What is Probate?

Probate refers to the legal process of administering a deceased person's estate, ensuring debts are paid and assets are distributed. Explore Wisconsin-specific templates to assist with this process.

Probate involves the legal process of settling an estate. Attorney-drafted templates make completing these documents quick and straightforward.

Get everything needed to transfer property from a decedent under Wisconsin law, with multiple related legal forms included for ease.

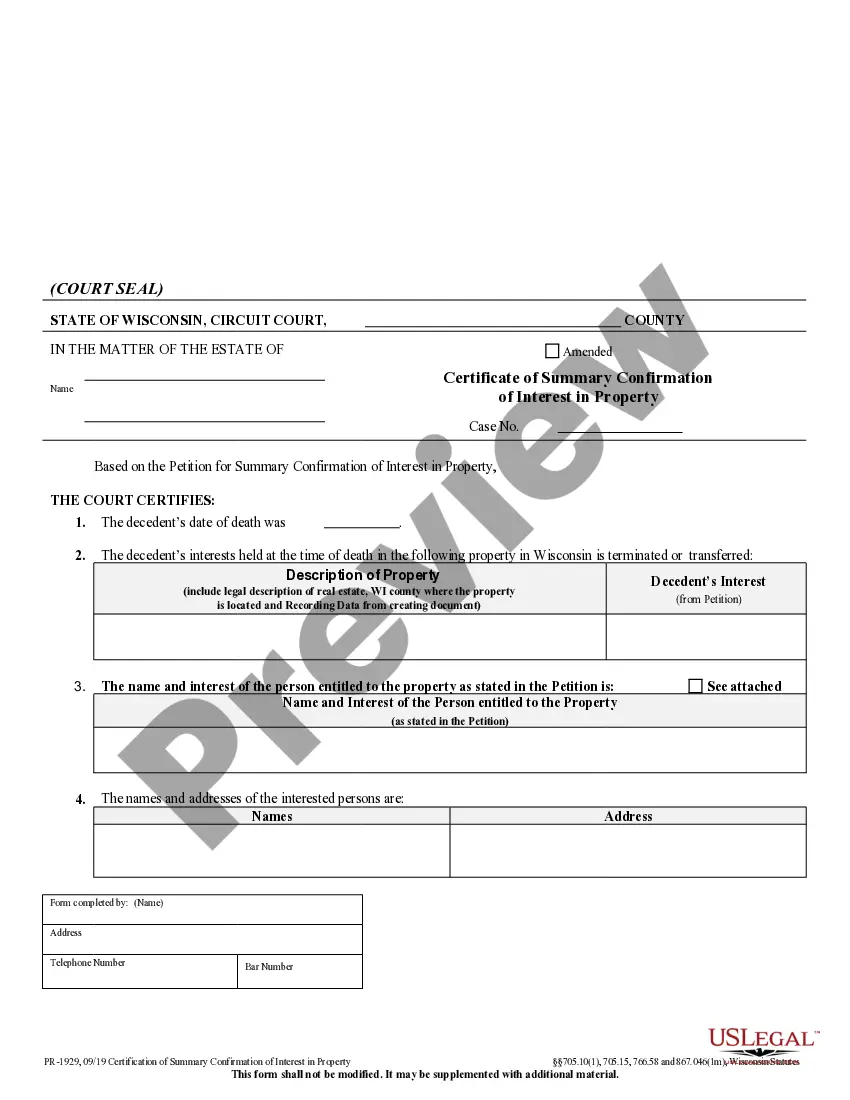

Get everything needed for a summary estate settlement in one convenient package, including multiple related legal forms.

Contains everything needed for the summary administration of an estate in one place, ensuring a smooth process.

Request a copy of a deceased person's Will to ensure proper estate management and probate procedures.

Terminate joint tenancy and legal rights associated with life estates in marital property effectively and fairly.

Navigate the informal estate administration process efficiently and obtain essential guidance for managing a decedent's estate.

Obtain legal authority to manage an estate through informal or formal administration, essential for personal representatives.

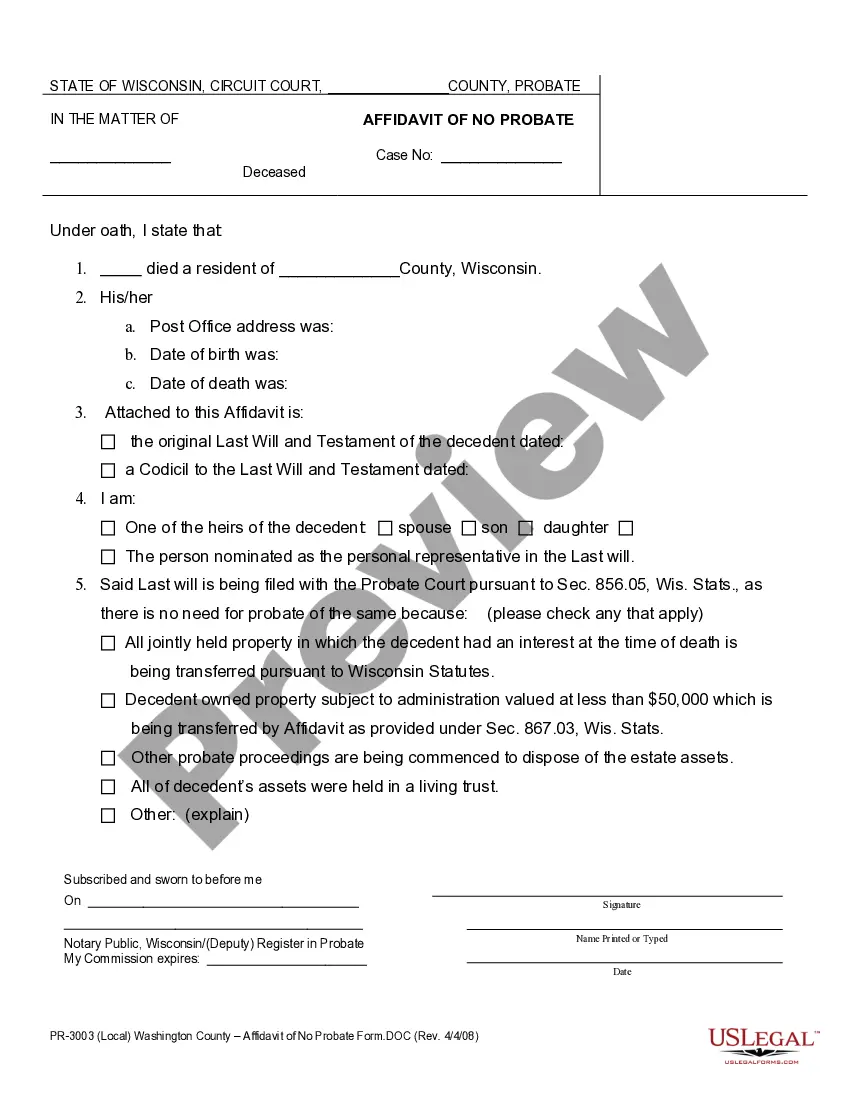

Use this form when there are no probate needs for a decedent's estate, allowing for direct transfer of assets.

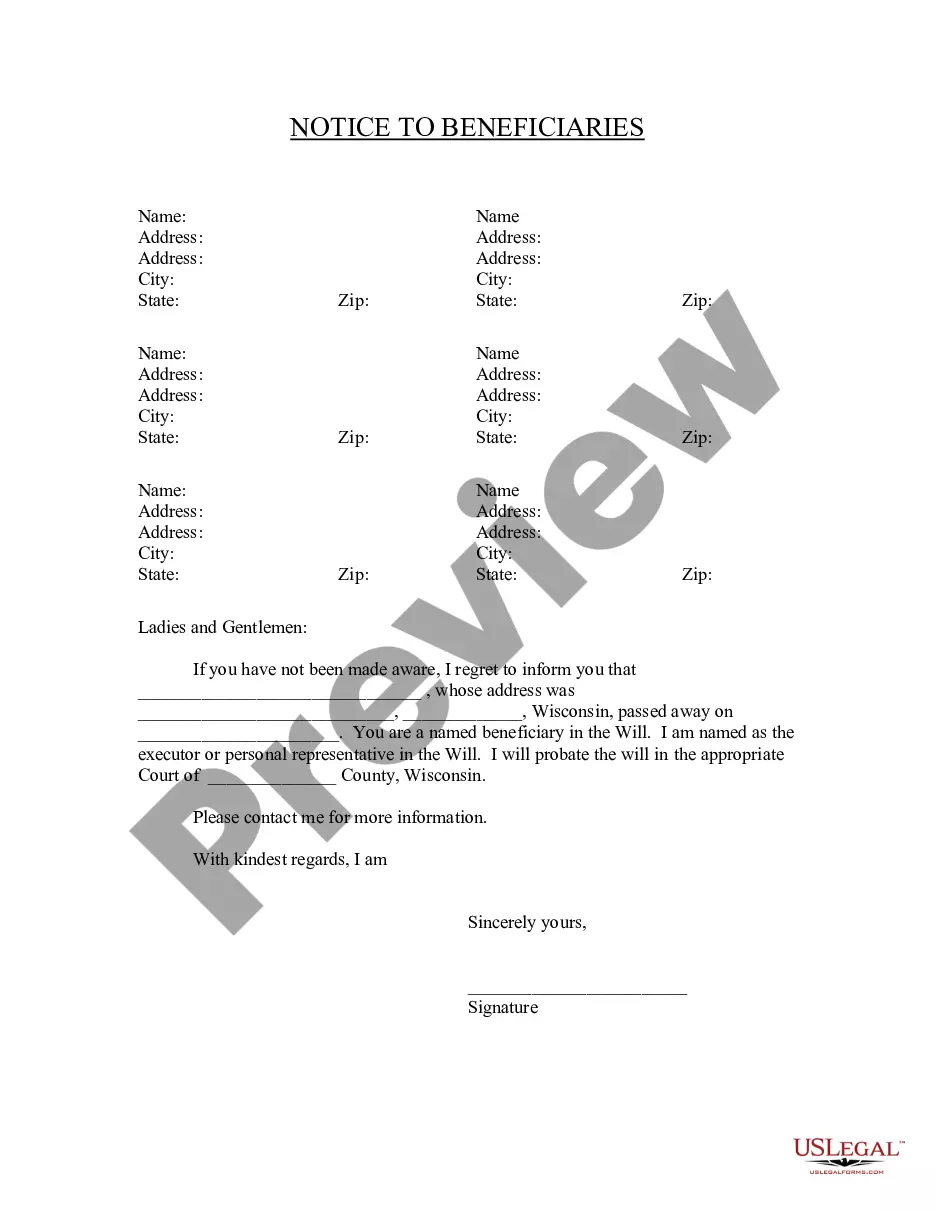

Notifying beneficiaries about their inclusion in a deceased individual's will is crucial for ensuring they are informed of their rights.

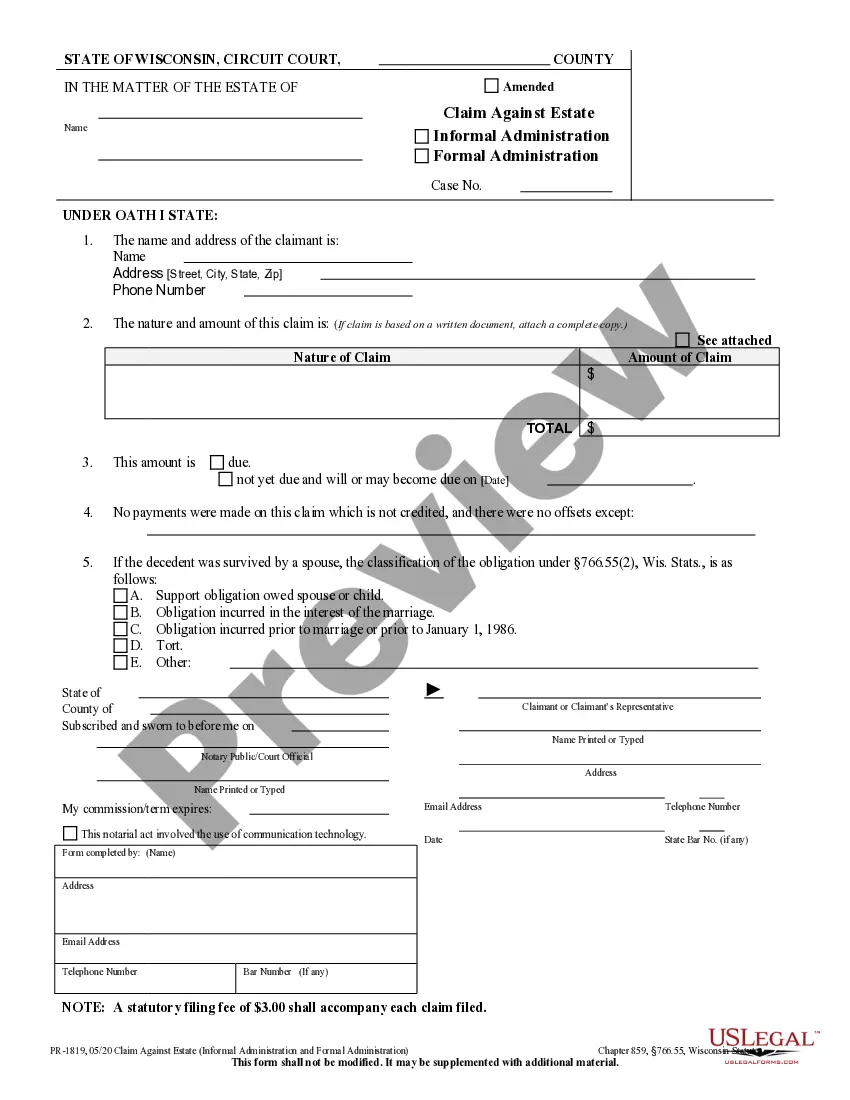

Obtain clarity on financial claims against an estate during administration processes, protecting rights related to unpaid obligations.

Probate is necessary for settling most estates after death.

Not all assets go through probate; some pass directly to beneficiaries.

The probate process can vary significantly by state.

Having a will can simplify the probate process.

Debts of the deceased must be settled before assets are distributed.

Begin your probate process with these steps.

A trust is not necessary if you have a will, but it can provide additional benefits.

If you do nothing, your estate may go through probate, following state laws for distribution.

It's wise to review your estate plan every few years or after major life changes.

Beneficiary designations can override your will, so ensure they align with your overall plan.

Yes, you can appoint separate individuals for financial and health decision-making.