Bank Loan Application Form and Checklist

Overview of this form

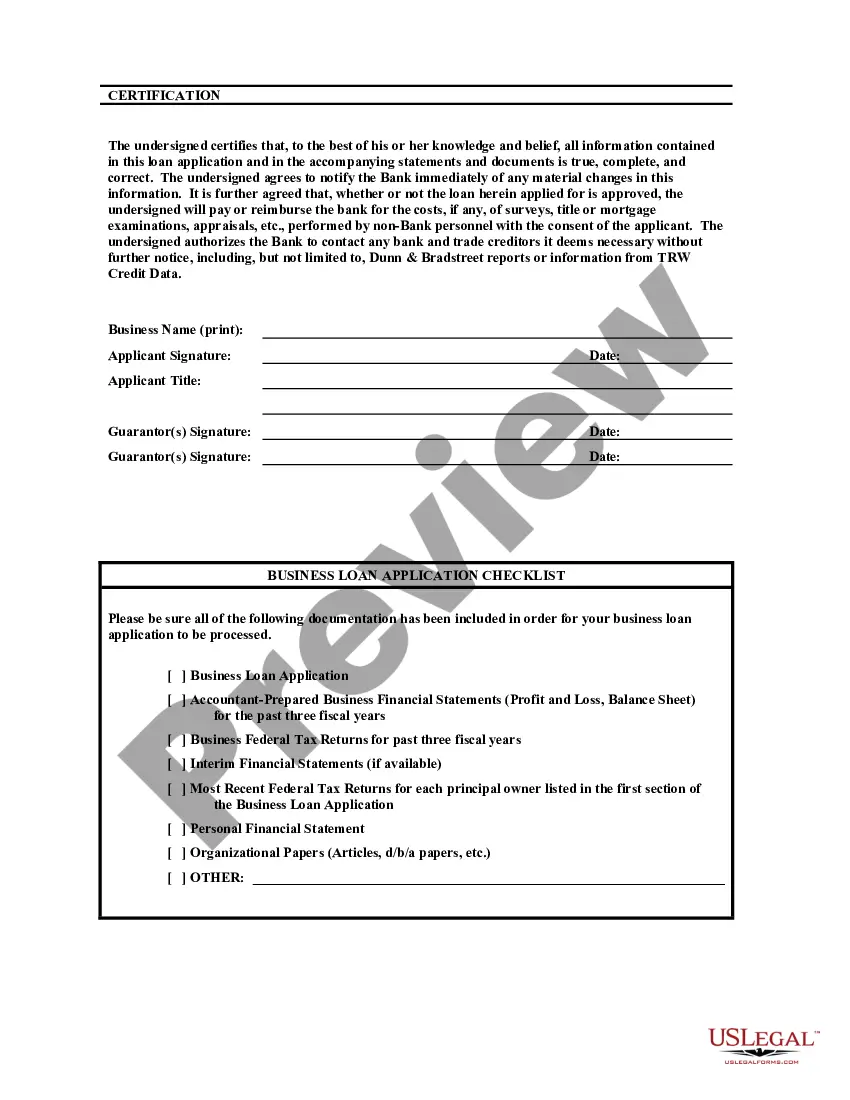

The Bank Loan Application Form and Checklist is a comprehensive document designed for businesses seeking funding from banks. This form incorporates a representative loan application alongside a checklist used by small community banks for internal review. Its goal is to simplify the application process by clearly outlining the information needed by financial institutions, ensuring that businesses submit a complete and accurate application to increase their chances of loan approval.

Form components explained

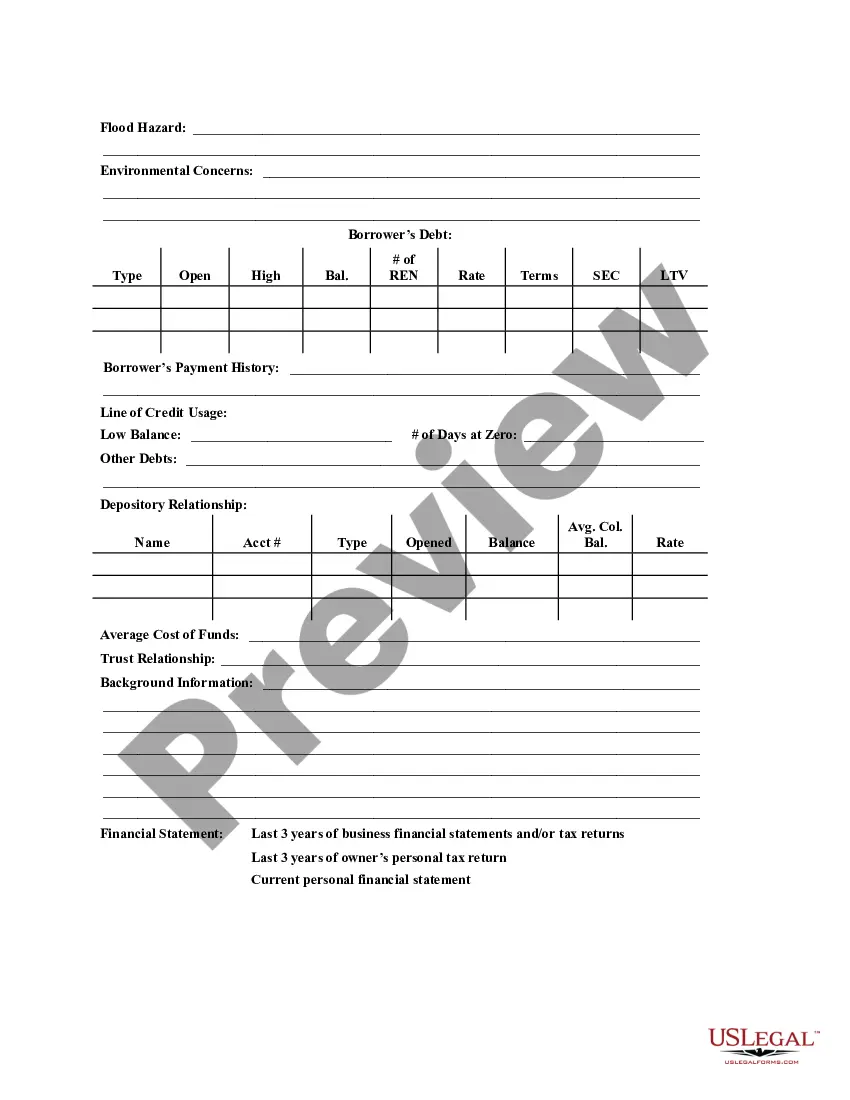

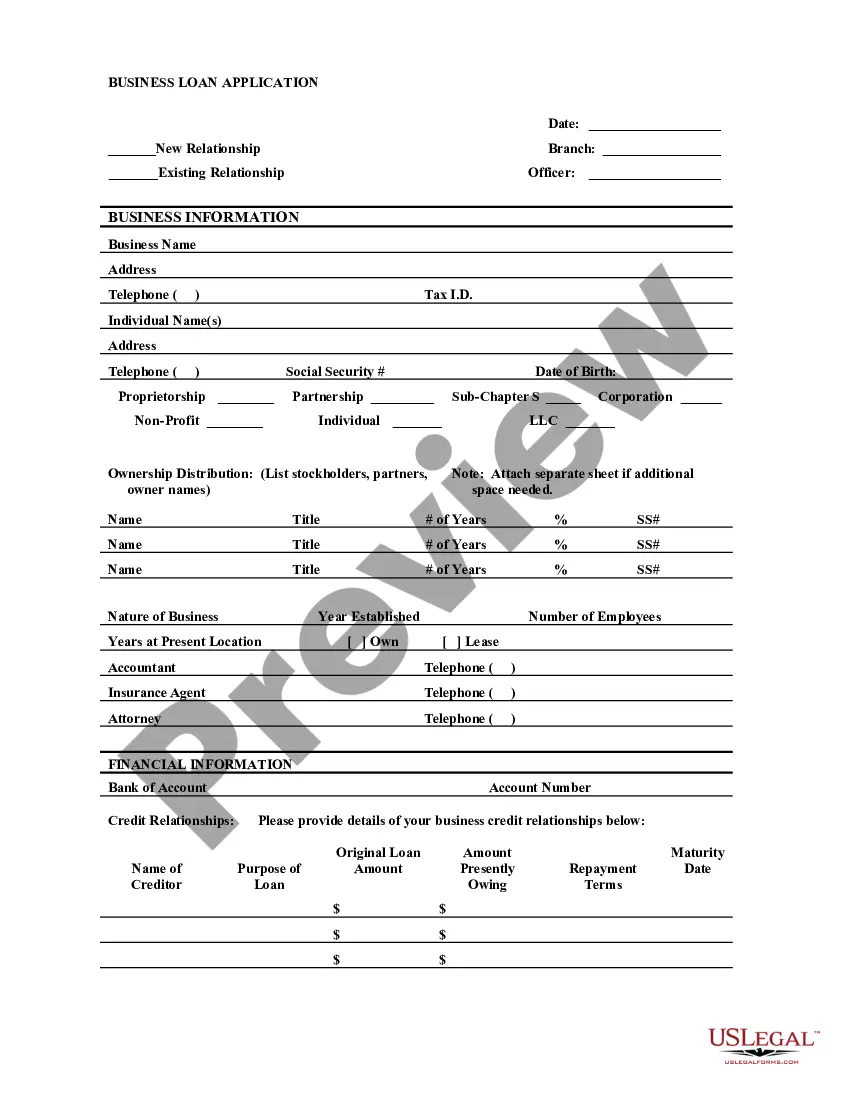

- Borrower information including business name, address, and tax ID.

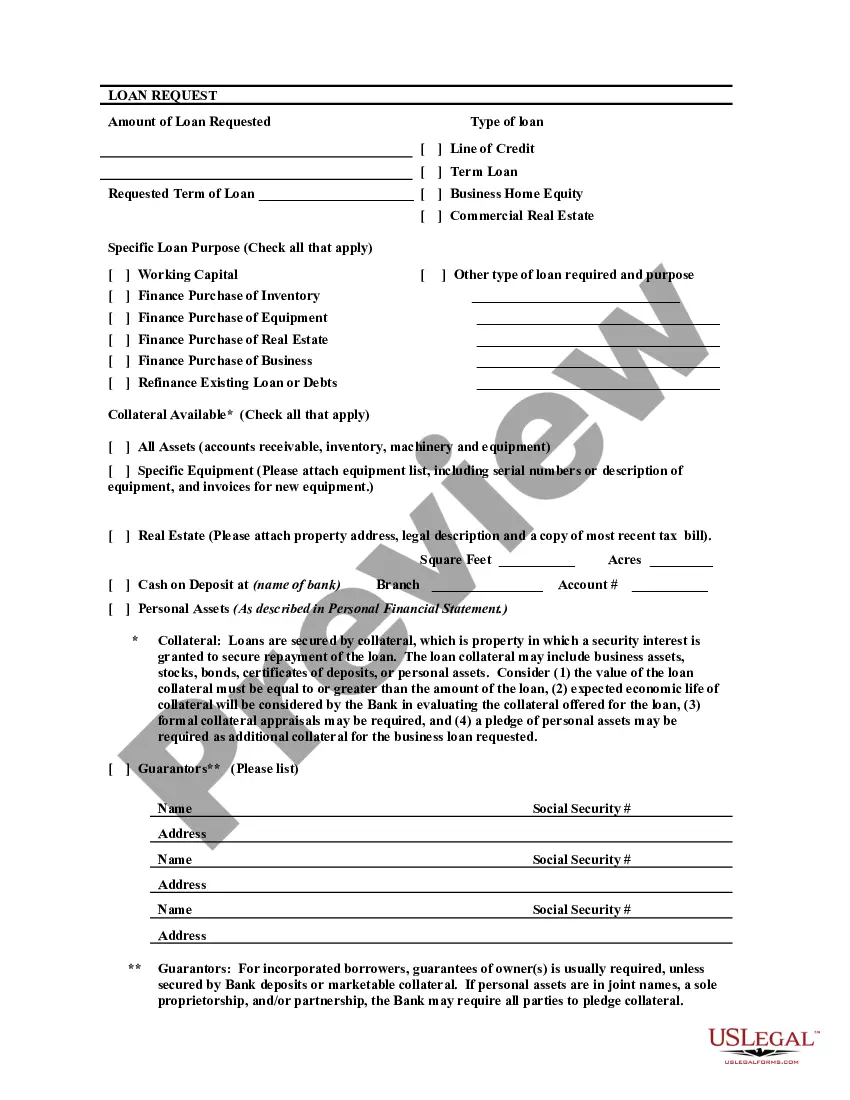

- Details of the loan request detailing purpose, amount, terms, and collateral.

- Personal and business financial history including tax returns and financial statements.

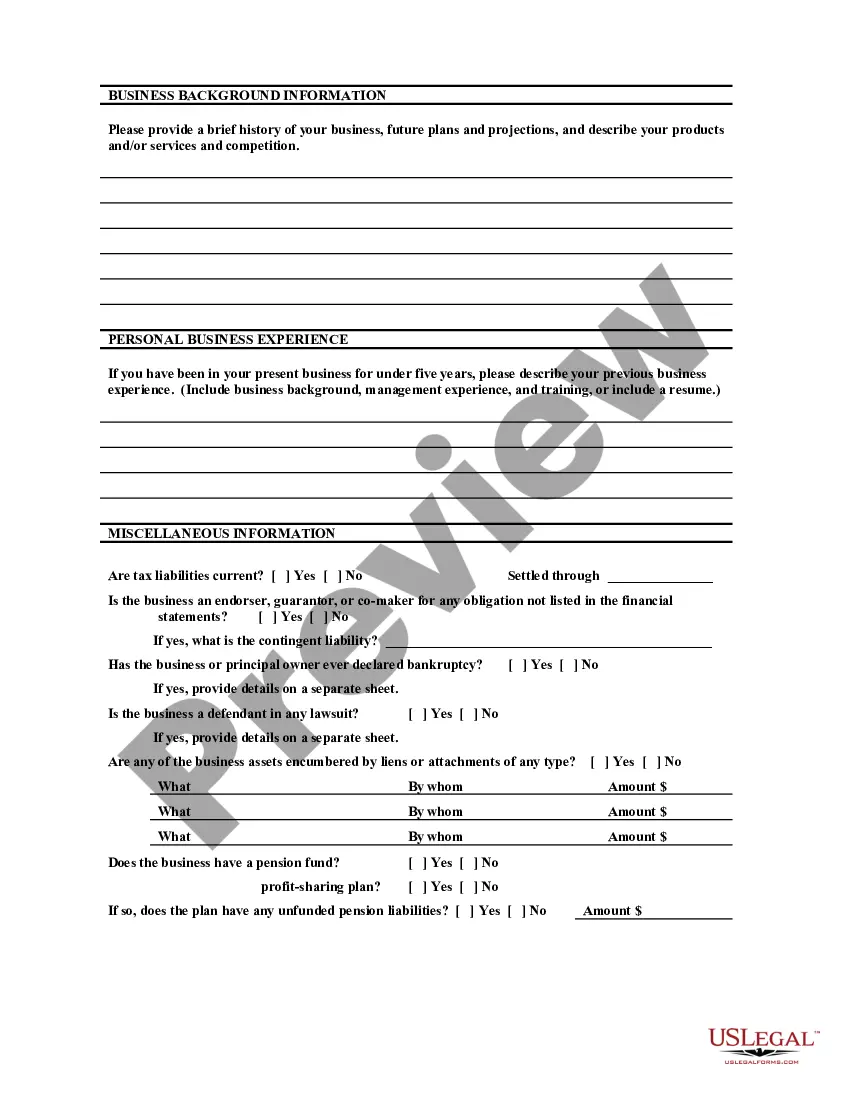

- Background information about the business and its owners, including previous experience.

- Checklist to ensure all necessary documentation is included for submission.

Common use cases

You should use the Bank Loan Application Form when you are preparing to apply for a business loan to finance operations, purchase inventory, or acquire property. It is essential when seeking funding to expand your business or refinance existing debts. This form assists in laying out all the necessary details banks require for evaluating your application.

Who should use this form

- Business owners looking for financial support from banks.

- Startups needing initial funding to launch operations.

- Established businesses seeking to expand or refinance debts.

- Accountants or financial advisors assisting clients with loan applications.

How to prepare this document

- Gather all necessary information about the business, including its history and financial performance.

- Complete the borrower information section with accurate details of the business and owners.

- Specify the amount of the loan requested and its intended purpose.

- Detail any collateral being offered as security for the loan.

- Attach required supporting documents such as financial statements and tax returns.

Does this document require notarization?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide complete financial documentation.

- Leaving sections blank or providing inaccurate information.

- Not following the checklist to ensure all required documents are included.

- Misunderstanding the purpose of the loan, leading to incorrect information in the application.

Benefits of using this form online

- Convenient access to complete the form at your own pace.

- Edit and update your information easily before final submission.

- Access to reliable templates created by licensed attorneys.

- Reduces the risk of errors by providing clear guidelines and a checklist.

Looking for another form?

Form popularity

FAQ

Here are five common requirements that financial institutions look at when evaluating loan applications. Credit Score and History. An applicant's credit score is one of the most important factors a lender considers when evaluating a loan application.Income.Debt-to-income Ratio.Collateral.Origination Fee.

Employment and income information Employment Status. Work phone number. Employer name. Gross monthly income amount and source(s) of income (all sources you want considered for your loan) Monthly mortgage or rent payment amount.

Fullerton India's process for personal loans is simple, completely digital, and involves quick decisioning so as to meet your requirements on time. Step1: Check the Eligibility Criteria.Step 2: Check Interest Rates and Other Charges.Step 3: Calculate your EMI.Step 4: Check Required Documents.

Proof of identity, such as a driver's license, passport, or state-issued ID card. Proof of your income. You may need to provide pay stubs, tax returns, W-2s and 1099s, bank statements, or your employer's contact information. If you are self-employed, the loan provider may ask for bank statements, 1099s, or tax returns.

Pre-approval requires proof of employment, assets, income tax returns, and a qualifying credit score. Mortgage pre-approval letters are typically valid for 60 to 90 days.

Lenders look at your income, employment history, savings and monthly debt payments, and other financial obligations to make sure you have the means to comfortably take on a mortgage.

What are the 5 Things to consider before accepting the Bank loan? Credibility. The rate of Interest. Payment flexibility. Response times. Understand the terms of the bank loan.

The Loan Documents Checklist provides a detailed list and description of items you need to process your loan. All documents must be legible and there can be no cut-offs on pages. Also, you should provide Adobe of PDF files which make organizing and processing your documents much easier.