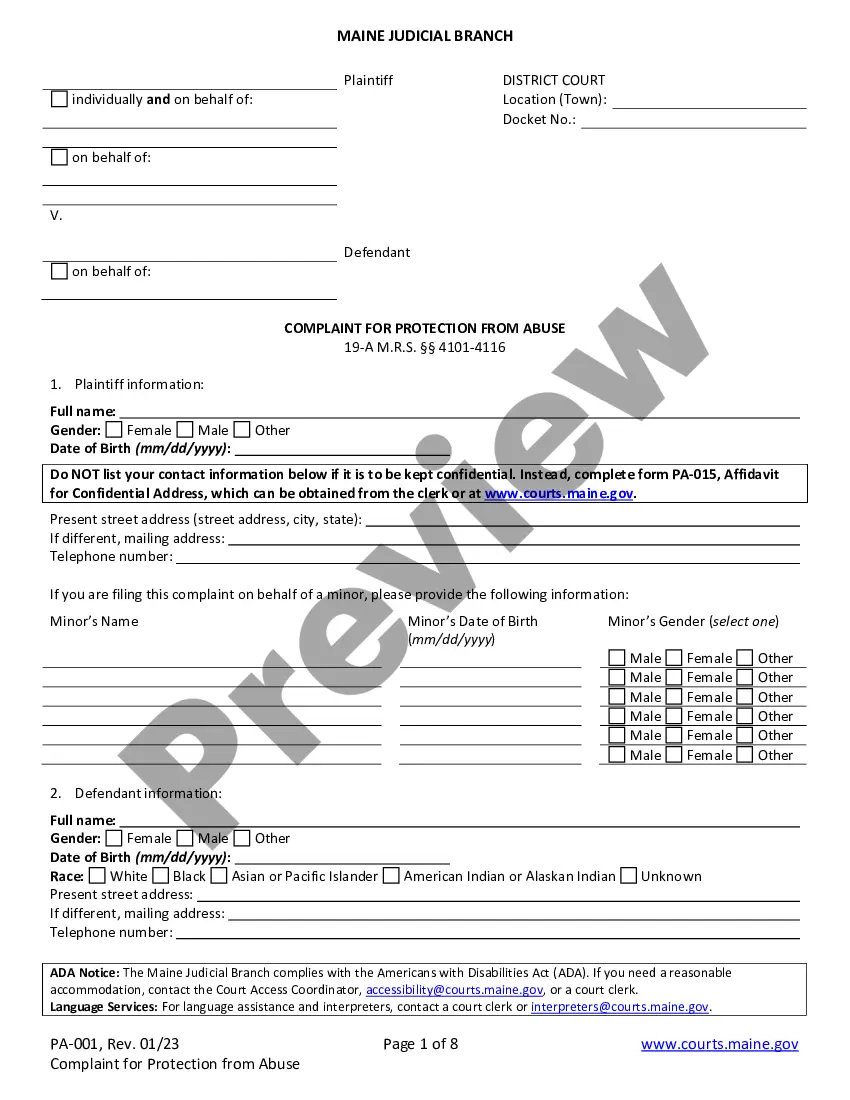

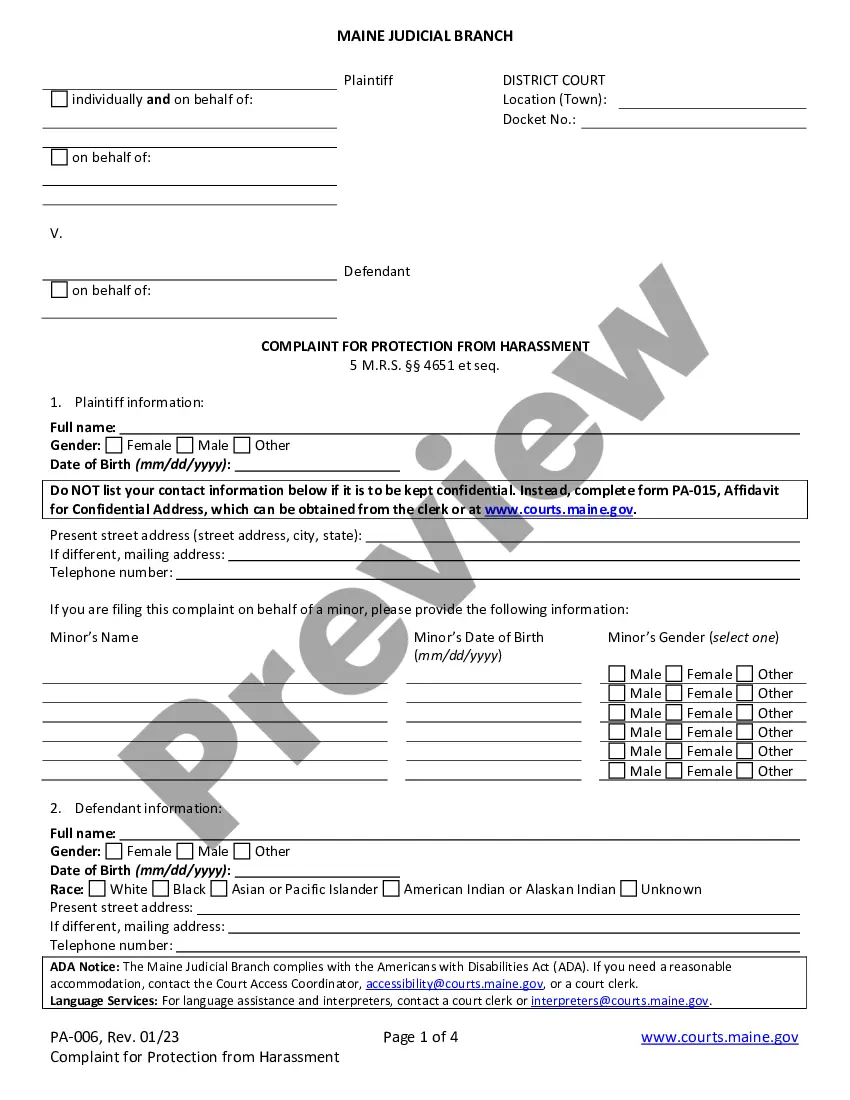

The Complaint initiates a court action and is the first document (pleading) filed in a lawsuit, listing the accusations upon which the complaining party bases their request for relief, and the relief sought. This sample document, a Complaint for Protection from Harassment, can be used as a model for drafting a similar complaint. Adapt to fit your own facts and circumstances. Available for download in standard format(s). USLF control no. ME-0011

Maine Complaint for Protection from Harassment

Description

How to fill out Maine Complaint For Protection From Harassment?

Greetings to the most important legal documents collection, US Legal Forms.

Here, you will discover any template including Maine Complaint for Protection from Harassment forms and download them (as many as you desire or need). Draft official documents in just a few hours, rather than days or even weeks, without spending a fortune on a lawyer.

Obtain the state-specific form in moments and feel confident knowing that it was created by our skilled legal experts.

To set up an account, select a pricing plan. Utilize a card or PayPal account to register. Save the template in your preferred format (Word or PDF). Print the document and complete it with your or your company’s information. Once you’ve filled out the Maine Complaint for Protection from Harassment, forward it to your attorney for validation. It’s an additional step but a crucial one to ensure you’re fully protected. Enroll in US Legal Forms today and gain access to thousands of reusable templates.

- If you’re currently a subscribed user, simply Log In to your account and click Download next to the Maine Complaint for Protection from Harassment you require.

- Since US Legal Forms is an online platform, you’ll continually have access to your saved forms, regardless of the device you’re utilizing.

- Locate them within the My documents section.

- If you haven't created an account yet, what are you hesitating for.

- Review our instructions below to get started.

- If this is a state-specific document, verify its applicability in your state.

- Review the details (if available) to determine if it’s the correct template.

- Explore more material with the Preview option.

- If the example meets your needs, click Buy Now.

Form popularity

FAQ

The benefits of living a debt-free lifestyle can be life-changing reduced financial stress, more money for saving and no interest payments, among them.

The best solution could be to strike a balance between saving and paying off debt. You might be paying more interest than you should, but having savings to cover sudden expenses will keep you out of the debt cycle.For them, saving and paying down debt at the same time might be the best approach.

HELPS is a 501(c)(3)charitable organization. We are classified as as a charity by the IRS. Around one third of our clients receive our services for free.

That's right, a debt-free lifestyle makes it easier to save!Those savings can go straight into your savings account, or help you pay down debt even faster. More savings allows you to build an emergency fund, plan a fun trip, and even save for retirement.

Freedom Debt Relief operates in most states and enables seniors to take out a lower-interest loan to pay back debts over two to five years. Freedom Debt Relief provides a variety of debt management services including debt consolidation.

While some experts say that you should pay your mortgage at about the age of 45, some other experts do not agree. They say that are some drawbacks associated with paying off mortgages early and ignoring some other investments that are potentially lucrative such as bonds and stocks.

You can apply for debt forgiveness or repayment programs to help you manage paying your credit card or loans better. Finally, seniors can seek legal protection from the Administration on Aging if creditors are harassing them. They also offer health, wellness, and other senior services.

Get professional help: Reach out to a nonprofit credit counseling agency that can set up a debt management plan. You'll pay the agency a set amount every month that goes toward each of your debts. The agency works to negotiate a lower bill or interest rate on your behalf and, in some cases, can get your debt canceled.

Getting help from family members. Refinancing an existing home mortgage. Take out a home equity line of credit. Apply for a reverse mortgage. The sale of assets. Utilizing a debt relief company.