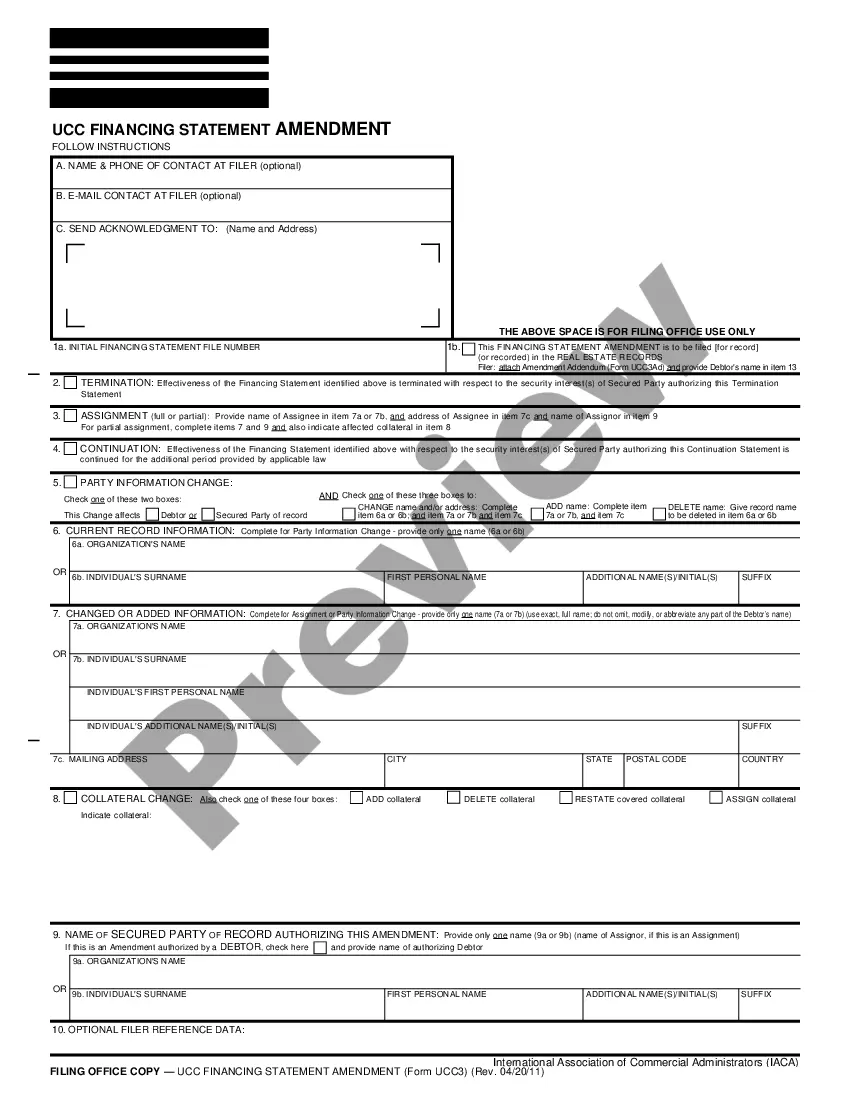

Orange California UCC3 Financing Statement Amendment

Description

How to fill out UCC3 Financing Statement Amendment?

Preparing documents for business or personal needs is consistently a significant responsibility.

When drafting a contract, a public service application, or a power of attorney, it is crucial to consider all federal and state laws and regulations pertinent to the specific area.

However, smaller counties and even municipalities also have legislative protocols that you have to take into account.

The remarkable aspect of the US Legal Forms library is that all documents you have ever acquired are permanently accessible – you can retrieve them in your profile within the My documents tab at any time. Enroll in the platform and swiftly acquire verified legal templates for any circumstance with just a few clicks!

- These factors contribute to the stress and duration needed to draft the Orange UCC3 Financing Statement Amendment without the aid of a professional.

- You can avoid the expense of hiring attorneys to prepare your documents and produce a legally compliant Orange UCC3 Financing Statement Amendment independently by utilizing the US Legal Forms web library.

- It is the largest online repository of state-specific legal templates that are meticulously reviewed, ensuring their validity when selecting a sample for your jurisdiction.

- Previously subscribed users merely need to Log In to their accounts to save the required form.

- If you do not yet possess a subscription, adhere to the step-by-step guidance below to obtain the Orange UCC3 Financing Statement Amendment.

- Examine the page you have accessed and confirm if it contains the document you need.

- To do this, utilize the form description and preview if these features are offered.

Form popularity

FAQ

Uniform Commercial Code1 statement is a legal notice filed by creditors in an effort to publicly declare their right to seize assets of debtors who default on loans. UCC1 notices are typically printed in local newspapers, in an effort to publicly express a lender's intent to seize collateralized assets.

To amend your collateral description, click the button labeled View/Amend Collateral. After clicking this button, a pop-up will appear and will display the current collateral description and provide options to Add Collateral, Delete Collateral or Change Collateral.

What is UCC3 Termination? UCC-3 Filing step-by-step - YouTube YouTube Start of suggested clip End of suggested clip You should also include a copy of the original UCC. Filing. So the lender can reference it quickly IMoreYou should also include a copy of the original UCC. Filing. So the lender can reference it quickly I like to do steps number one and two simultaneously.

To do so you will generally need to make a trip in person down to your secretary of state's office. Once there, you will be able to swear under oath that you've satisfied the debt in full and wish to request for the UCC-1 filing to be removed.

UCC. A UCC3 is a change statement to a UCC1. It's an amendment filing to an original UCC1 financing statement that changes or adds information to the originally filed UCC1. It's a filing tool secured parties use to manage their UCC portfolio to maintain their perfected security interests.

1 financing statement (an abbreviation for Uniform Commercial Code1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

Uniform Commercial Code filings are filings which register the secured party's interest in a loan secured by non-titled property.

How to complete a UCC1 (Step by Step) Filer Information. Name and phone number of contact at filer. Email contact at filer.Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

A UCC financing statement also called a UCC-1 financing statement or a UCC-1 filing is a legal form that allows a lender to announce a lien on an asset to secure a loan. By filing the UCC financing statement, the lender is giving notice that it has an interest in the property listed in the filing.

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.