Financial Support Agreement - Guaranty of Obligation

Understanding this form

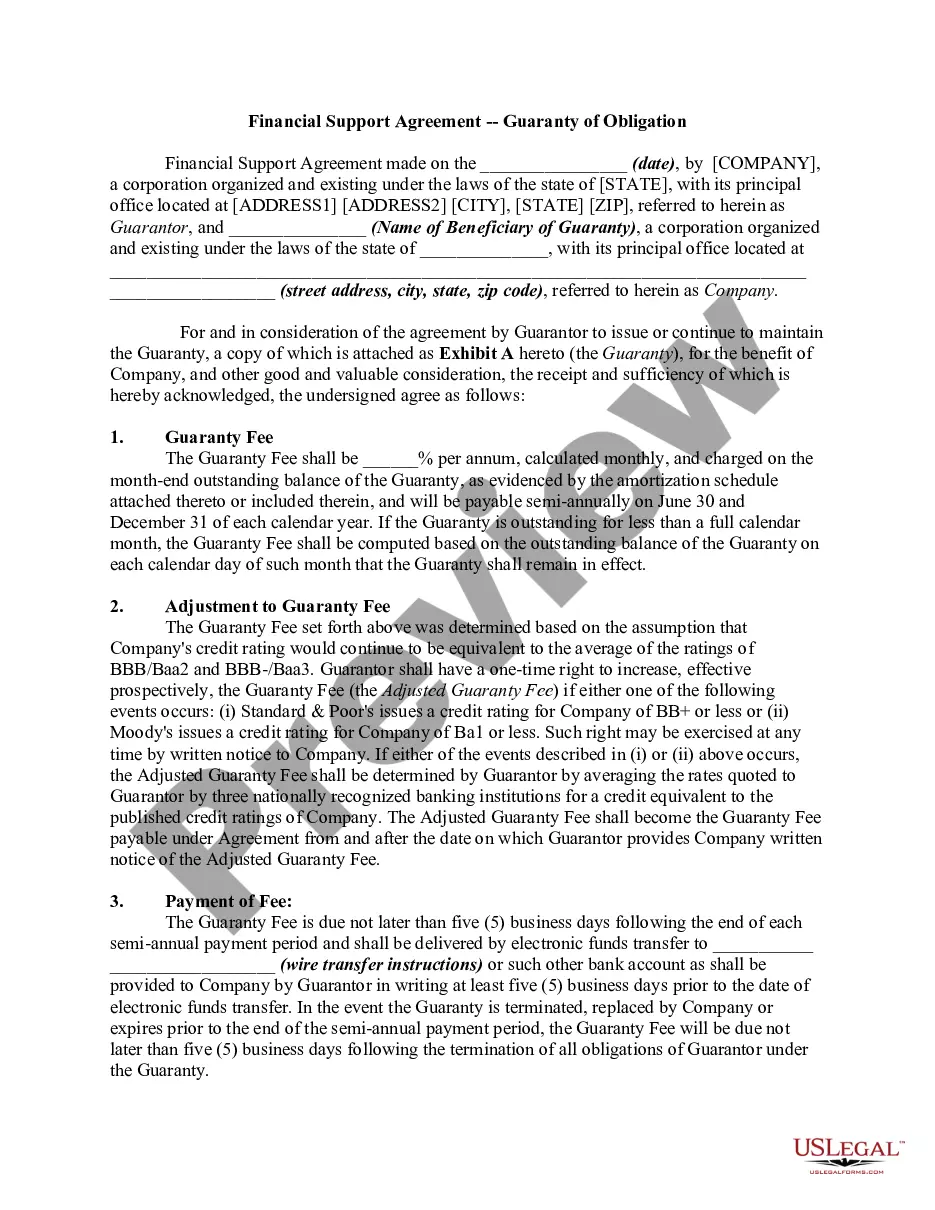

The Financial Support Agreement - Guaranty of Obligation is a legal document in which one corporation, referred to as the Guarantor, agrees to provide financial backing to another corporation, known as the Company, by guaranteeing specific debts. This arrangement allows the Company to secure funding based on the Guarantor's creditworthiness, typically in exchange for a guaranty fee. Unlike similar agreements, this form specifically outlines the terms of the guaranty, including fee structures and payment obligations, ensuring clarity for both parties involved.

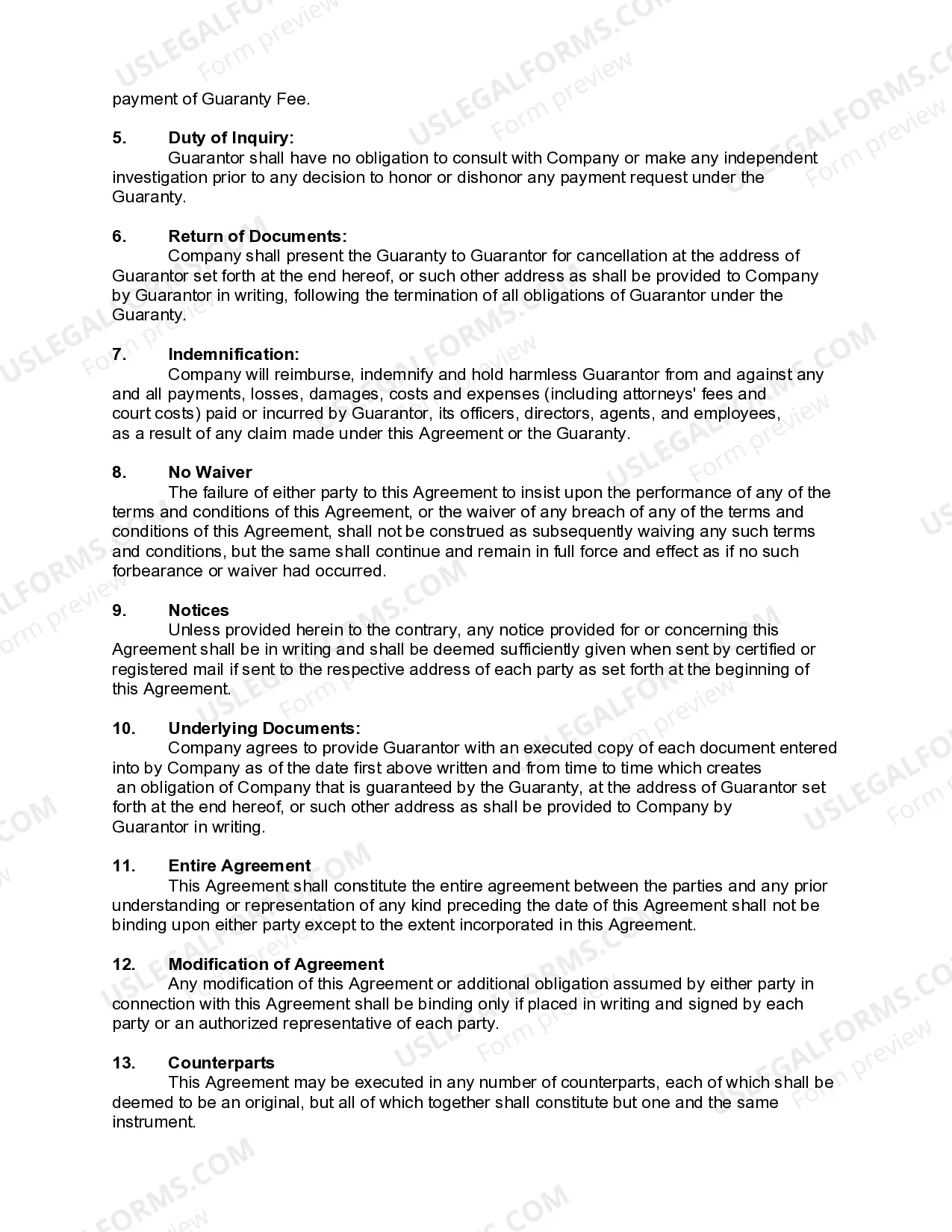

Form components explained

- Guarantor and Company identification, including names and addresses.

- Guaranty Fee structure, detailing payment amounts and schedules.

- Conditions for adjusting the Guaranty Fee based on credit ratings.

- Payment instructions for the Guaranty Fee, including electronic transfer details.

- Indemnification clause to protect the Guarantor from losses.

- Notices and documentation requirements related to the Guaranty.

When this form is needed

This form should be used in situations where one corporation needs financial support from another corporation, particularly when seeking to secure loans or credit facilities. This agreement is useful when the Company does not have sufficient credit standing to secure financing on its own and needs the backing of a more financially robust entity. It is especially relevant in corporate finance transactions and can facilitate business expansion or operational funding.

Who needs this form

- Corporations seeking financial assistance through a guaranty arrangement.

- Companies requiring assurance from a more creditworthy corporation for debt obligations.

- Financial officers or legal advisors involved in corporate financing arrangements.

Steps to complete this form

- Identify the Guarantor and Company by entering their names and addresses in the appropriate fields.

- Specify the date of the agreement at the top of the document.

- Define the Guaranty Fee and how it will be calculated in the designated section.

- Include any payment instructions, such as bank transfer details.

- Ensure all parties sign the agreement, including printed names and positions within their respective corporations.

Notarization guidance

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to accurately identify the parties involved in the agreement.

- Incorrectly calculating the Guaranty Fee or payment terms.

- Not updating the form to comply with specific state laws where applicable.

- Omitting necessary signatures from authorized representatives.

Benefits of completing this form online

- Convenience of downloading and completing the form at your convenience.

- Editability allows for customization to meet your specific needs.

- Access to templates drafted by licensed attorneys ensures legal accuracy.

Looking for another form?

Form popularity

FAQ

A Guarantor's obligations A guarantor may be bound to maintain repayments on a borrower's loan in circumstances where the borrower defaults on repayments. Alternatively they may be called upon to repay the loan in full.

There are two types of Guarantee i.e. Specific Guarantee which is for a specific transaction and Continuing Guarantee which is for a series of transactions. Specific Guarantee: A guarantee which is given for only one transaction or debt, the guarantee is known as a Specific Guarantee.

Guarantors are asked to sign a guarantee agreement this is a legally binding document and once you sign it you become responsible for the loan repayments if the person you are acting as guarantor for cannot pay.

A guarantor is a third party who 'guarantees' a loan, mortgage or rental agreement. This means they agree to repay the total amount owed if the borrower or renter can't pay what they owe. By guaranteeing the agreement, you become responsible for any arrears that occur.

By Practical Law Commercial. A deed guaranteeing the performance of a party's payment obligations under a commercial agreement and indemnifying the payee against loss arising out of a failure of the payer to pay the guaranteed amounts.

Bid/Tender Guarantee. Issued in support of an exporter's bid to supply goods or services and, if successful, ensures compensation in the event that the contract is not signed. Performance Guarantee. Advance Payment Guarantee. Warranty Guarantee. Retention Guarantee.

No, if you have signed an agreement and are acting as the guarantor for a guarantor loan, you cannot stop being this until the loan term has ended.

Most landlords and letting agents require tenants to have a Guarantor in order to qualify as a suitable tenant. Some tenants for one reason or another can't arrange a Guarantor.The reality is, a guarantor is a prerequisite for every sensible landlord, and rightly so.

A surety is an insurer of the debt, whereas a guarantor is an insurer of the solvency of the debtor. A suretyship is an undertaking that the debt shall be paid; a guaranty, an undertaking that the debtor shall pay.A surety binds himself to perform if the principal does not, without regard to his ability to do so.