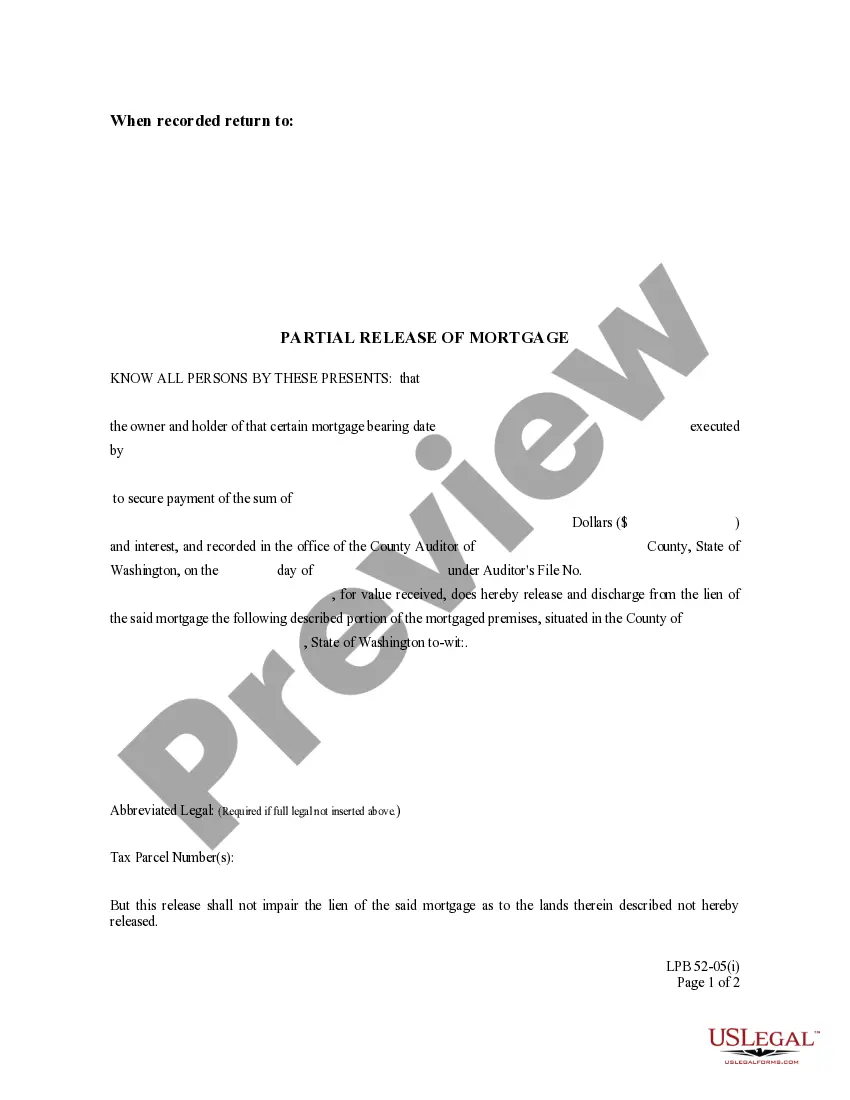

This is an official Washington court form, a Partial Release of Mortgage (with individual acknowledgment).

Everett Washington Partial Release of Mortgage with individual acknowledgment

Description

How to fill out Washington Partial Release Of Mortgage With Individual Acknowledgment?

Irrespective of one's societal or occupational rank, completing legal-related paperwork is a regrettable requirement in the contemporary work landscape.

Frequently, it’s nearly impossible for an individual without a legal background to generate such documents independently, primarily because of the complex terminology and legal subtleties they involve.

This is where US Legal Forms proves to be beneficial.

Check that the form you’ve identified is applicable to your locality since the regulations of one state or county may not apply to another.

Review the document and read a brief overview (if available) of situations for which the paper can be utilized. If the selected form does not meet your requirements, you may start again and search for the necessary document.

- Our platform offers a vast assortment of over 85,000 pre-prepared state-specific documents suitable for nearly any legal circumstance.

- US Legal Forms also serves as a valuable resource for associates or legal advisors seeking to enhance their efficiency by utilizing our DIY forms.

- Whether you need the Everett Washington Partial Release of Mortgage with individual acknowledgment or another document suitable for your jurisdiction, US Legal Forms has everything readily available.

- Here’s how you can obtain the Everett Washington Partial Release of Mortgage with individual acknowledgment in just minutes using our trustworthy platform.

- If you are already a customer, you can proceed to Log In to your account to download the required form.

- However, if you are new to our platform, please ensure you follow these guidelines before downloading the Everett Washington Partial Release of Mortgage with individual acknowledgment.

Form popularity

FAQ

A partial discharge of a mortgage occurs when a lender releases a portion of the mortgage lien on a property. In Everett, Washington, this process allows you to retain ownership while enabling you to sell or refinance part of the property. It is important to acknowledge that this action requires formal approval from your lender. Utilizing tools like US Legal Forms can simplify the paperwork needed for a partial discharge of mortgage with individual acknowledgment.

To obtain a partial release of your mortgage in Everett, Washington, you must first contact your lender. They will provide the necessary documentation and requirements for this process. Typically, this involves demonstrating that you have fulfilled specific conditions, such as paying down a portion of the mortgage. Using platforms like US Legal Forms can help streamline this process by providing the required forms for the partial release of mortgage with individual acknowledgment.

To record a release of your mortgage, you must file the mortgage release document with the county clerk or recorder’s office where the property is located. Ensure that your document is properly executed and includes any necessary signatures for a smooth recording process. In Everett, Washington, a partial release of mortgage with individual acknowledgment requires careful attention to detail, so consider consulting with legal resources to avoid any mistakes. Accurate recording protects your property rights and updates public records.

To obtain a partial release of a mortgage, you must contact your lender and request this specific modification of your mortgage agreement. You will likely need to provide documentation supporting your request, including the reason for the partial release. In Everett, Washington, ensure your request aligns with any conditions your lender may have set. Using platforms like US Legal Forms can streamline this process and provide specific documents tailored for your needs.

A mortgage release document is a formal notice stating that a lender has forgiven a borrower’s debt, typically upon full payment. This document serves as proof that the mortgage is no longer in effect. In Everett, Washington, a partial release of mortgage with individual acknowledgment can occur when only a portion of the property is released. This allows borrowers to clear title on part of the property while maintaining their mortgage for the rest.

In a partial release of mortgage, the grantor is the homeowner who is requesting the release. This individual owns the property and has a mortgage that covers it, seeking to remove a lien on a specific portion of their land. In Everett, Washington, understanding this role is crucial, as it helps streamline interactions with lenders and ensures the process adheres to legal requirements. Clearly identifying the grantor can simplify negotiations and documentation.

An example of a partial release could involve a homeowner in Everett, Washington, who owns a 10-acre lot with a mortgage. If the homeowner decides to sell 2 acres of land for development, they may request a partial release from their lender. Upon approval, the lender would release their claim on the sold 2-acre section, allowing the homeowner to proceed with the sale while still being responsible for the mortgage on the remaining 8 acres. This scenario illustrates how partial releases facilitate property management.

To obtain a partial release of mortgage, several documents are required, including a formal request outlining your intent. You may also need to provide proof of the property's value, current mortgage balance, and any relevant sale contracts. In Everett, Washington, reaching out to your lender early in the process can help clarify additional requirements. Platforms like uslegalforms can assist you in preparing the necessary documentation to ensure a smooth transaction.

Securing a partial release of a mortgage can be straightforward, provided you meet specific criteria set by your lender. Generally, the lender will assess your mortgage balance and property value to determine if they can approve the request. In Everett, Washington, homeowners often find success with this process when they clearly communicate their intentions and provide all necessary documentation. Utilizing platforms like uslegalforms can streamline this process, offering templates and guidance.

A partial release is the process through which a lender reduces their claim on a portion of the mortgaged property, enabling the homeowner to sell or transfer that portion. It allows the borrower's existing mortgage to still secure the remaining property while releasing the lien on the sold segment. This is particularly valuable in Everett, Washington, as it helps homeowners manage their properties more effectively without fully paying off their mortgages. Overall, a partial release facilitates real estate transactions smoothly.