South Dakota Contract for Deed Seller's Annual Accounting Statement

Understanding this form

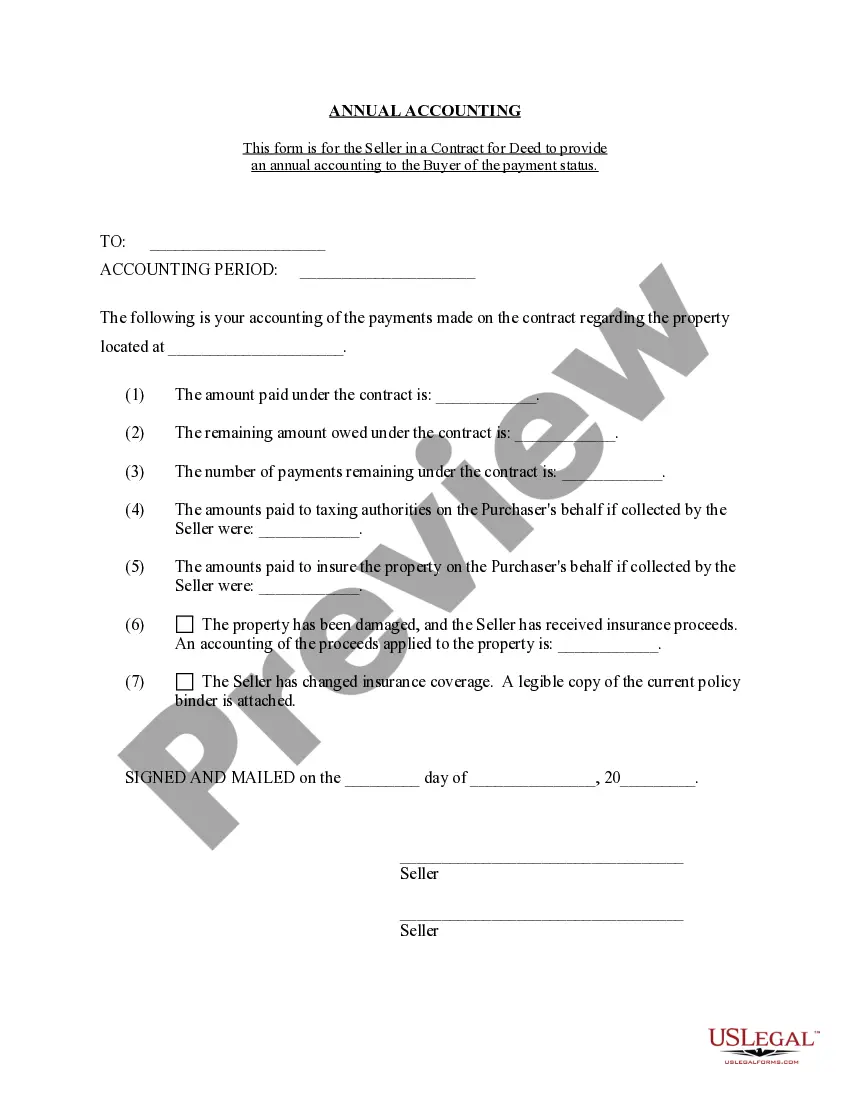

The Contract for Deed Seller's Annual Accounting Statement is a formal document that provides the Purchaser with a detailed overview of the payments made towards the purchase price and interest in a contract for deed arrangement. This annual statement is crucial for transparency, enabling the Purchaser to understand their financial position related to the sale. Unlike other financial statements, this form specifically focuses on the payments related to the contract for deed, highlighting both the number of payments and their amounts.

Key components of this form

- Identification details of the Seller and Purchaser

- Total number of payments received to date

- Total amount of payments received

- Interest accrued over the period

- Remaining balance of the contract for deed

Common use cases

This form is used annually by the Seller to report to the Purchaser on the financial status of the contract for deed. It is essential for both parties to maintain clear records of payments and interest for legal and financial purposes. Use this document when you need to provide an annual update on the Purchaser's progress in fulfilling their payment obligations under the contract.

Who can use this document

- Sellers who have entered into a contract for deed agreement with a Purchaser

- Purchasers who wish to receive an annual accounting statement of their payments

- Real estate professionals managing transactions involving contracts for deed

Completing this form step by step

- Identify and fill in the names of the Seller and Purchaser at the top of the document.

- Enter the total number of payments made by the Purchaser.

- Specify the total amount received from these payments.

- Calculate and include the interest that has accrued over the specified period.

- Provide the remaining balance owed on the contract for deed.

Does this document require notarization?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to update the form annually, resulting in outdated information.

- Inaccurately calculating the total amount of payments received.

- Neglecting to document interest accrued correctly.

Why complete this form online

- Convenient access to download and complete the document at your own pace.

- Editable fields allow for easy updates as needed.

- Reliable legal forms drafted by licensed attorneys, ensuring compliance and accuracy.

Looking for another form?

Form popularity

FAQ

A contract for deed is a legal agreement for the sale of property in which a buyer takes possession and makes payments directly to the seller, but the seller holds the title until the full payment is made.

A: No, they are not. The Contract to Sell comes before a Deed of Sale, as the former serves as the basis for the latter. There is an act of finality when it comes to the Deed of Sale. On the other hand, the Contract to Sell requires that the parties first complete the conditions they agreed to.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

The buyer receives the deed from the seller and becomes the legal owner.A contract for deed is a contract where the seller remains the legal owner of the property and the buyer makes monthly payments to the seller to buy the house. The seller remains the legal owner of the property until the contract is paid.

The buyer must record the contract for deed with the county recorder where the land is located within four months after the contract is signed. Contracts for deed must provide the legal name of the buyer and the buyer's address.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

Generally, contract for deed sellers use IRS Form 6252 to report installment sales in the year in which they take place. You also use Form 6252 during each year you receive income from your contract for deed.