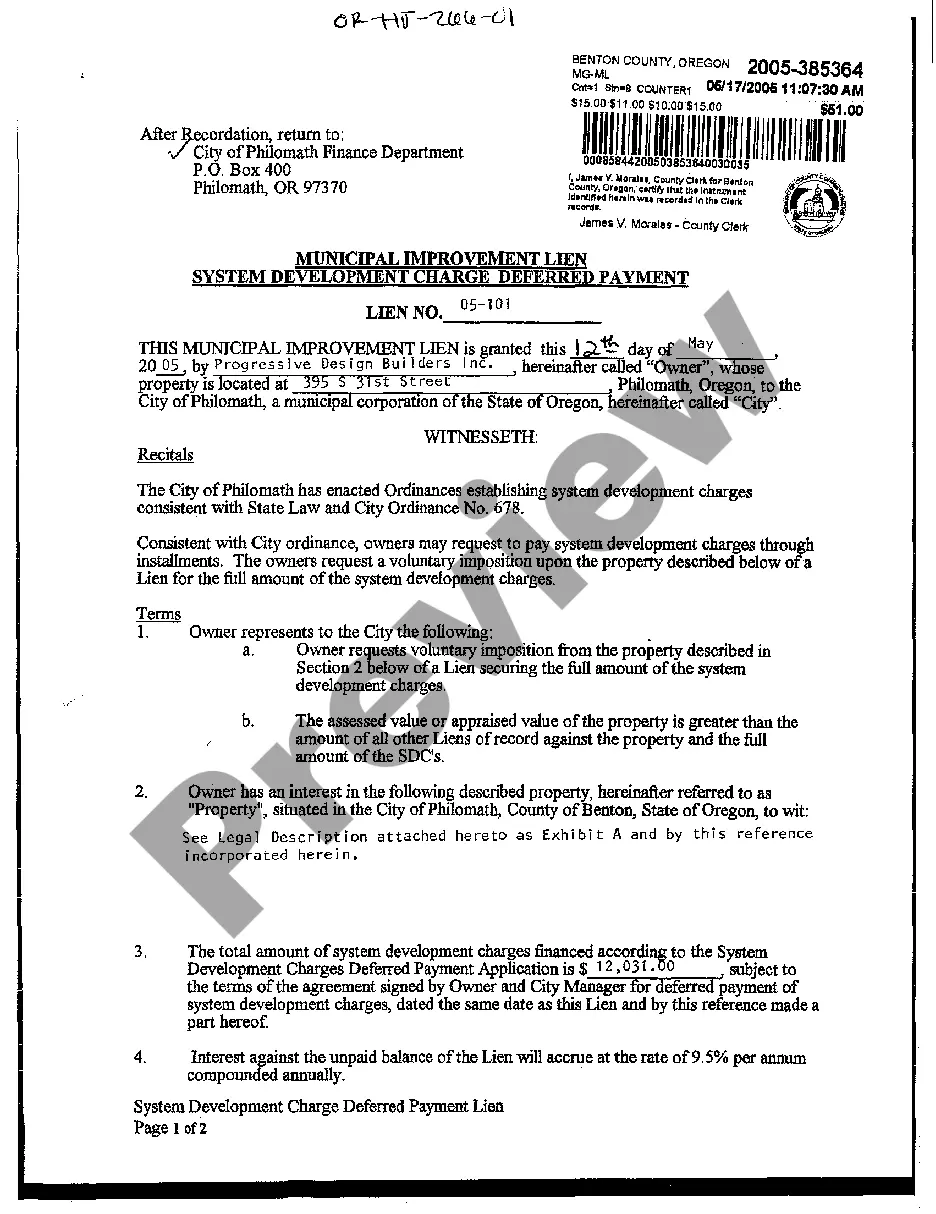

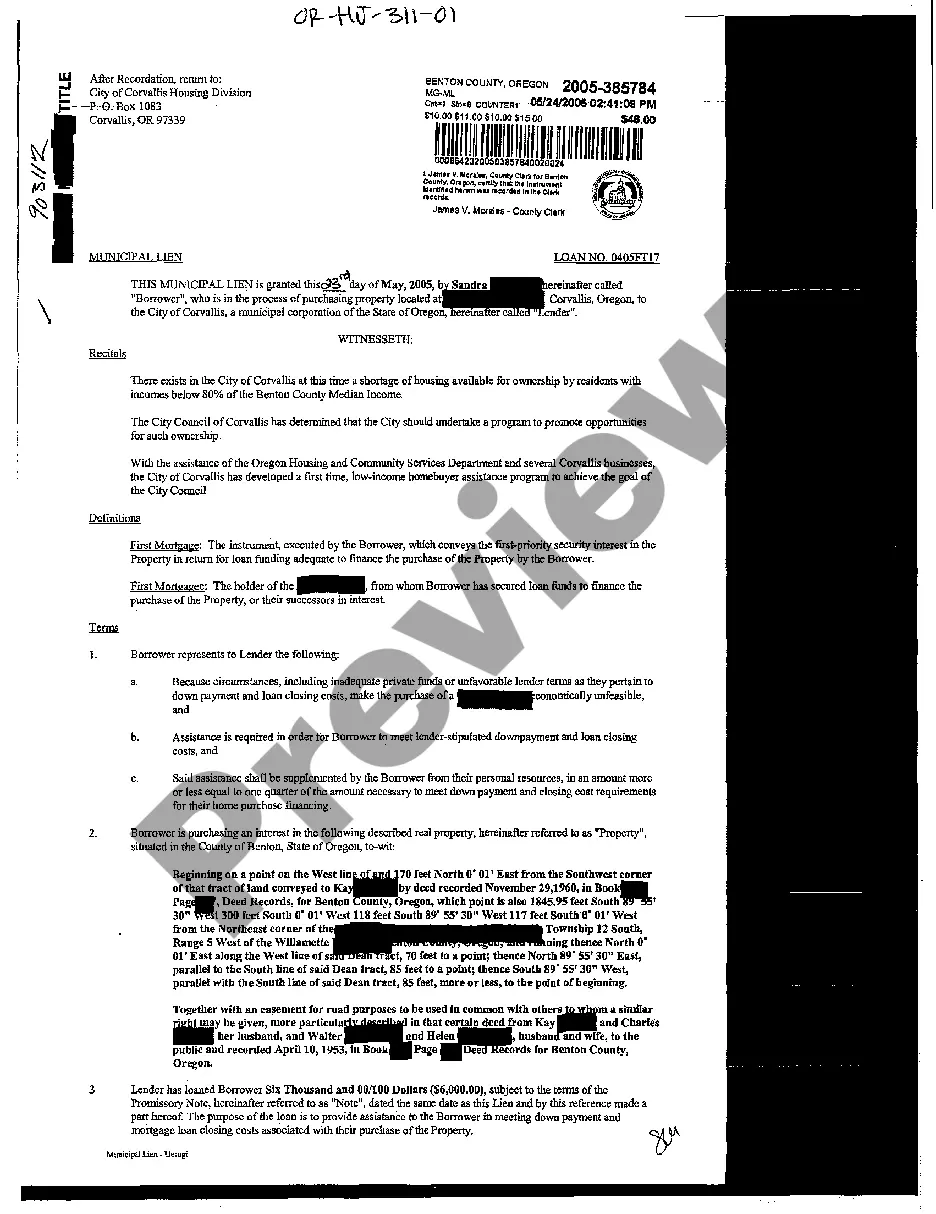

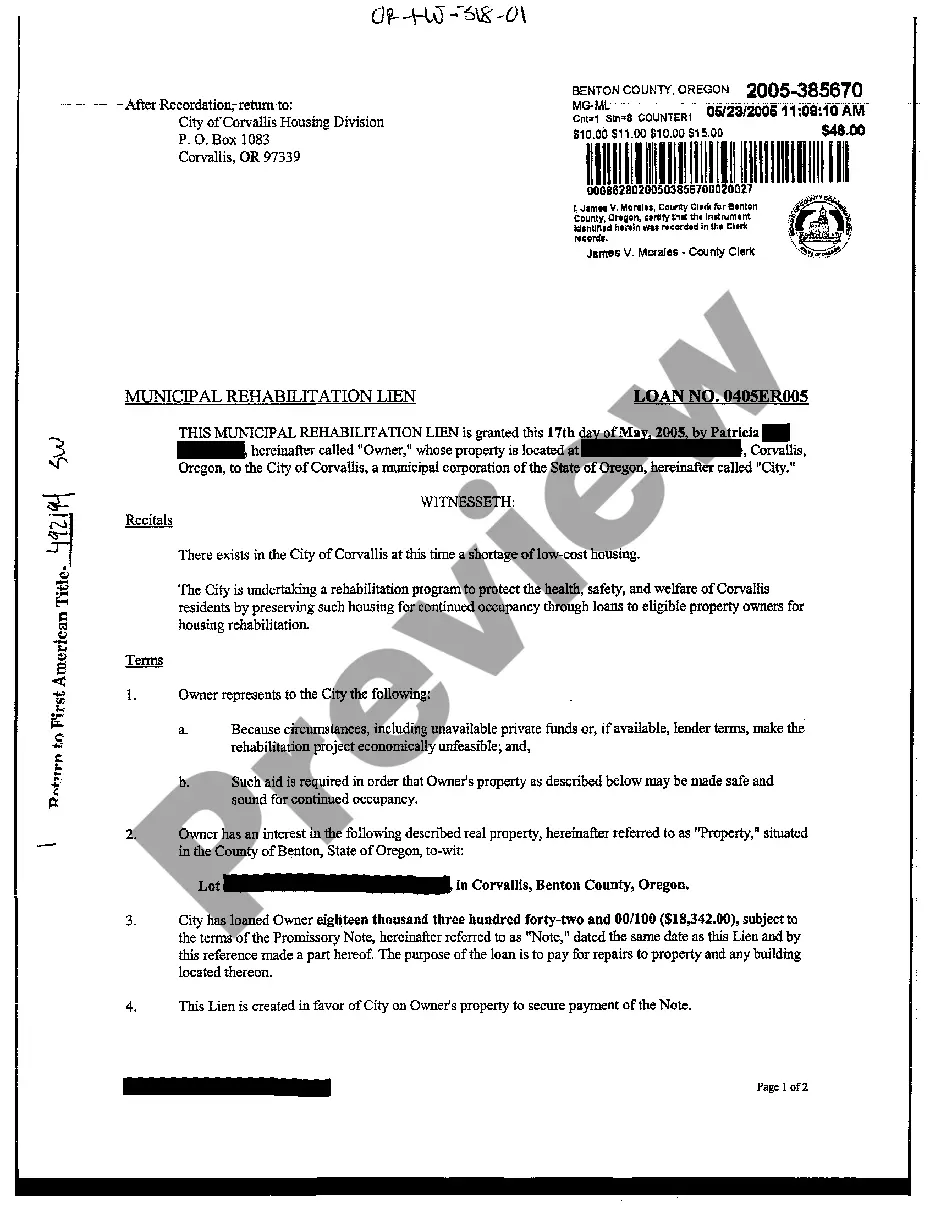

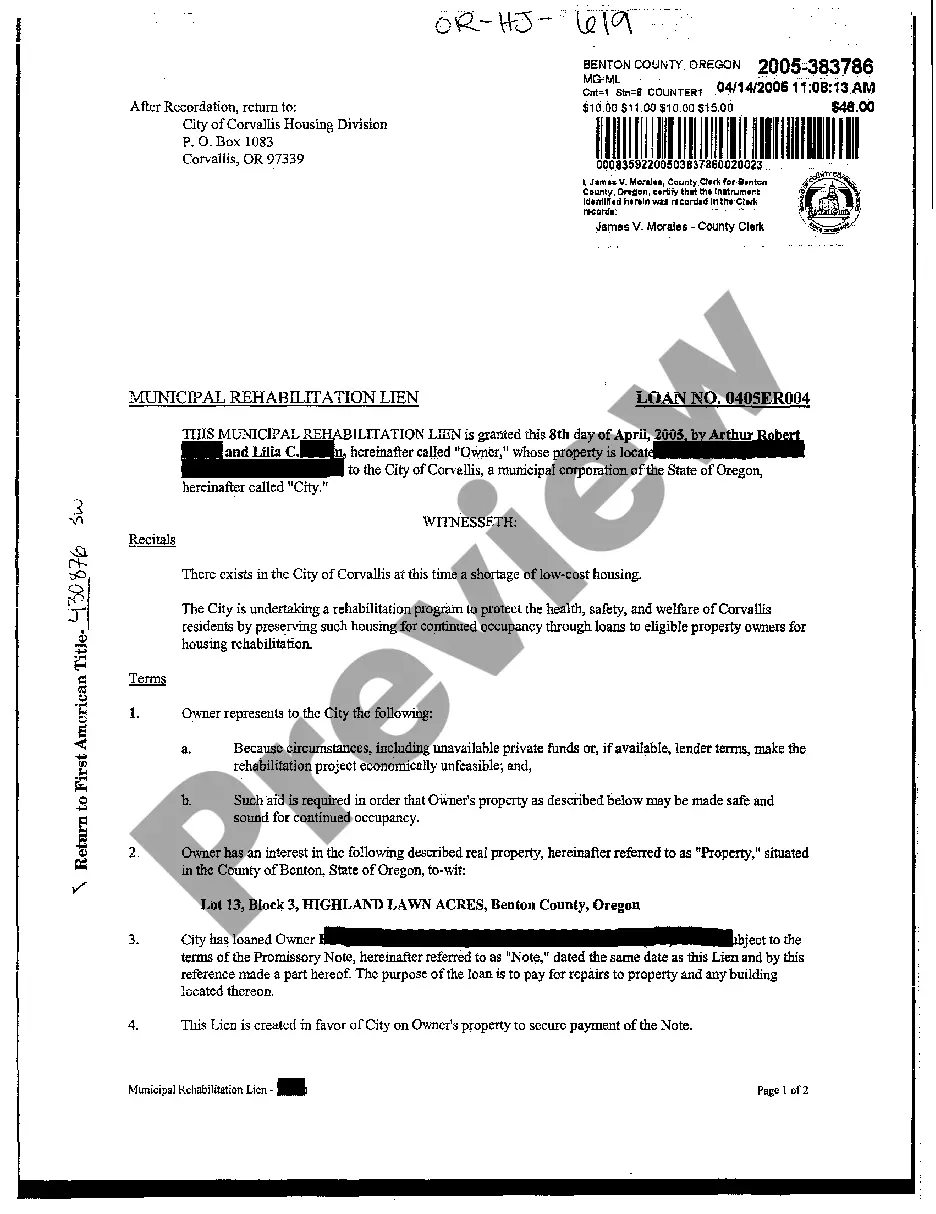

Oregon Municipal Improvement Lien

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Oregon Municipal Improvement Lien?

Creating papers isn't the most simple task, especially for those who almost never work with legal paperwork. That's why we advise using correct Oregon Municipal Improvement Lien samples created by skilled attorneys. It allows you to prevent problems when in court or handling official institutions. Find the documents you require on our site for high-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will immediately appear on the template page. Soon after accessing the sample, it’ll be stored in the My Forms menu.

Users without a subscription can easily get an account. Follow this simple step-by-step help guide to get the Oregon Municipal Improvement Lien:

- Be sure that file you found is eligible for use in the state it is required in.

- Verify the file. Utilize the Preview feature or read its description (if offered).

- Buy Now if this template is what you need or go back to the Search field to find a different one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after doing these easy steps, you are able to complete the sample in an appropriate editor. Check the filled in details and consider requesting a lawyer to review your Oregon Municipal Improvement Lien for correctness. With US Legal Forms, everything becomes much simpler. Give it a try now!

Form popularity

FAQ

Step 1: Determine if you have the right to file a lien. Step 2: Send notice of right to lien. Step 3: Prepare the lien document. Step 4: File the lien. Step 5: Send notice of lien. Step 6: Secure payment. Step 7: Release the lien.

What Is Perfect Title? Perfect title refers to ownership of a property through a deed free of any liens or defects. This is sometimes referred to as a good, clean, or free and clear title.

Contact a tax or business attorney. Contact the creditor directly. Arrange a discount that is suitable to both parties. Offer them something in return. Broach the subject of bankruptcy.

A perfected lien is a lien that has been filed with the appropriate filing agent in order to make the securing interest in an asset binding.A perfected lien provides legal documentation to prove that a creditor has a legal right to seize property in place of payments for which they are owed.

There, a construction lien on a commercial project must be filed with a county clerk within 90 days of the last day services or materials were provided. Filing a construction lien on residential projects requires filing a Notice of Unpaid Balance and Right to File Lien within 90 days of the last day of service.

Make sure the debt the lien represents is valid. Pay off the debt. Fill out a release-of-lien form. Have the lien holder sign the release-of-lien form in front of a notary. File the lien release form. Ask for a lien waiver, if appropriate. Keep a copy.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

Secondly there is the improvement lien. This lien can be maintained not only against the owner of the property but against all comers. It arises where there is no contract between the parties. As with a debtor/creditor lien, the lien holder must be in possession of the property.

To perfect its lien, the lender must record or file the mortgage with the appropriate legal authority. Usually, the mortgage is recorded in the land records in the county where the property is located.