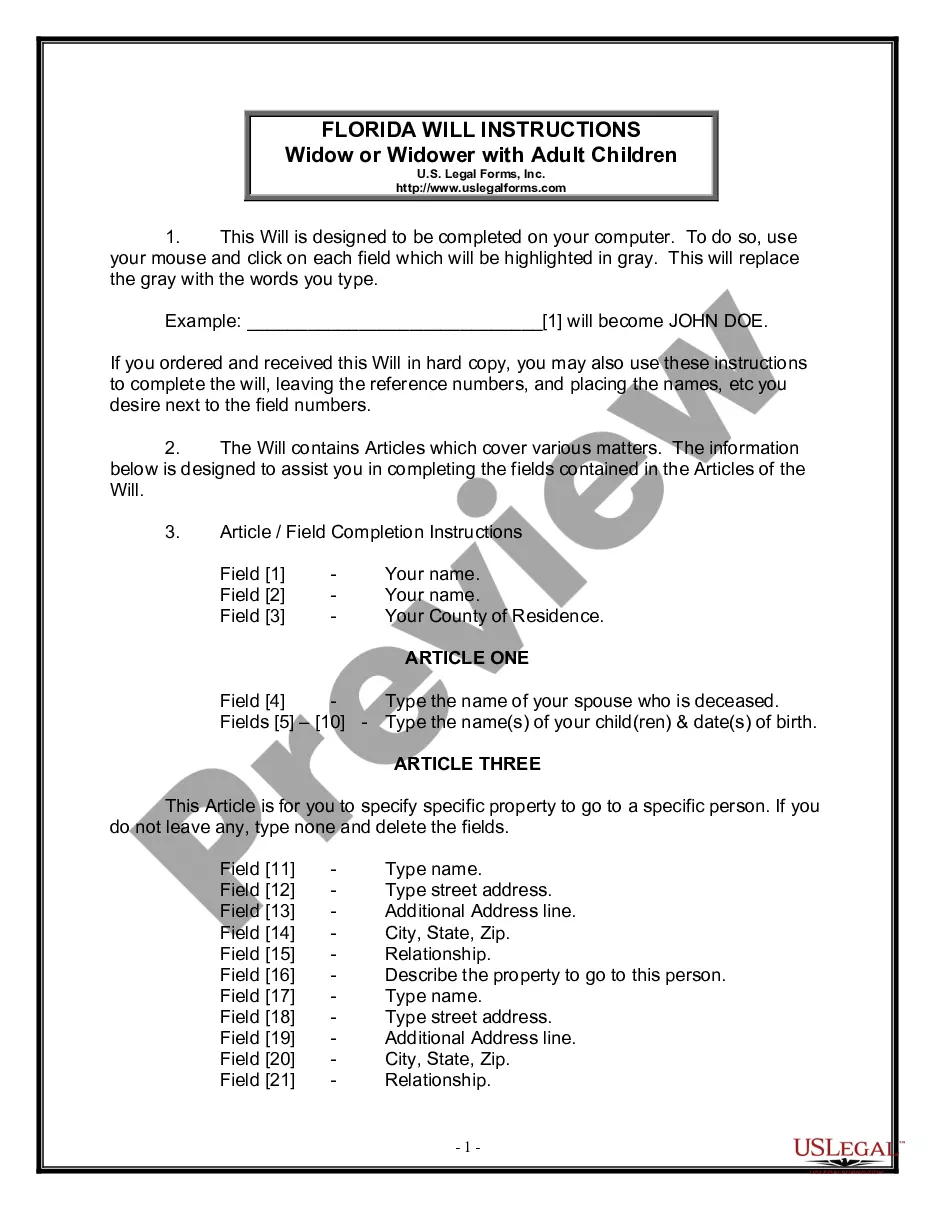

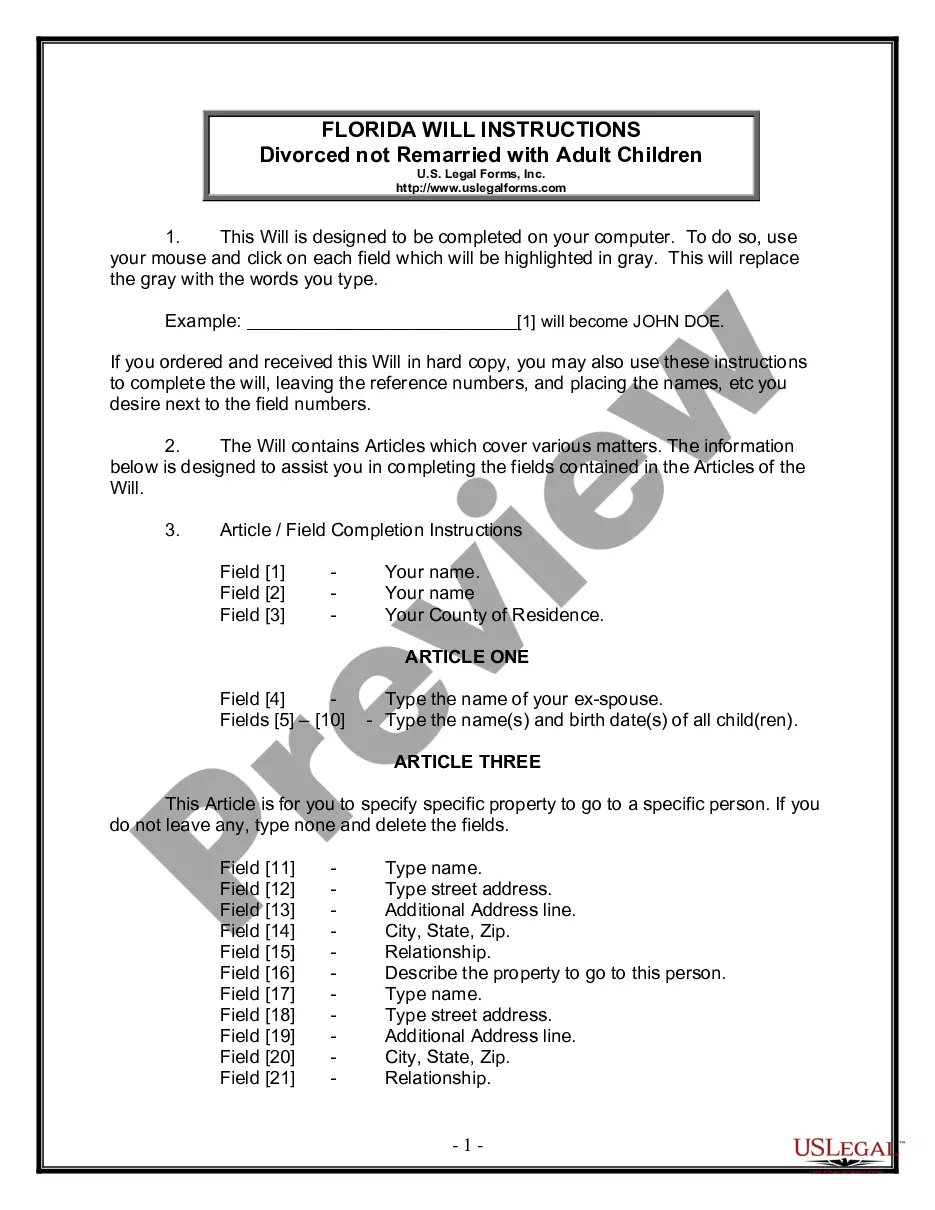

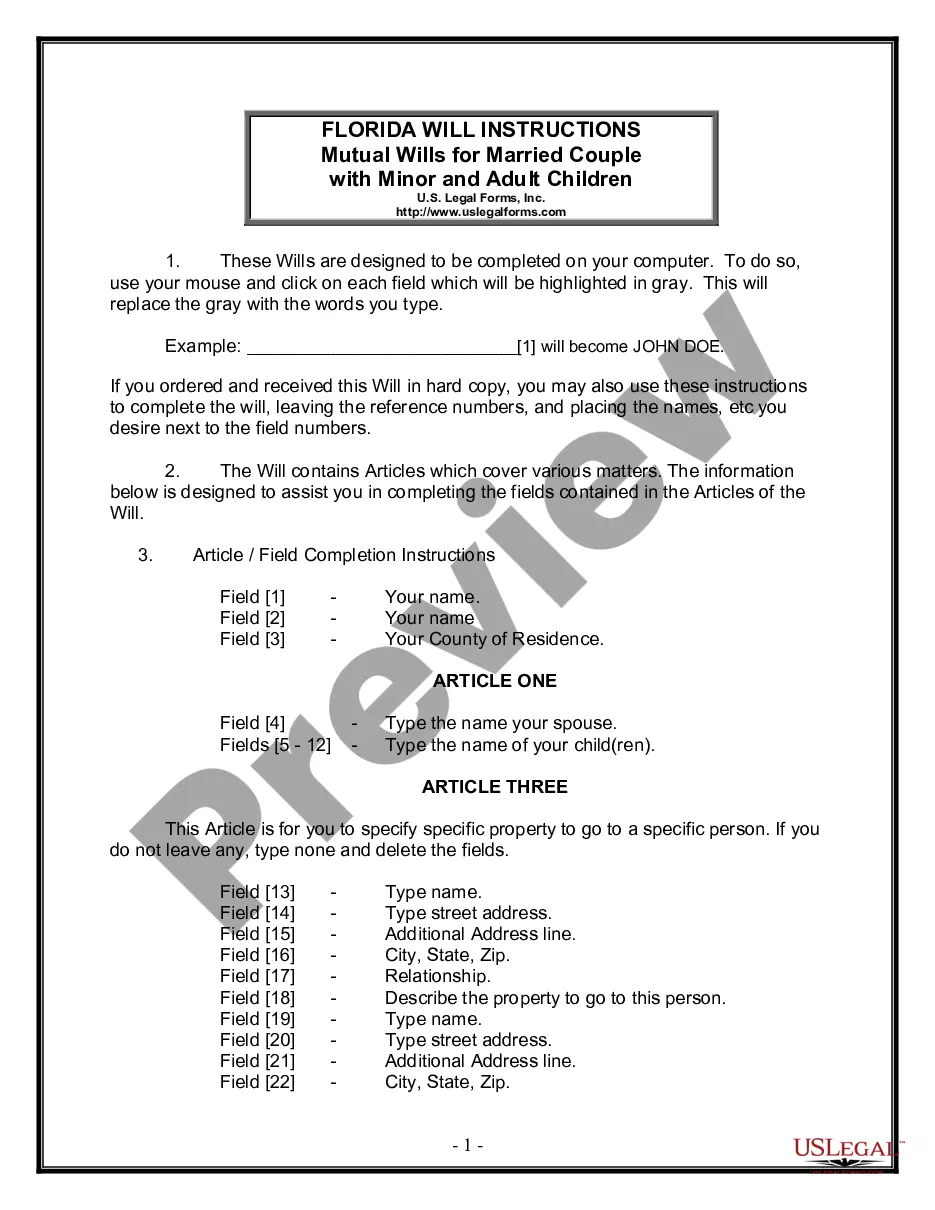

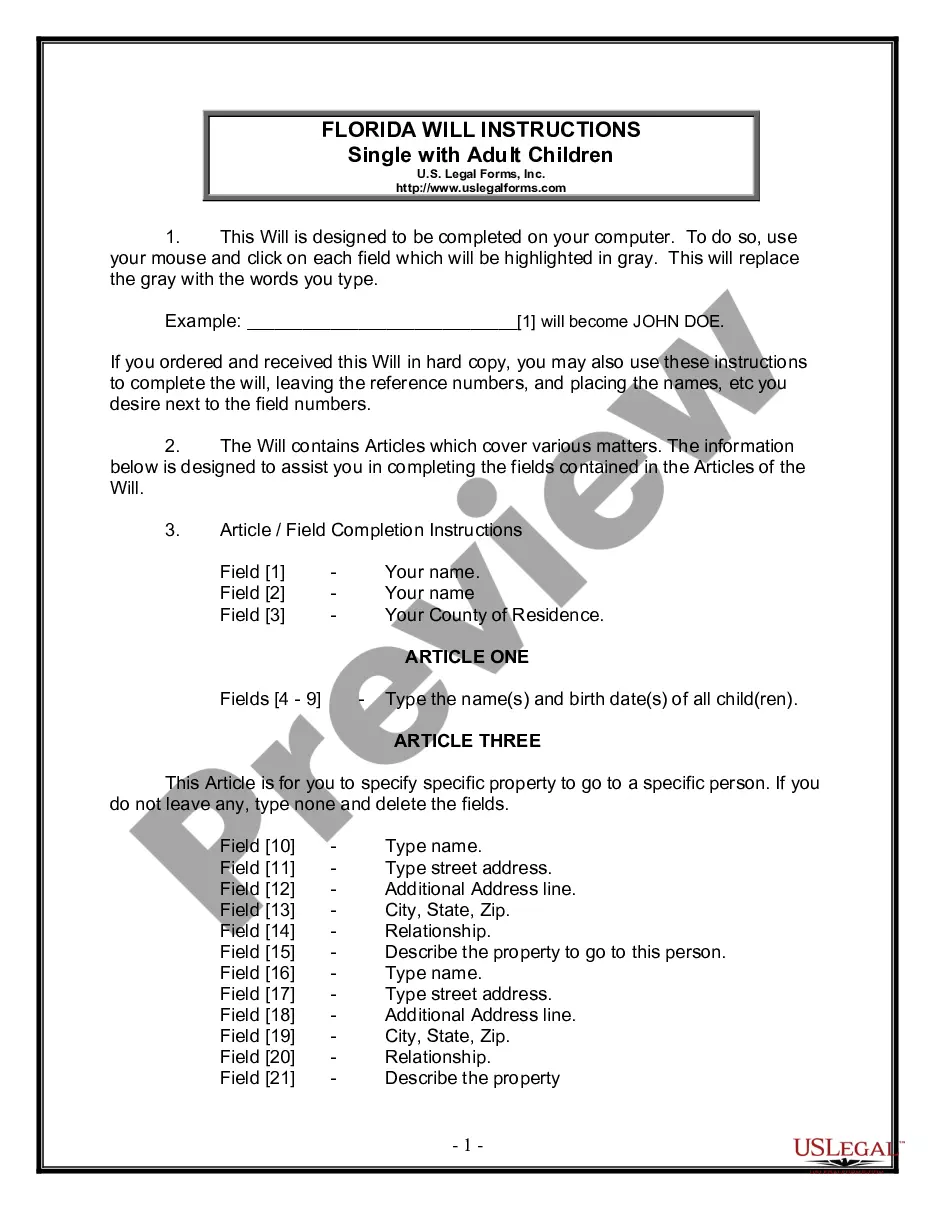

What is Last Will and Testament?

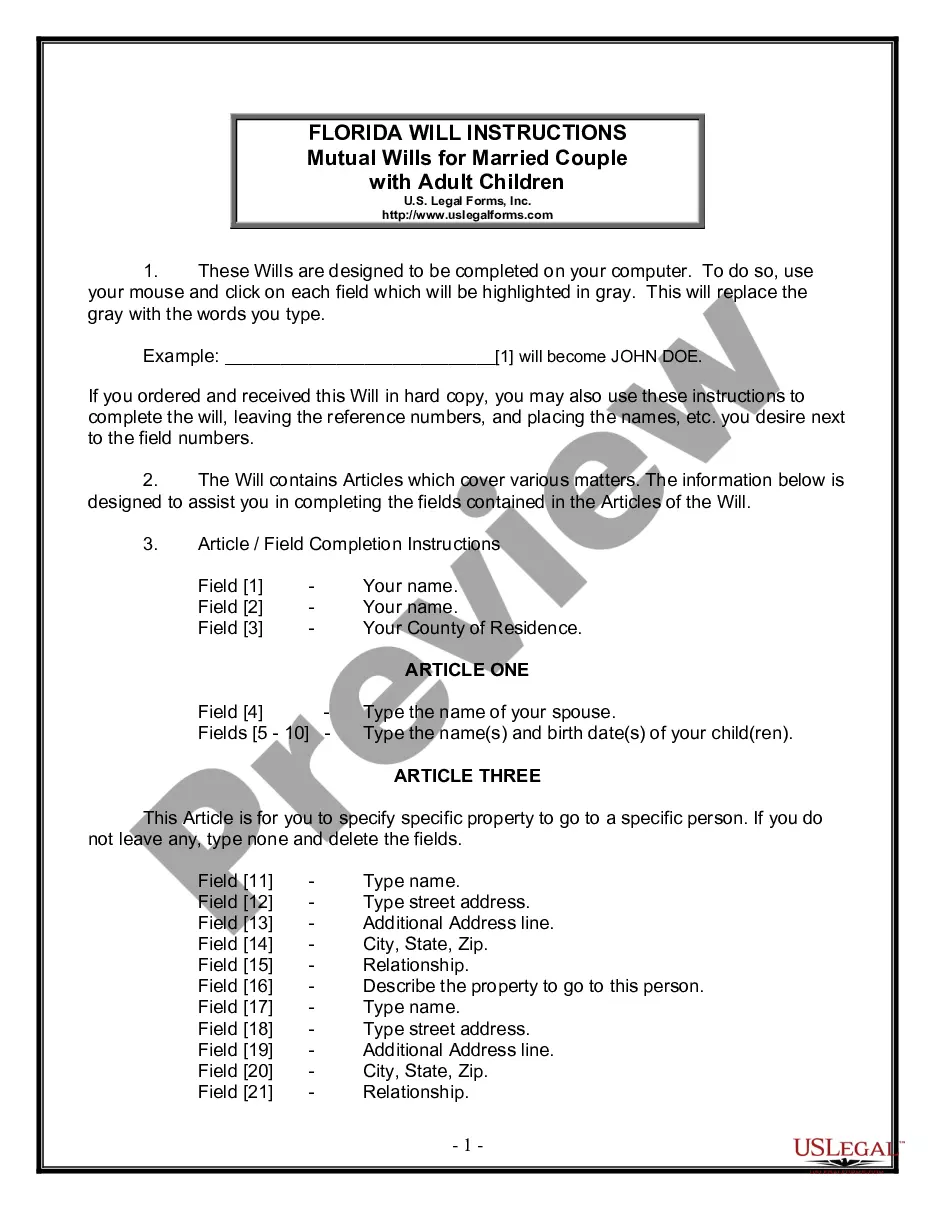

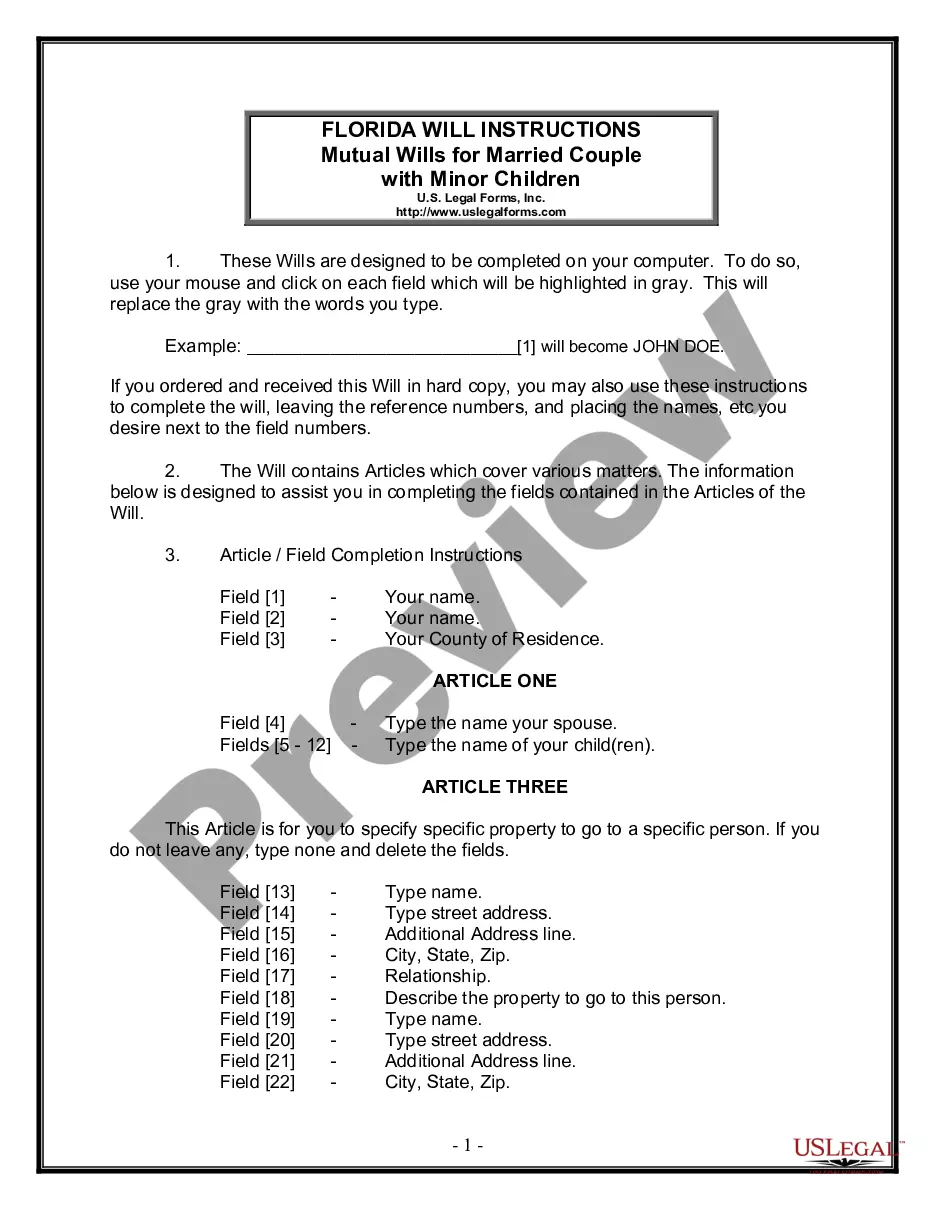

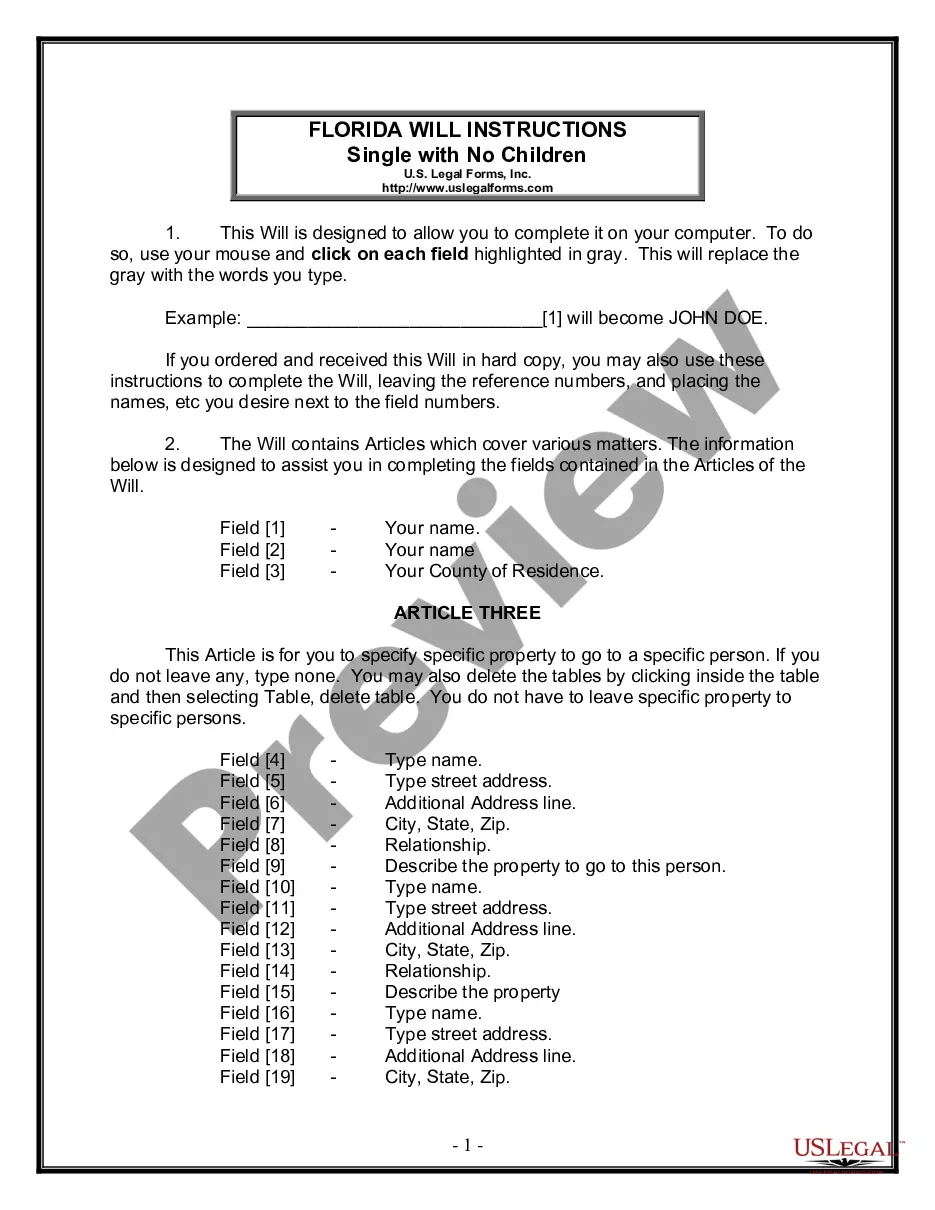

A Last Will and Testament is a legal document that outlines how your assets will be distributed after your death. It also names guardians for minor children and can designate an executor to manage your estate. Explore state-specific templates for your needs.