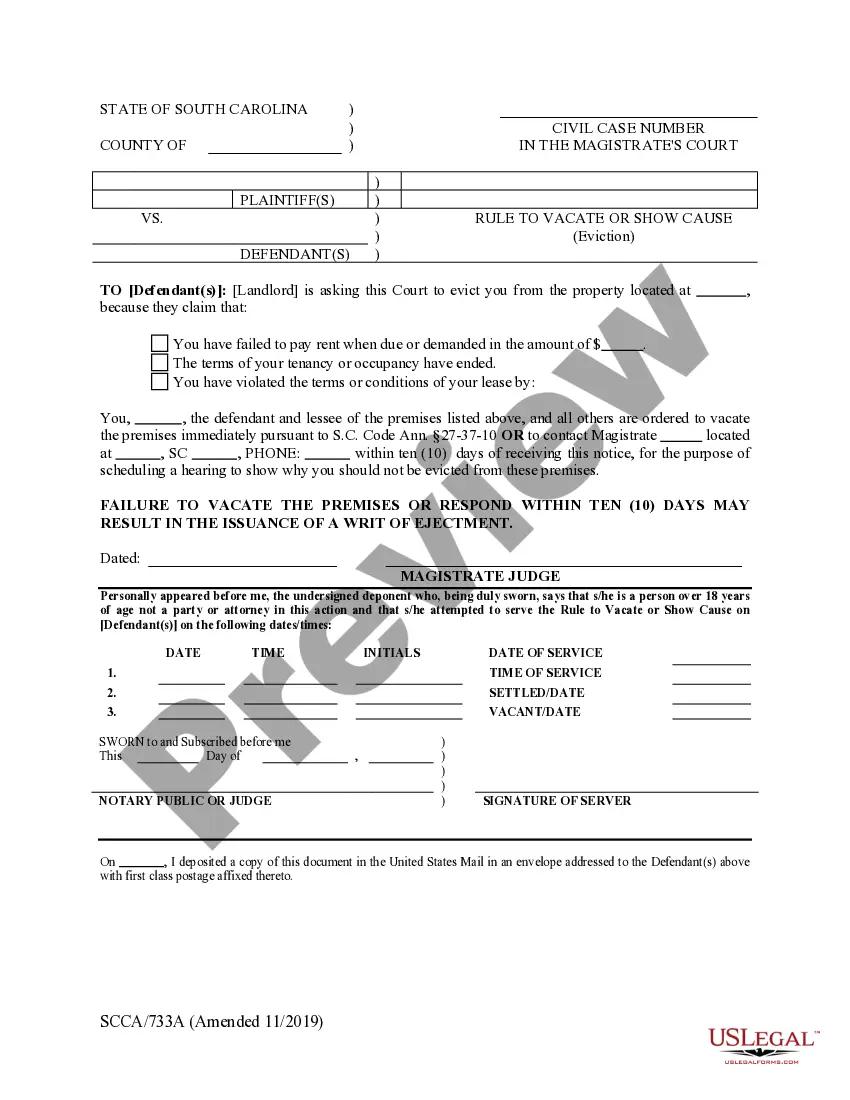

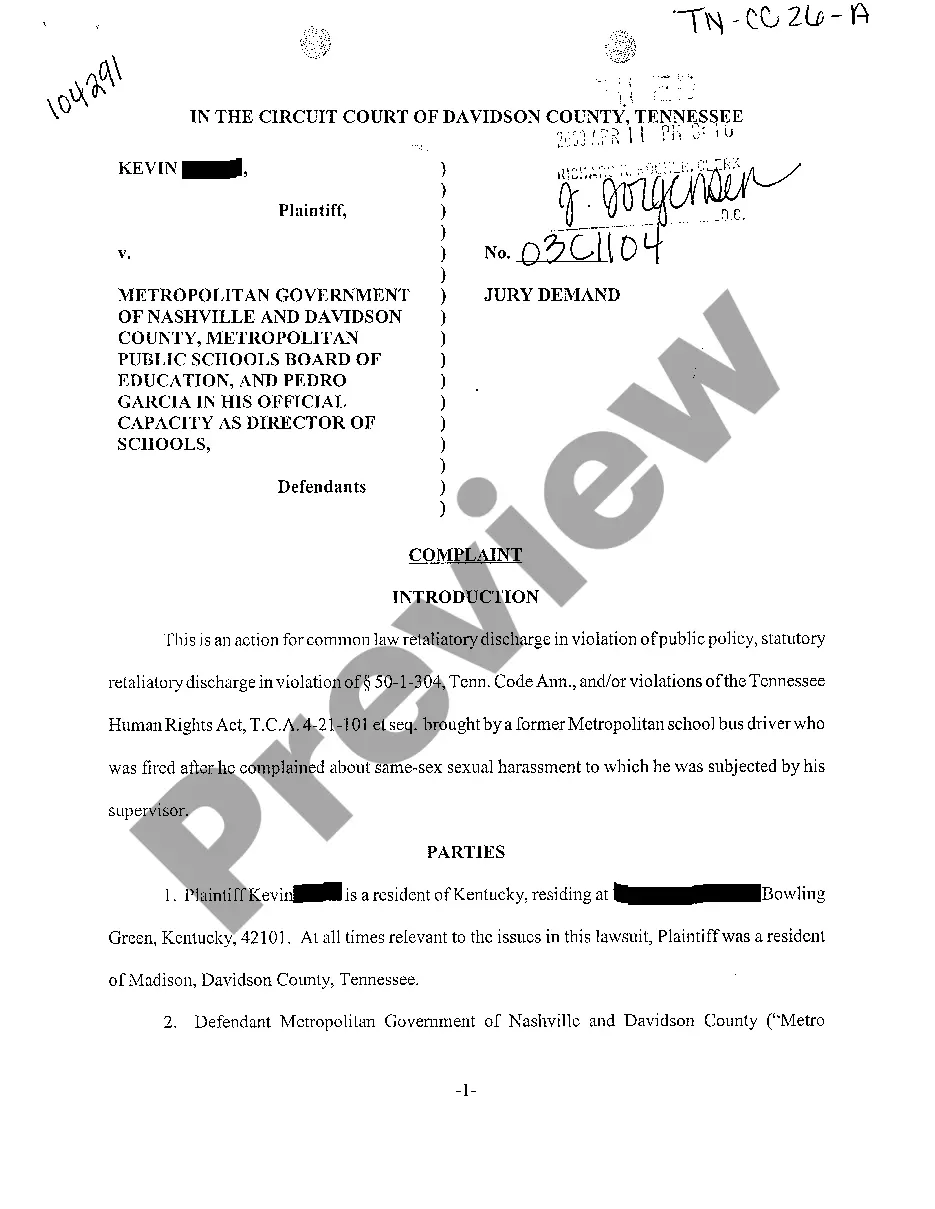

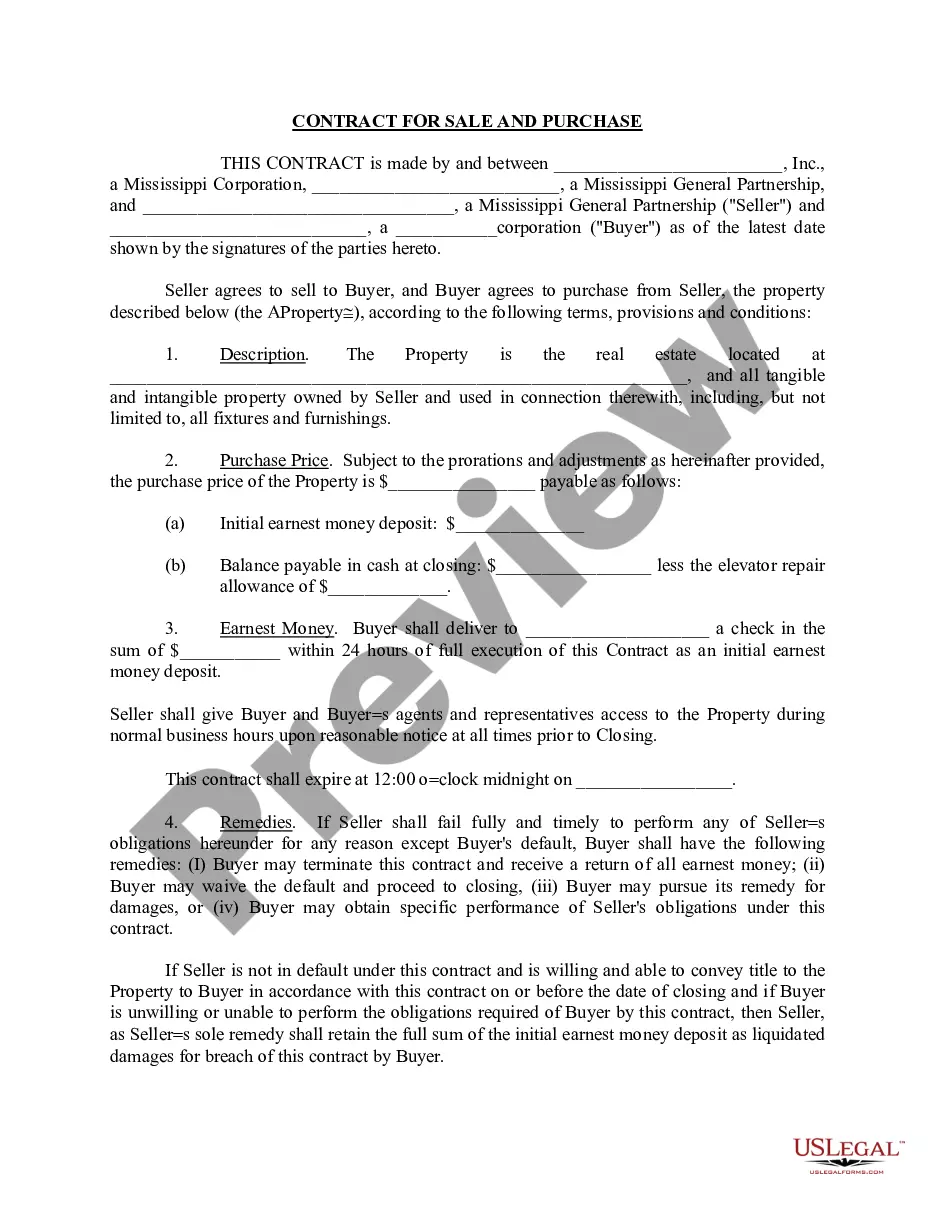

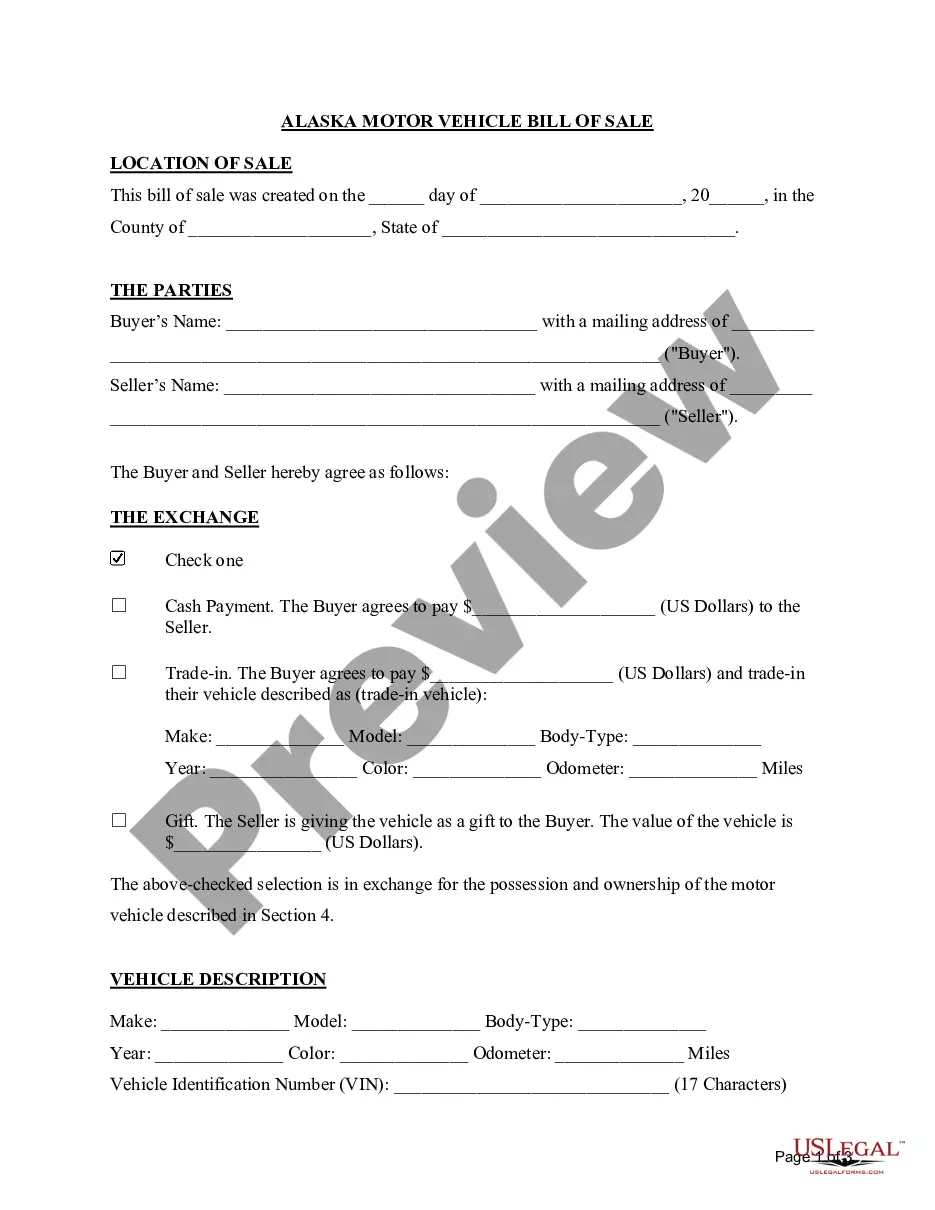

Idaho Semi Annual Report Workers Compensation Premium Tax is a required tax paid by employers in the state of Idaho to the Idaho Industrial Commission (IIC). This tax is based on the amount of workers’ compensation premiums that employers pay to insure their employees against work-related injuries and illnesses. The Idaho Semi Annual Report Workers Compensation Premium Tax must be paid by all employers who are subject to Idaho’s workers’ compensation laws. The tax is paid twice a year, and the report and payment must be submitted by the 15th day of the 6th month after the end of the employer’s semi-annual period. There are two types of Idaho Semi Annual Report Workers Compensation Premium Tax: the regular and the excess tax. The regular tax rate is 3 percent of the total premiums paid during the semi-annual period. The excess tax rate is 4.5 percent of the total premiums paid.

Idaho Semi Annual Report Workers Compensation Premium Tax

Description

How to fill out Idaho Semi Annual Report Workers Compensation Premium Tax?

US Legal Forms is the simplest and most cost-effective method to find suitable official templates.

It’s the largest online collection of business and personal legal documents crafted and verified by legal experts.

Here, you can obtain printable and fillable forms that adhere to national and local regulations - just like your Idaho Semi Annual Report Workers Compensation Premium Tax.

Review the form description or preview the document to ensure you’ve selected the one that fits your needs, or find an alternative using the search feature above.

Click Buy now when you’re confident about its alignment with all the specifications, and choose the subscription plan that you prefer most.

- Acquiring your template involves just a few straightforward steps.

- Users with an existing account and a valid subscription simply need to Log In to the web platform and download the form onto their device.

- Subsequently, they can locate it in their account under the My documents section.

- Here’s how you can secure a correctly drafted Idaho Semi Annual Report Workers Compensation Premium Tax if you are using US Legal Forms for the first occasion.

Form popularity

FAQ

Idaho law states that workers receiving income benefits being paid and discontinued longer than four years after the date of your accident allow one additional year after the final payment of benefits to request a hearing for additional benefits.

Is workers' compensation taxable in Idaho? Each state has its own rules and guidelines. However, in Idaho, any workers' compensation benefits collected are not taxable.

The basic benefit is sixty-seven percent (67%) of your average weekly wage, subject to the minimums and maximum of 90% of the average state wage provided in Idaho Code (I.C.) 72-408 and 72-409.

Workers' compensation is no-fault insurance. It provides compensation for missed work, permanent injuries, and rehabilitation in the event an employee is injured on the job. Employers are protected from paying costly medical bills and defending against lawsuits no matter who is at fault in an accident.

To qualify for workers' compensation benefits, you must report your job-related injury or disease to your employer IMMEDIATELY. You could lose all benefits if you wait longer than 60 days to report your injury. Tell your employer about your injury or disease.

(Exemptions From Workers Compensation) Employment of members of an employer's family not dwelling in his household if the employer is the owner of a sole proprietorship, provided the family member has filed with the Commission a written declaration of his election for exemption from coverage.

Workers Compensation Insurance: Employers having one or more full-time, part-time, seasonal or occasional employees must provide workers compensation insurance unless specifically exempt under Idaho law.

Ask your employer or the Idaho Industrial Commission for a First Report of Injury or Illness form. Fill out the form to the best of your ability. Return your completed form to the Idaho Industrial Commission's main office in Boise.