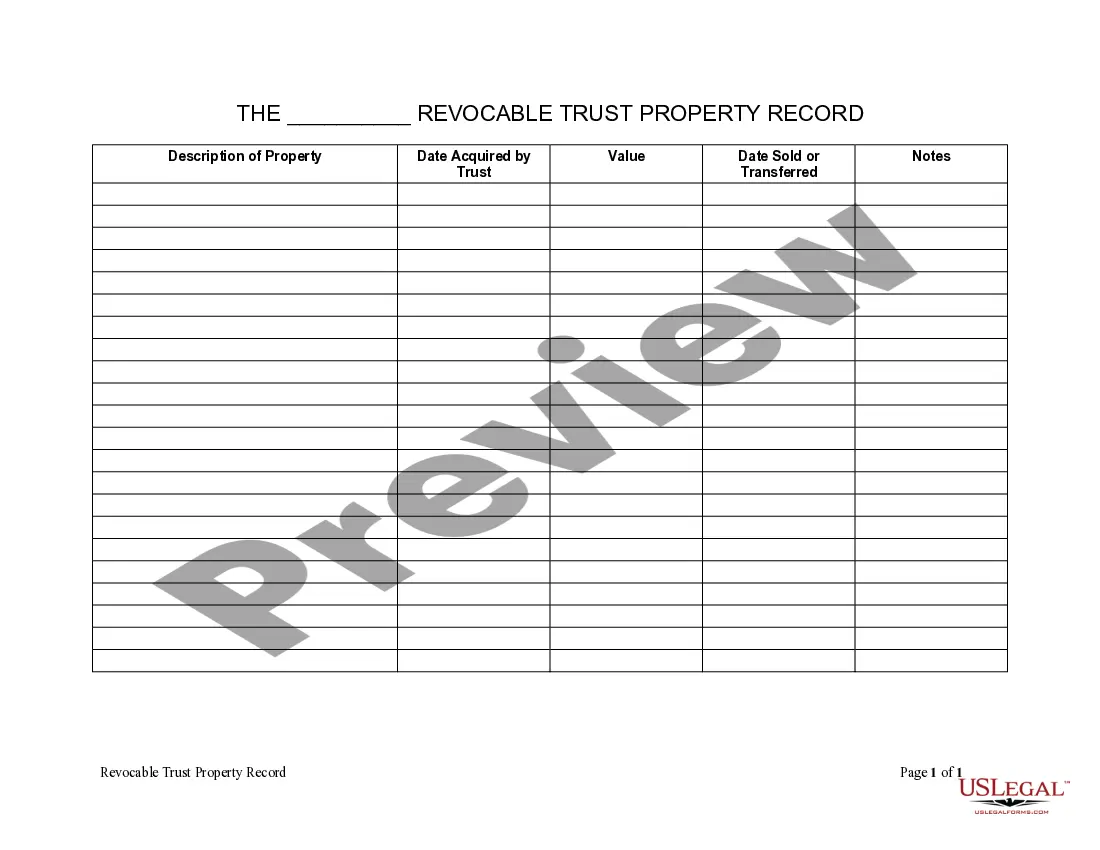

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Seattle Washington Living Trust Property Record

Description

How to fill out Washington Living Trust Property Record?

We consistently aim to reduce or circumvent legal complications when handling intricate legal or financial issues.

To achieve this, we engage attorney services that are typically very costly.

Nevertheless, not every legal issue is equally complicated.

The majority can be managed independently.

Leverage US Legal Forms whenever you need to obtain and download the Seattle Washington Living Trust Property Record or any other form quickly and securely.

- US Legal Forms is an online repository of current DIY legal templates ranging from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform enables you to take control of your situations without the need for legal representation.

- We offer access to legal form templates that are not always easily found in public domains.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

In Washington, there is a relatively high threshold for which estates must go through probate. Any estate worth less than $100,000 does not have to go to probate court, so you likely won't need a living trust if your estate is worth less than that.

Drawbacks of a Living Trust Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

They are more costly and take more time to get set up correctly. Trusts don't become public record, so you can maintain privacy about how your estate was split.

Some of the Cons of a Revocable Trust Shifting assets into a revocable trust won't save income or estate taxes. No asset protection. Although assets held in an irrevocable trust are generally beyond the reach of creditors, that's not true with a revocable trust.

A trust is also harder to contest than a will, offering security that your plan will remain in place. Washington applies an estate tax to estates worth over $2 million and federal estate tax applies to estates of more than $5 million. Your living trust will not shield your assets from this tax.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

There are a variety of assets that you cannot or should not place in a living trust. These include: Retirement Accounts: Accounts such as a 401(k), IRA, 403(b) and certain qualified annuities should not be transferred into your living trust. Doing so would require a withdrawal and likely trigger income tax.

The bottom line is that a trust provides far more potential asset protection than an outright inheritance. Depending upon the needs of your family, an estate planning attorney can create a trust for you that protects assets and preserves them for your beneficiaries.

To create a living trust in Washington, prepare a written trust document and sign it before a notary public. To finalize the trust and make it effective, you must transfer ownership of your assets into it.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.