What is Probate?

Probate involves the management of a deceased person's estate. It includes validating wills, settling debts, and distributing assets. Explore state-specific templates for your needs.

Probate is the legal process of administering an estate. Attorney-drafted templates make it fast and easy to complete.

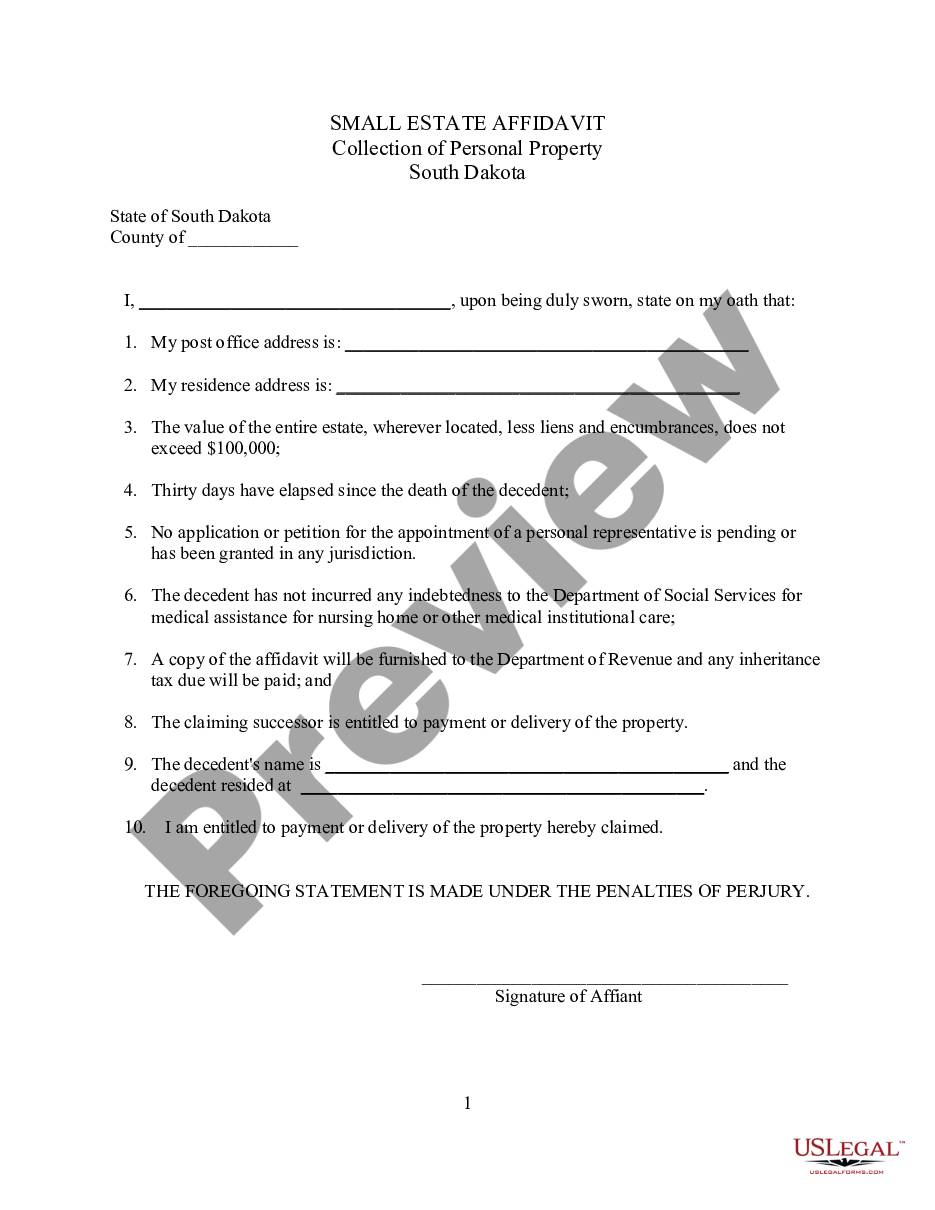

Easily collect a deceased person's personal property if their estate is valued under $100,000 and no formal executor is needed.

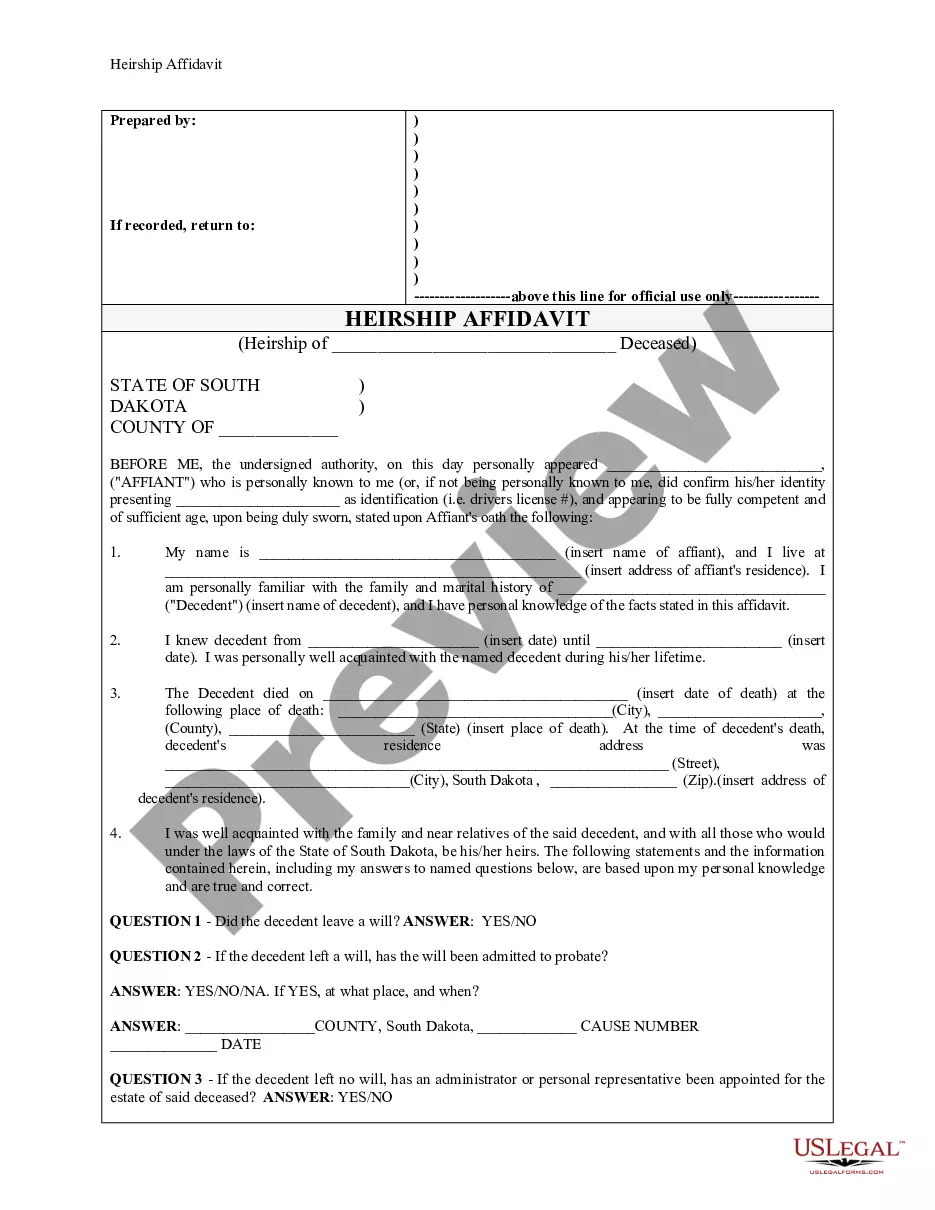

Establishes legal heirship to a deceased person's assets, crucial for settling their estate.

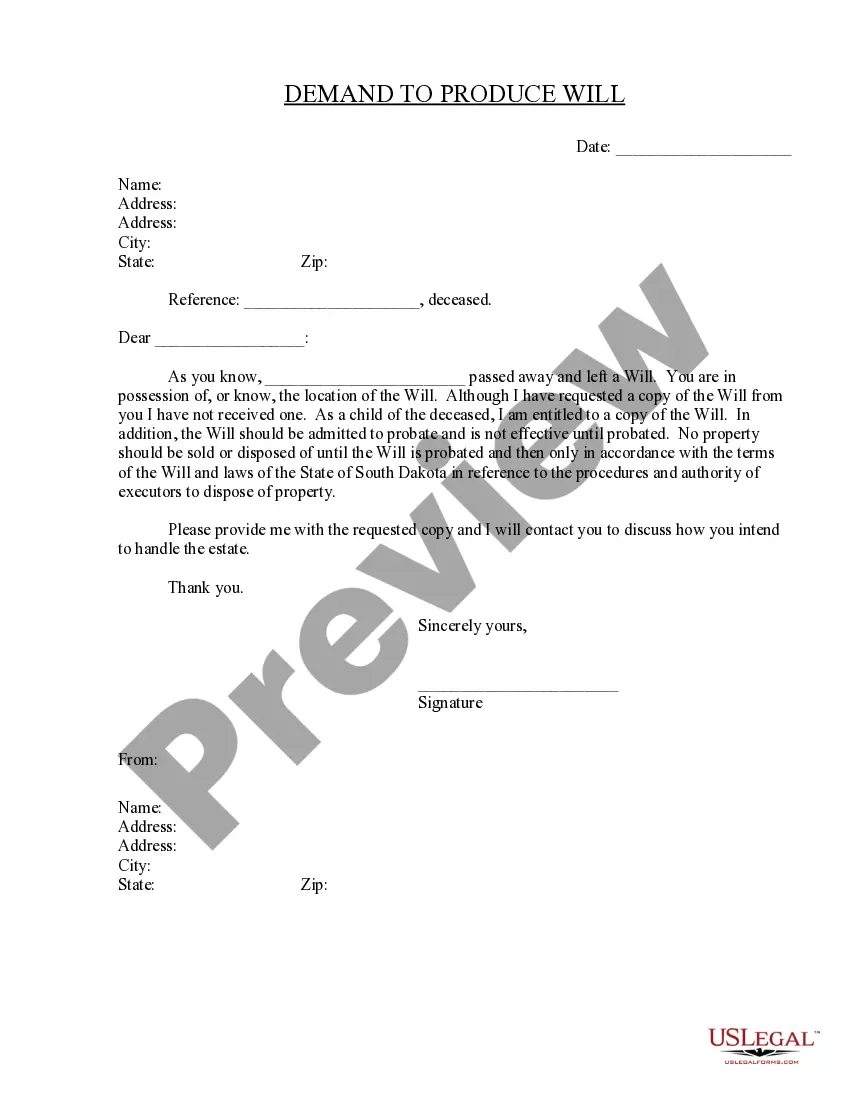

Request a copy of a deceased person's Will to understand estate distribution and ensure proper legal handling.

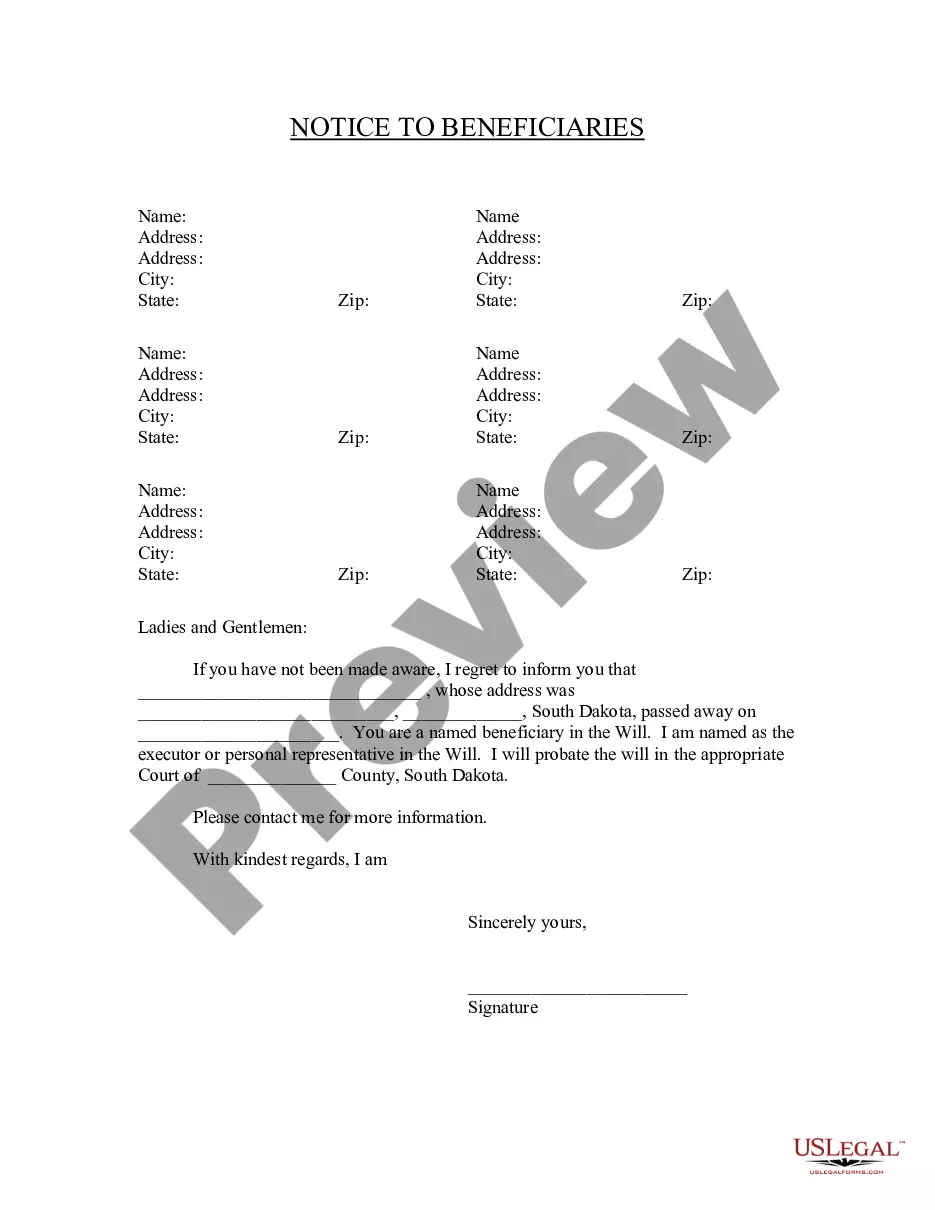

Notify beneficiaries of their inclusion in a will and provide essential details post-death of the testator.

Disclaim any rights to inherit property from an estate or trust, allowing for clear distribution according to your wishes.

Clarify estate divisions among heirs to avoid disputes over inheritance.

Challenge a will's validity by citing mental incompetence or undue influence.

Clarify joint ownership of property, addressing common misconceptions and explaining rights and responsibilities in shared ownership scenarios.

Renounce your right to inherit property, allowing it to pass to others according to state law, without claiming your share.

Streamline the probate process by formally renouncing executorship, ensuring legal compliance and efficient estate management.

Probate is essential for settling most estates after a person's death.

All assets titled in the deceased's name typically go through probate.

Probate can be a lengthy process, often taking several months.

Some assets may bypass probate, such as joint accounts and trusts.

Heirs have the right to be notified of probate proceedings.

Probate can involve various fees, including court and executor fees.

Begin your probate process with these easy steps.

A trust can offer additional benefits, like avoiding probate, but it's not mandatory.

If no estate plan exists, the state will determine how your assets are distributed.

It's wise to review your estate plan every few years or after major life events.

Beneficiary designations often override wills, directly transferring assets to named individuals.

Yes, you can appoint separate agents for financial and health care decisions.