What is Last Will and Testament?

A Last Will and Testament is a legal document that specifies how your assets should be distributed after your passing. It's used to ensure your wishes are honored. Explore state-specific templates to get started.

Last Will and Testament documents help outline your wishes after death. Attorney-drafted templates can be quick and simple to complete.

Prepare for the future with essential documents that protect your health, finances, and loved ones in one convenient package.

Create a legally binding will to specify how your property should be distributed after your death.

Create a comprehensive will tailored for a widow or widower with adult children, ensuring that your wishes regarding asset distribution are clearly outlined.

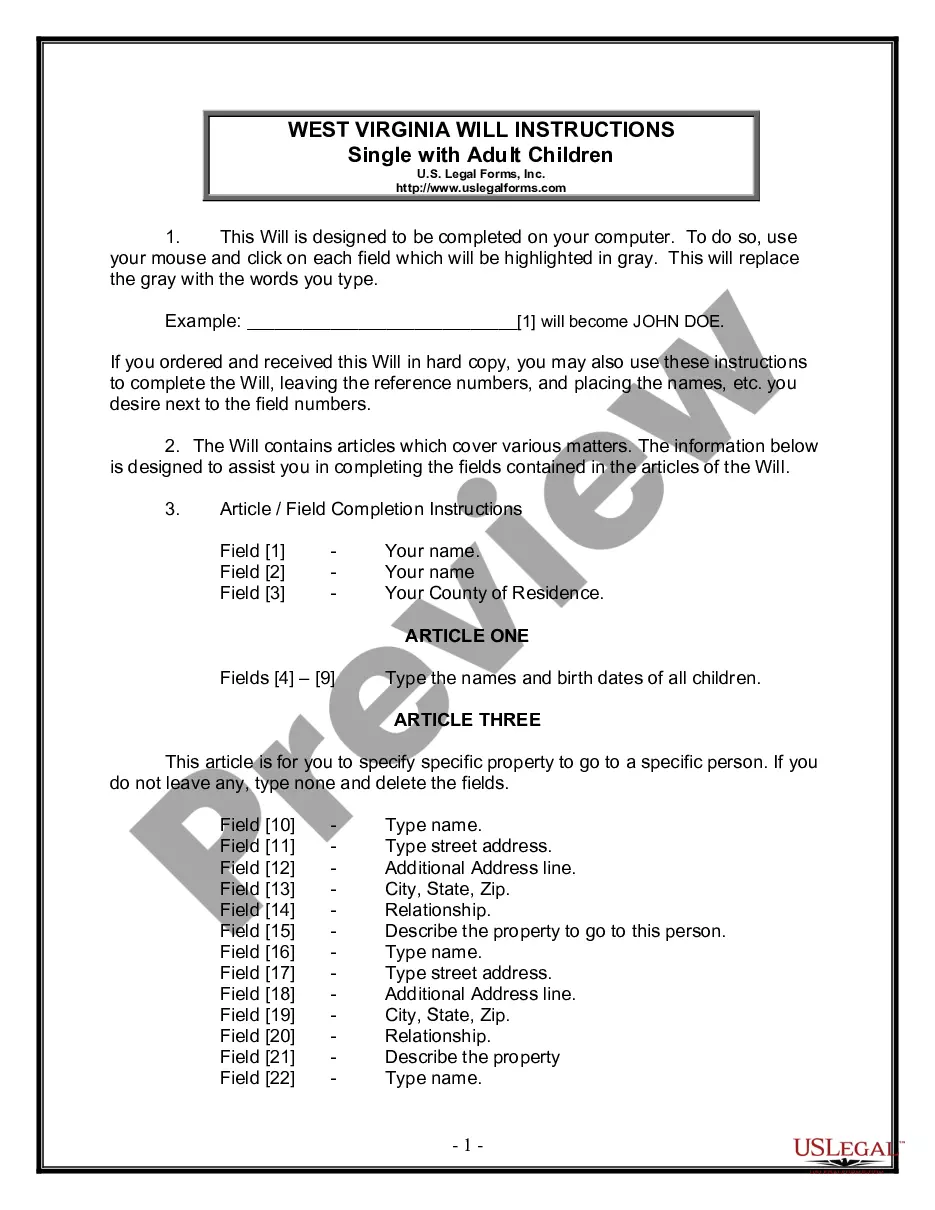

Prepare a legally binding will for your estate, ensuring your adult children inherit properly after divorce.

Plan your estate effectively and ensure your wishes are honored after your passing, especially for adult children.

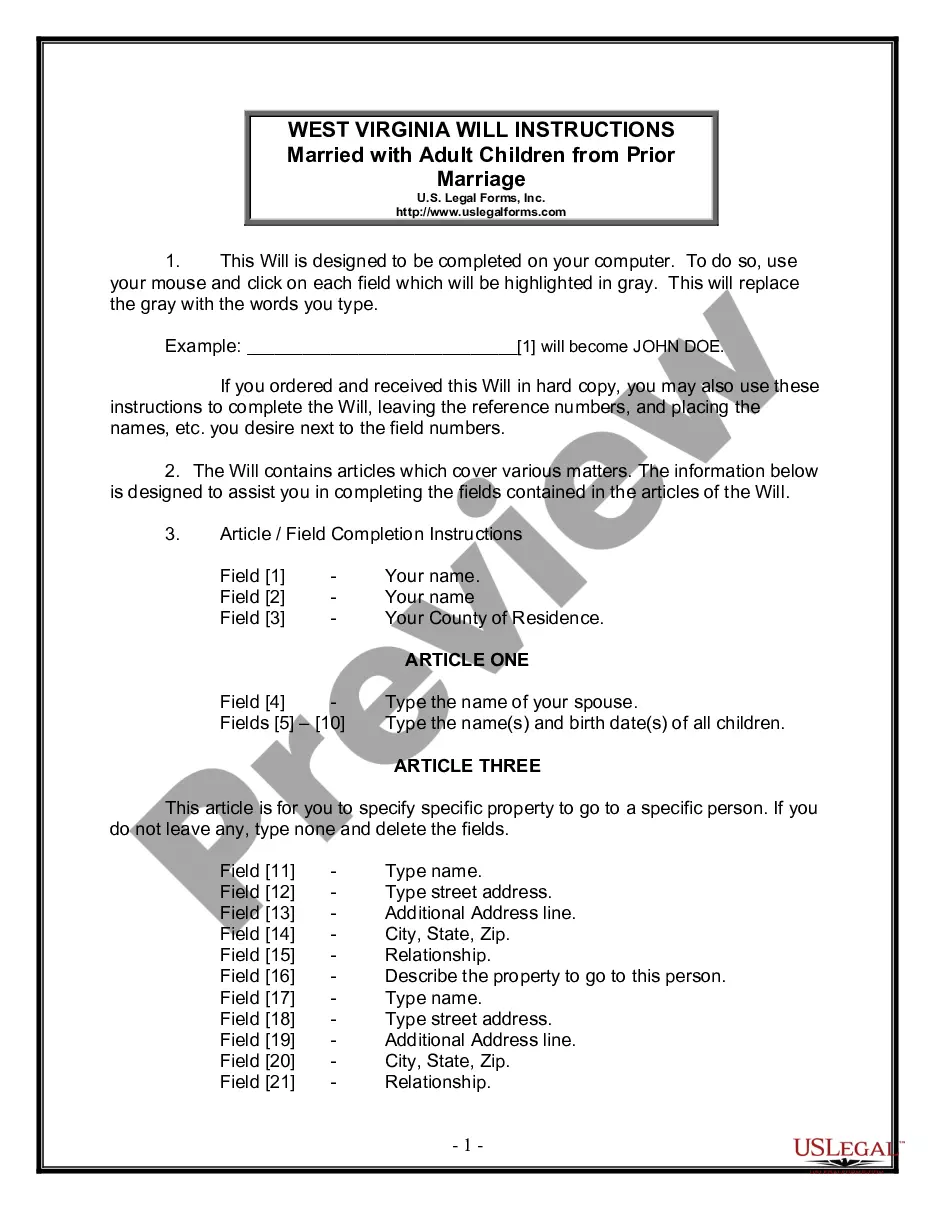

Create a comprehensive estate plan that specifies how your assets will be distributed, especially when blending families or managing prior relationships.

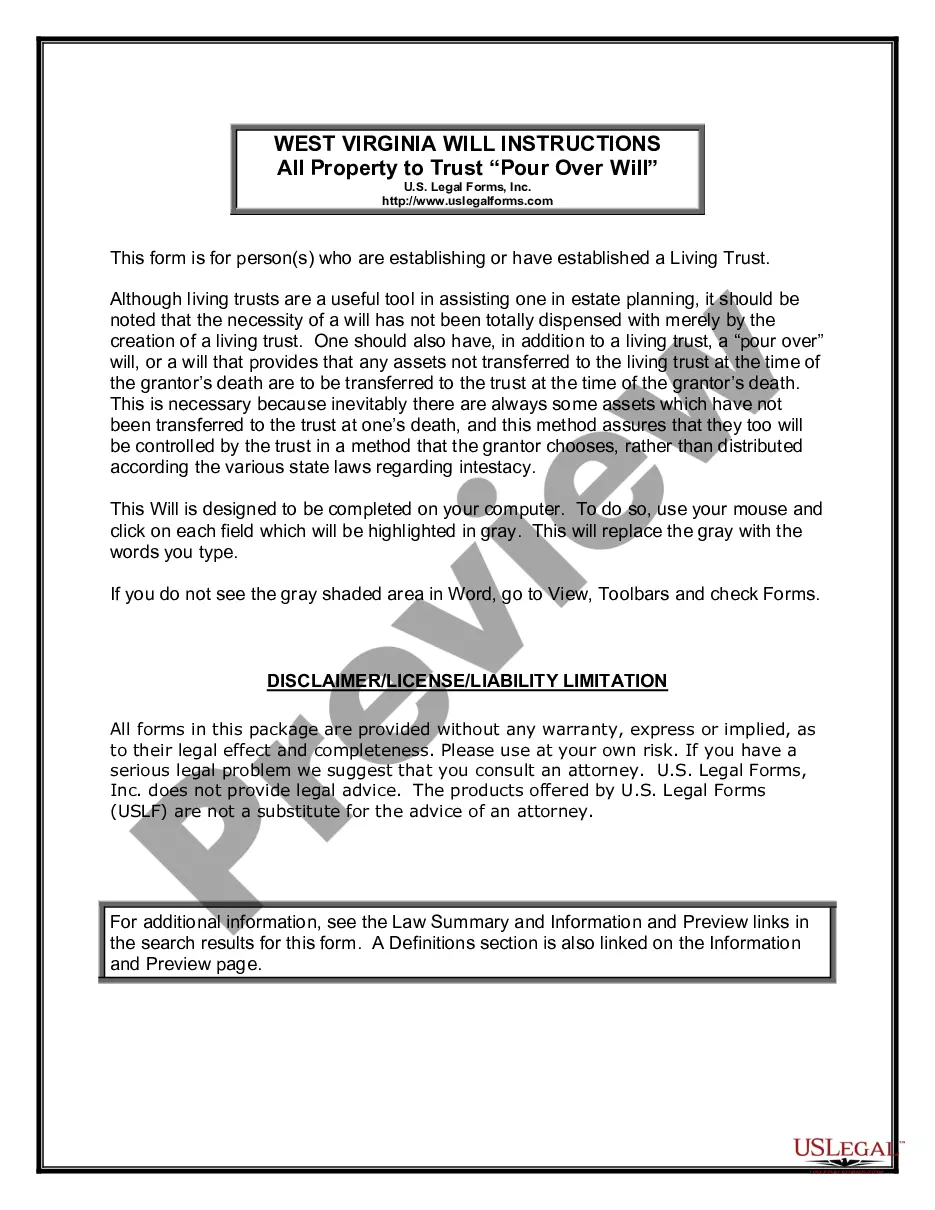

Securely transfer any remaining assets to your trust upon your death, ensuring your wishes are honored and avoiding state distribution laws.

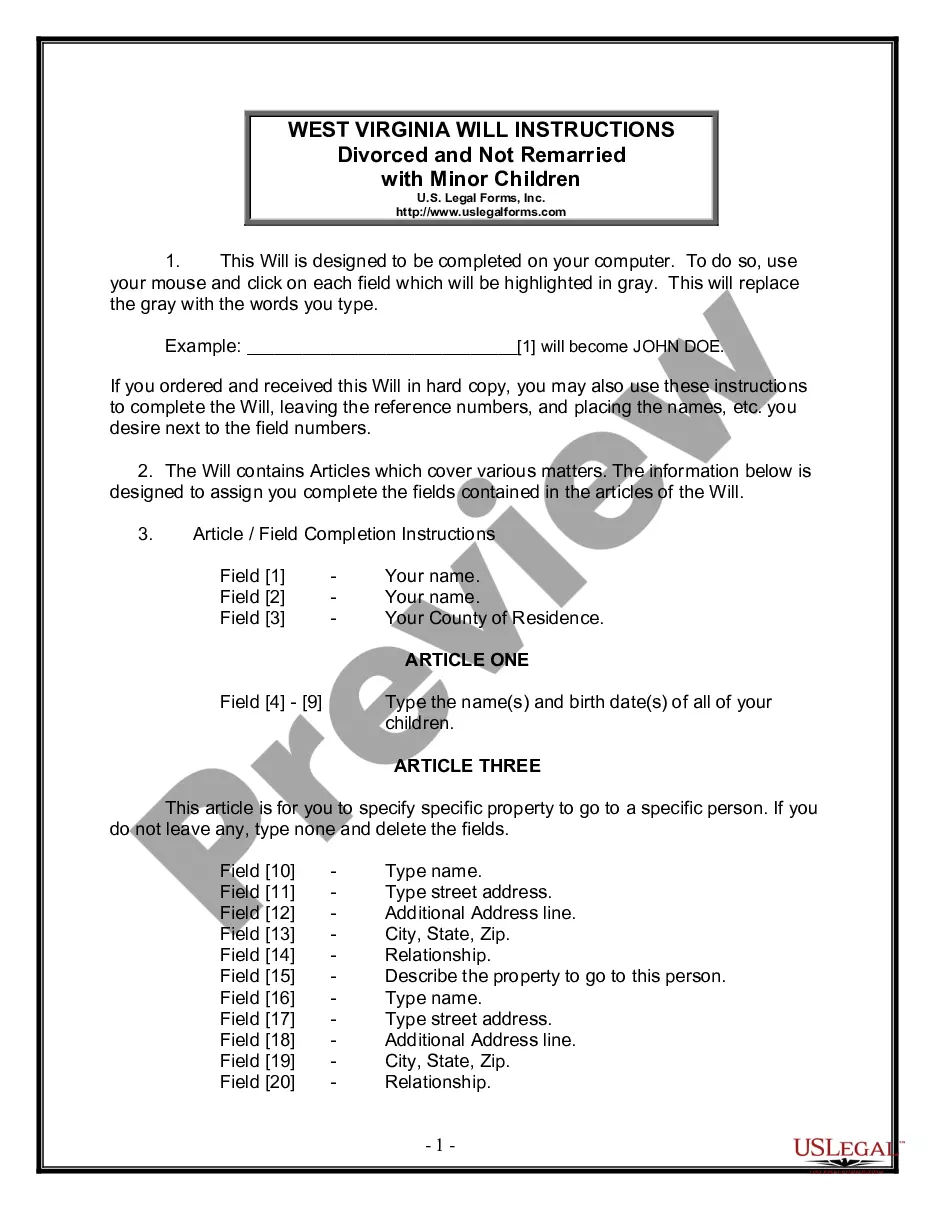

Create a legally binding document to designate guardianship and manage assets for minor children after death.

Create a plan for your assets and guardianship for your children with this legally binding document.

Ensure your wishes are honored after your passing by designating heirs and guardians in a carefully structured document.

A Last Will and Testament appoints an executor to manage your estate.

Wills can specify guardianship for minor children.

Witnesses may be required to validate the will.

An executor is responsible for ensuring the will's terms are followed.

Beneficiaries receive assets as outlined in the will.

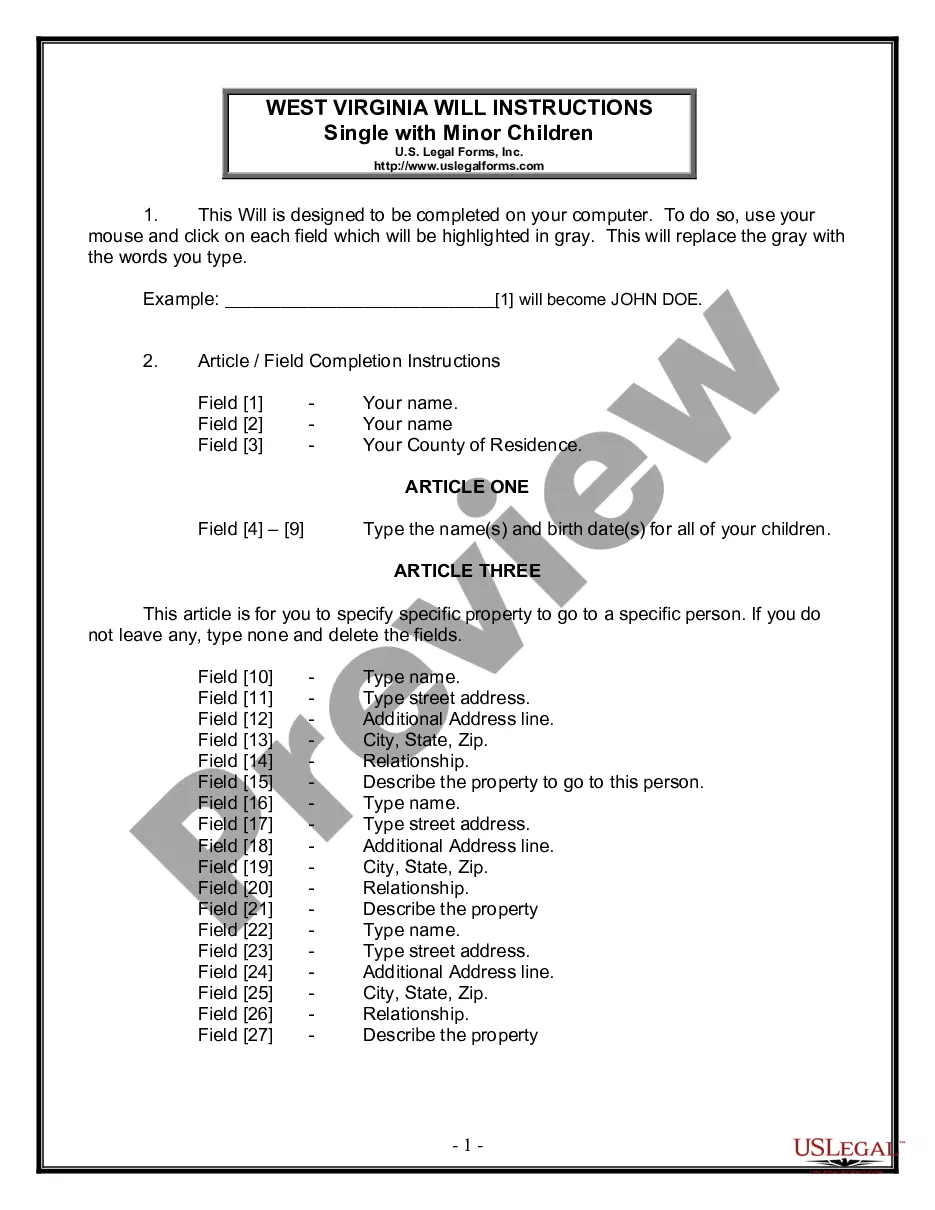

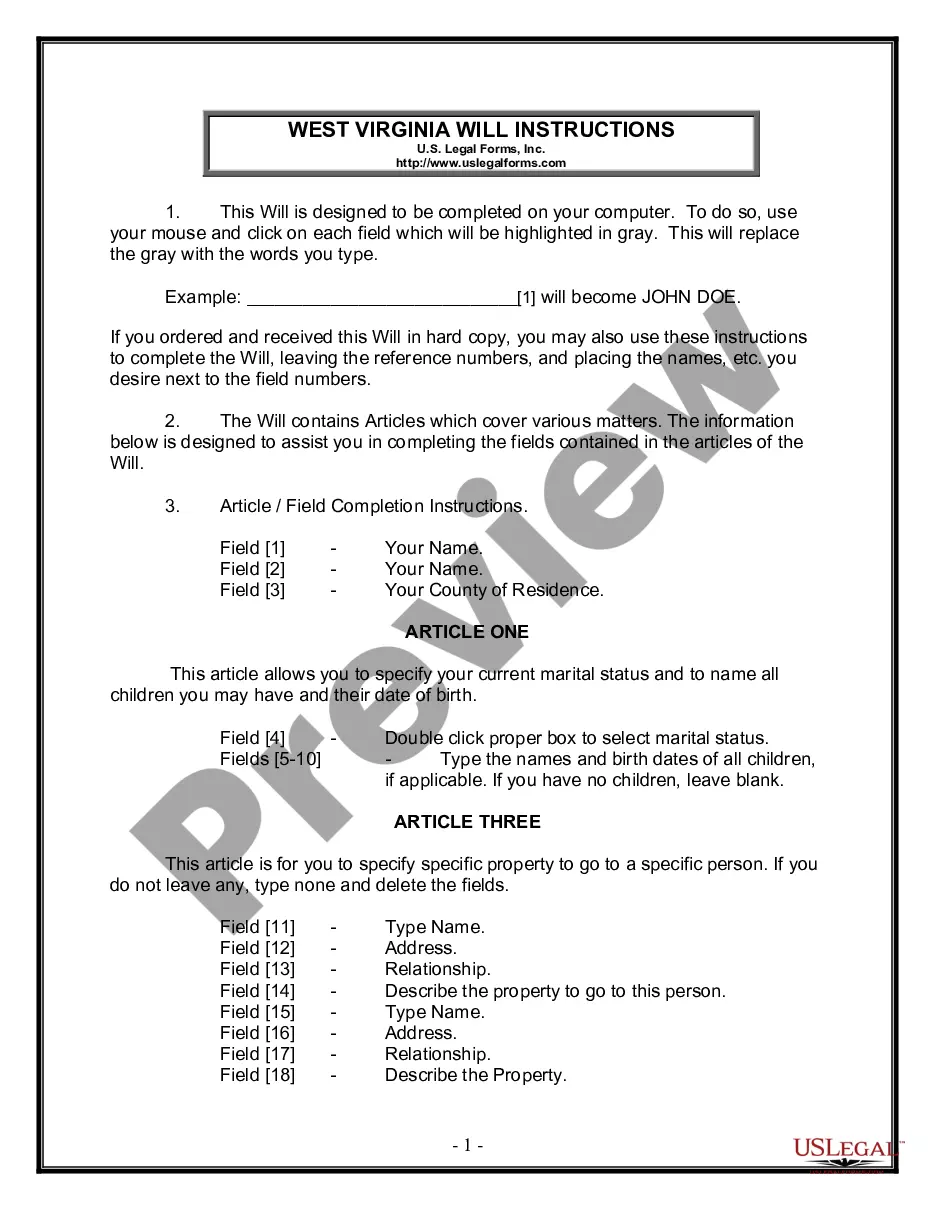

Begin your journey with these simple steps.

A trust can provide additional benefits, like avoiding probate, but it's not necessary for everyone.

Without a will, state laws will dictate how your assets are distributed, which may not align with your wishes.

It's wise to review your will after major life changes, such as marriage or the birth of a child.

Beneficiary designations on accounts may override your will, so keep them aligned with your wishes.

Yes, you can appoint separate individuals for financial and health care decisions in your planning documents.