the template to your device by clicking Download. That’s it! You are required to fill out the Idaho Quitclaim Deed from Husband and Wife to Corporation form and review it. To ensure everything is correct, consult your local legal advisor for assistance. Sign up and effortlessly access approximately 85,000 beneficial forms.

- Our certified experts ensure that you receive current examples at all times.

- To take advantage of the document library, choose a subscription and set up an account.

- If you have already done so, simply Log In and click on the Download button.

- The Idaho Quitclaim Deed from Husband and Wife to Corporation template will swiftly be saved in the My documents section (a section for every document you download on US Legal Forms).

- To create a new account, adhere to the brief instructions below.

- If you're planning to use state-specific documents, ensure you select the correct state.

- If possible, review the description to grasp all the details of the document.

Form popularity

FAQ

A quitclaim deed can be considered unfavorable because it does not provide warranties or guarantees regarding the property's title. When you obtain an Idaho Quitclaim Deed from Husband and Wife to Corporation, you accept the property as-is, which may bring unexpected complications. This lack of protection can lead to disputes over ownership or undisclosed liabilities. To mitigate these risks, it is advisable to consult with a real estate professional or use our platform for legal guidance.

Yes, for an Idaho Quitclaim Deed from Husband and Wife to Corporation, both parties typically need to be present during the signing and notarization of the deed. This ensures that both the grantors and the grantee agree to the terms. It also adds a layer of security to the transaction, safeguarding against future disputes. You can simplify this process by using our platform to prepare the deed correctly.

When filling out a quit claim deed to add a spouse, it’s crucial to include both names clearly as grantors and the name of the property already held. Specify the relationship in the deed language, such as 'from Husband and Wife to Corporation'. Make sure to accurately describe the property, and obtain the required signatures in front of a notary. Services like US Legal Forms provide templates that simplify this process, ensuring you cover all necessary legal bases efficiently.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.