What is Last Will and Testament?

A Last Will and Testament outlines how your assets will be distributed after death. It is essential for ensuring your wishes are followed. Explore state-specific templates for your needs.

Last Will and Testament documents help ensure your wishes are honored. Attorney-drafted templates are quick and easy to fill out.

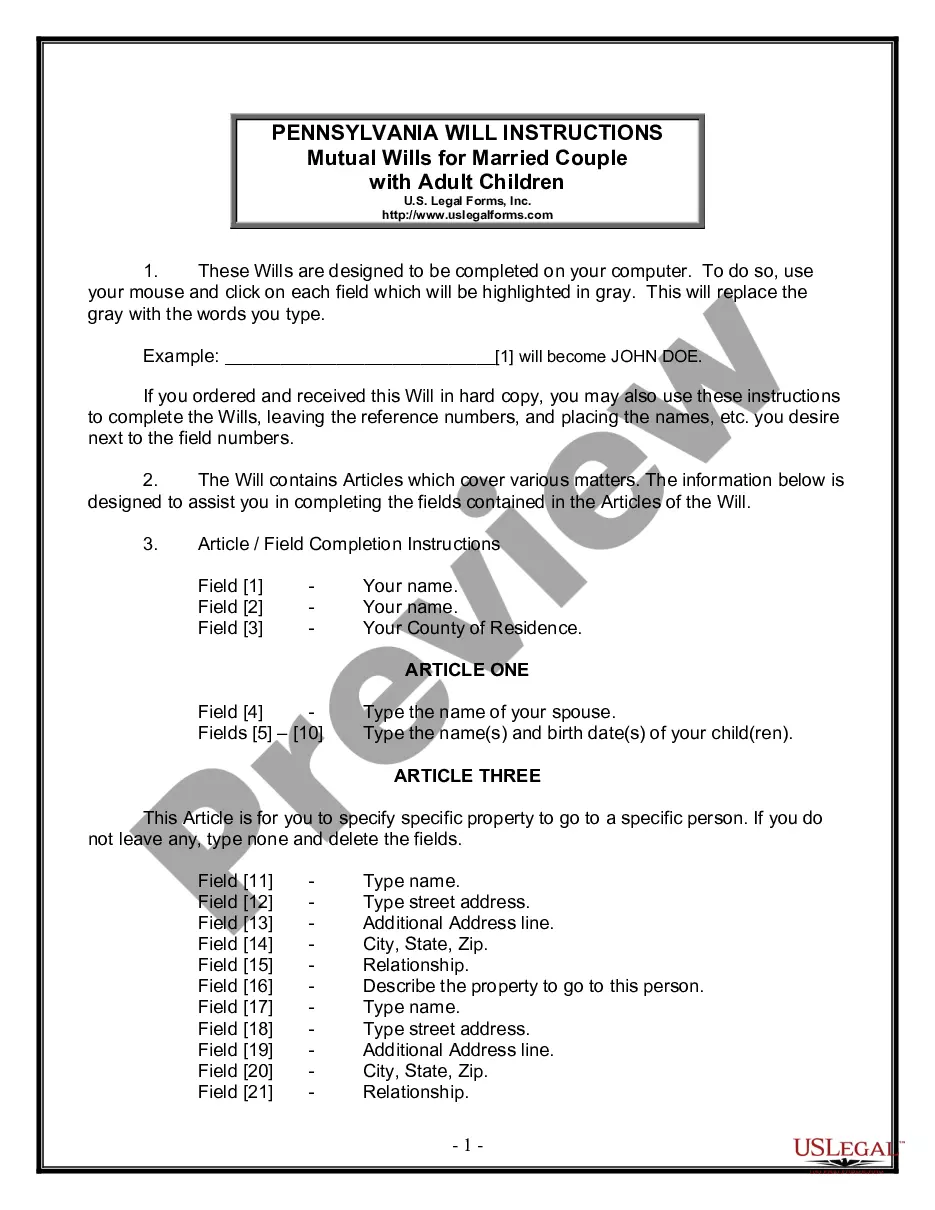

Create legally binding wills for a married couple with adult children to ensure clear distribution of assets and designate personal representatives.

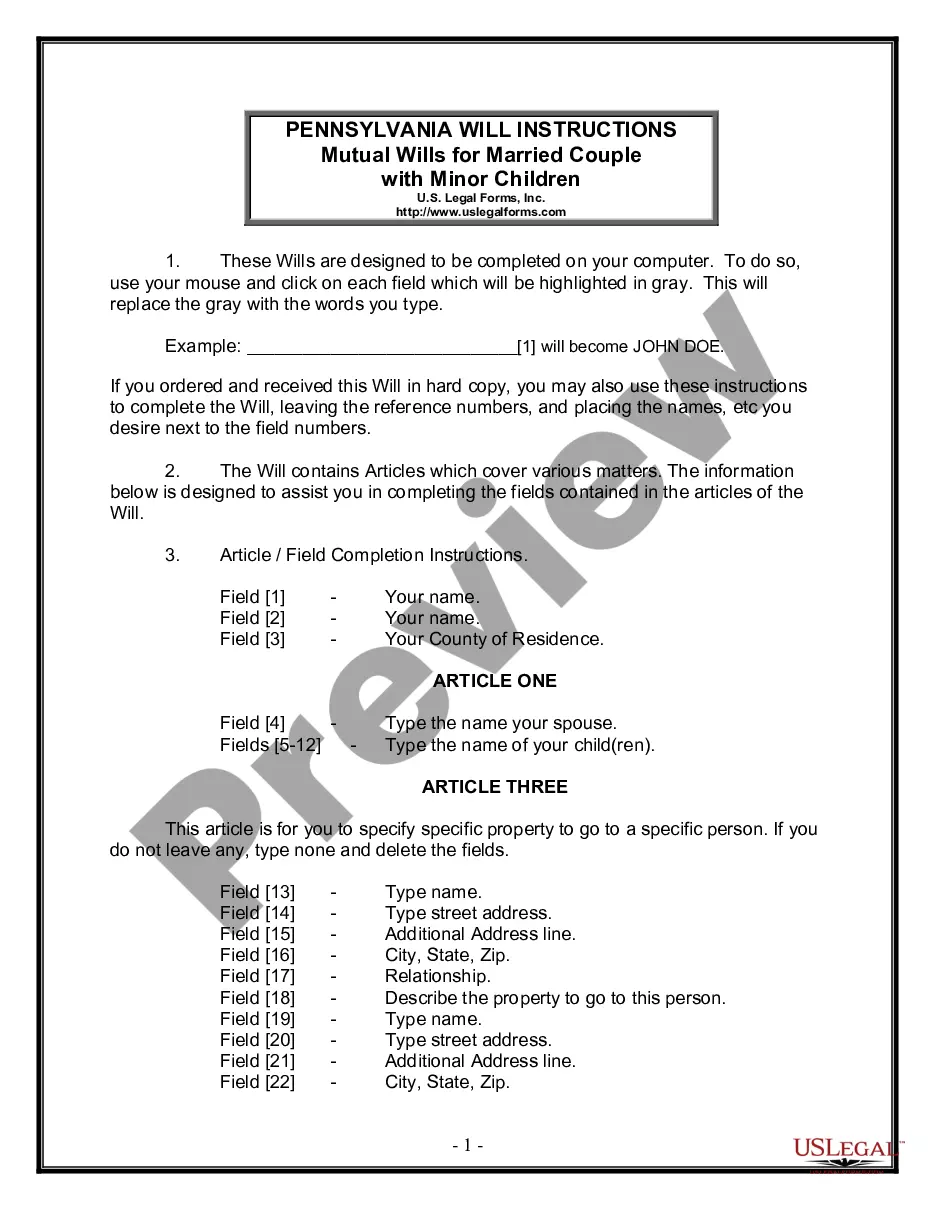

Prepare mutual wills tailored for married couples with minor children to ensure your family's future is secure and your wishes are honored.

Get everything needed for estate planning in one place, ensuring peace of mind for you and your loved ones.

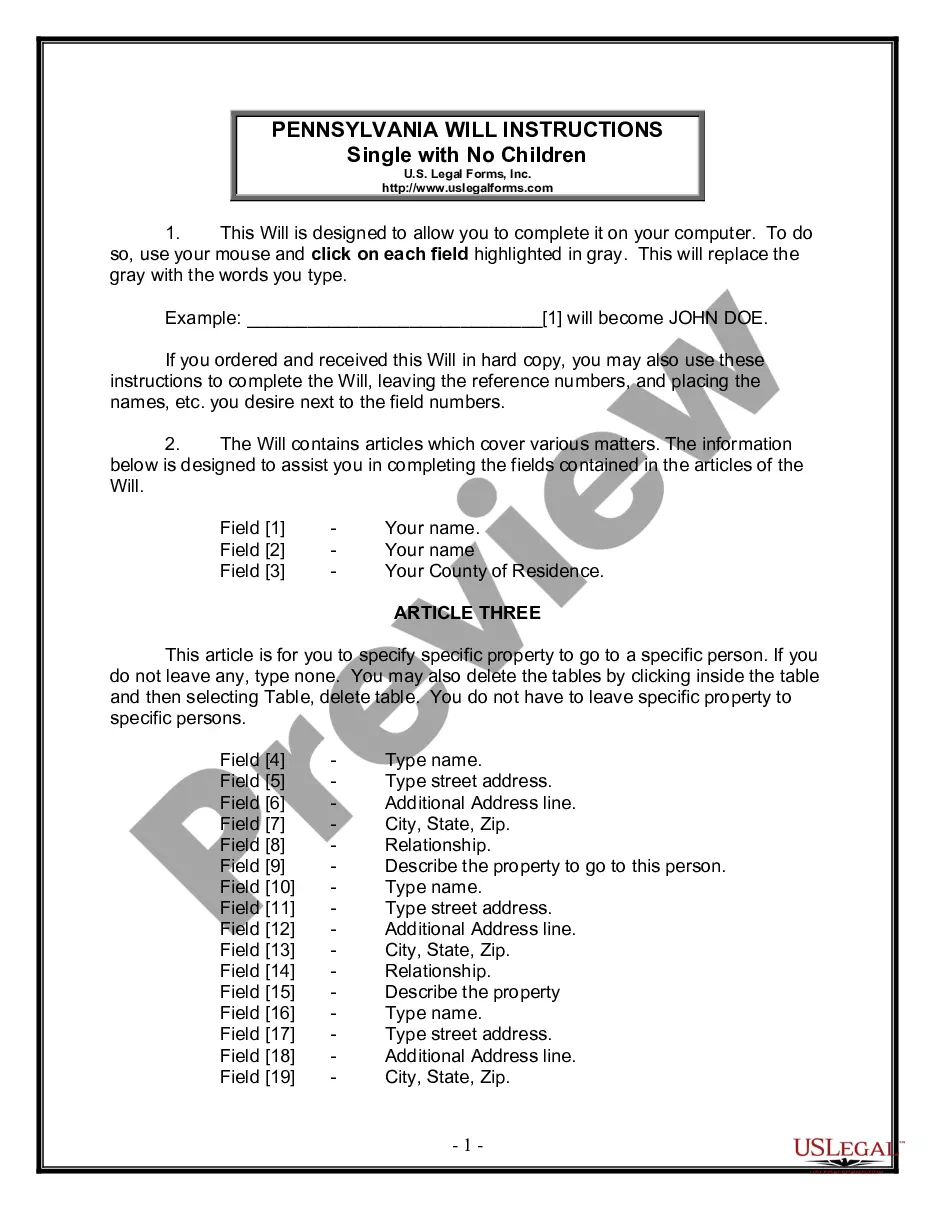

Prepare a customized will to specify how your property and belongings are distributed after your death.

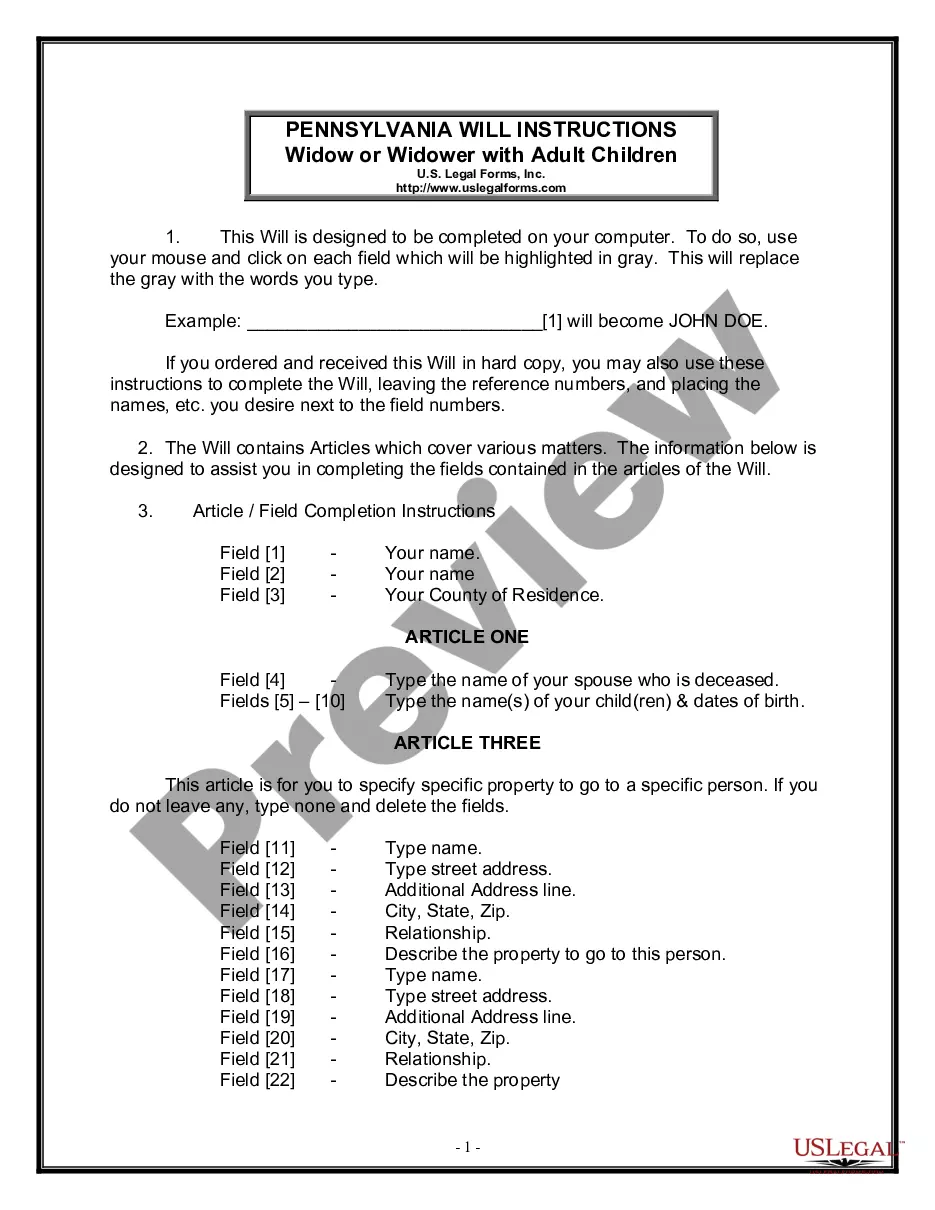

Plan your estate with a tailored document for widows and widowers, ensuring your adult children receive designated assets.

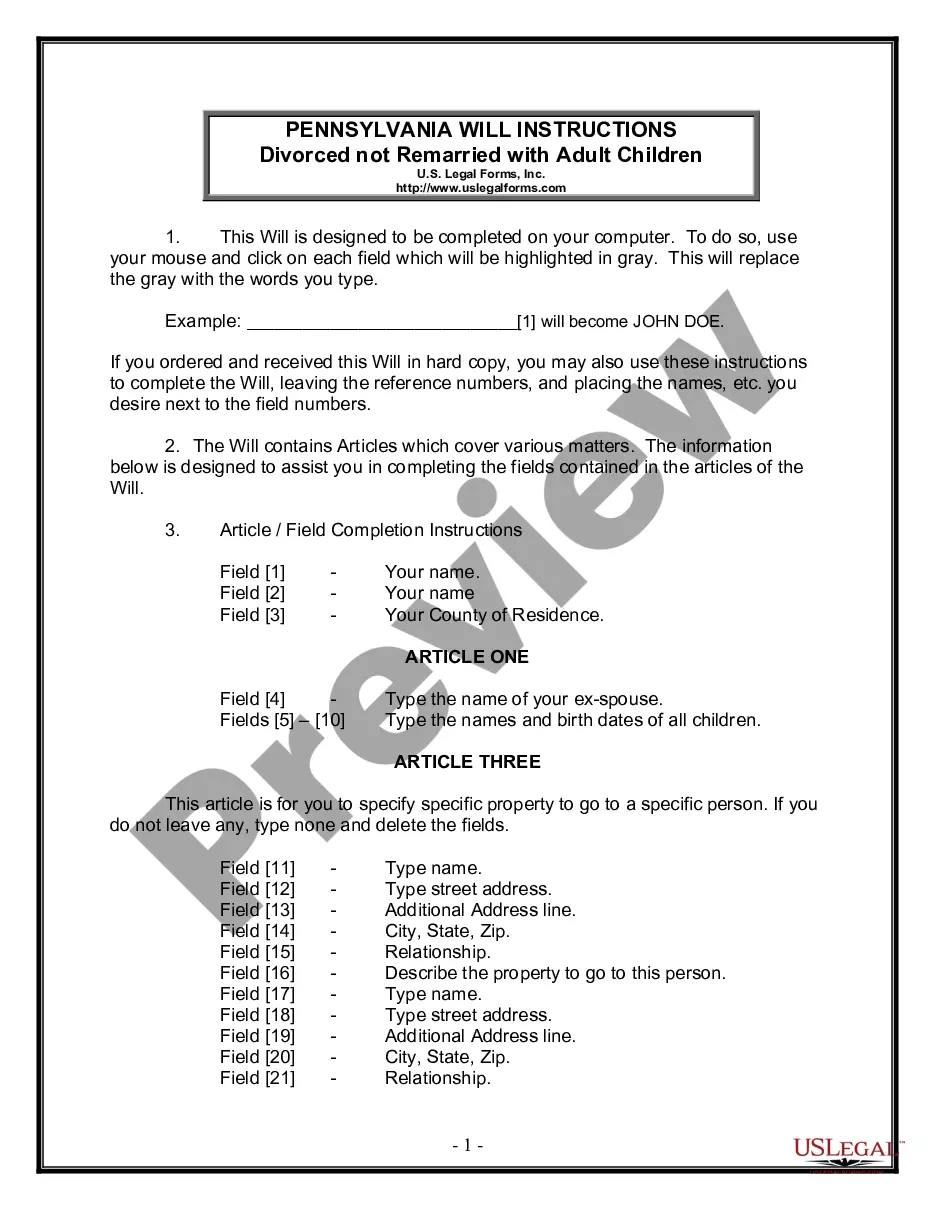

Create a will tailored for divorced individuals with adult children, ensuring your estate is distributed according to your wishes.

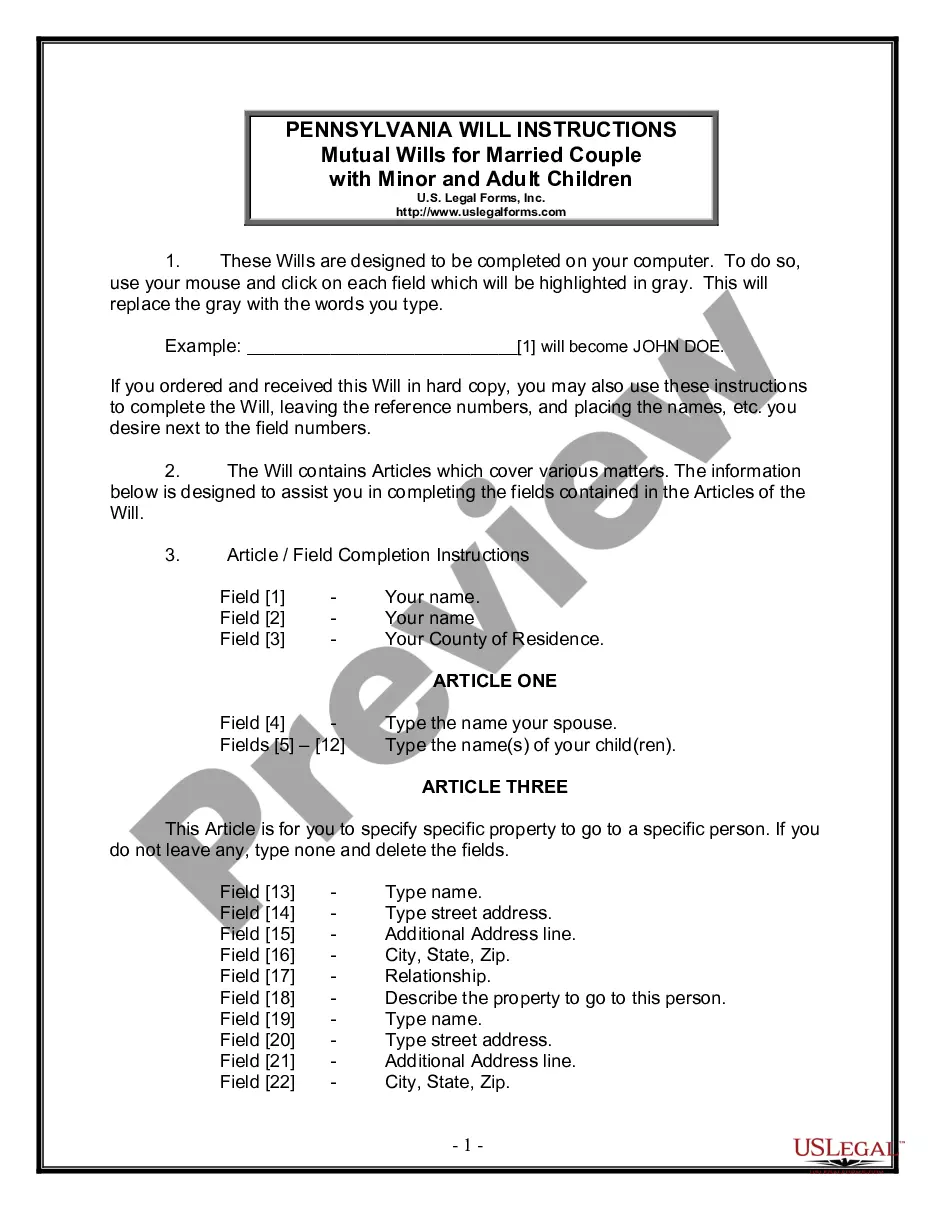

Create legal mutual wills to ensure your spouse and children are protected in your estate plan.

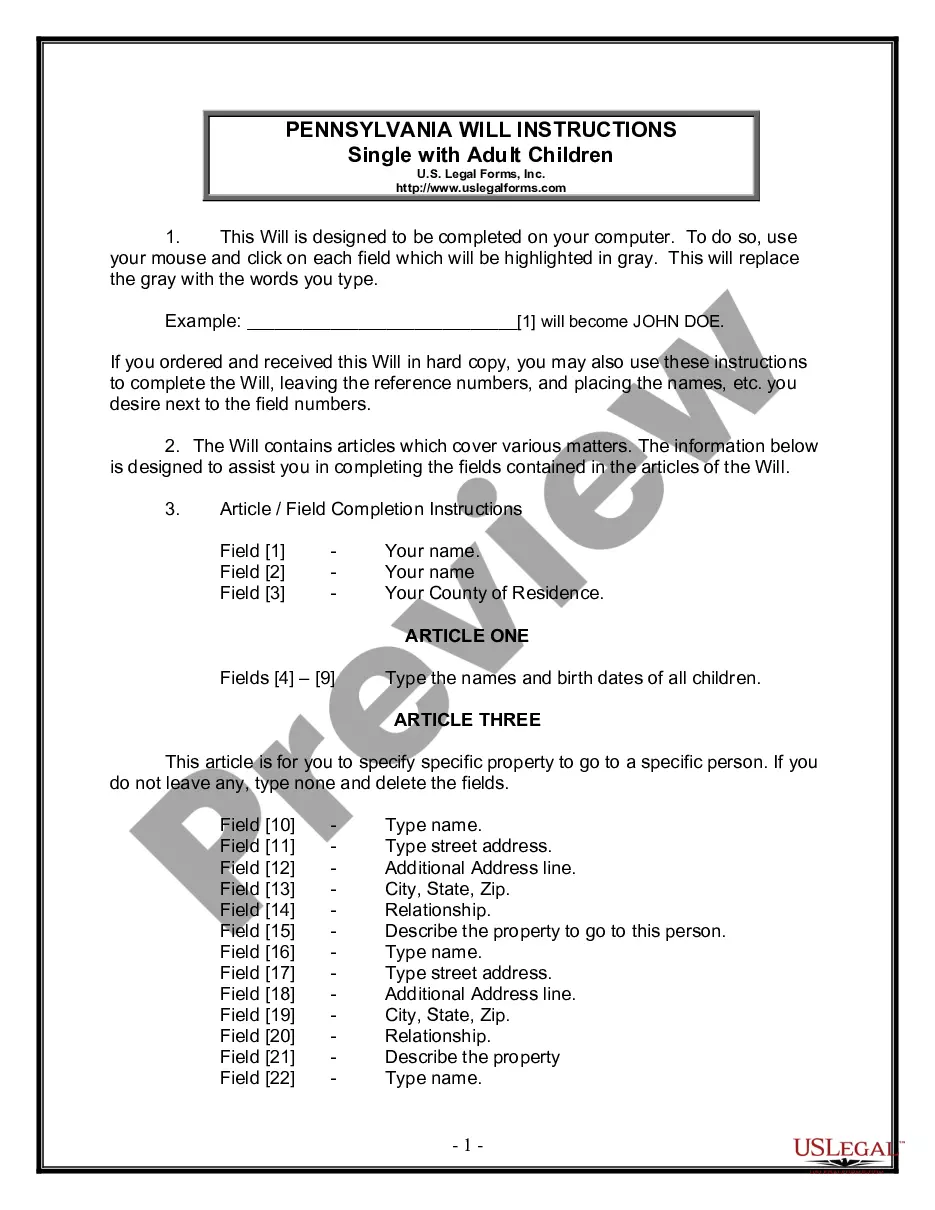

Ensure your wishes are honored after your passing. This document supports single individuals with adult children in distributing their assets clearly.

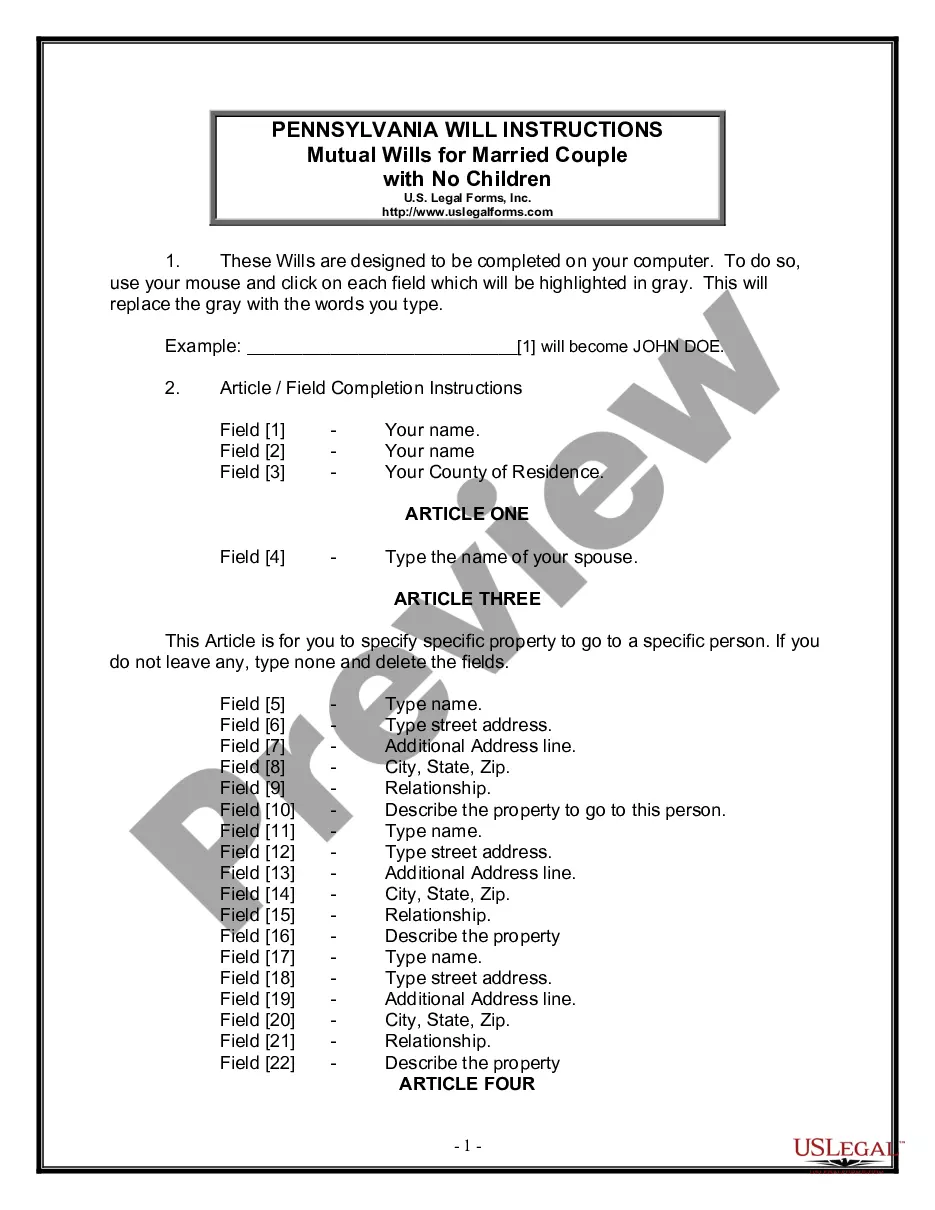

Ideal for married couples without children, this package ensures both partners are protected in estate planning.

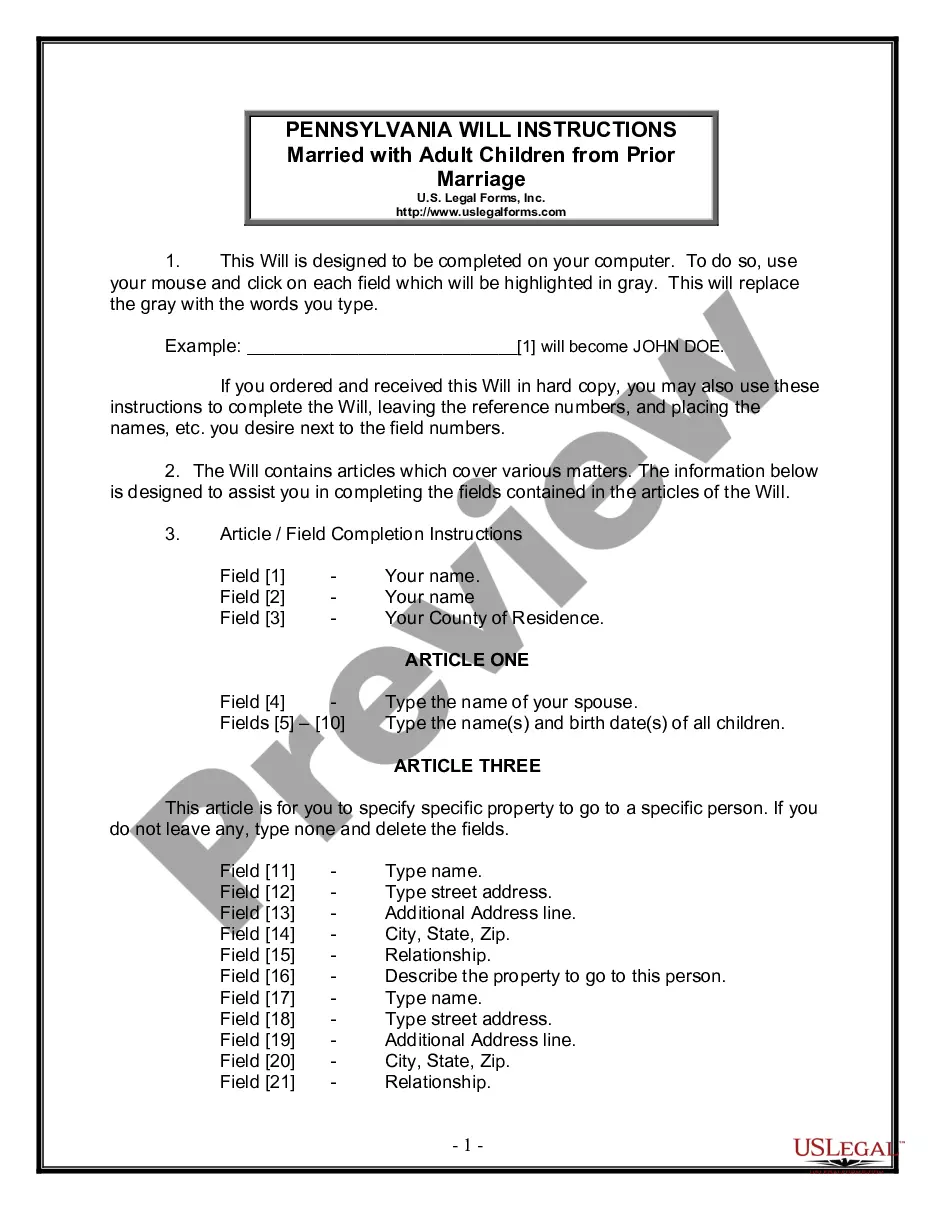

Create a comprehensive estate plan that ensures your adult children from a previous marriage are provided for after your passing.

A Last Will and Testament is a crucial estate planning tool.

Wills can be contested, so clarity is essential.

Many wills require witnesses to be legally valid.

Beneficiaries can be individuals or organizations.

Wills can be updated as life circumstances change.

Joint and mutual wills are designed for couples.

Holographic wills may have specific state requirements.

Begin quickly with these straightforward steps.

Not necessarily; a will can suffice, but trusts offer additional benefits.

Without a will, state laws dictate asset distribution, which may not reflect your wishes.

Update your plan whenever significant life events occur, like marriage or the birth of a child.

Beneficiary designations can override will instructions, so ensure they align with your overall plan.

Yes, you can designate separate individuals for financial and healthcare decisions.