Charlotte North Carolina Certificate of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership

Description

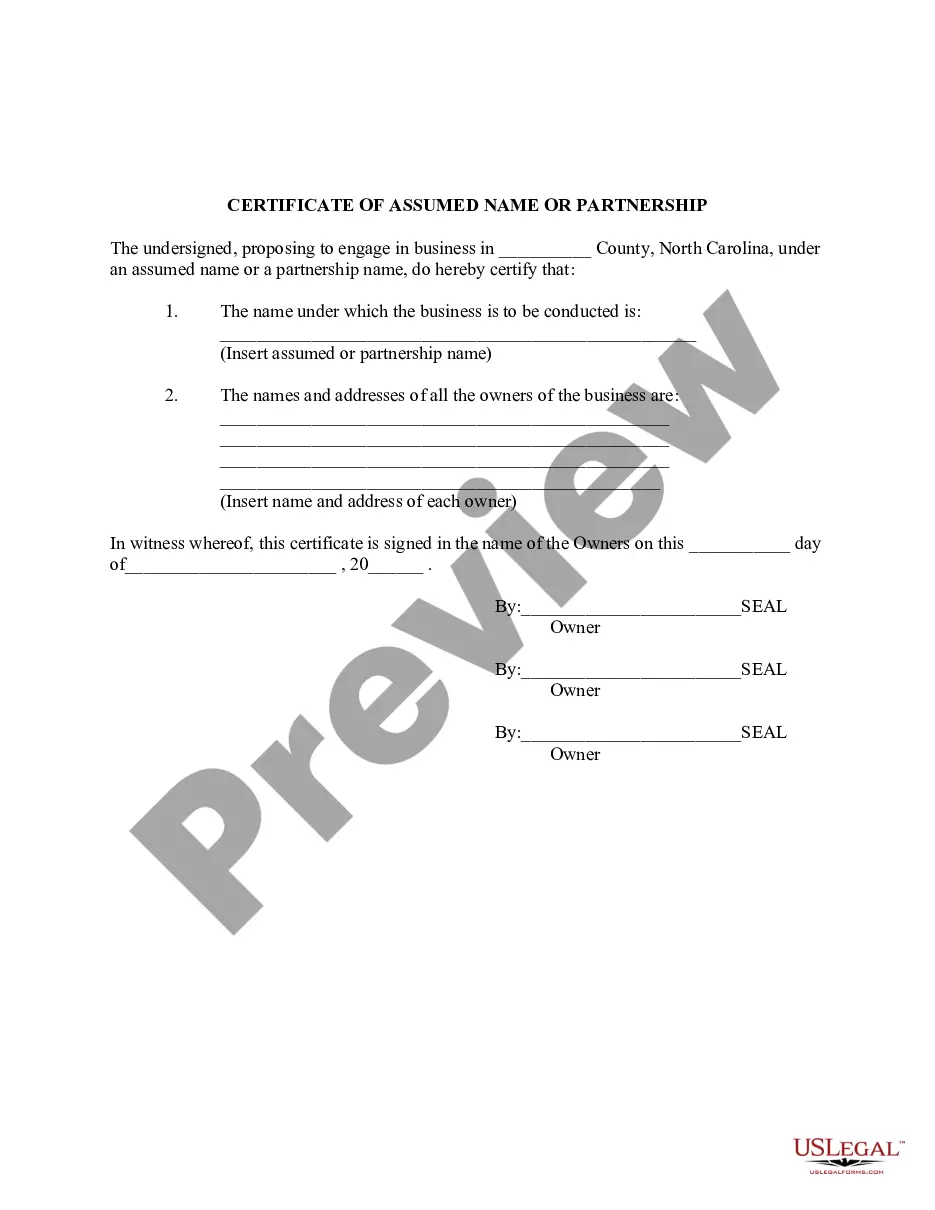

How to fill out North Carolina Certificate Of Assumed Name For Partnership, Sole Proprietorship Or Limited Partnership?

If you are looking for a suitable form template, it’s exceptionally challenging to discover a more user-friendly platform than the US Legal Forms site – one of the most comprehensive collections on the web.

Here you can find thousands of templates for business and personal use categorized by type and state, or by keywords.

With the excellent search function, locating the latest Charlotte North Carolina Certificate of Assumed Name for Partnership, Sole Proprietorship, or Limited Partnership is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Obtain the form. Choose the format and save it to your device. Edit the document. Fill out, modify, print, and sign the acquired Charlotte North Carolina Certificate of Assumed Name for Partnership, Sole Proprietorship, or Limited Partnership.

- Moreover, the relevance of each document is validated by a group of professional attorneys who frequently review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Charlotte North Carolina Certificate of Assumed Name for Partnership, Sole Proprietorship, or Limited Partnership is to Log In to your profile and click the Download button.

- If this is your first time utilizing US Legal Forms, simply adhere to the instructions outlined below.

- Ensure you have opened the form you require. Review its description and use the Preview feature to examine its content. If it doesn’t suit your needs, employ the Search option at the top of the screen to locate the correct document.

- Confirm your choice. Select the Buy now button. After that, choose the desired pricing option and provide the necessary information to create an account.

Form popularity

FAQ

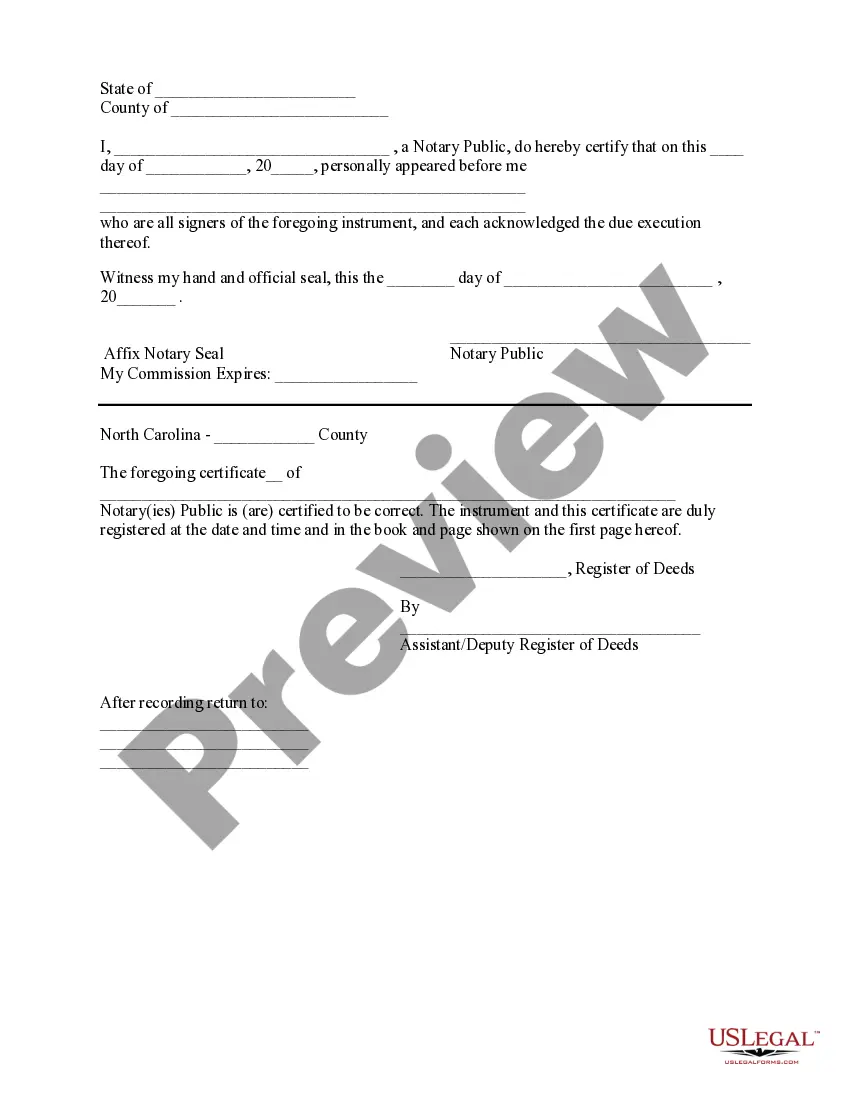

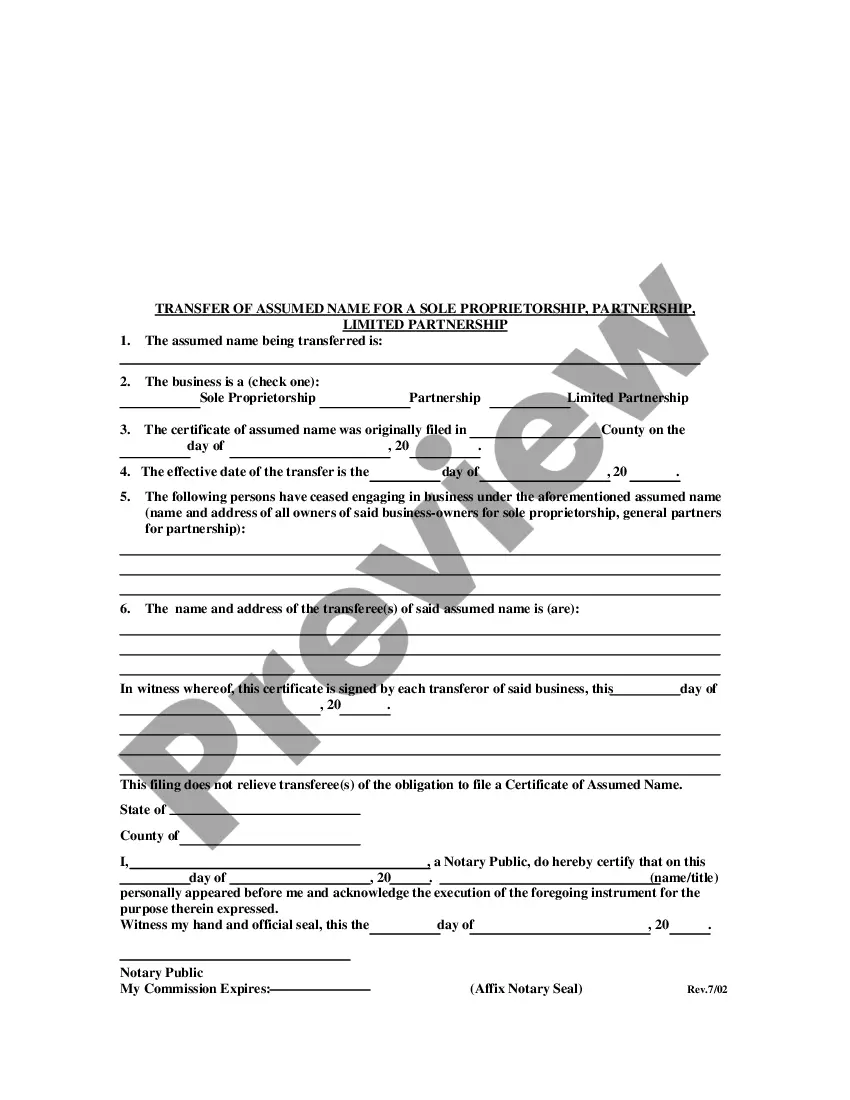

In North Carolina, you register your DBA with the Register of Deeds office in your business' home county. You must complete the Assumed Business Name Certificate form and return it to your local office.

Under North Carolina law, any business that seeks to use a name other than the name of its owners, or other than the name under which it was formed must file for a DBA. Specifically, such businesses will need to file official paperwork in the office of the register of deeds of such county where the business is located.

N.C.G.S § 66-71.4(a) requires that any person engaging in business in this State under an assumed business name, the person must file an assumed business name certificate in the office of the register of deeds of the county in which the person is or will be engaged in business.

North Carolina allows you to list up to five DBA names that you want to register. The name of the person or entity doing business under the DBA name. This is your name or the name of your LLC, partnership, or corporation.

Your business should include its legal name and its assumed name in contracts. For example: ABC, LLC d/b/a Assumed Name. Just because your business has filed an assumed name does not mean that other people or companies are precluded from using that name.

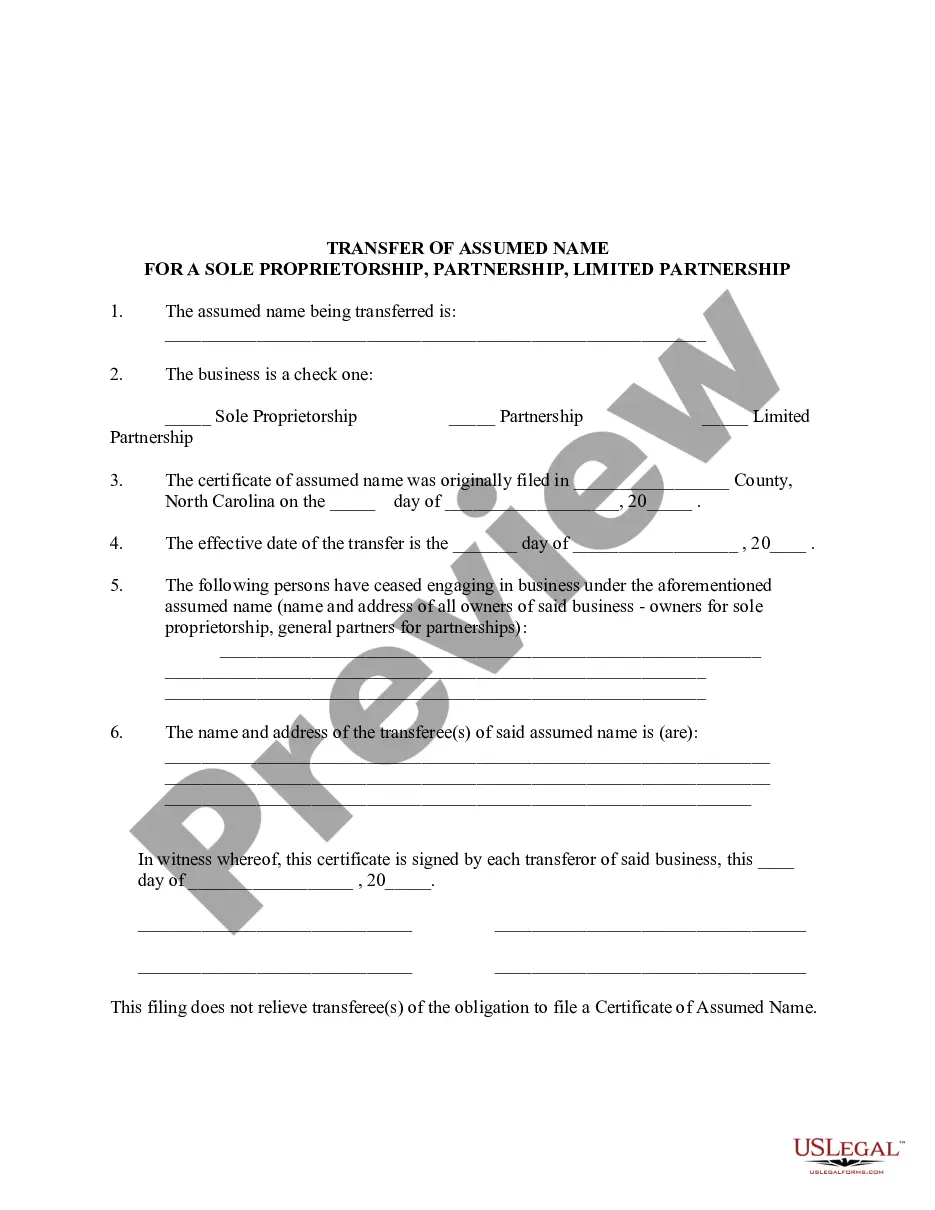

When a statutory business entity such as a corporation, limited liability company (LLC), or limited partnership (LP) does business under an assumed name (also known as a DBA or ?Doing Business As?) that means it is using a name other than the one set forth in its formation document.

A legal name is the official name of a person or business in government records. Any other name used for business purposes is an assumed name. Assumed names are also known as: Fictitious names.

North Carolina allows you to list up to five DBA names that you want to register. The name of the person or entity doing business under the DBA name. This is your name or the name of your LLC, partnership, or corporation.

A North Carolina DBA (doing business as) is called an assumed business name. North Carolina assumed business name registration allows a business to operate under a name that's different from its legal name. Forming an LLC is the best choice for most small businesses. Learn more in our DBA vs LLC guide.

The fee for recording your Assumed Name Registration form is $26.00. If you have further questions about filing an Assumed Name please contact the Register of Deeds office at 910-798-7711 .