What is Probate?

Probate is the legal process of validating a will and administering an estate. These documents ensure proper distribution of assets. Explore our state-specific templates for your needs.

Probate involves managing a deceased person's estate. Our attorney-drafted templates are quick and easy to use.

Use this affidavit to claim personal property from a decedent's estate without formal probate when the estate value is below $208,850.

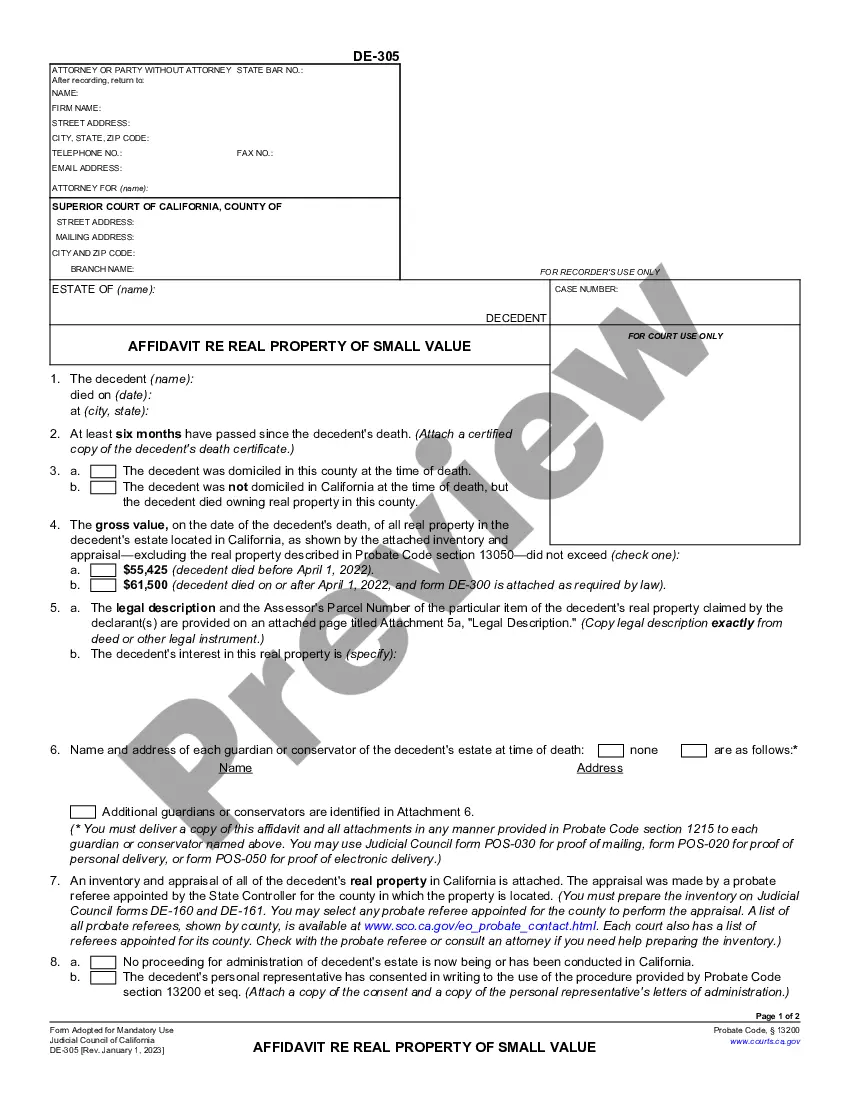

Use this affidavit to claim real property valued at $55,425 or less from a deceased person’s estate, simplifying the legal transfer process.

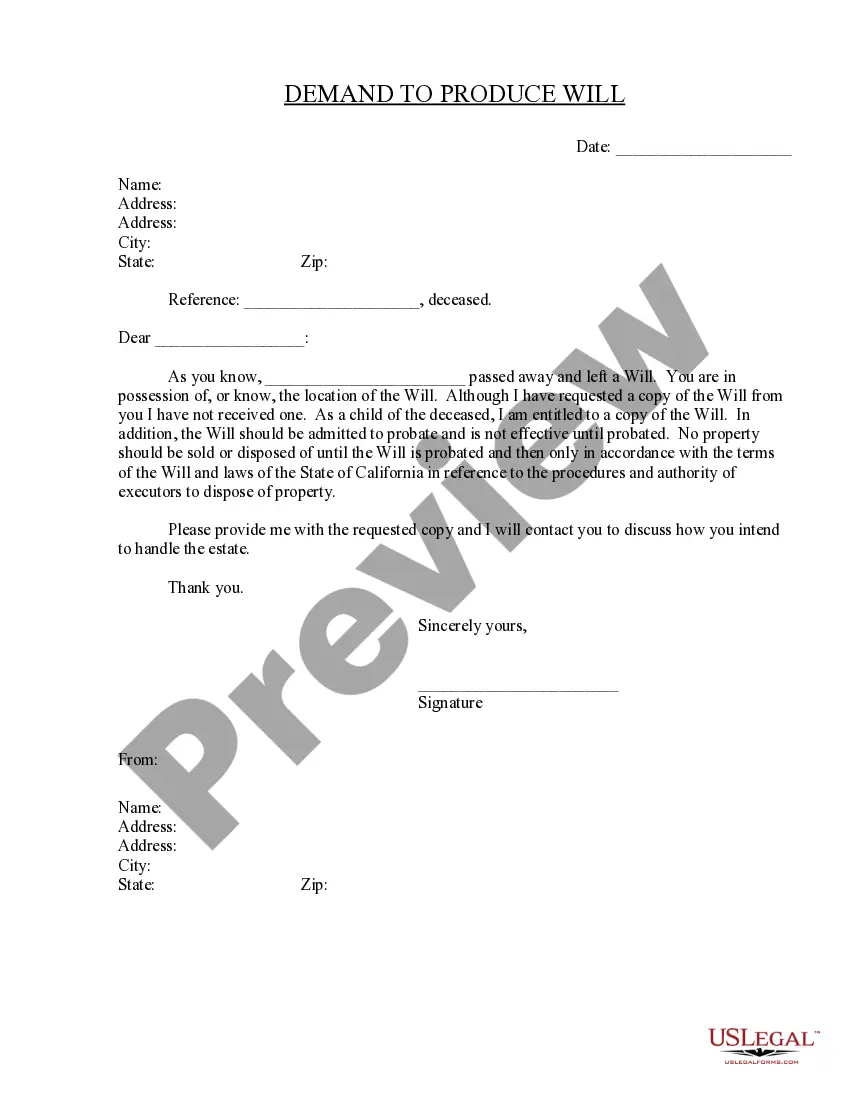

Request a copy of a deceased person's will to ensure estate matters are handled legally and according to the deceased's wishes.

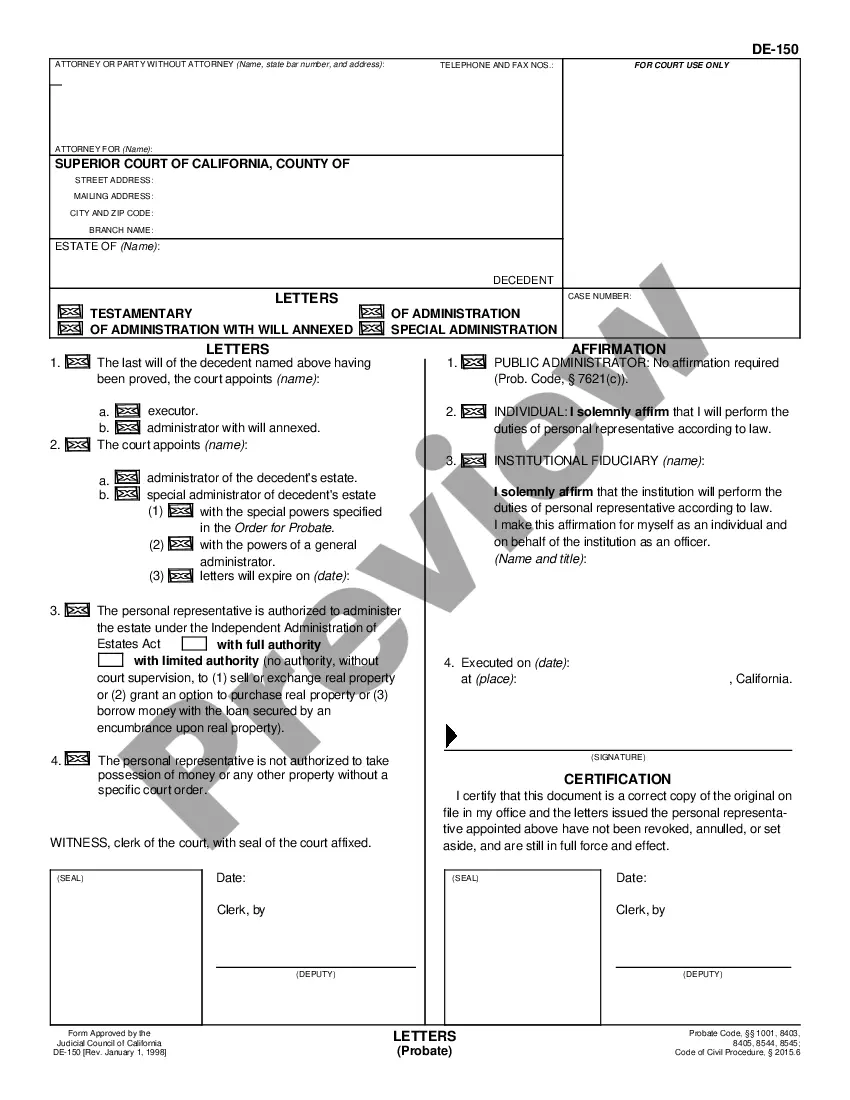

Obtain the necessary legal authority to manage a deceased person's estate, whether through an executor appointed by a will or an administrator without one.

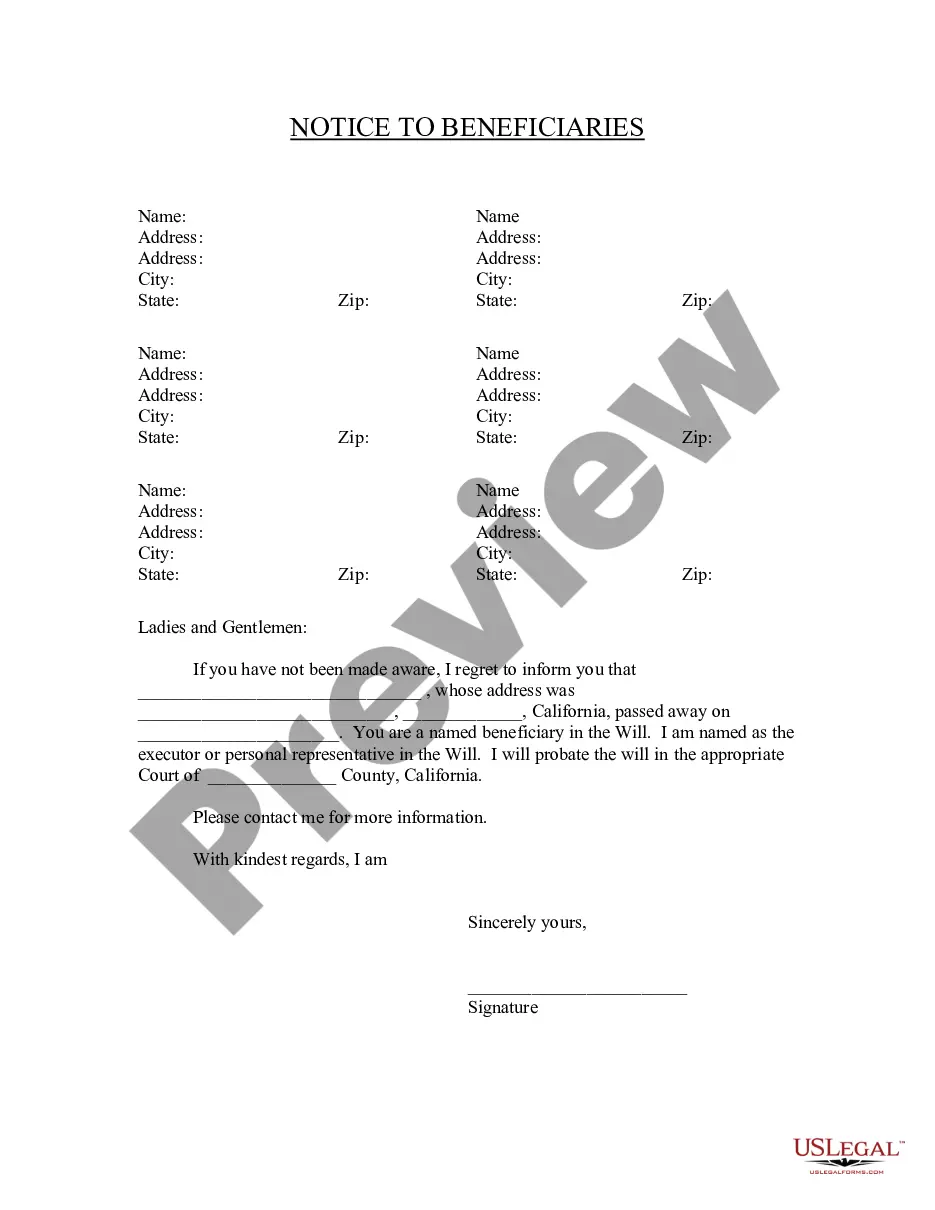

Notify beneficiaries named in a will about their status and next steps in the probate process.

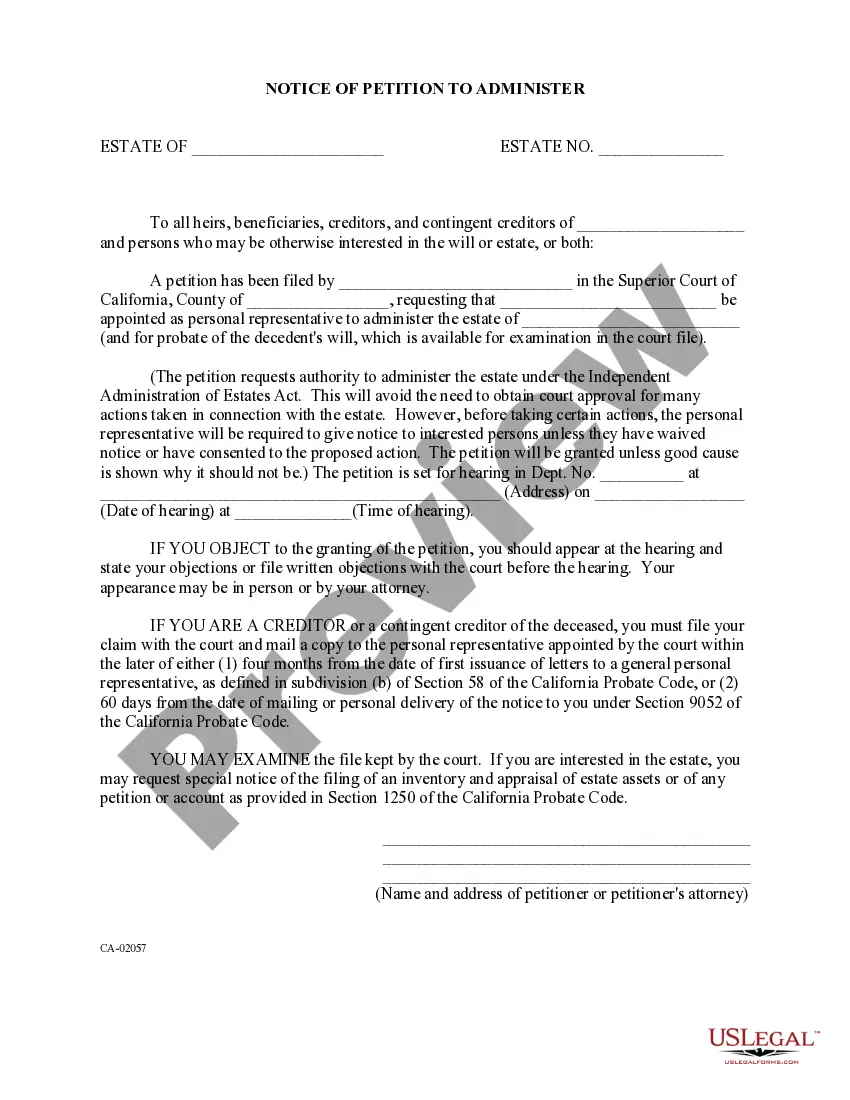

Initiate the probate process by appointing a personal representative to manage the estate, streamlining approvals under the Independent Administration of Estates Act.

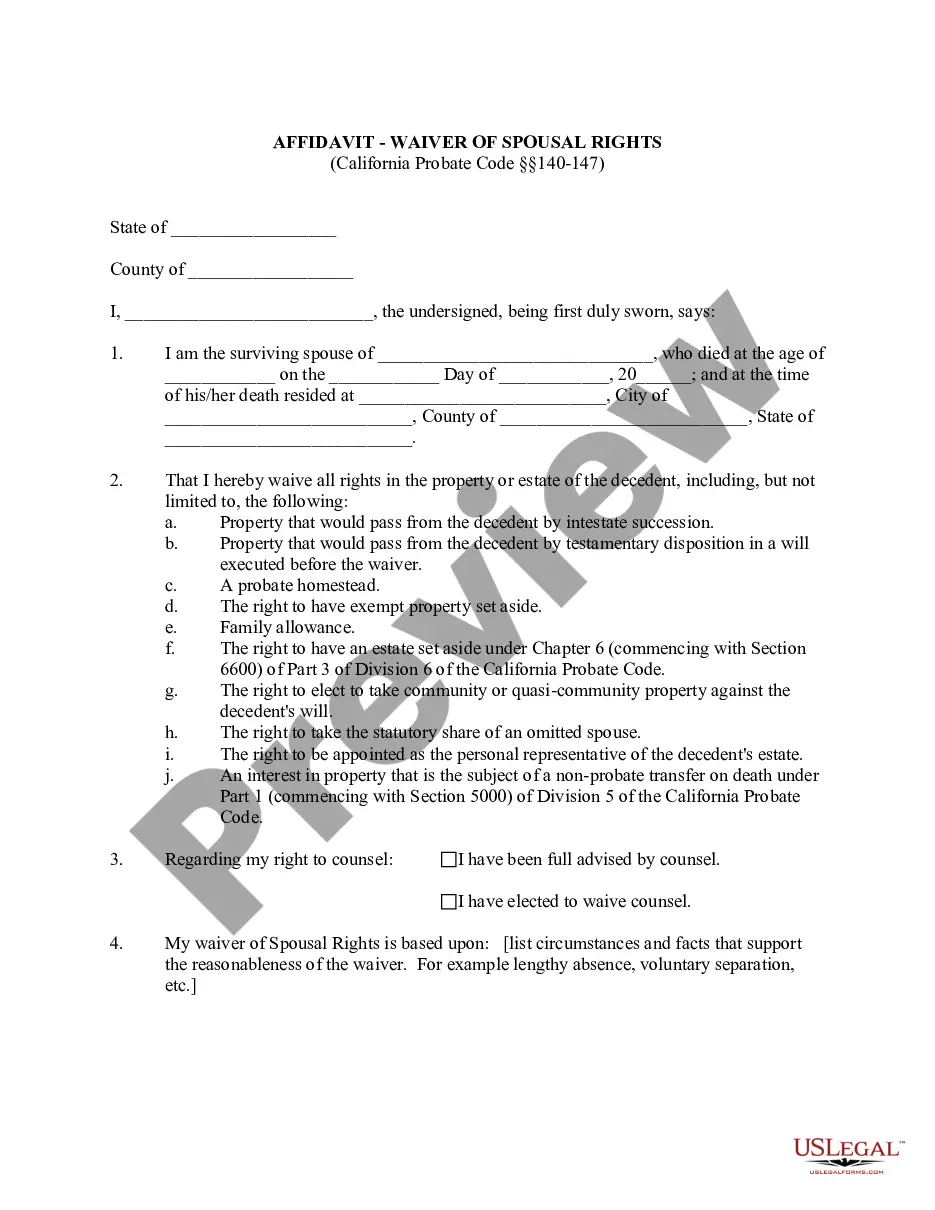

Use this affidavit to formally waive spousal rights to an estate in accordance with California probate law.

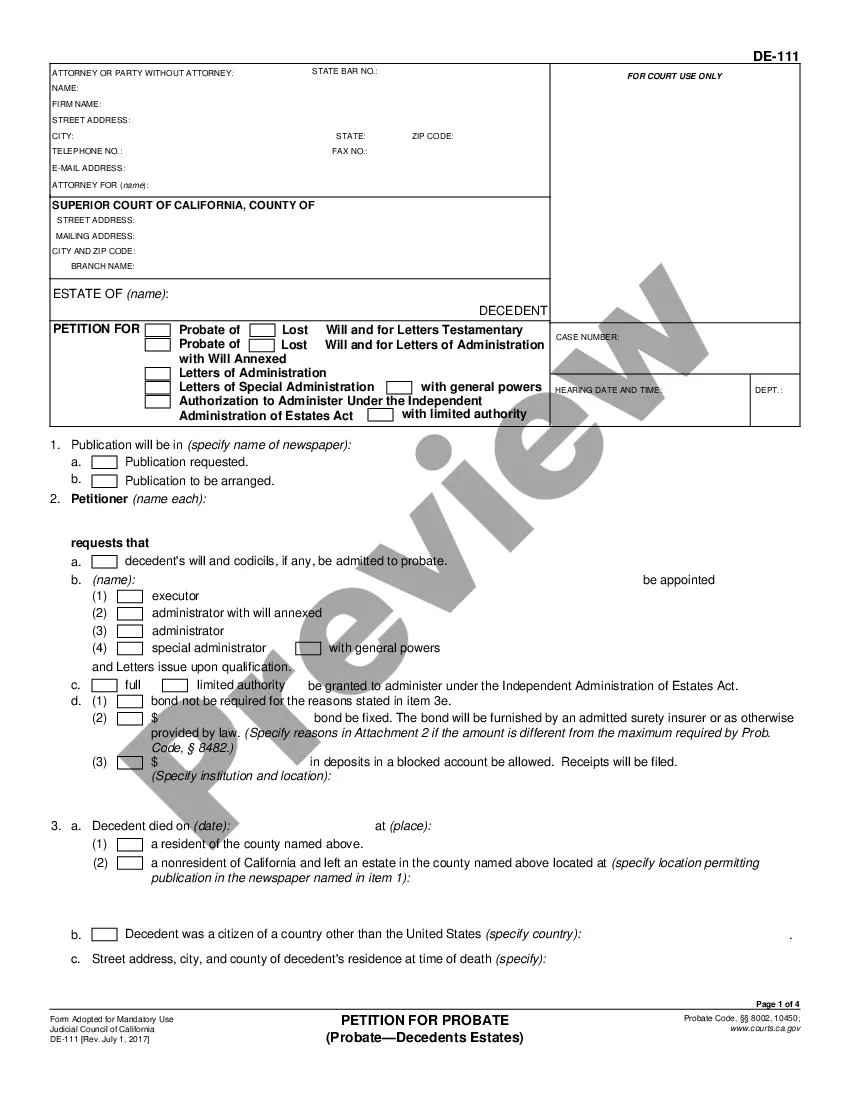

Ensure the proper distribution of a deceased person's assets through a legal petition.

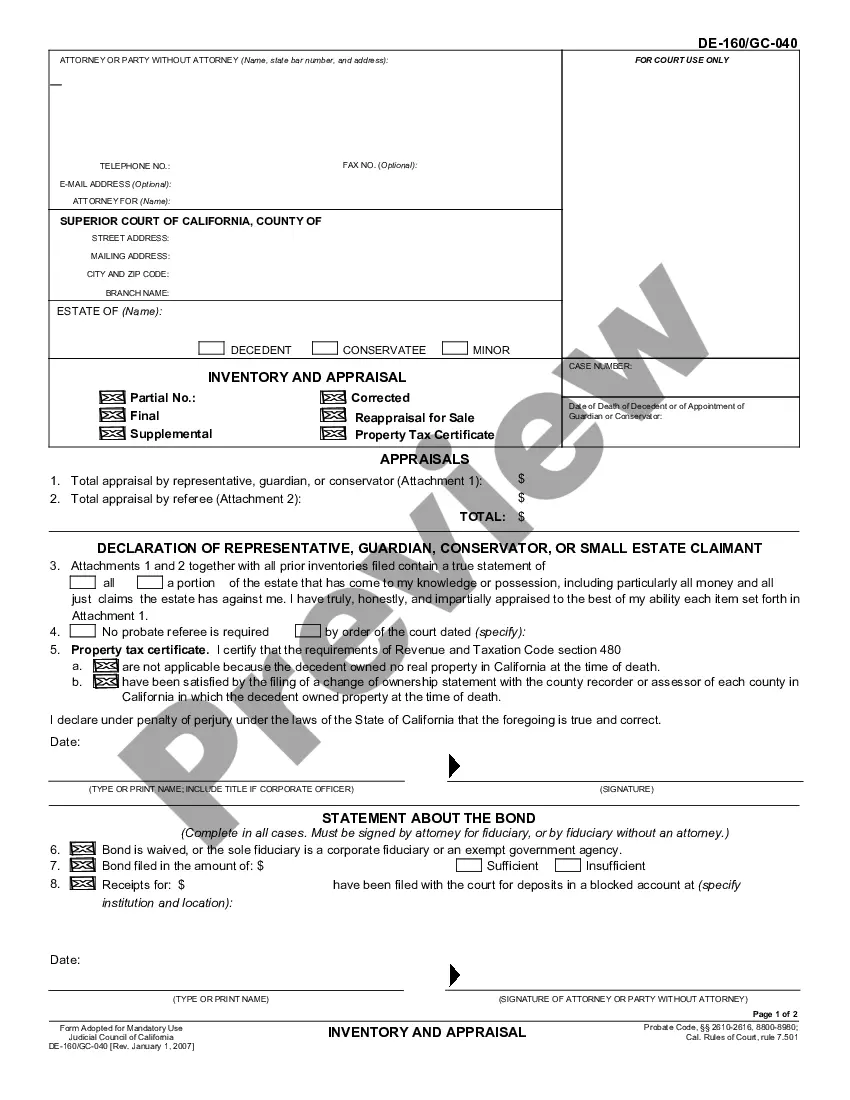

Utilize this form to accurately report and assess assets in an estate or for minor conservation, ensuring proper valuation during legal proceedings.

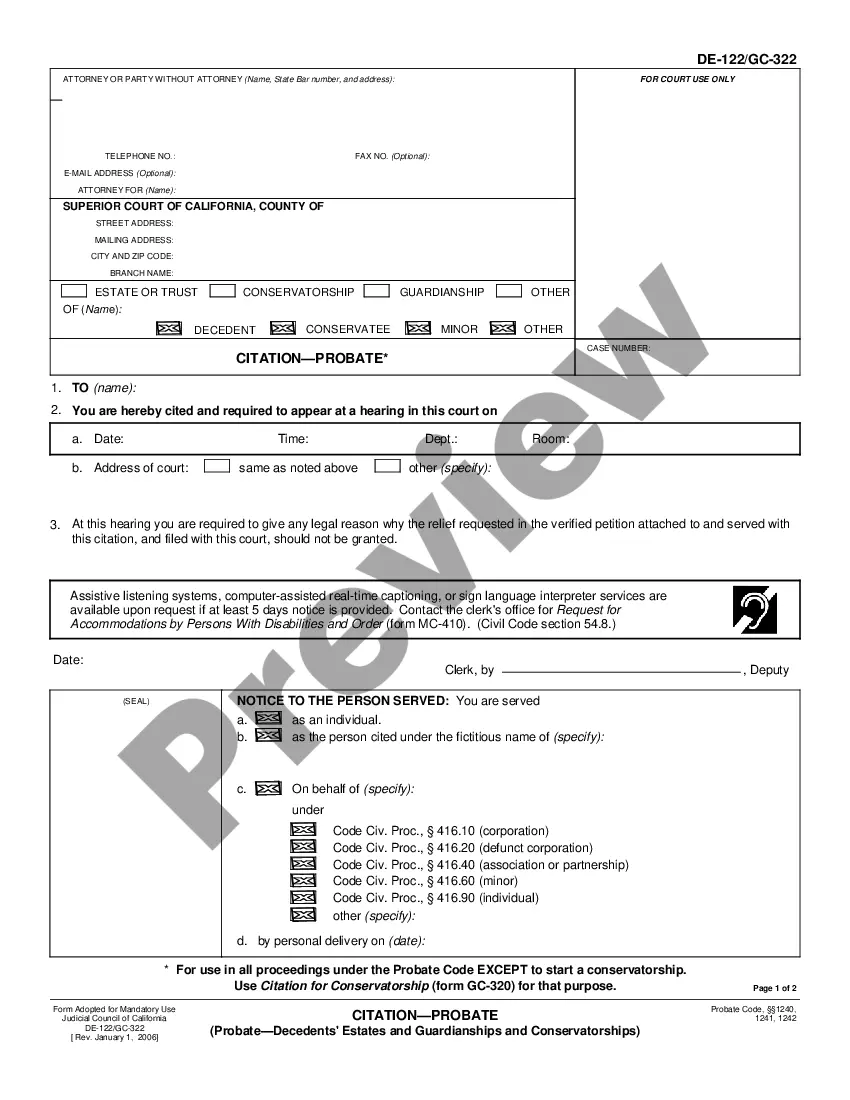

Use this citation to require someone to appear at a probate hearing and respond to requests regarding an estate or guardianship.

Probate is necessary to settle a deceased person's estate.

Wills typically require probate, while trusts do not.

All assets must be accounted for during probate.

Heirs may need to be notified throughout the process.

Probate can be time-consuming, varying by case complexity.

Begin your probate journey easily with these steps.

A trust can help avoid probate and manage assets efficiently.

If no plan is in place, the state will determine asset distribution.

Review your plan regularly, especially after major life changes.

Beneficiary designations can override will provisions for certain assets.

Yes, you can designate separate agents for financial and health matters.