What is Power of Attorney?

Power of Attorney grants authority to another person to act on your behalf in legal matters. These documents are used when someone cannot manage their own affairs. Explore state-specific templates for your needs.

Power of Attorney documents allow someone to make decisions on your behalf. Attorney-drafted templates are quick and easy to complete.

Get everything needed for planning your life documents in one convenient package.

Grant broad powers to your agent to manage your property and finances, even if you become incapacitated.

Empower someone to manage your property and finances if you become disabled, ensuring your affairs are handled without delay or confusion.

Prepare essential legal documents for managing your health and finances, all conveniently included in one package.

Empower someone to make care and custody decisions for your child when you're unavailable or unable to act.

Grant authority to someone you trust to manage your financial affairs, even when you cannot. This document ensures your interests are protected.

Gather essential forms for making and revoking health care decisions in one convenient package.

Grant someone authority to manage your bank accounts, even if you become incapacitated.

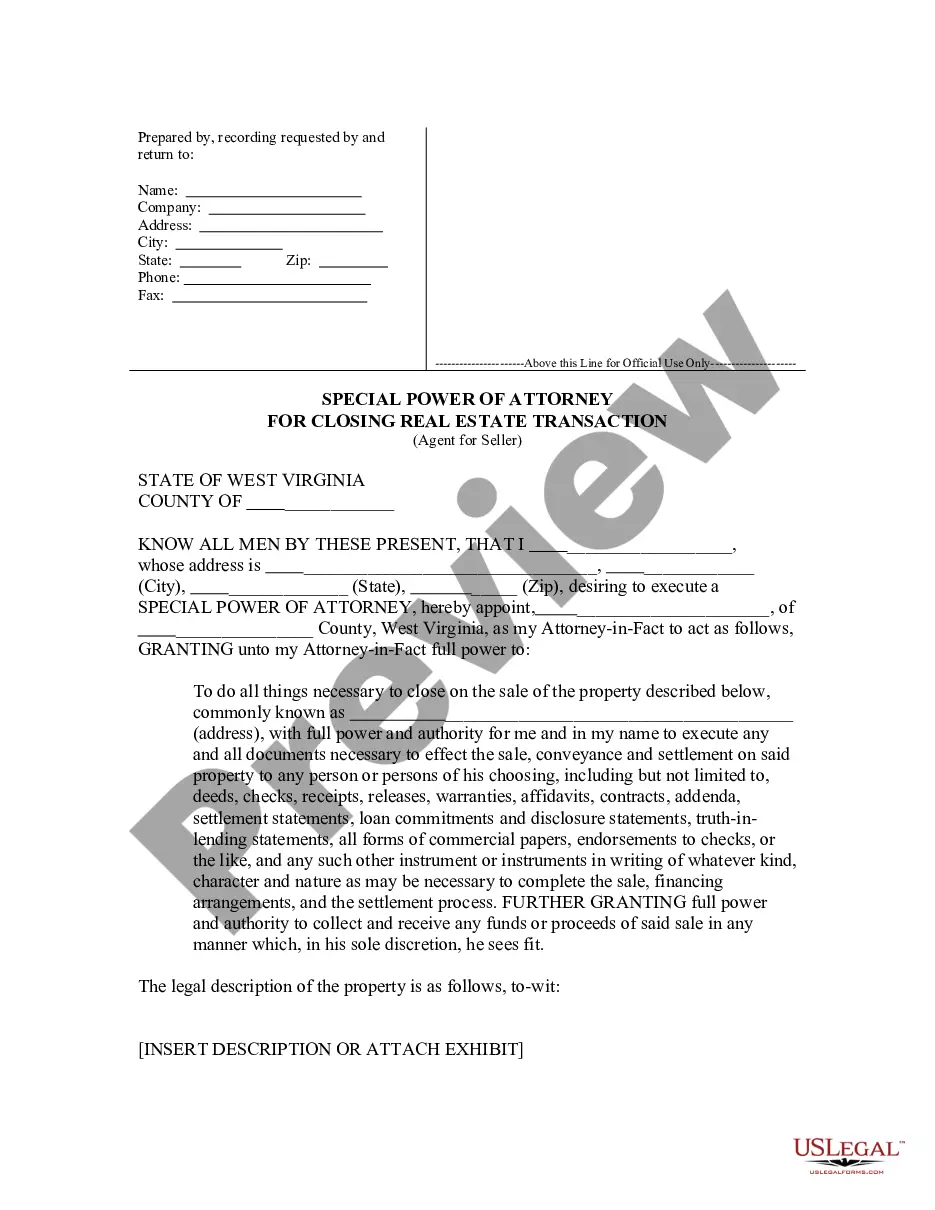

Authorize someone to handle property sales on your behalf, ensuring your interests are protected during real estate transactions.

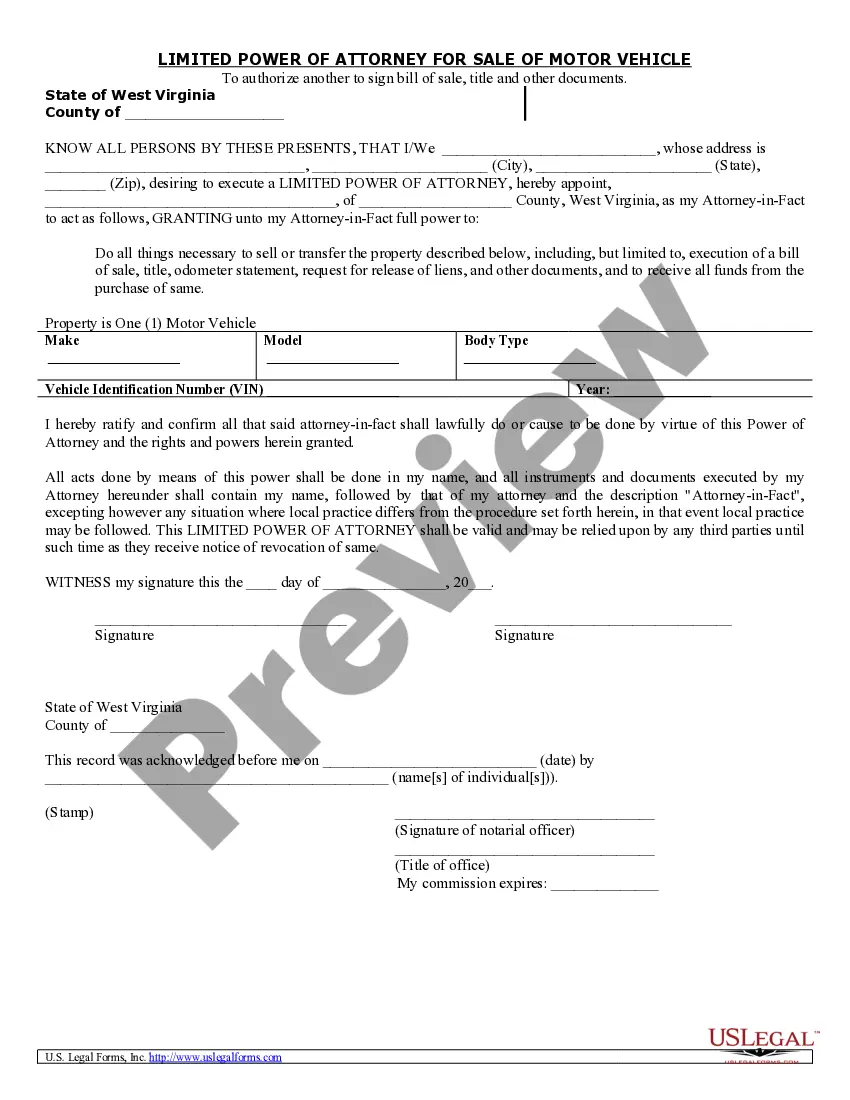

Authorize someone else to handle the sale of your motor vehicle with ease. This legal form simplifies the vehicle transfer process.

A Power of Attorney can be tailored to specific needs.

Documents often require notarization or witnesses in many states.

Agents must act in the principal's best interest.

Durable Powers of Attorney are used to manage affairs during incapacity.

Medical decisions can be made through a Healthcare Proxy or Medical POA.

Begin your process quickly with these straightforward steps.

A trust can manage assets during your lifetime, while a will distributes them after death.

Without a Power of Attorney, decisions may be made by a court or default rules.

It's wise to review and update your plan every few years or after major life events.

Beneficiary designations typically override your will, affecting asset distribution.

Yes, you can appoint separate agents for financial and healthcare decisions.