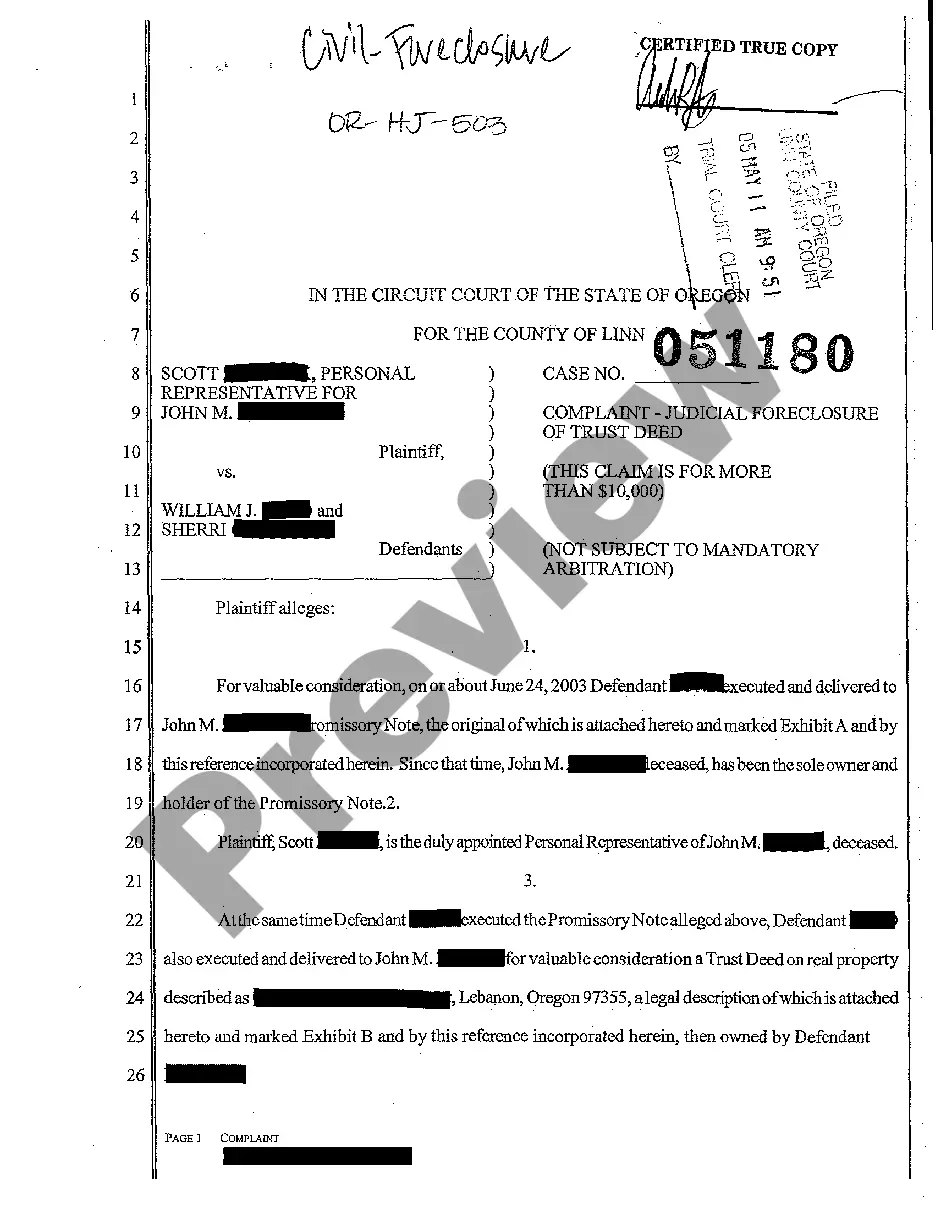

Oregon Complaint - Judicial Foreclosure of Judgment Lien

Description

How to fill out Oregon Complaint - Judicial Foreclosure Of Judgment Lien?

The work with documents isn't the most easy process, especially for those who rarely work with legal paperwork. That's why we recommend using accurate Oregon Complaint - Judicial Foreclosure of Judgment Lien samples made by skilled attorneys. It allows you to eliminate difficulties when in court or handling official organizations. Find the samples you want on our site for high-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. When you’re in, the Download button will immediately appear on the template page. After downloading the sample, it will be stored in the My Forms menu.

Users with no an activated subscription can easily create an account. Make use of this brief step-by-step guide to get your Oregon Complaint - Judicial Foreclosure of Judgment Lien:

- Make certain that the form you found is eligible for use in the state it is necessary in.

- Verify the file. Make use of the Preview option or read its description (if available).

- Buy Now if this sample is what you need or return to the Search field to find a different one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a required format.

After completing these straightforward steps, you can fill out the form in your favorite editor. Check the filled in information and consider asking an attorney to review your Oregon Complaint - Judicial Foreclosure of Judgment Lien for correctness. With US Legal Forms, everything gets much simpler. Test it now!

Form popularity

FAQ

If you fail to attend Court in accordance with the Examination Order you will be in contempt of Court and a warrant for your arrest can be issued. A judgment creditor can issue a Garnishee Order on the basis of the information the judgment creditor has obtained about your financial situation.

Tools creditors can use to collect a judgment If the creditor chooses not to wait for you to sell or refinance the property, the creditor can try to foreclose on the judgment lien. This means that the creditor forces you to sell the property and pay what you owe with that money.

Again, most residential foreclosures in Oregon are nonjudicial. Here's how the process works. Before filing a notice of default, the lender provides you (the borrower) with notice about participating in a resolution conference (mediation).

Banks and other lenders typically use a trust deed. A trust deed can be foreclosed by a lawsuit in the circuit court of the county where the property is located. This type of foreclosure is referred to as a judicial foreclosure and is now common for residential loans in Oregon.

Once a non-mortgage lien is placed on your home, the holder of the lien can choose to take one of two routes.For example, property tax liens may sometimes be foreclosed outside of court, while the holder of a mechanics' liens must typically sue the homeowner in court in order to foreclose.

The short answer is, yes, selling a house with a judgment can be done. But most homebuyers expect the title report to come back clean. So you'll need to be upfront about the property lien and have a plan for how you'll address it. You have options for satisfying the judgment creditors.

To fight a creditor's attempts to gain a judgement against you, you'll need to respond to the Summons and Complaint by providing an Answer to the court within the appropriate amount of time. Your Answer should include a request for the creditor to prove the validity of the debt.

A judgment lienholder can also foreclose on your home to get paid. But judgment lienholders rarely foreclose because of the time and money needed to complete the process, and often they wouldn't get anything anyway because senior mortgages or other liens have priority and get paid first.

A lien foreclosure action is a lawsuit to foreclose the mechanics lien. The lien claimant must file a lien foreclosure action within 90 days of the date that he or she recorded the mechanics lien. Often a lien claimant with a valid claim will fail to follow through, making the lien invalid.