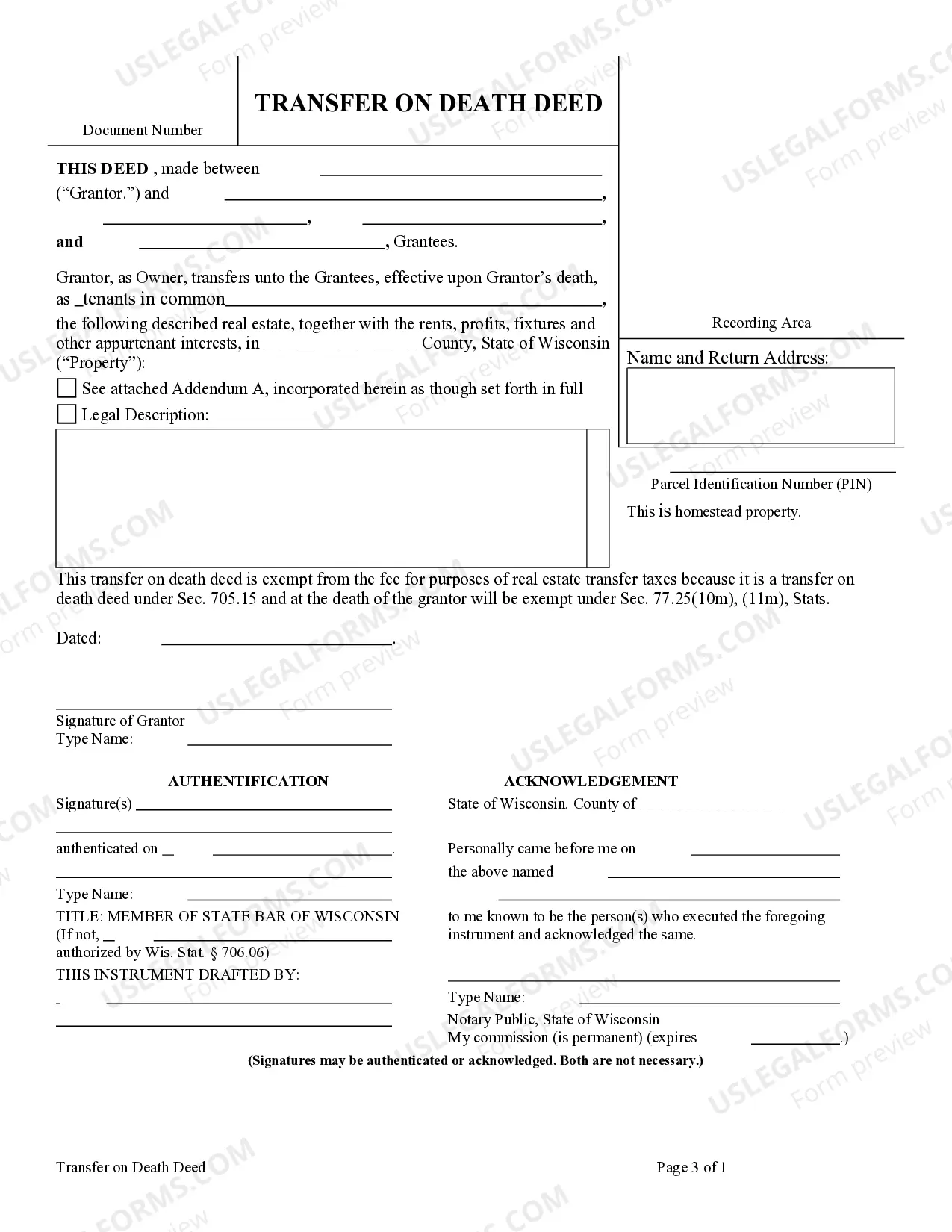

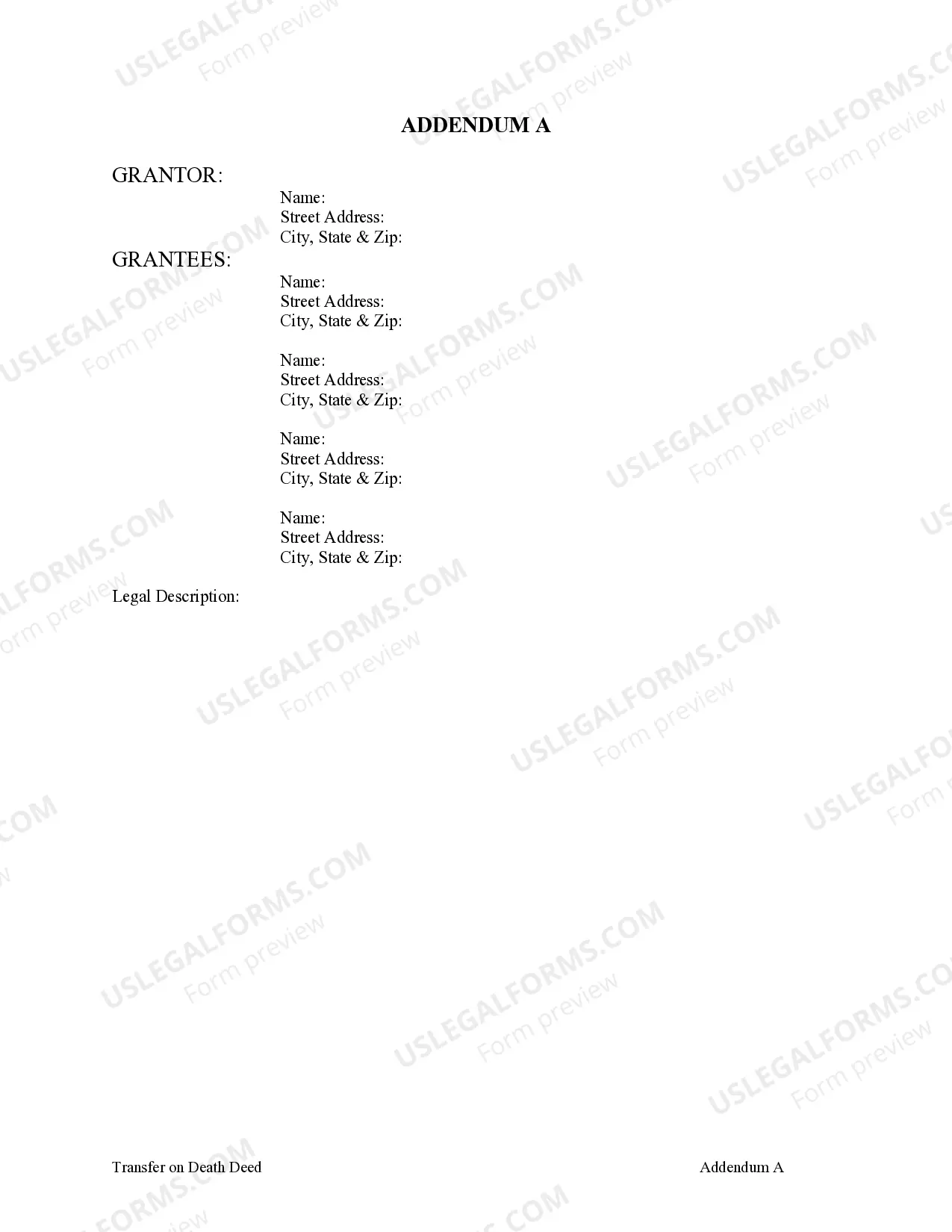

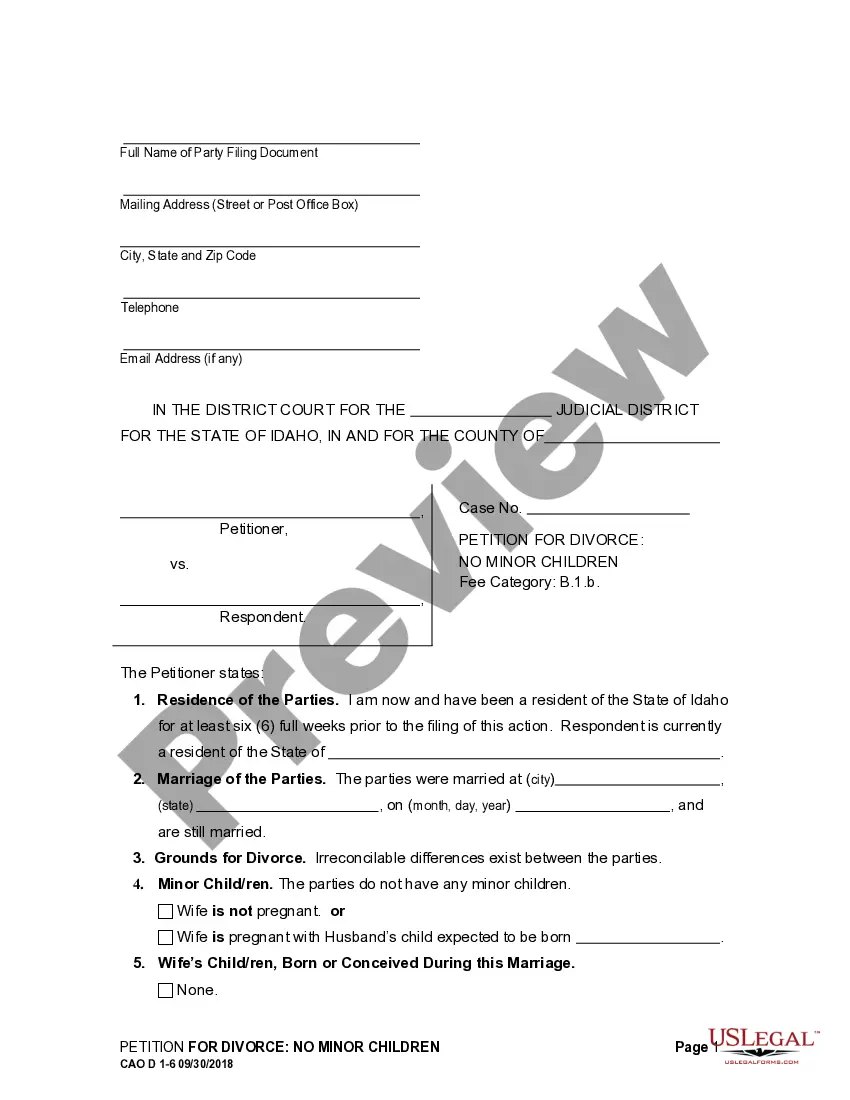

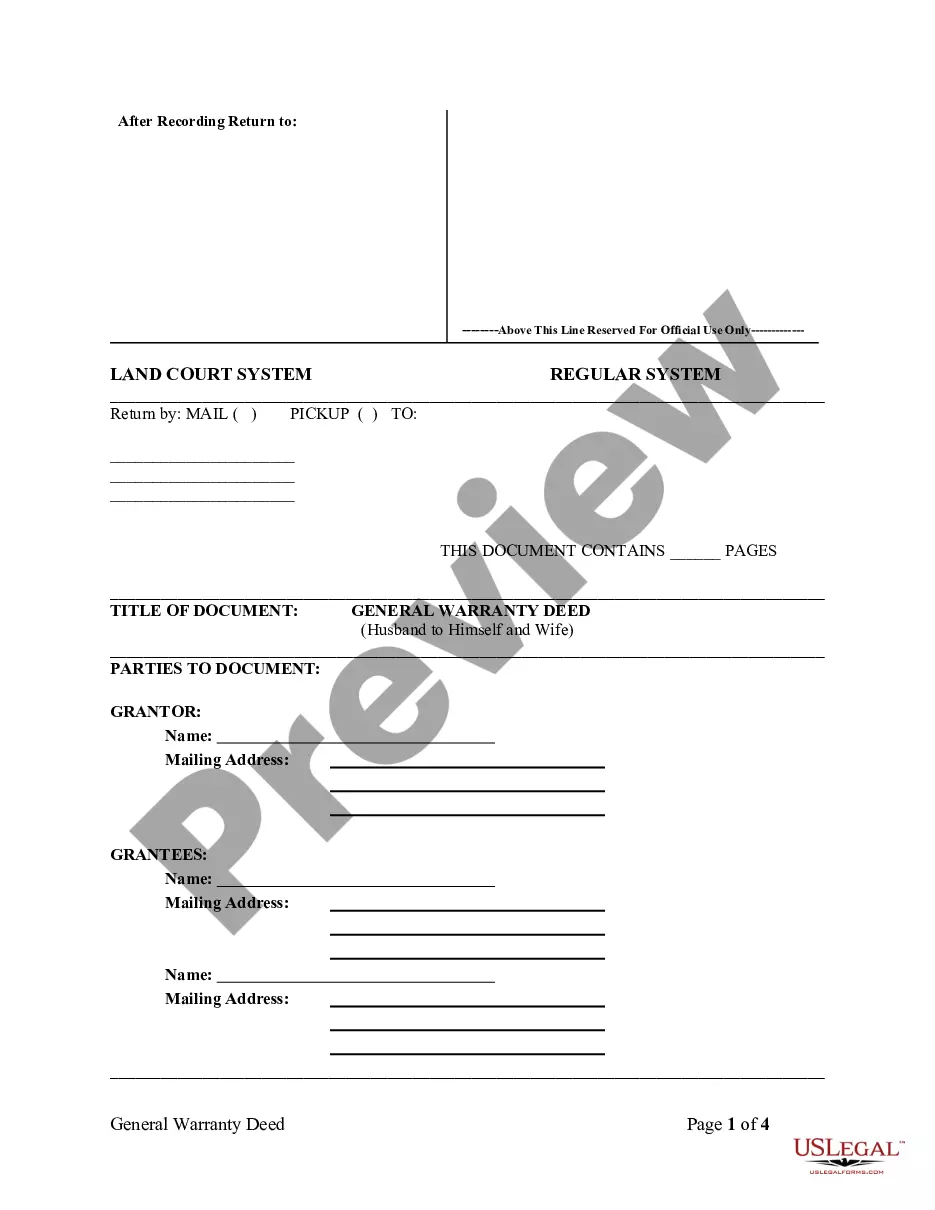

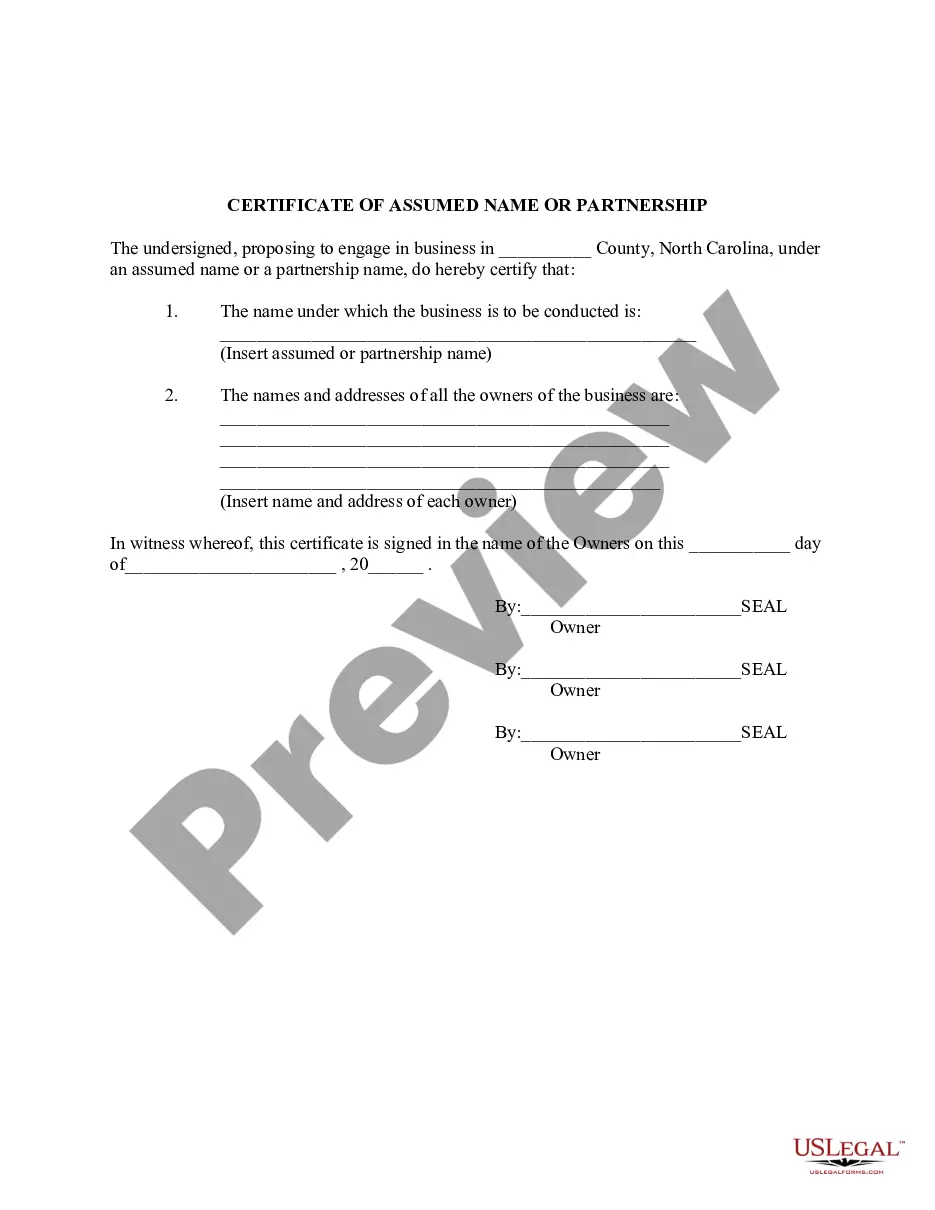

This form is a Beneficiary or Transfer on Death Deed where the Grantor is an individual and the Grantees are four (4) individuals. This transfer is revocable by Grantor until his or her death and effective only upon the death of the Grantor. The Deed does NOT have provisions for a successor or secondary contingent beneficiary. This deed complies with all state statutory laws.

Green Bay Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed from Individual to Four (4) Individuals does NOT include Alternate Beneficiary Provision

Description

How to fill out Wisconsin Transfer On Death Deed Or TOD - Beneficiary Deed From Individual To Four (4) Individuals Does NOT Include Alternate Beneficiary Provision?

We consistently aim to lessen or evade legal complications when handling intricate legal or financial situations.

To achieve this, we enroll in legal services that are typically very costly.

However, not every legal concern is as complicated.

Many can be managed independently.

Utilize US Legal Forms whenever you need to locate and retrieve the Green Bay Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed from Individual to Four (4) Individuals, which does NOT include Alternate Beneficiary Provision or any other document securely and conveniently.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform empowers you to take charge of your affairs without the need to hire a lawyer.

- We offer access to legal document templates that aren’t always available to the public.

- Our templates are specific to states and regions, which greatly eases the search process.

Form popularity

FAQ

To obtain a Green Bay Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed from Individual to Four (4) Individuals does NOT include Alternate Beneficiary Provision, you need to follow a few straightforward steps. First, you should gather necessary details about the property and the individuals involved. Next, you can use resources available on platforms like USLegalForms, which offer templates and guidance to create a valid deed. Finally, ensure that the deed is signed, notarized, and recorded properly at your local county clerk's office to complete the process.

The Green Bay Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed from Individual to Four (4) Individuals does NOT include Alternate Beneficiary Provision does not inherently avoid capital gains tax. Constructing the deed won't exempt beneficiaries from tax responsibilities when they sell the property. It is advisable to consult with tax professionals to understand potential tax implications and plan appropriately.

Yes, Wisconsin recognizes the Green Bay Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed from Individual to Four (4) Individuals does NOT include Alternate Beneficiary Provision. This legal mechanism allows property owners to transfer assets to named beneficiaries directly, ensuring a straightforward transition. It's crucial for individuals to understand the process and requirements involved in utilizing this option effectively.

Using a Green Bay Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed from Individual to Four (4) Individuals does NOT include Alternate Beneficiary Provision can be advantageous in certain circumstances. It simplifies the transfer of property at death without going through probate. However, it is essential to evaluate your specific situation and consult professionals to ensure this choice aligns with your goals.

The Green Bay Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed from Individual to Four (4) Individuals does NOT include Alternate Beneficiary Provision can lead to complexities. One major drawback is that it does not provide asset protection from creditors. Additionally, if beneficiaries disagree or have disputes regarding the property, it can result in conflict. You may want to consider these factors carefully before proceeding.

While you can prepare a beneficiary deed without a lawyer, it’s advisable to seek legal assistance to navigate the specifics. A Green Bay Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed from Individual to Four (4) Individuals does NOT include Alternate Beneficiary Provision can have legal implications that a professional can help clarify. Utilizing resources like uslegalforms can also be useful, but having a lawyer review your deed can provide added peace of mind.

One potential downside of a beneficiary deed is that it may not address all situations regarding your property, especially if the beneficiaries are not prepared to manage it. Furthermore, a Green Bay Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed from Individual to Four (4) Individuals does NOT include Alternate Beneficiary Provision does not provide directions on what to do with debts associated with the property. Therefore, family members may face unexpected challenges if they aren't aware of these aspects.

Writing a beneficiary deed requires accurate information about the property and the intended beneficiaries. You need to include the legal description of the property and identify who will inherit it upon your death. For those unsure about the process, using resources like uslegalforms can provide clear templates and guidance to help ensure all necessary elements are included.

Choosing between a TOD or a traditional beneficiary deed often depends on your specific situation and goals. A Green Bay Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed from Individual to Four (4) Individuals does NOT include Alternate Beneficiary Provision allows property transfer without going through probate, which can be advantageous for many individuals. It's best to consider your unique circumstances and possibly consult with a legal professional or use a platform like uslegalforms to find the right solution for you.

A beneficiary deed serves as evidence of your intent regarding property ownership but is not a substitute for a title. This deed indicates who will receive the property after your passing. However, the actual ownership documentation should be maintained to establish clarity regarding any legal matters related to the property.