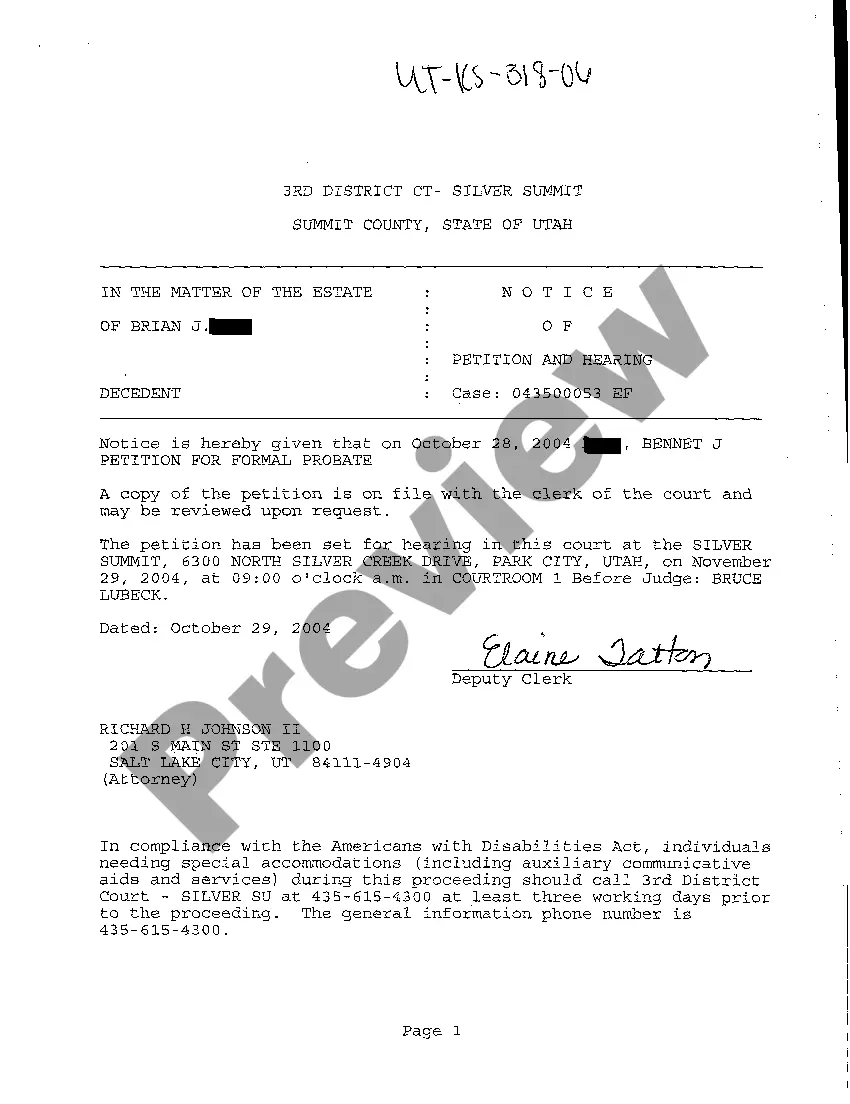

What is Probate?

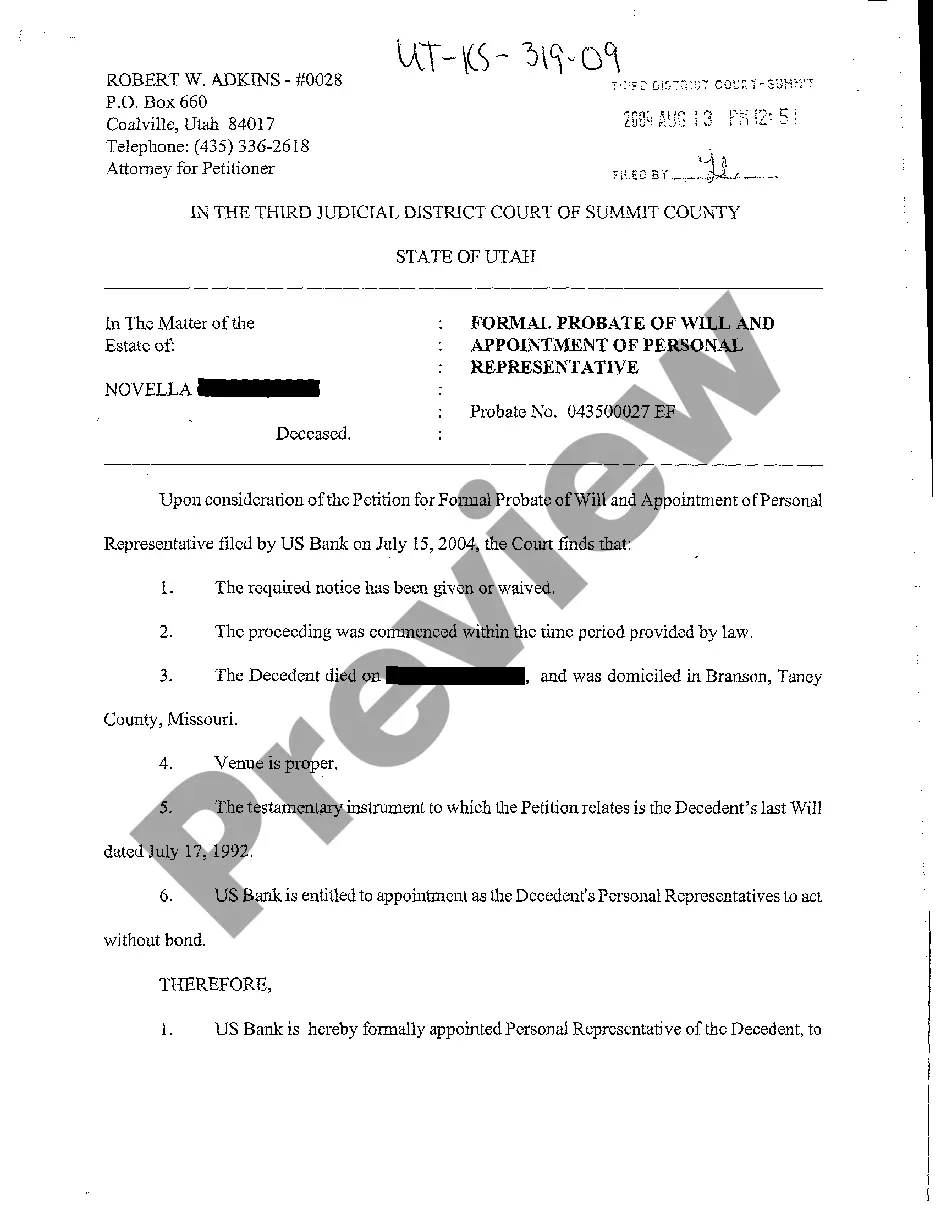

Probate involves legal processes to settle an estate after someone passes away. These documents ensure proper distribution of assets. Explore our state-specific templates for your needs.

Probate documents help manage a deceased person's assets. Our attorney-drafted templates are quick and simple to use.

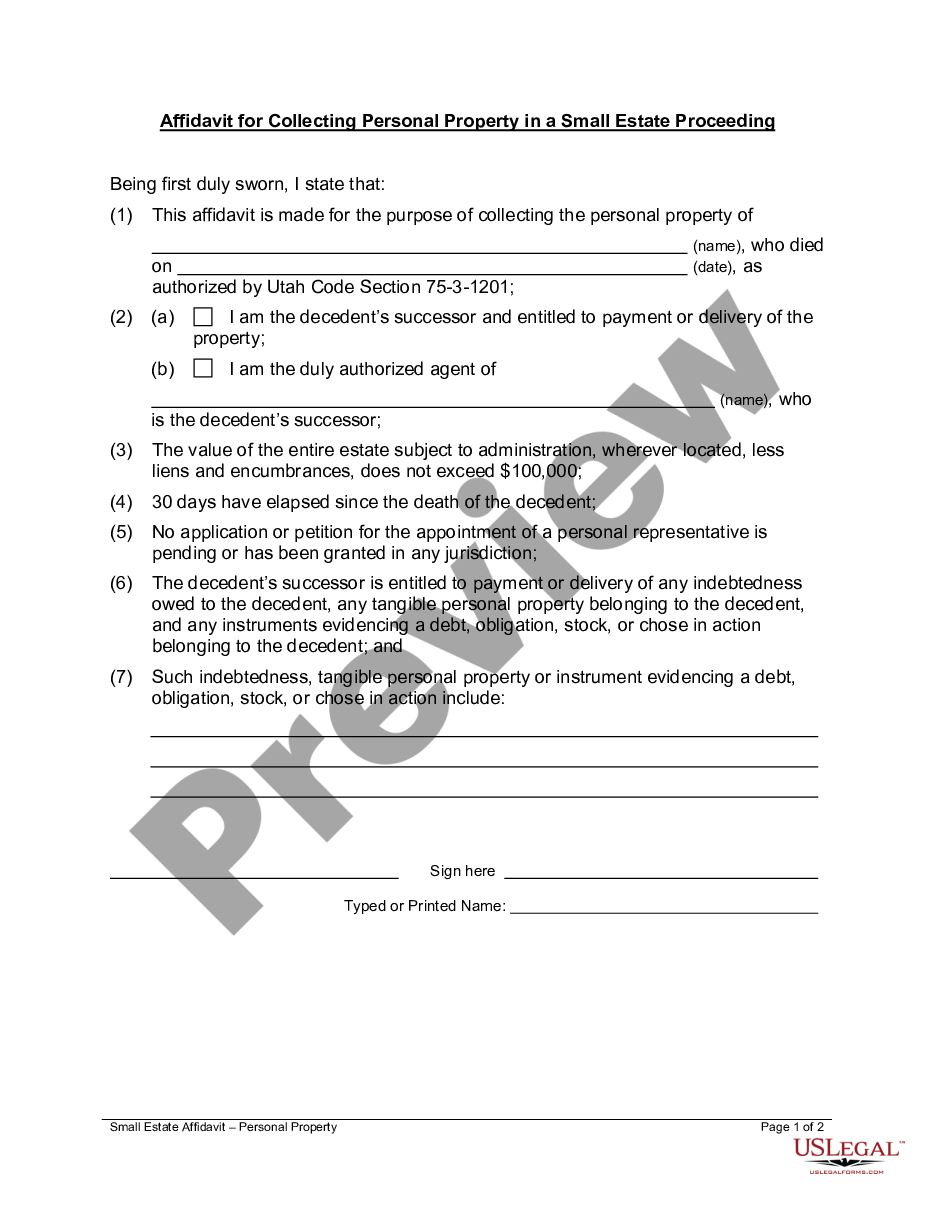

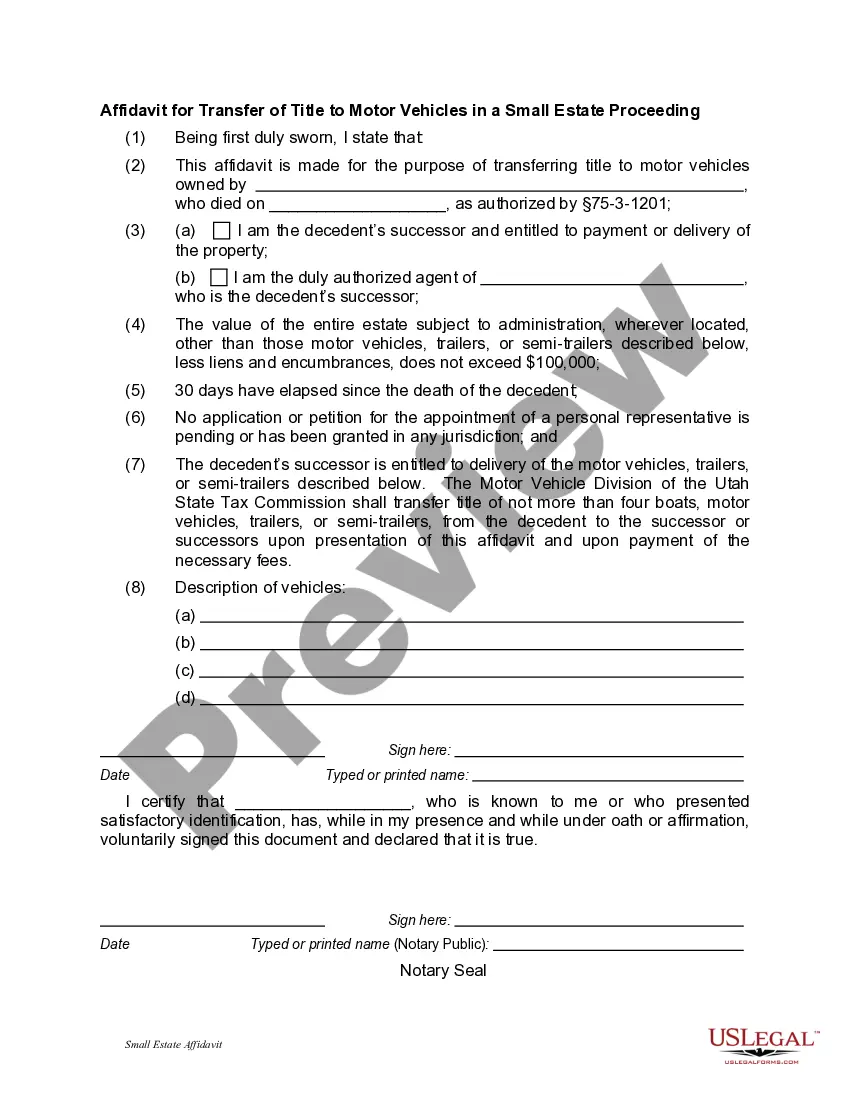

Use this affidavit to collect personal property if the estate value is under $100,000 and no probate process is pending.

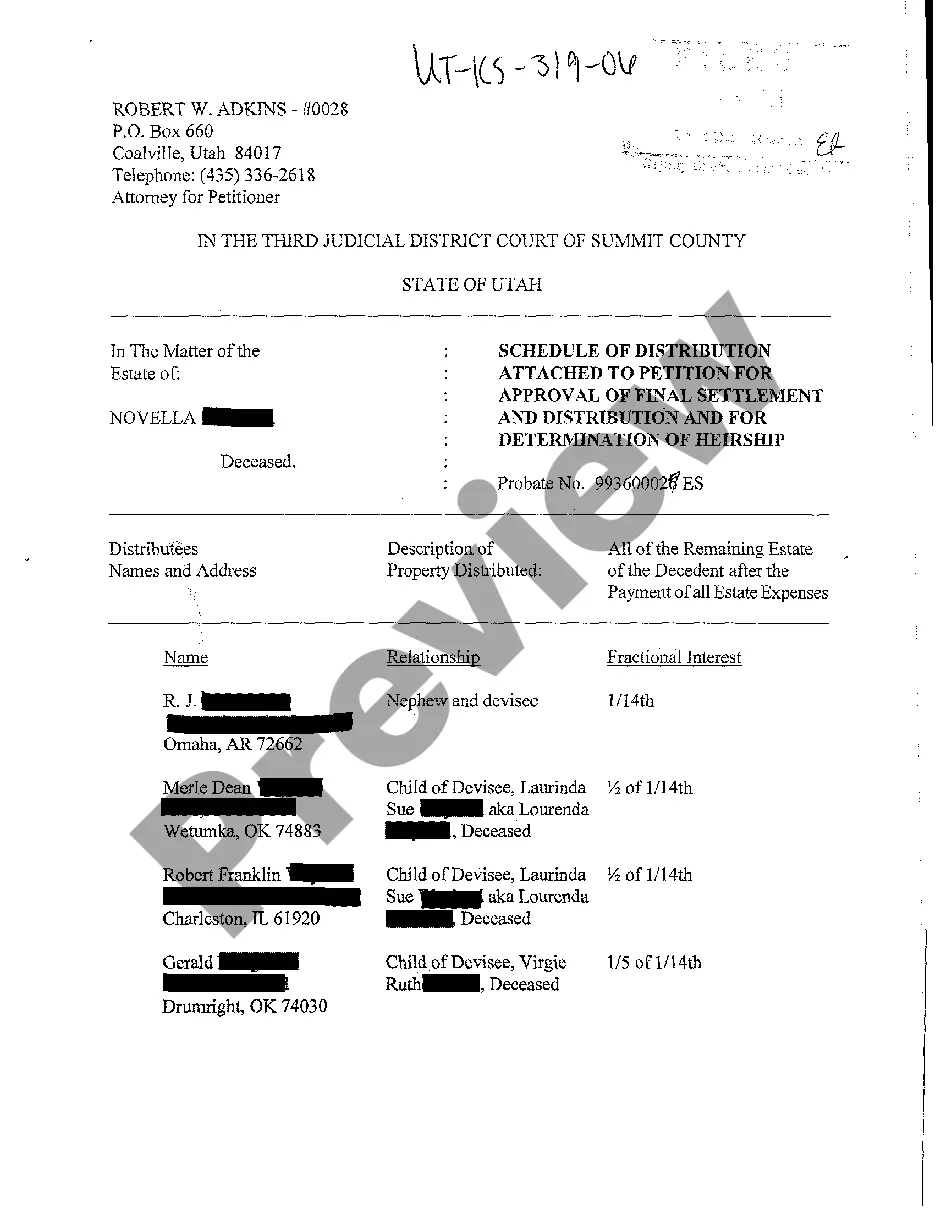

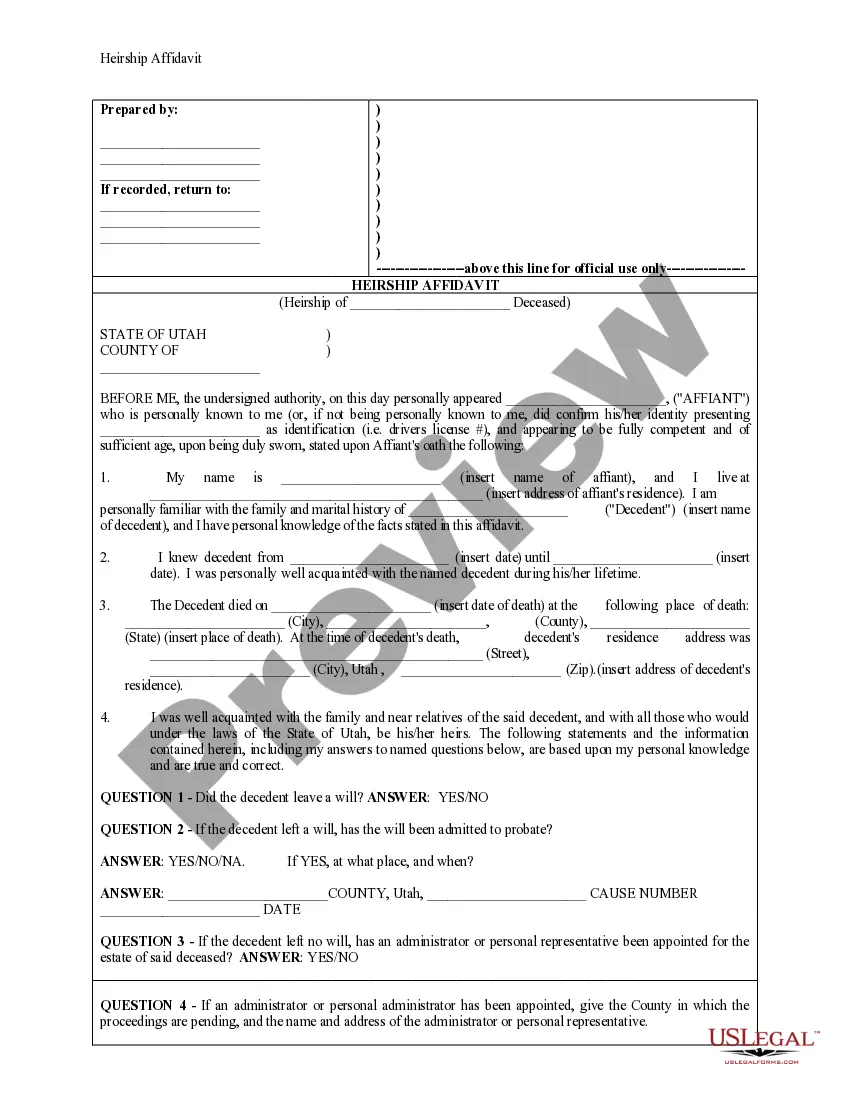

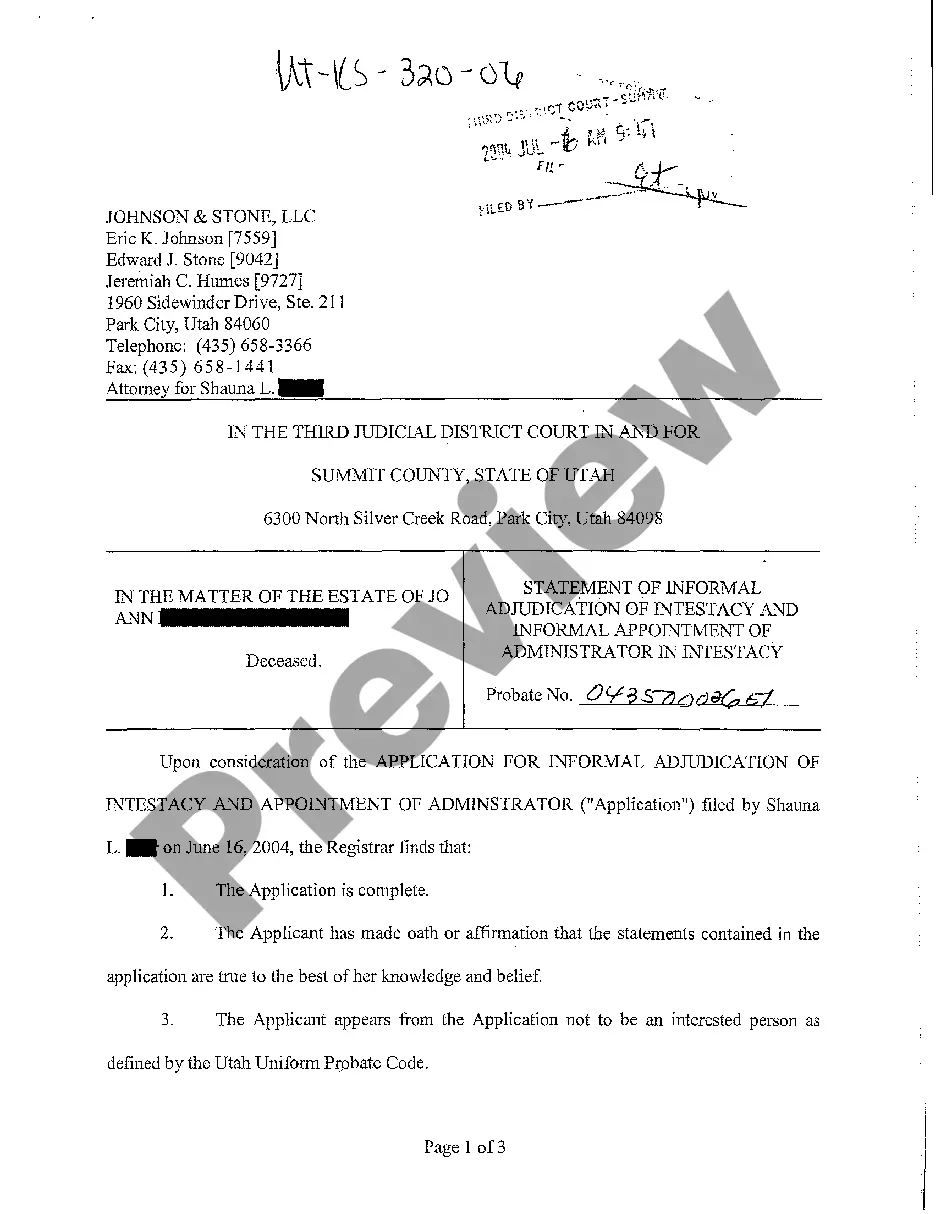

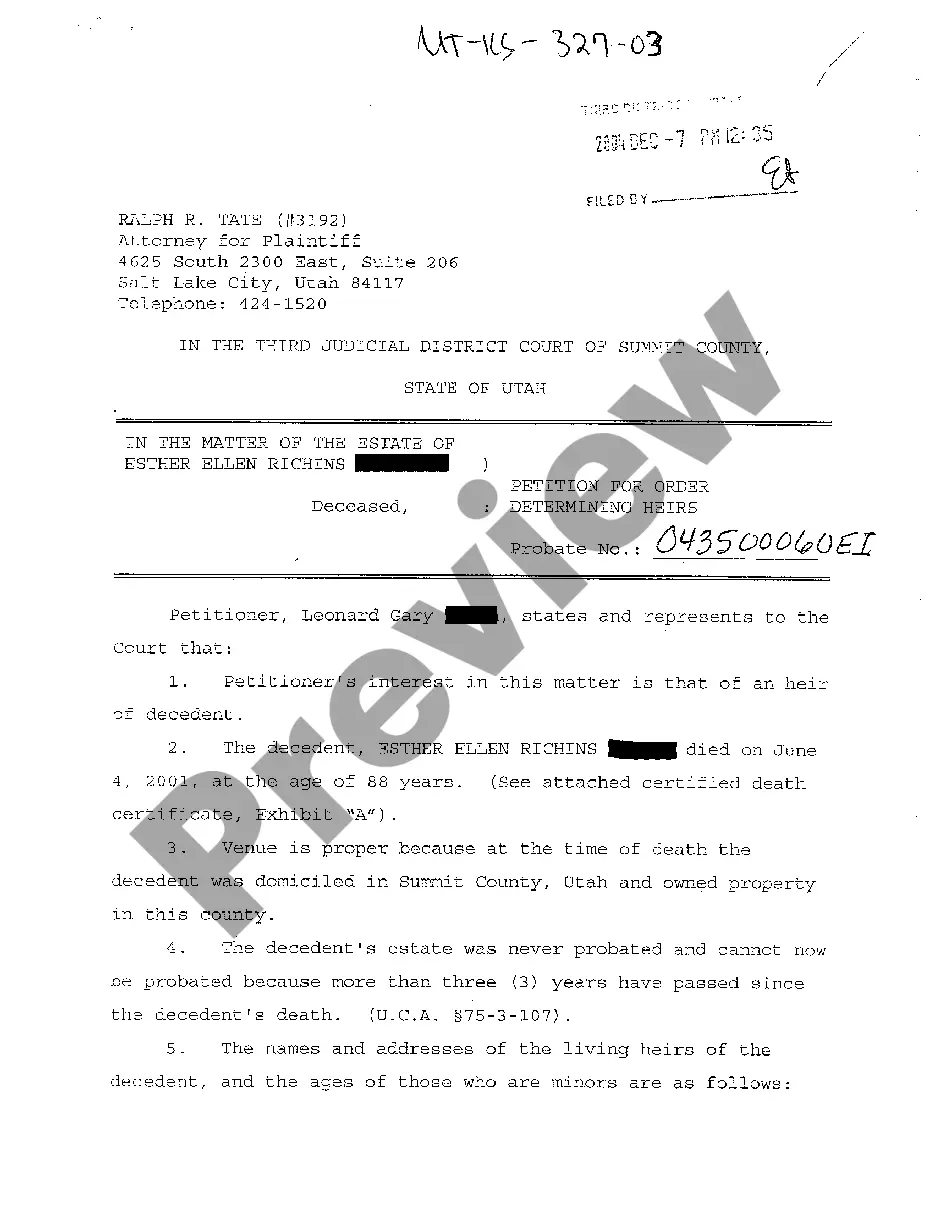

Use this document to establish the heirs of a deceased person for legal purposes, especially if there is no will.

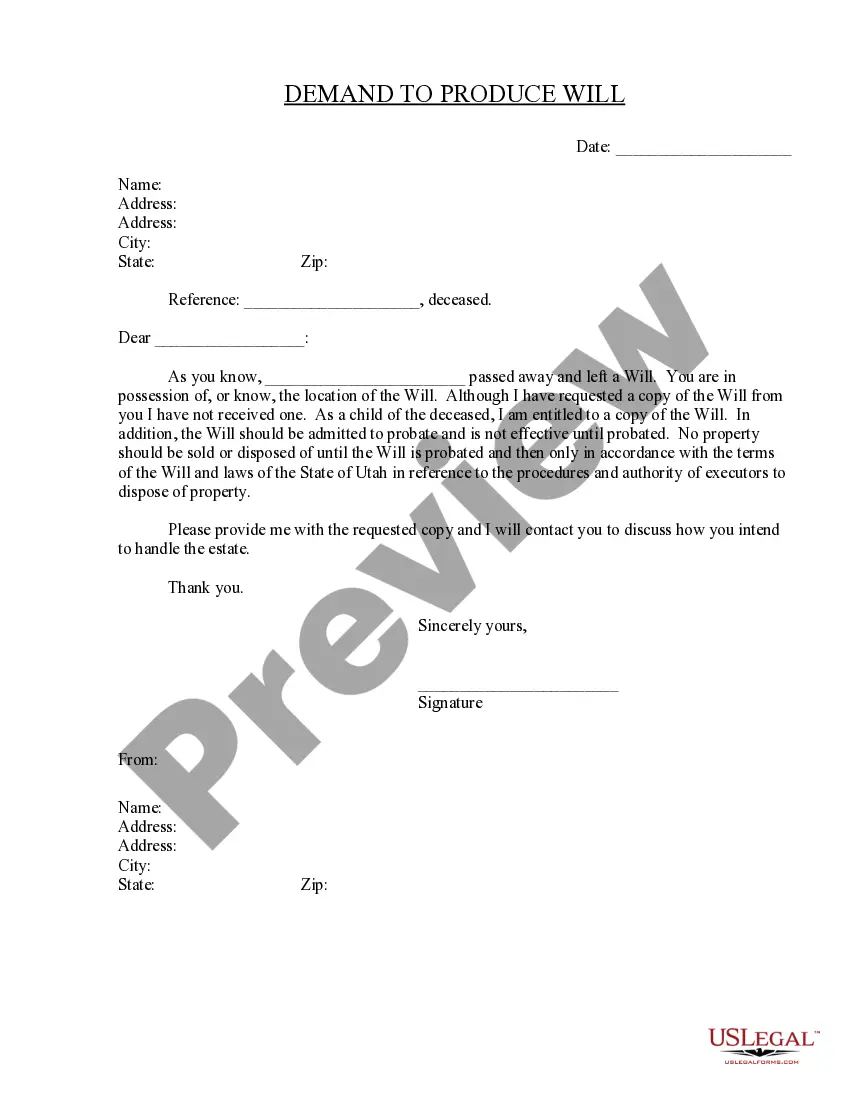

Request access to a deceased person's Will to ensure your rights as an heir are protected.

Use this affidavit to transfer ownership of motor vehicles in small estate cases, simplifying the process without needing a personal representative.

Ensure all beneficiaries are informed about their inheritance status after a loved one's passing, particularly if contact details are uncertain.

Probate is the legal process of settling an estate.

It typically involves validating the deceased's will.

Probate can take several months to complete.

Not all assets require probate to transfer ownership.

Executors must manage the estate's debts and taxes.

Begin your probate process with these simple steps.

A trust can offer additional benefits, like avoiding probate, but isn’t necessary.

If no action is taken, the state will manage the estate according to local laws.

Review your estate plan every few years or after major life changes.

Beneficiary designations can override your will, so ensure they are current.

Yes, you can designate separate agents for financial and health matters.