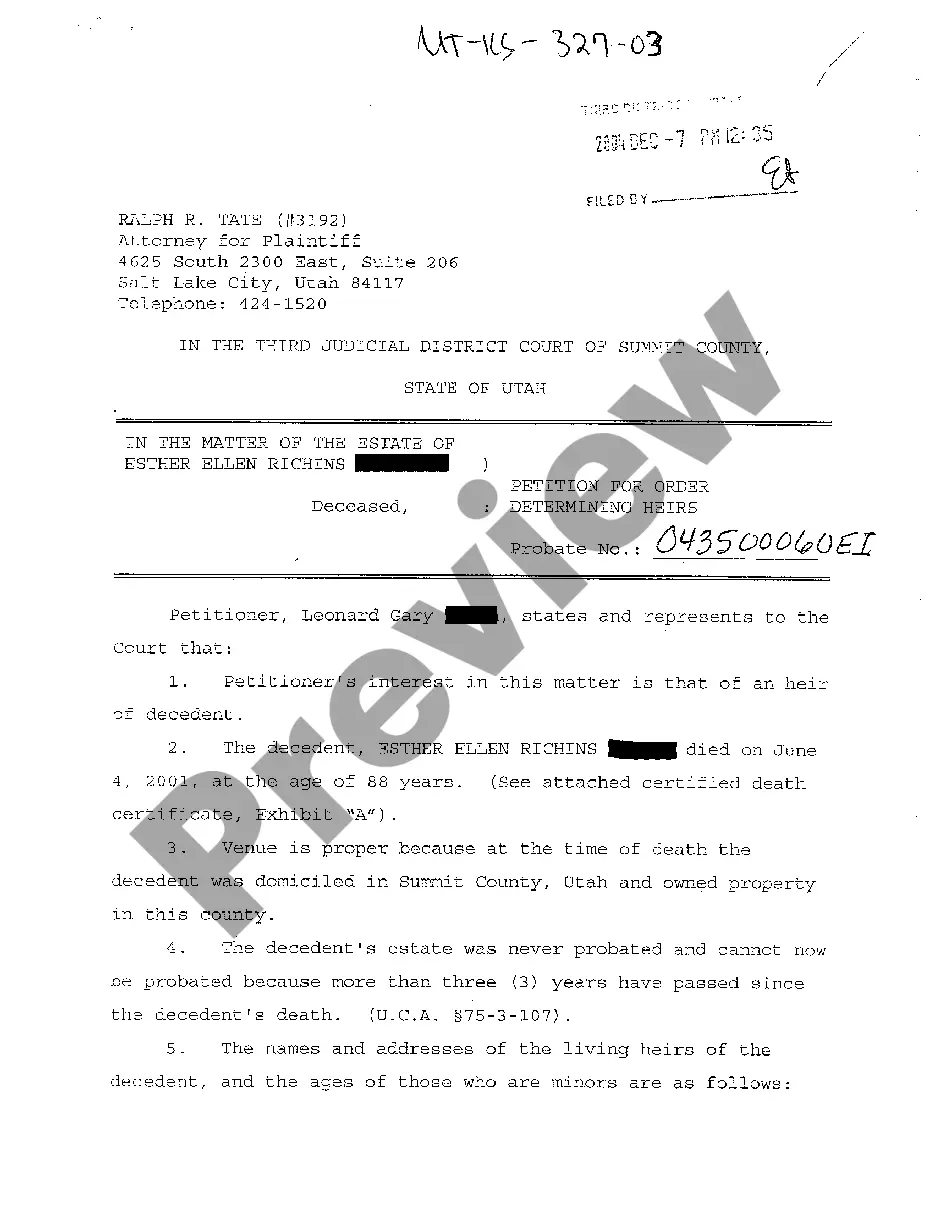

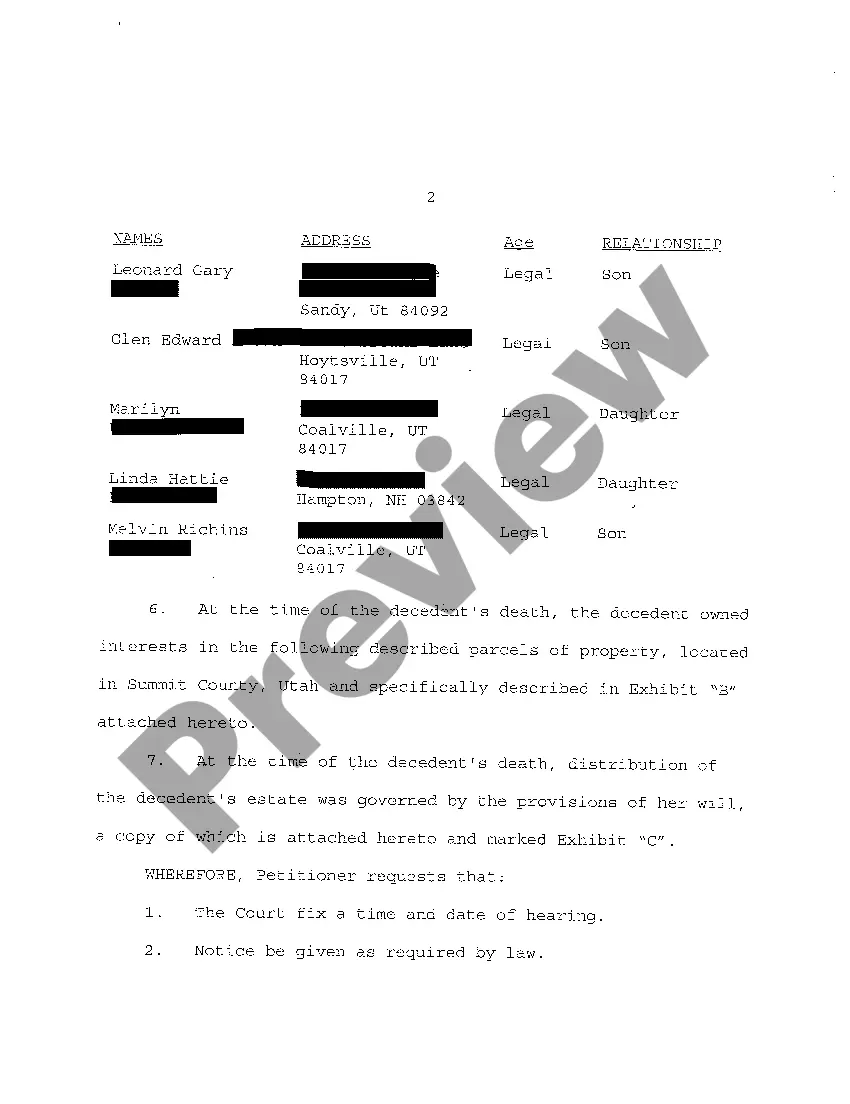

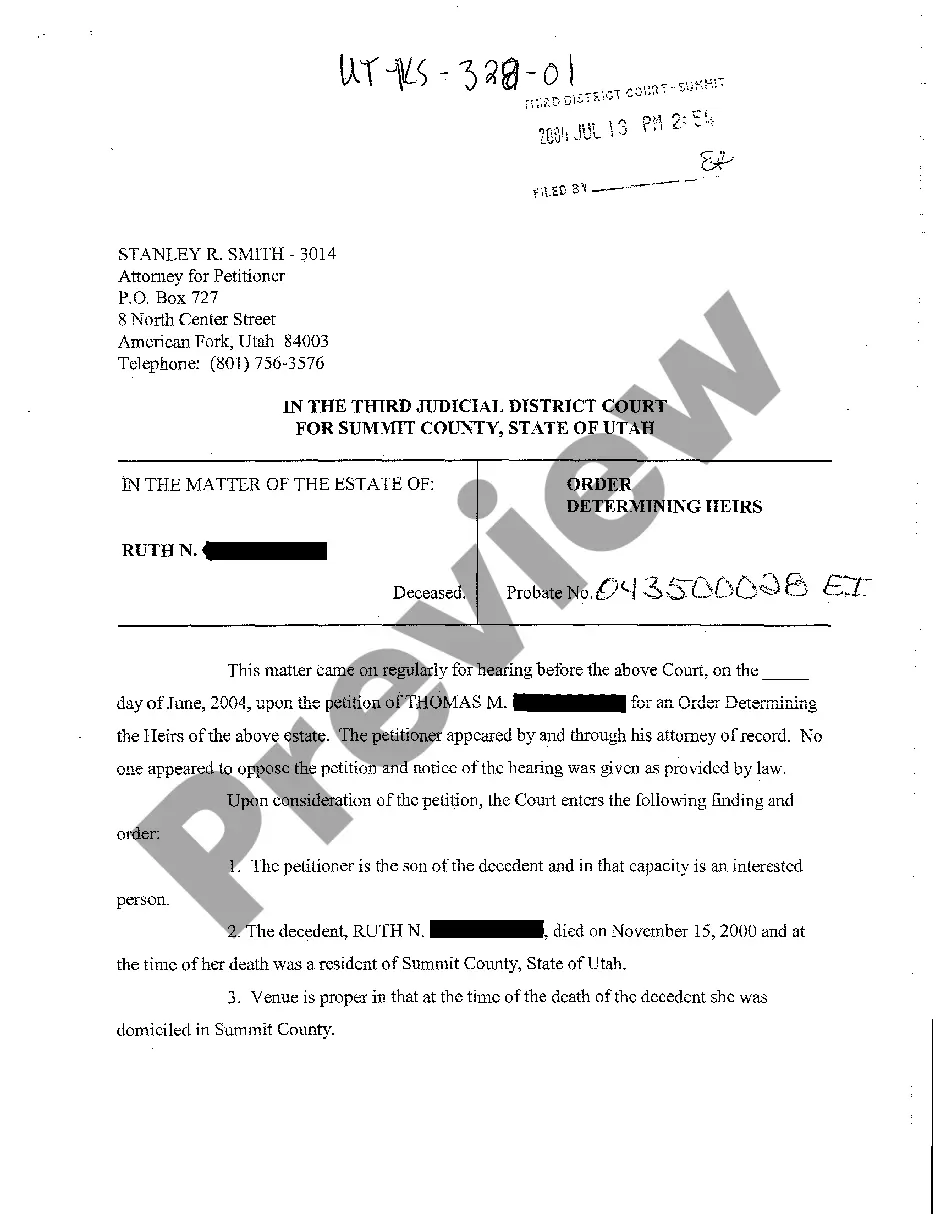

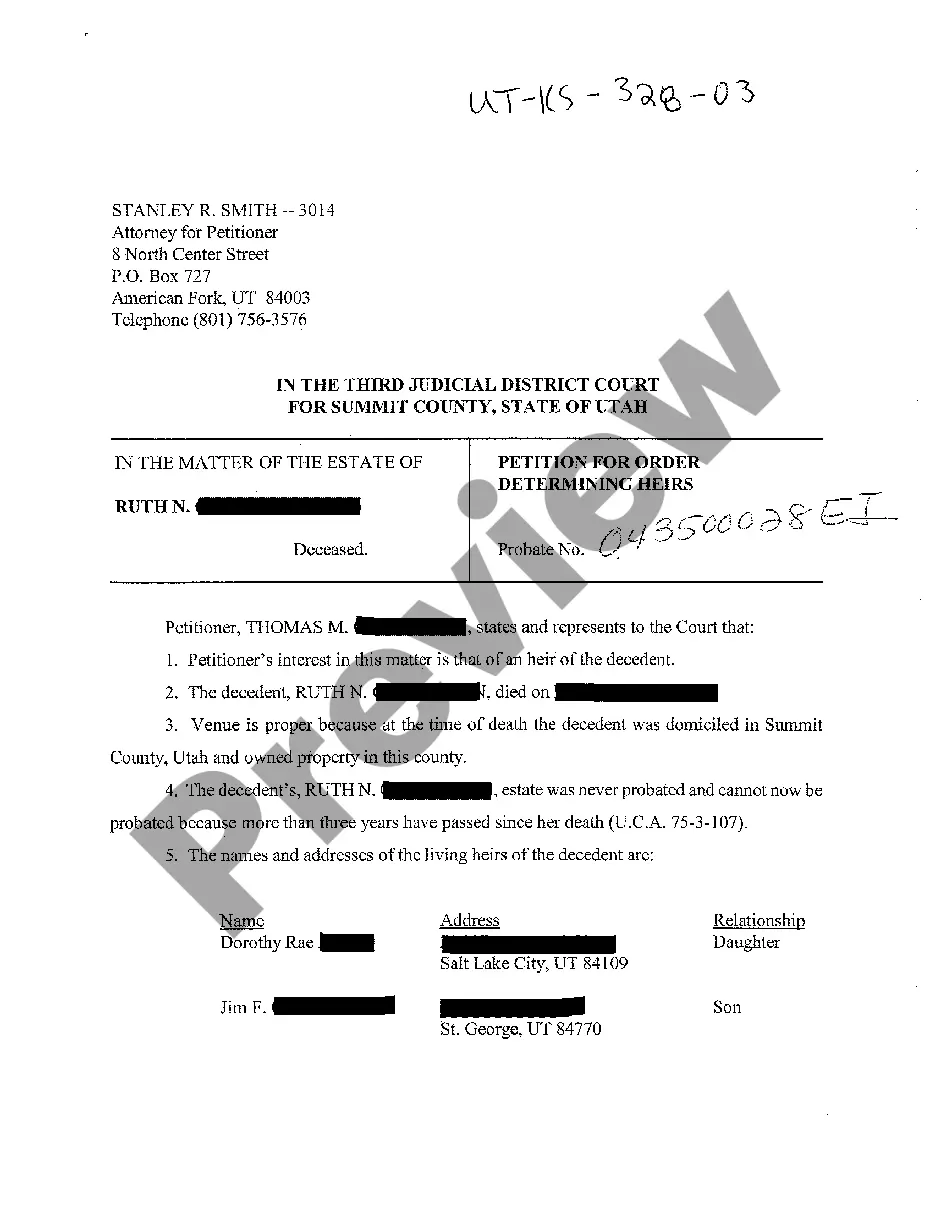

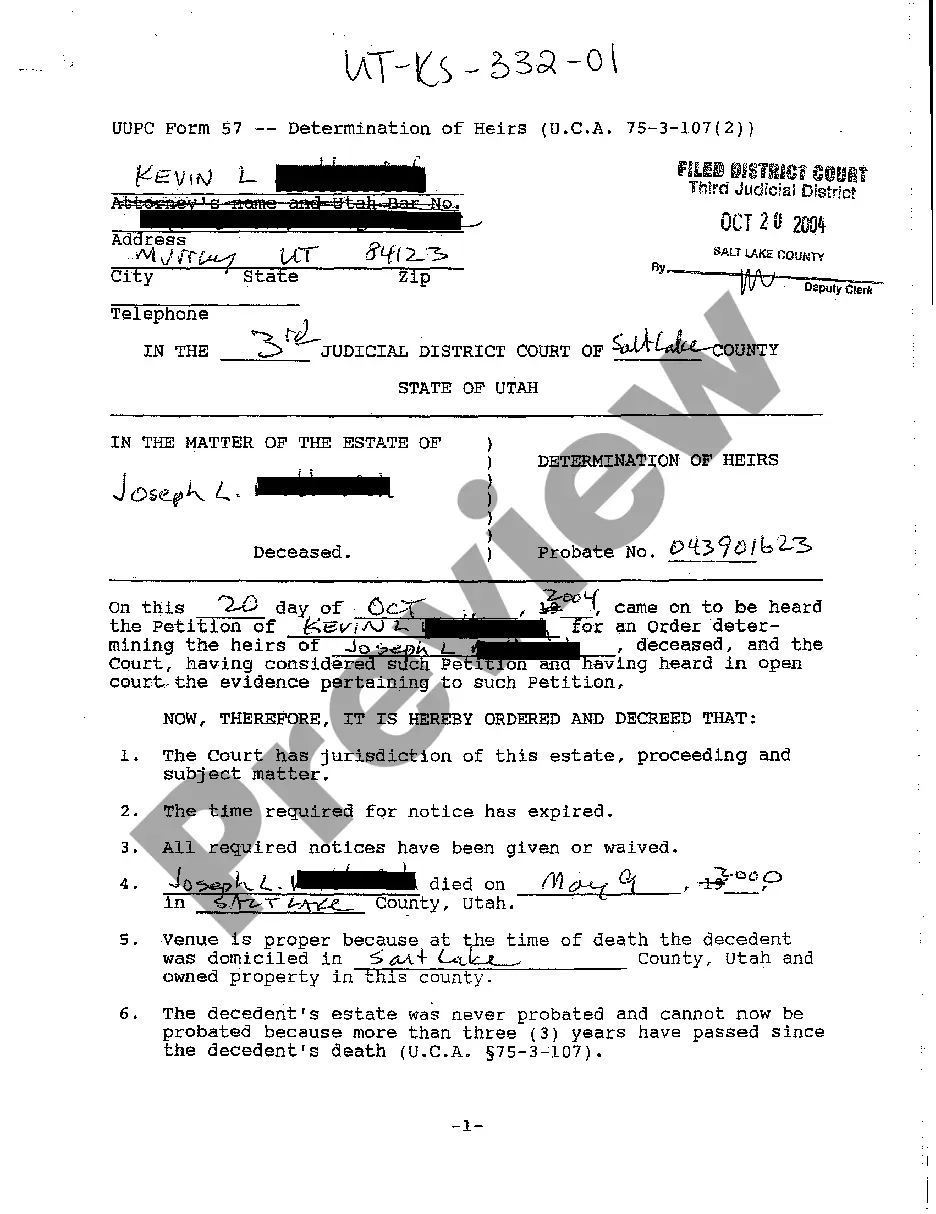

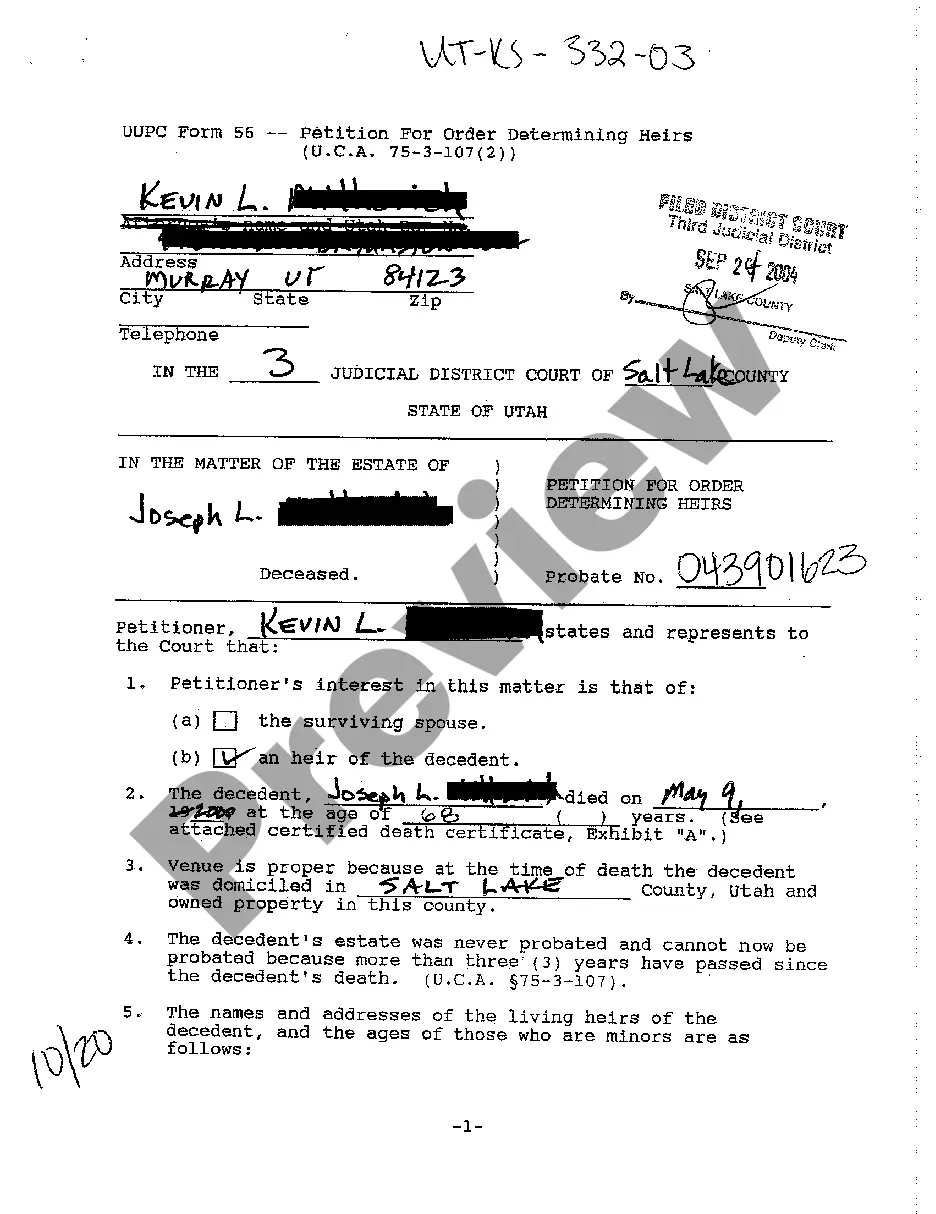

Utah Petition for Order Determining Heirs

Description

How to fill out Utah Petition For Order Determining Heirs?

Among numerous paid and free examples which you get online, you can't be certain about their accuracy and reliability. For example, who created them or if they’re skilled enough to deal with what you require these people to. Always keep calm and utilize US Legal Forms! Get Utah Petition for Order Determining Heirs templates made by skilled attorneys and avoid the expensive and time-consuming procedure of looking for an lawyer or attorney and then paying them to draft a document for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the form you are seeking. You'll also be able to access all your previously saved templates in the My Forms menu.

If you are utilizing our service for the first time, follow the instructions listed below to get your Utah Petition for Order Determining Heirs easily:

- Make sure that the file you see is valid in the state where you live.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another example utilizing the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

Once you’ve signed up and purchased your subscription, you can use your Utah Petition for Order Determining Heirs as many times as you need or for as long as it continues to be active where you live. Edit it in your favored offline or online editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

Probate is required if: the estate includes real property (land, house, condominium, mineral rights) of any value, and/or. the estate has assets (other than land, and not including cars) whose net worth is more than $100,000.

How long do you have to make a claim? The Act has a strict time limit for making a claim of six months from the date of the Grant of Probate or Letters of Administration. In very exceptional circumstances this may be extended to allow a late claim, but as a rule you must stick to the six month deadline.

An inheritance that remains unclaimed will pass on the next person in the line of intestate succession. If the nonclaiming individual was the last in the intestate line, the property will escheat, or revert to the state.

All of the heirs must sign. The only way to get around a deadlock like this is to have the succession representative sell the house.

If you are entitled to an inheritance, it doesn't just disappear if the probate case must be closed before you can receive it. Instead, it is deposited in a fund with the county in which the probate case was opened.

In many states, the required period is 120 hours, or five days. In some states, however, an heir need only outlive the deceased person by any period of time -- theoretically, one second would do.

As an heir, you are entitled to a copy of the Will, whether you are named as a beneficiary or not. If there is a probate estate, then you should receive a copy of the Will. If you do not, you can always get it from the court. If there is no probate estate, then the Will is not going to do anything.

Unfortunately, there is not much you can do if the person will not agree to settle or sell the home. There may be other legal tactics you can do, but generally, if the property must get sold (or you want to sell the home) and the other heirs do not, then a partition action may be your only option.

There is a strict time limit within which an eligible individual can make a claim on the Estate. This is six months from the date that the Grant of Probate was issued. For this reason, Executors are advised to wait until this period has lapsed before distributing any of the Estate to the beneficiaries.