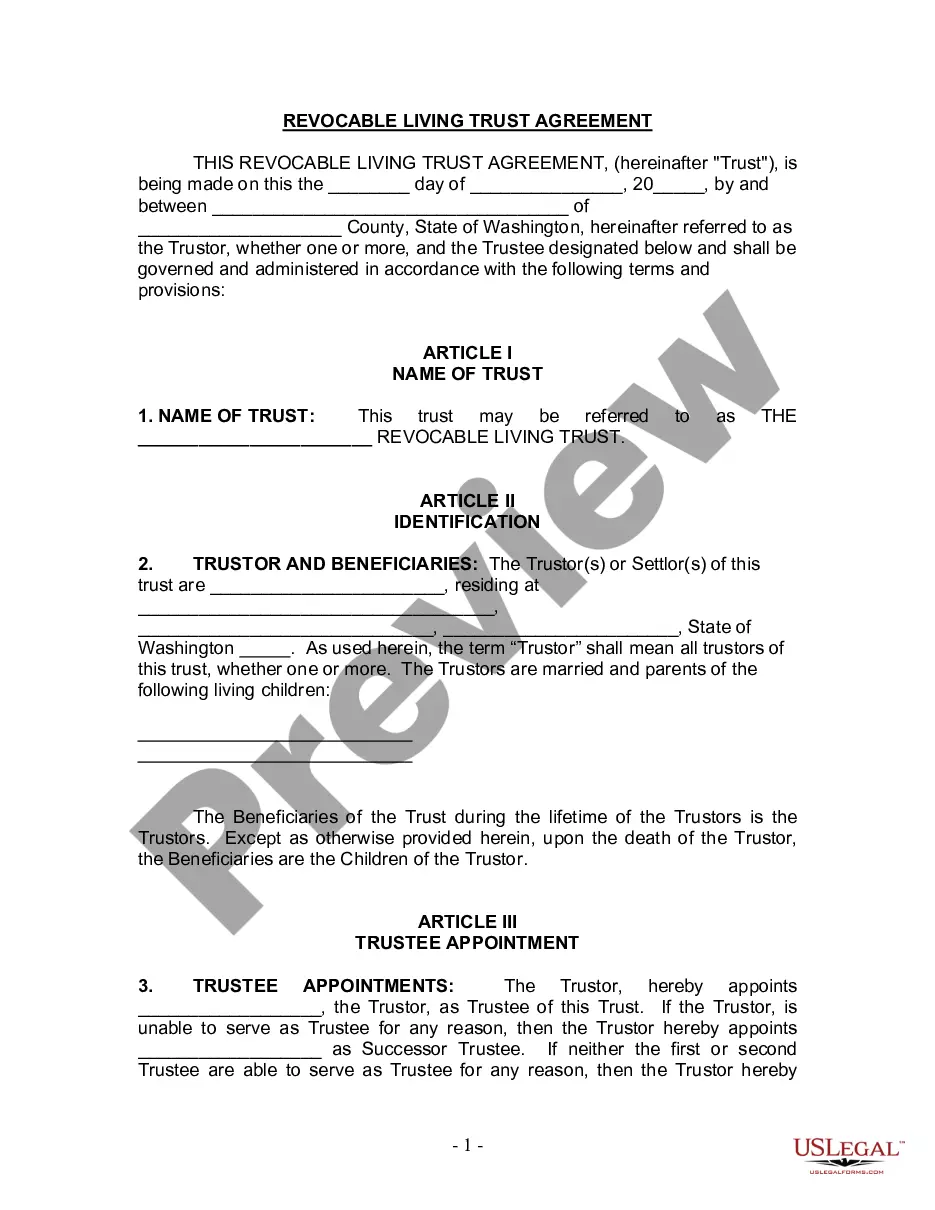

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Seattle Washington Living Trust for Husband and Wife with One Child

Description

How to fill out Washington Living Trust For Husband And Wife With One Child?

Acquiring validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms database.

It’s an online collection of over 85,000 legal documents catering to both personal and professional necessities and various real-world situations.

All the forms are properly categorized by their intended use and jurisdiction areas, making it as quick and easy as pie to locate the Seattle Washington Living Trust for Husband and Wife with One Child.

Keep your documentation organized and compliant with legal standards is of utmost importance. Leverage the US Legal Forms library to always have vital document templates for any necessities right at your fingertips!

- Check the Preview mode and form description.

- Ensure you’ve chosen the correct one that satisfies your needs and fully adheres to your local jurisdiction standards.

- Search for another template, if needed.

- Upon noticing any discrepancies, use the Search tab above to find the appropriate one. If it meets your requirements, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

The Joint Trust. Typically, when a married couple utilizes a Revocable Living Trust-based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

Separate trusts may offer better protection from creditors, if this is a concern. For example, at the death of the first spouse, the deceased spouse's trust becomes irrevocable, which makes it harder to access by creditors. And yet the surviving spouse can still access it for income and other needs.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

Joint trusts are easier to manage during a couple's lifetime. Since all assets are held in one trust, ownership mimics how many couples hold their assets - jointly. Both spouses having equal control of the management of joint assets held by the trust.

Simple Living Trusts for Married Couples Simple living trusts are often considered the easiest kinds of trusts to set up and keep. In a simple living trust, a couple can share the control and benefits of the trust while they are living. Once one spouse dies, the other spouse will have total control over the trust.

A married couple has many reasons to establish a living trust. A living trust can help their estate survive onerous estate taxes, avoid probate if they both die, and side step the need for a conservatorship if either one (or both) become incapacitated.

The price of creating a living trust in Washington depends on how you go about making it. The first option is to use an online service and draw the trust up yourself. This will cost a few hundred dollars at most. The other option is to hire an attorney, which could cost more than $1,000.

A joint revocable trust is probably the easiest form of living revocable trusts for a married couple to use. A joint revocable trust merges the estate planning of a couple using a single trust document. Joint trusts and individual trusts each have advantages and disadvantages.