What is Probate?

Probate refers to the legal process of administering a deceased person's estate. It typically involves validating the will, settling debts, and distributing assets. Explore state-specific templates to streamline your process.

Probate involves managing a deceased person's estate. Attorney-drafted templates are quick and straightforward to complete.

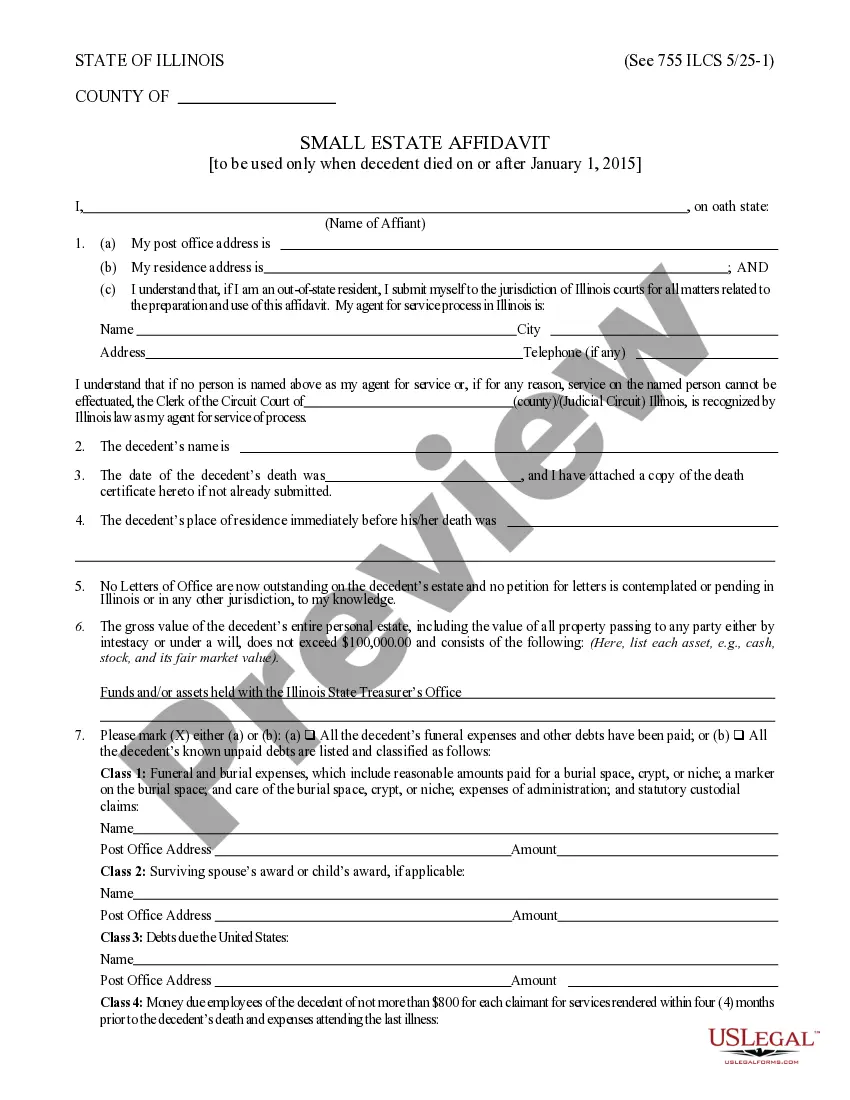

Use this affidavit to simplify the transfer of assets from a decedent's estate valued under $100,000 without requiring formal probate.

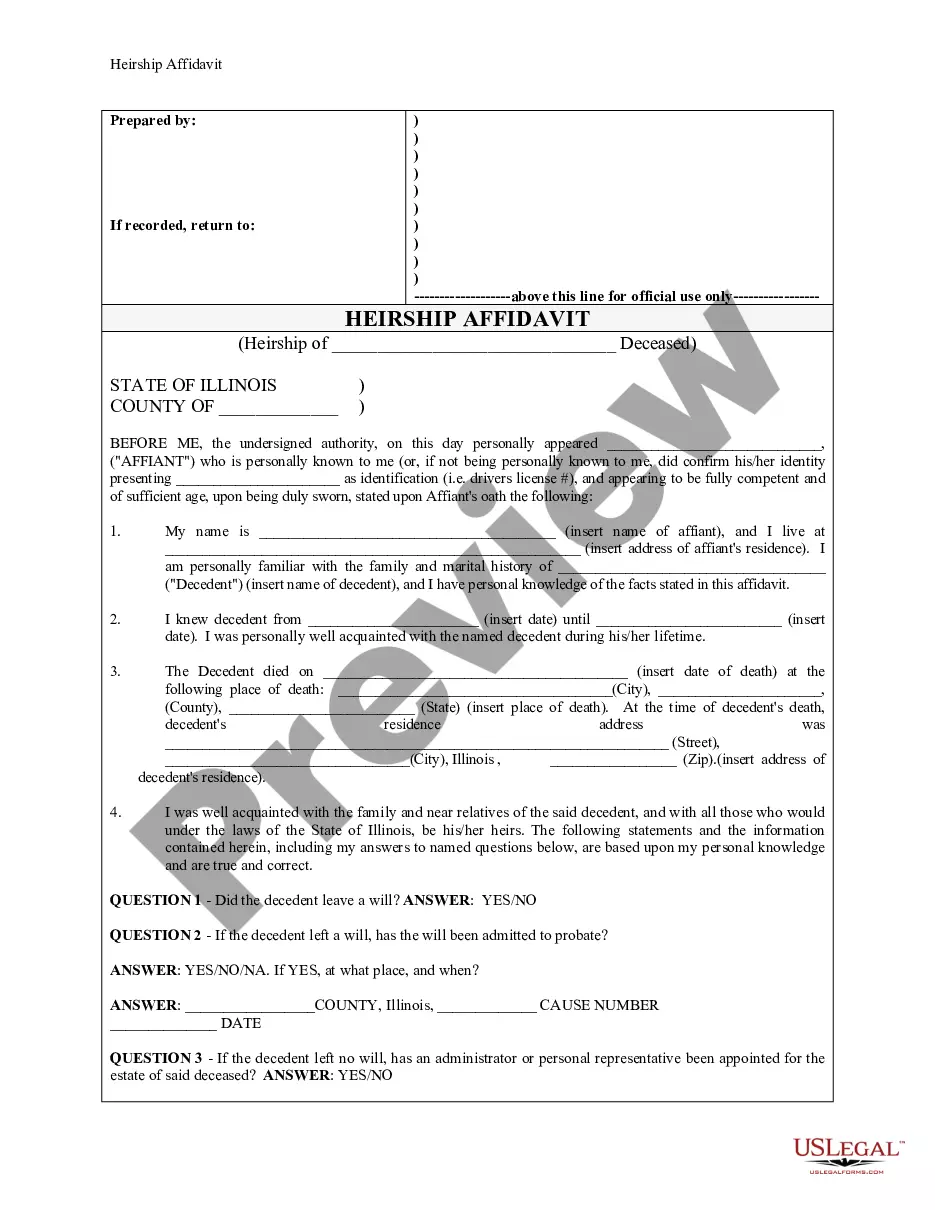

Use this to establish legal heirship after someone's death, especially when there's no will or probate process.

Convert your estate's administration to independent management, allowing for greater flexibility and reduced court oversight.

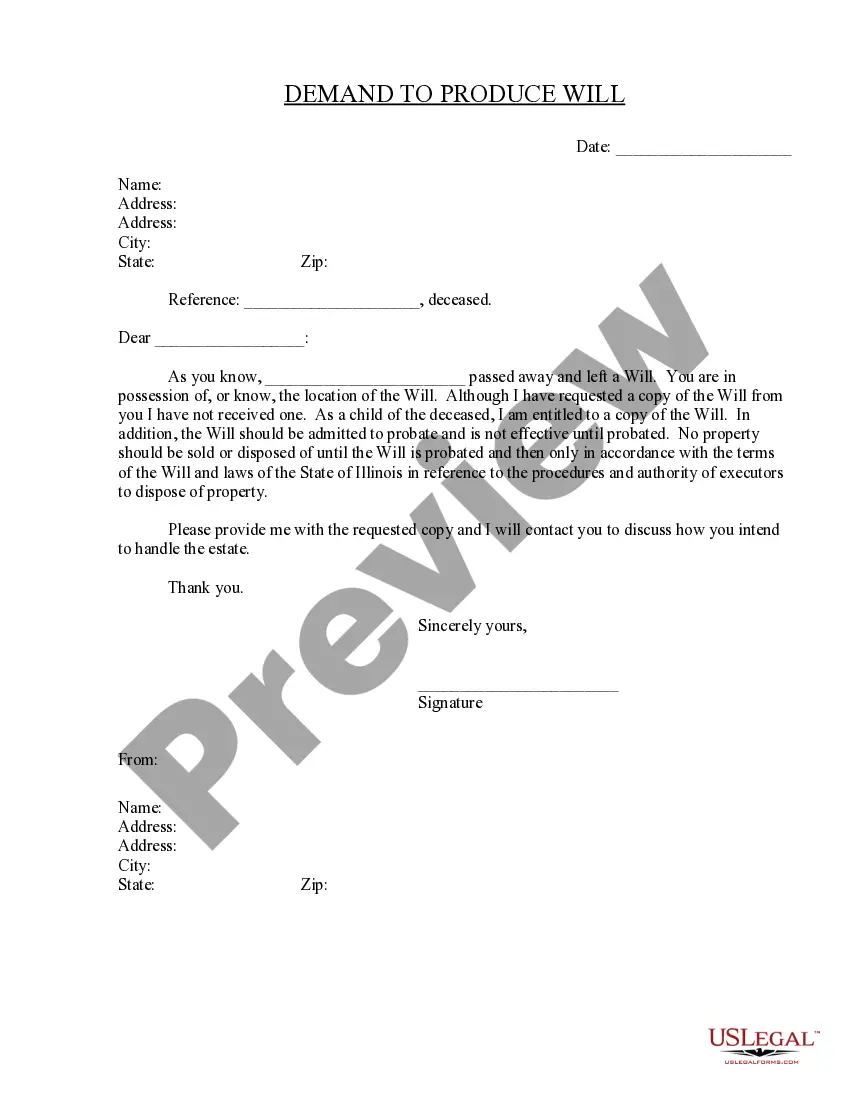

Request a copy of the deceased's Will to ensure proper estate administration as an heir.

Essential for initiating probate proceedings and managing an estate's assets after a loved one's death.

Request the court to waive the one-day waiting period for your marriage license, allowing for immediate issuance.

Establish legal guardianship for a minor when their parents can't care for them, ensuring their safety and well-being.

Use this report to confirm the completion of estate administration and to provide a summary of all related proceedings.

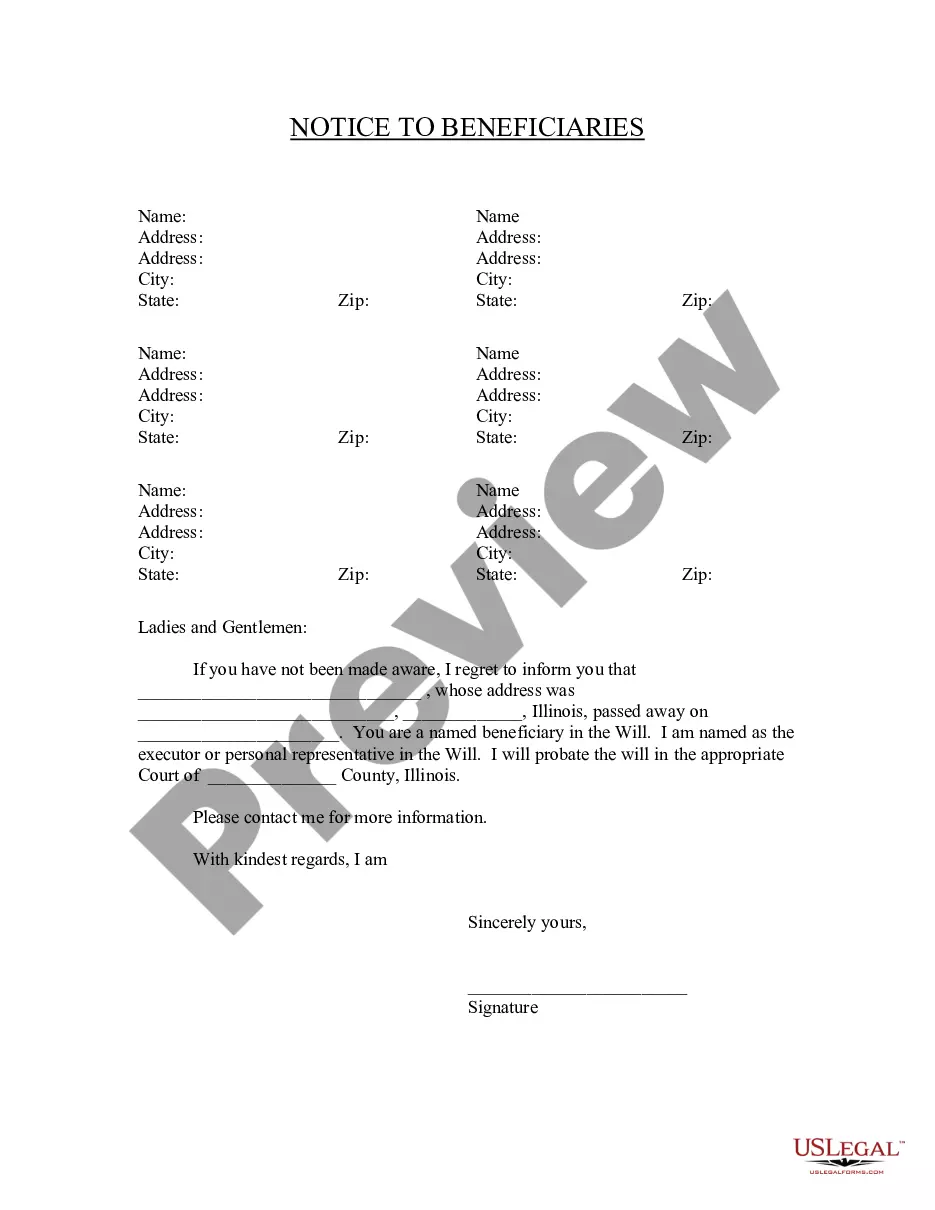

Inform beneficiaries of their status in a will and provide essential details about the probate process.

Essential for formalizing a claim decision in probate court, allowing users to proceed with further legal actions.

Probate is necessary to settle a deceased person's estate.

Not all assets go through probate, especially those in trusts.

Probate can be time-consuming and may involve court appearances.

Debts and taxes must be settled before assets are distributed.

Probate court oversees the process to ensure legality.

Begin the probate process with these simple steps.

A trust can provide additional management and privacy benefits, but a will is essential.

Ignoring estate planning can lead to intestacy, where state laws dictate asset distribution.

Update your plan whenever significant life changes occur, like marriage or the birth of a child.

Beneficiary designations typically override will instructions, so review them regularly.

Yes, you can designate separate individuals for financial and healthcare decisions.