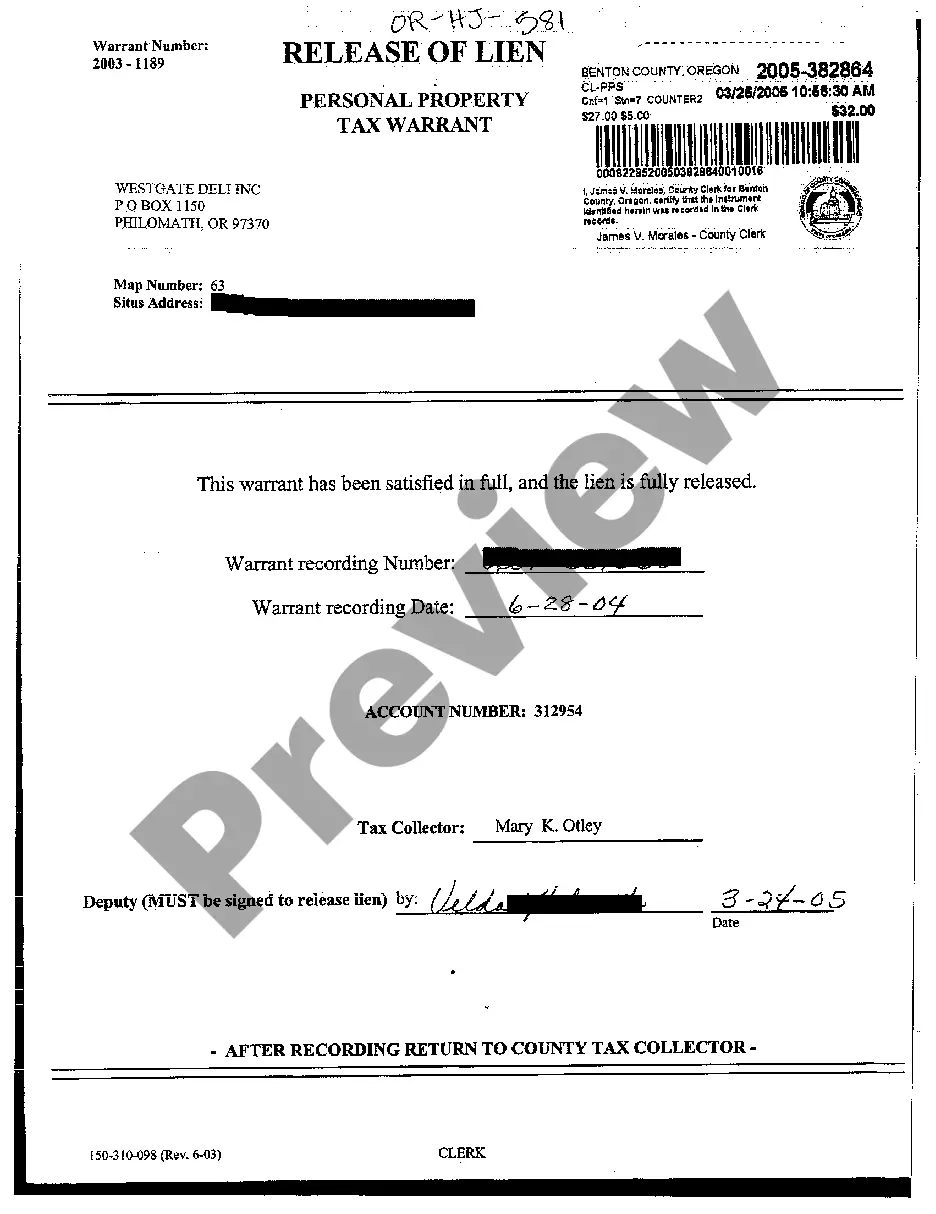

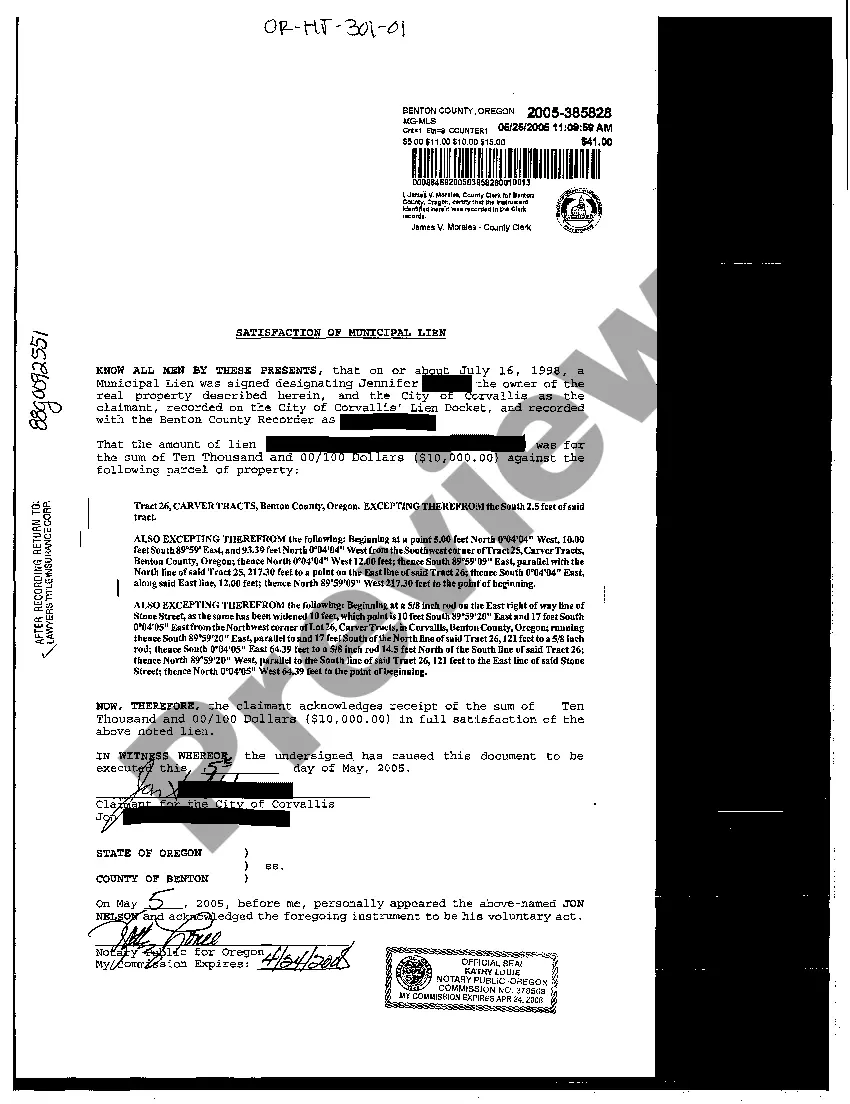

Oregon Satisfaction of Municipal Lien

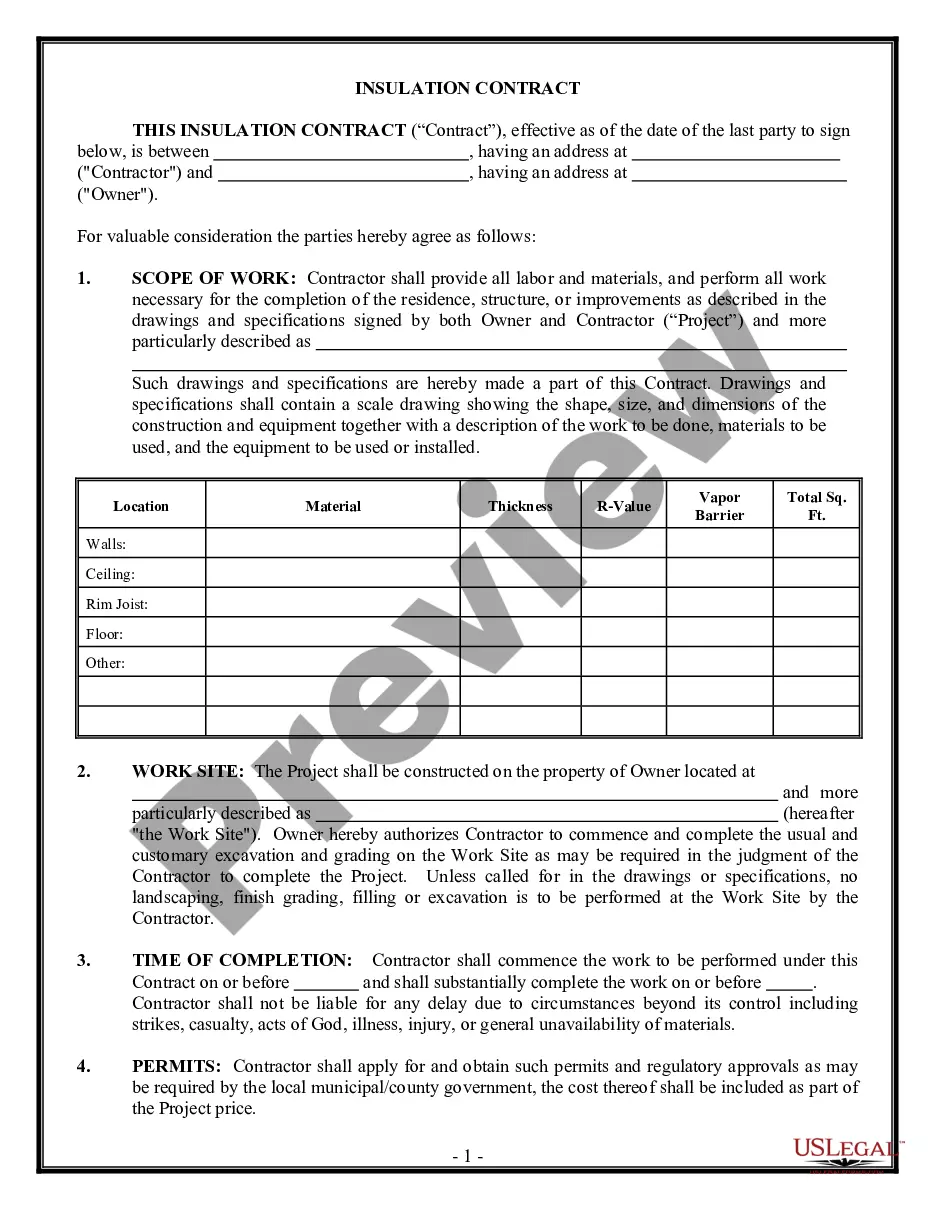

Description

How to fill out Oregon Satisfaction Of Municipal Lien?

Creating papers isn't the most simple task, especially for people who rarely deal with legal papers. That's why we advise making use of correct Oregon Satisfaction of Municipal Lien templates created by skilled lawyers. It gives you the ability to eliminate troubles when in court or dealing with formal organizations. Find the templates you want on our website for top-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will immediately appear on the template webpage. Right after accessing the sample, it’ll be stored in the My Forms menu.

Customers without a subscription can easily get an account. Follow this short step-by-step guide to get the Oregon Satisfaction of Municipal Lien:

- Be sure that the form you found is eligible for use in the state it’s required in.

- Verify the file. Utilize the Preview feature or read its description (if readily available).

- Buy Now if this template is the thing you need or go back to the Search field to get another one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After completing these simple actions, you can fill out the sample in a preferred editor. Recheck completed info and consider requesting a legal representative to review your Oregon Satisfaction of Municipal Lien for correctness. With US Legal Forms, everything becomes easier. Try it now!

Form popularity

FAQ

Yes, you have to pay interest which will continue to accrue and the contract rate. The lien survived the discharge of the debt in your BK.

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

The defendant should ask for a letter confirming that the entire amount of the judgment has been paid. He or she may do so by sending a demand letter to the plaintiff. The release and satisfaction form is filed with the court clerk and entered into the case record.

A Satisfaction of Judgment is a document signed by one party acknowledge receipt of the payment. The Satisfaction of Judgment is then filed with the court. This is beneficial to the paying party for multiple reasons. One, the court is put on notice that the debt has been satisfied.

You will need one original, notarized copy for the judgment debtor. If you recorded an abstract of judgment to place a lien against the debtor's real property, you will need an original, notarized copy of your Acknowledgment of Satisfaction of Judgment (EJ-100) for each county where you placed a lien.

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).

Satisfied Judgments A satisfied judgment is the opposite of an unsatisfied judgment. It means that your debt is either paid or settled. While you may not have completely paid off your debt in full, you can satisfy a judgment by making a new payment plan and paying what you and the lender agreed on.

Oregon judgments expire after 10 years from the date of entry by a court, unless a creditor (i.e., you or your attorney) files a certificate within that 10 year time period to have enforcement of the judgment extended for another 10 years.

There are a few ways you can satisfy or avoid a lien altogether. The firstand most obviousoption is to repay the debt. If you pay off your obligation, the creditor will remove the lien. This is done by filing a release through the same place the lien was recordedthe county or state.