What is Last Will and Testament?

A Last Will and Testament specifies how your assets are distributed after you pass away. It also names guardians for minor children. Explore state-specific templates for your needs.

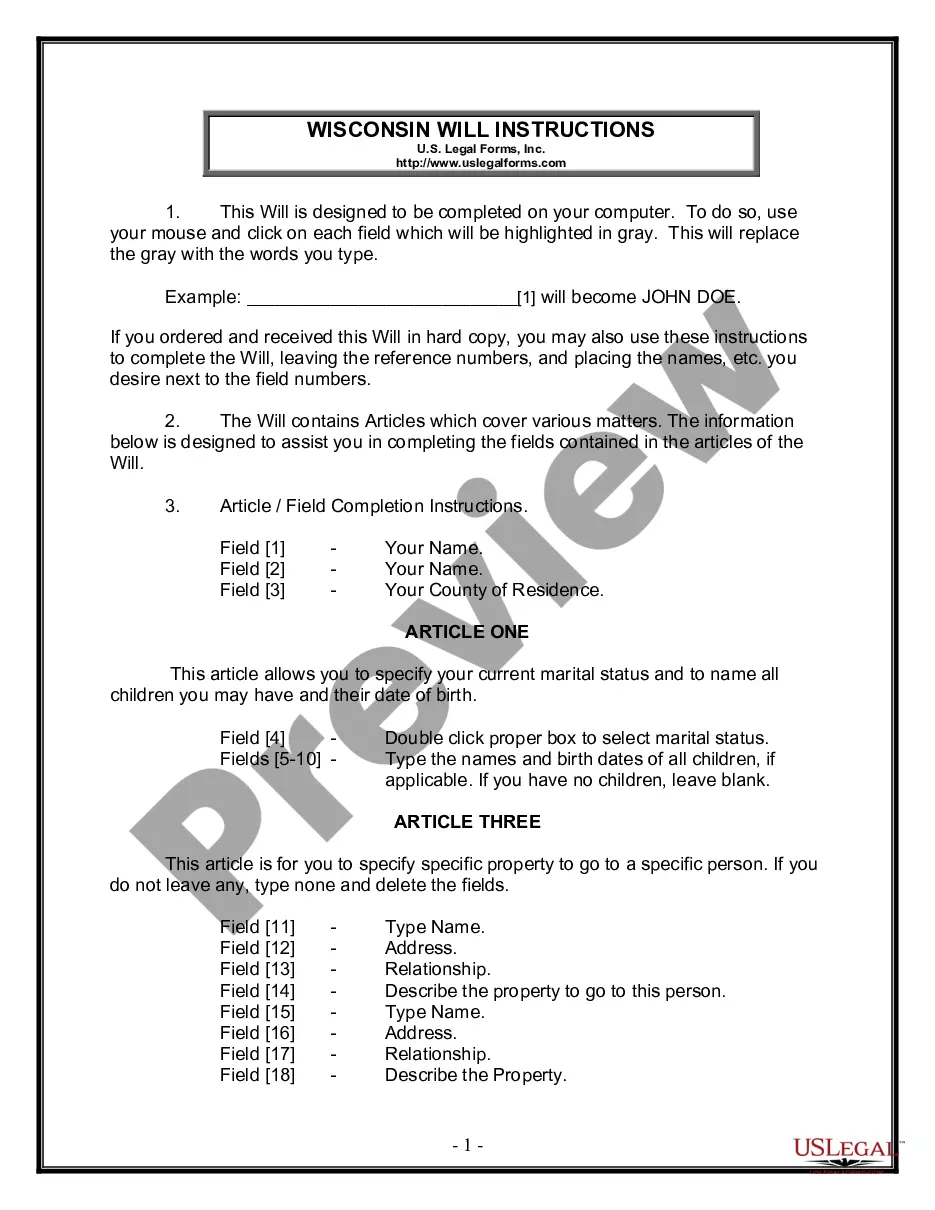

A Last Will and Testament outlines your wishes after death. Attorney-drafted templates are quick and user-friendly.

Prepare for the future with essential documents that ensure your loved ones are protected and informed in one convenient package.

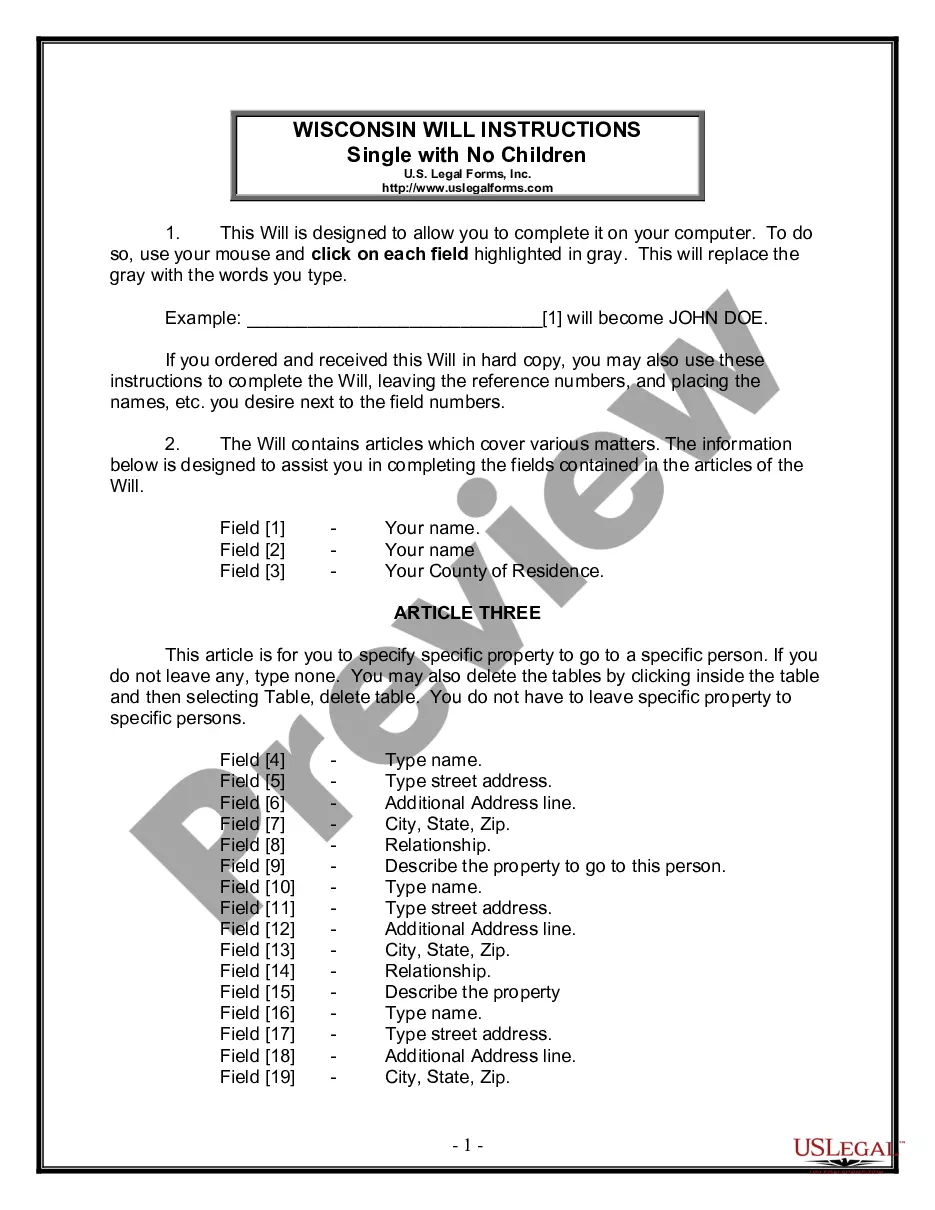

Ensure your wishes are honored after passing with this easy-to-complete will designed for singles without children.

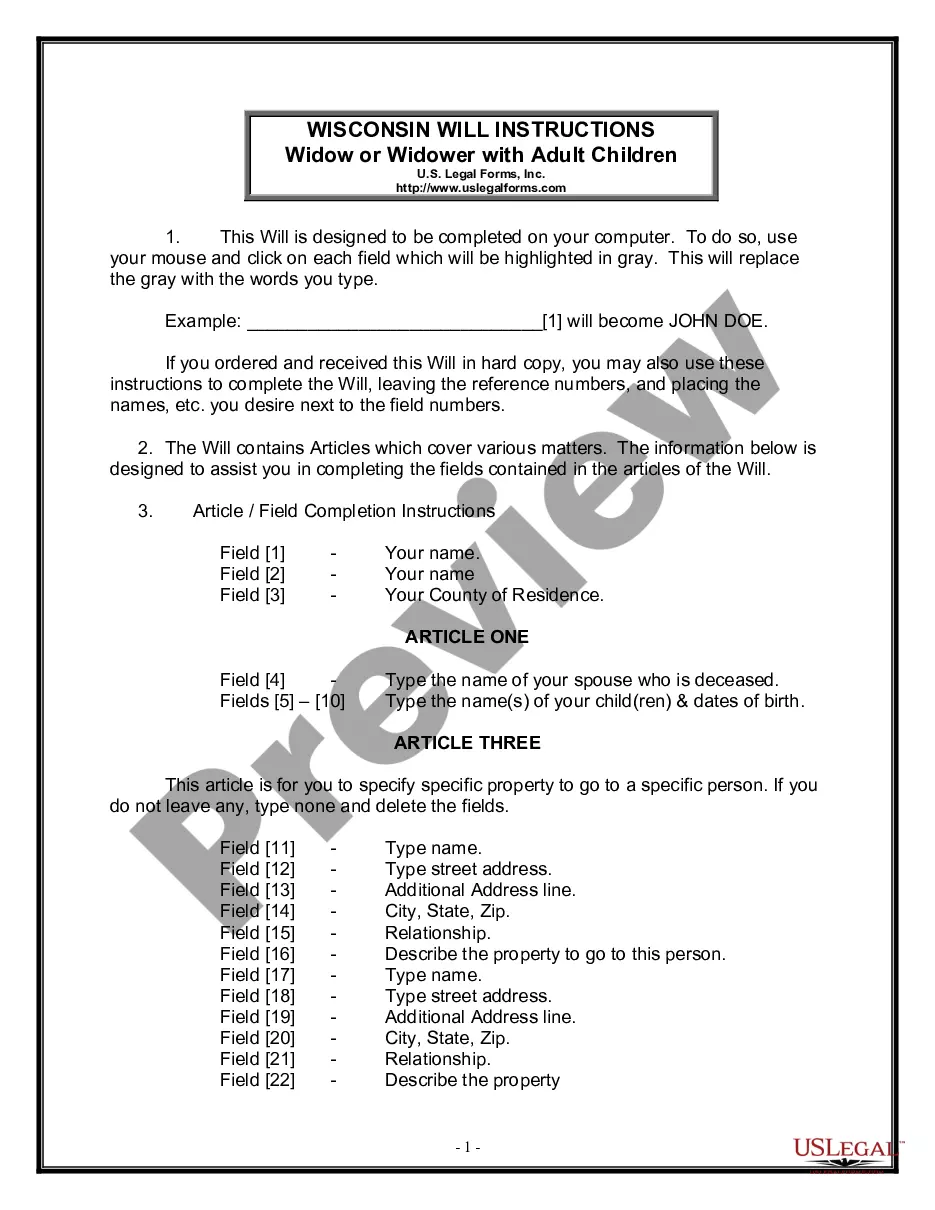

Prepare a comprehensive estate plan for a widow or widower to ensure your assets are distributed according to your wishes.

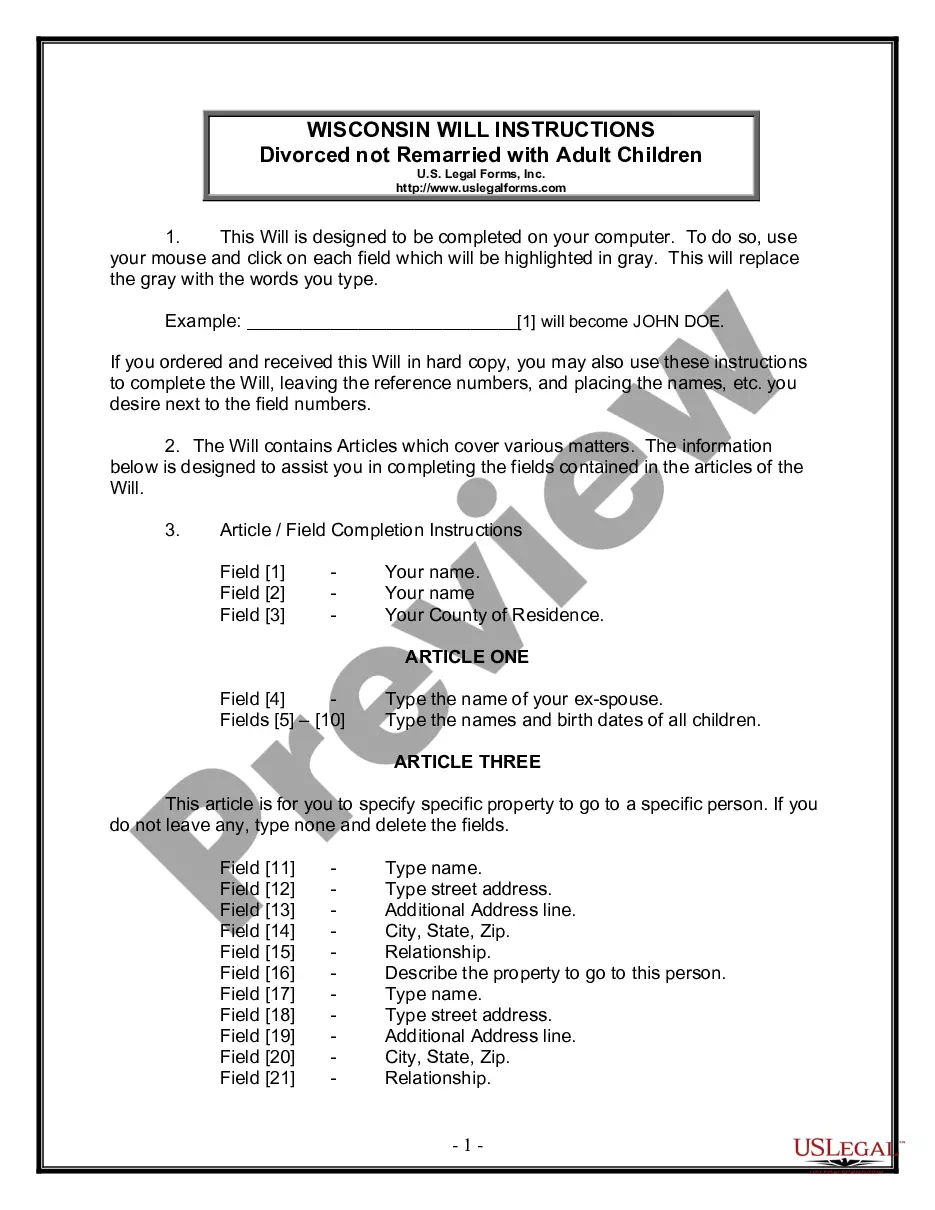

Create a will that specifies how your property will be distributed after your death, particularly for those who are divorced and have adult children.

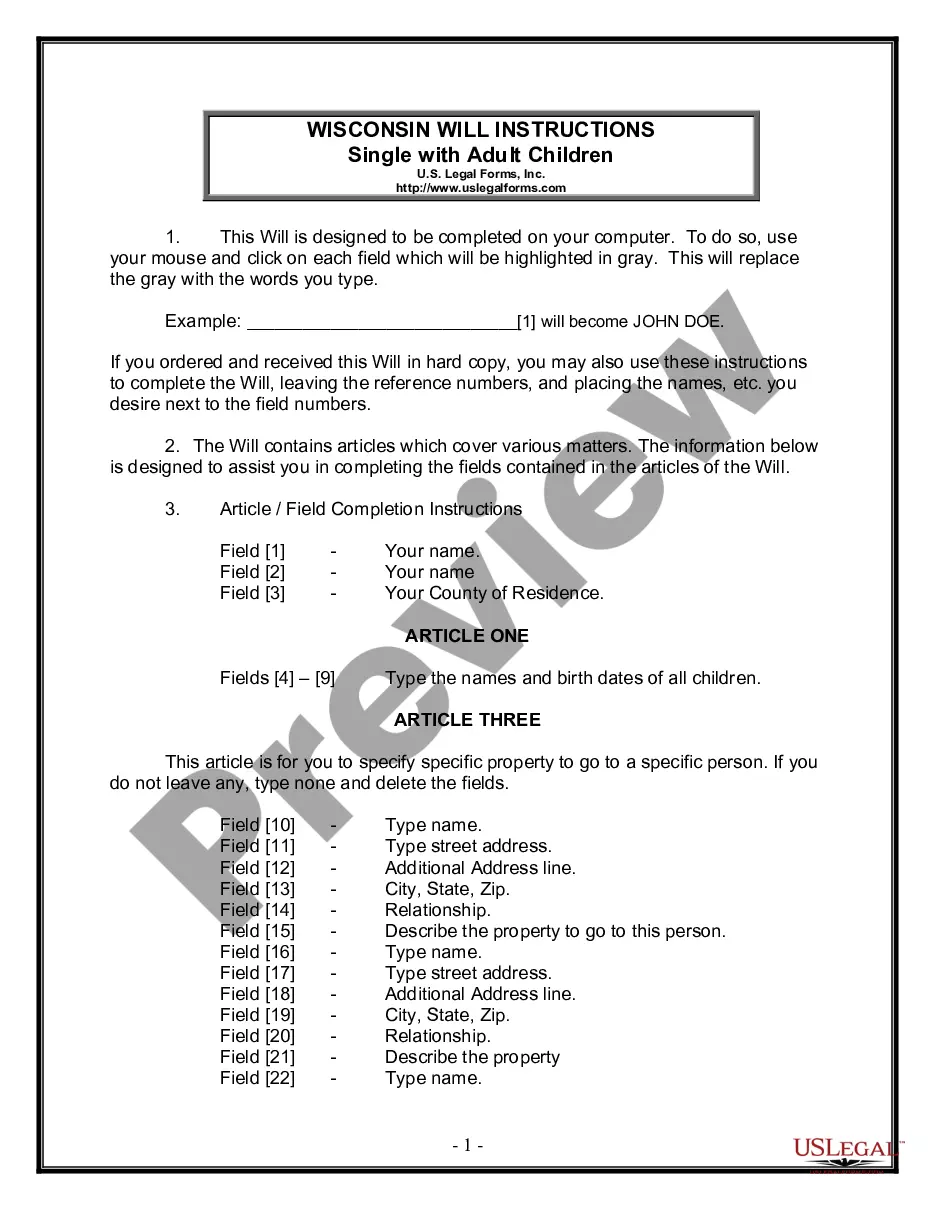

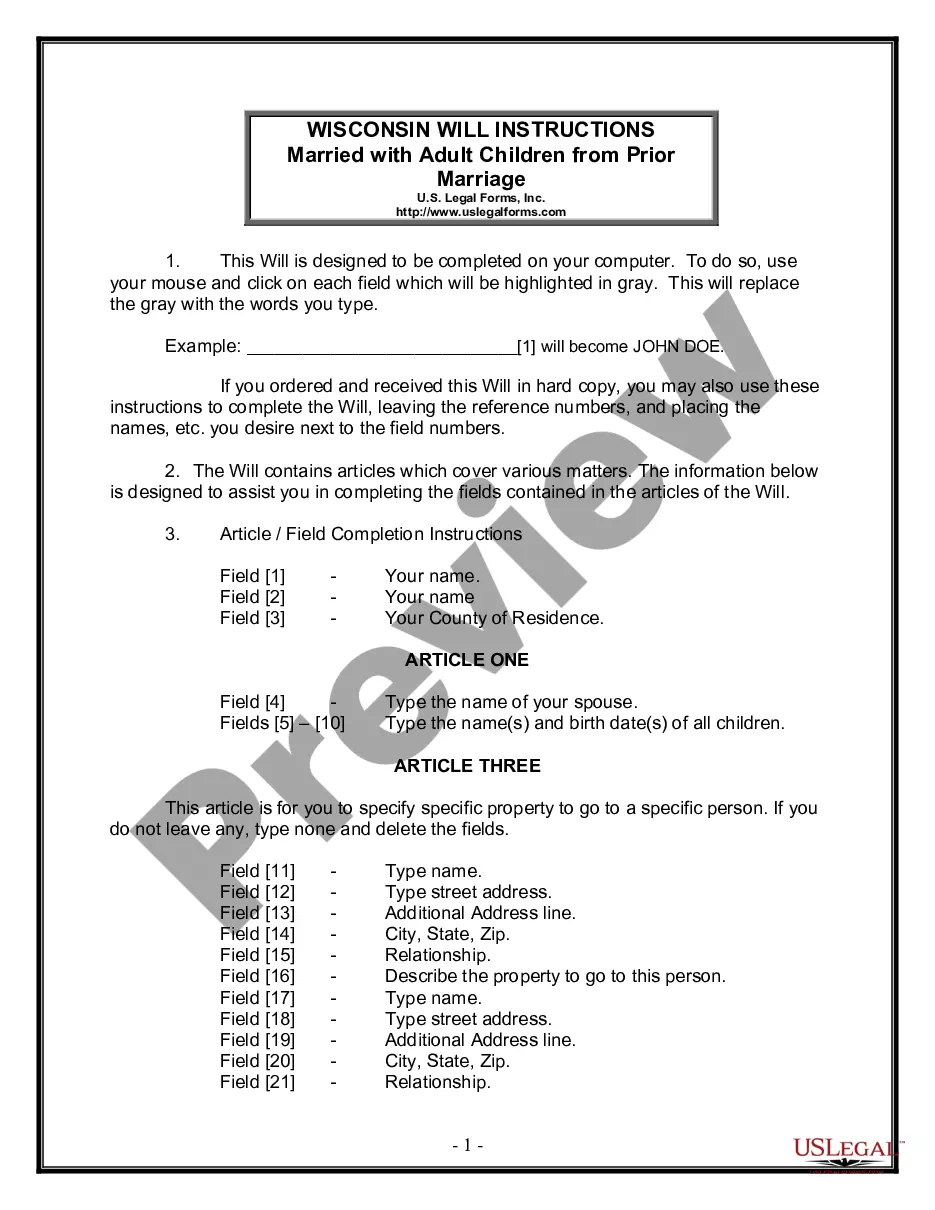

Plan your estate and provide for your adult children with a straightforward last will. Guide their inheritance and appoint a personal representative.

Prepare a comprehensive plan for your assets, ensuring they are distributed according to your wishes after your passing.

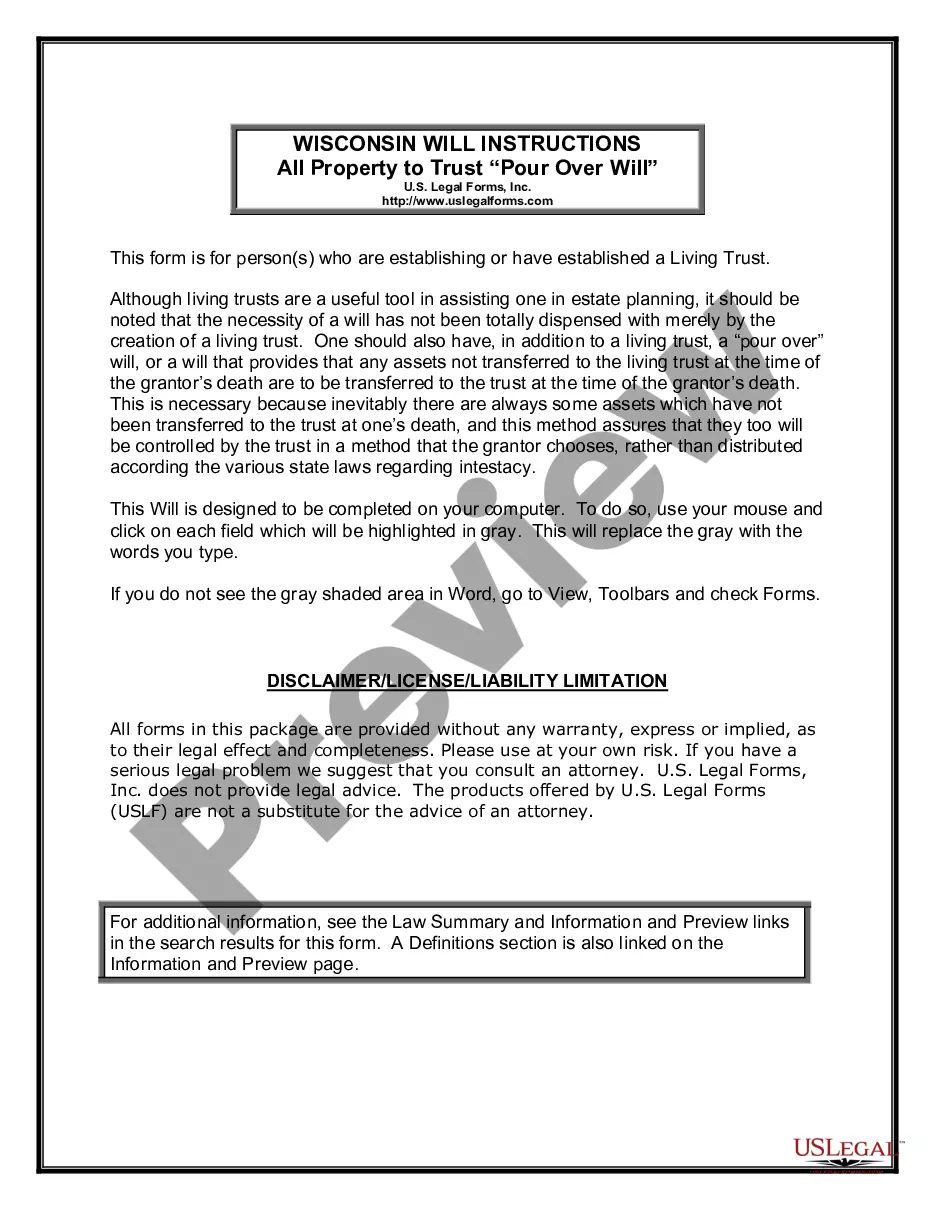

Ensure your living trust covers all your assets, even those not transferred before your death.

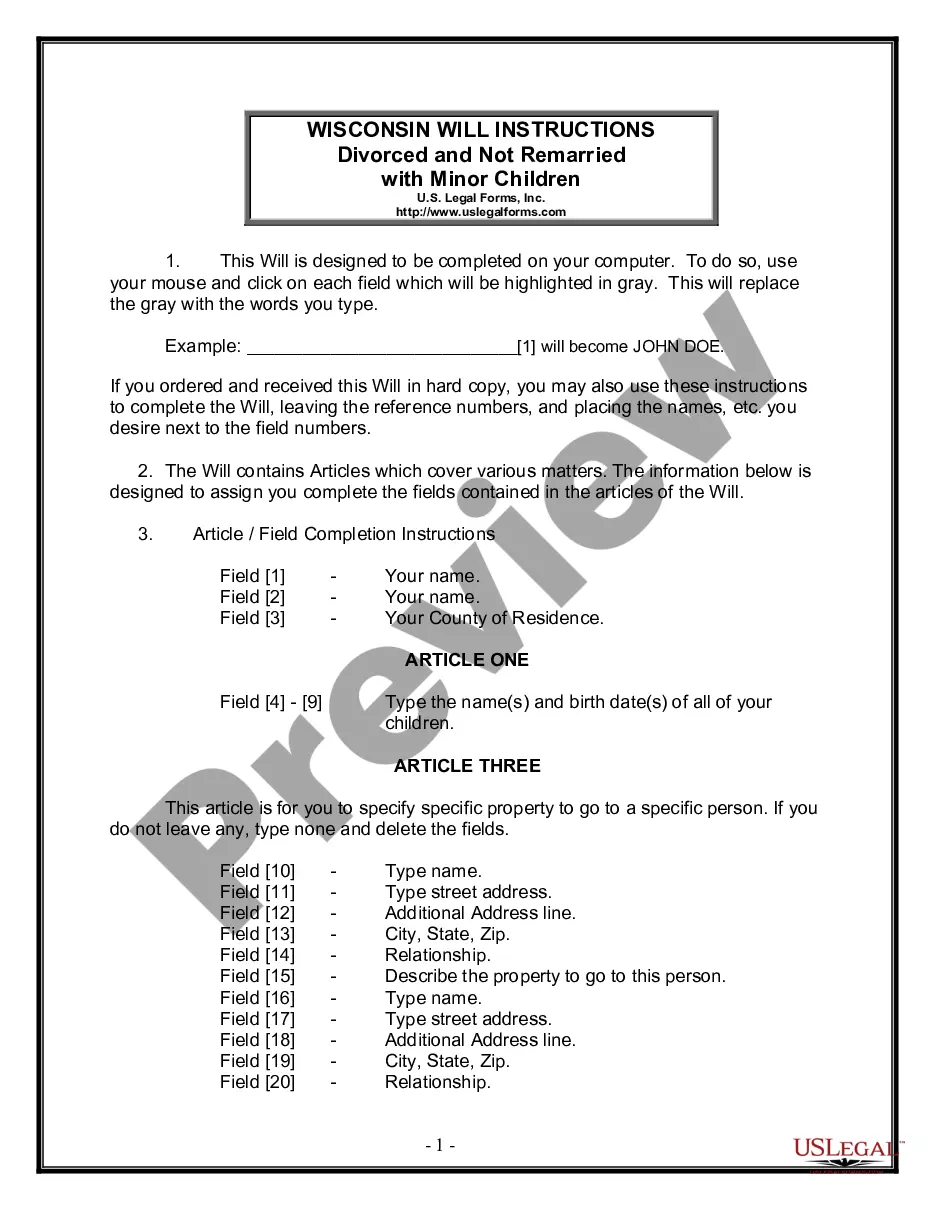

Create a tailored will that outlines asset distribution for divorced parents with minor children, ensuring your wishes are legally documented.

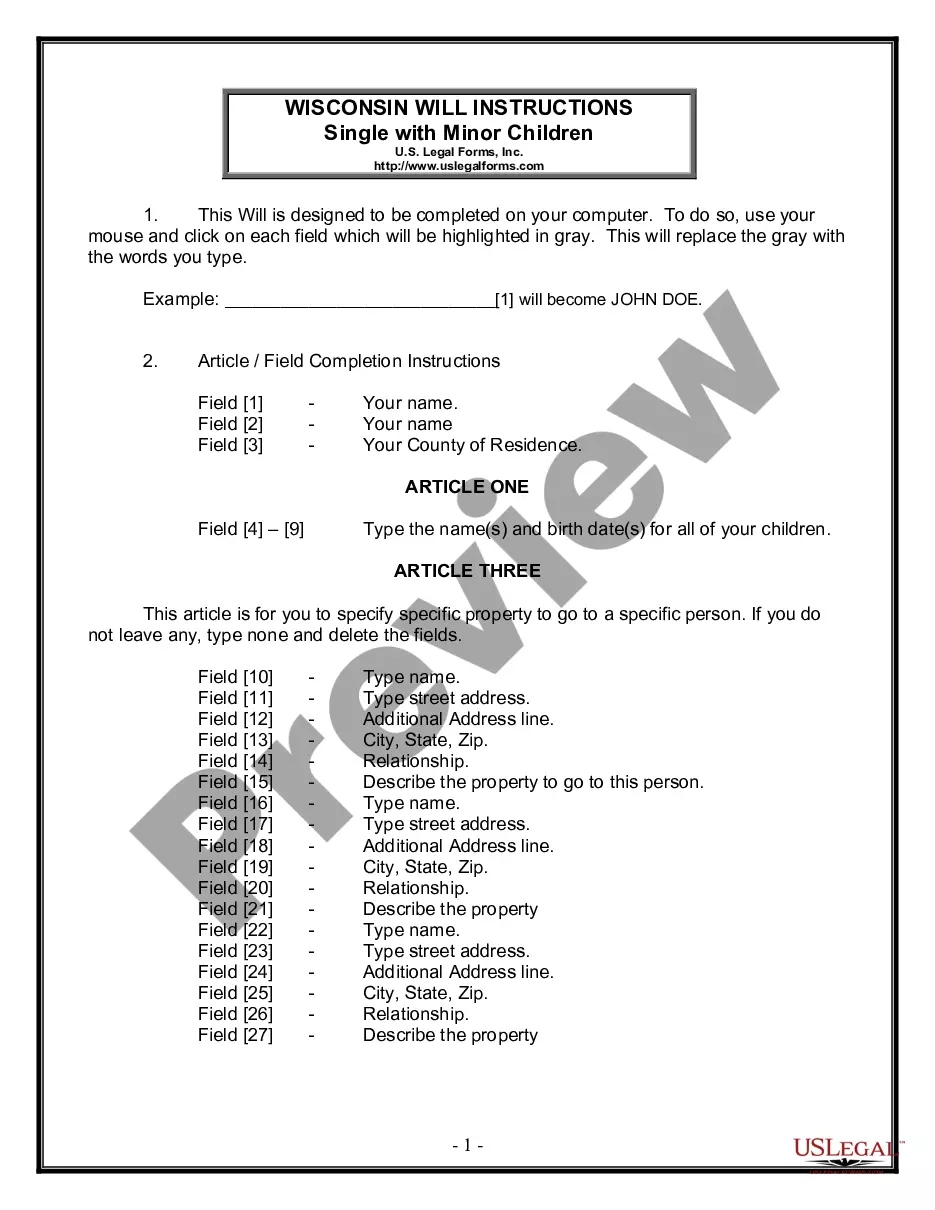

Prepare essential instructions for your estate, appoint guardians for minor children, and ensure your wishes are legally documented.

Plan your estate and ensure your wishes are honored after your death.

A Last Will and Testament is essential for asset distribution.

Wills can designate guardians for minor children.

Many wills require witnesses or notarization.

Simplifying the probate process can be achieved with self-proving wills.

You can amend your will as your life circumstances change.

Begin your planning journey in a few easy steps.

Not necessarily; a will can suffice, but a trust may offer additional benefits.

Your assets may be distributed according to state law, potentially not reflecting your wishes.

Consider updating your will after major life events, like marriage or the birth of a child.

Beneficiary designations can override will provisions for certain assets, like life insurance.

Yes, you can designate separate individuals for financial and healthcare decisions.