Wayne Michigan UCC1-AD Financing Statement Addendum

Description

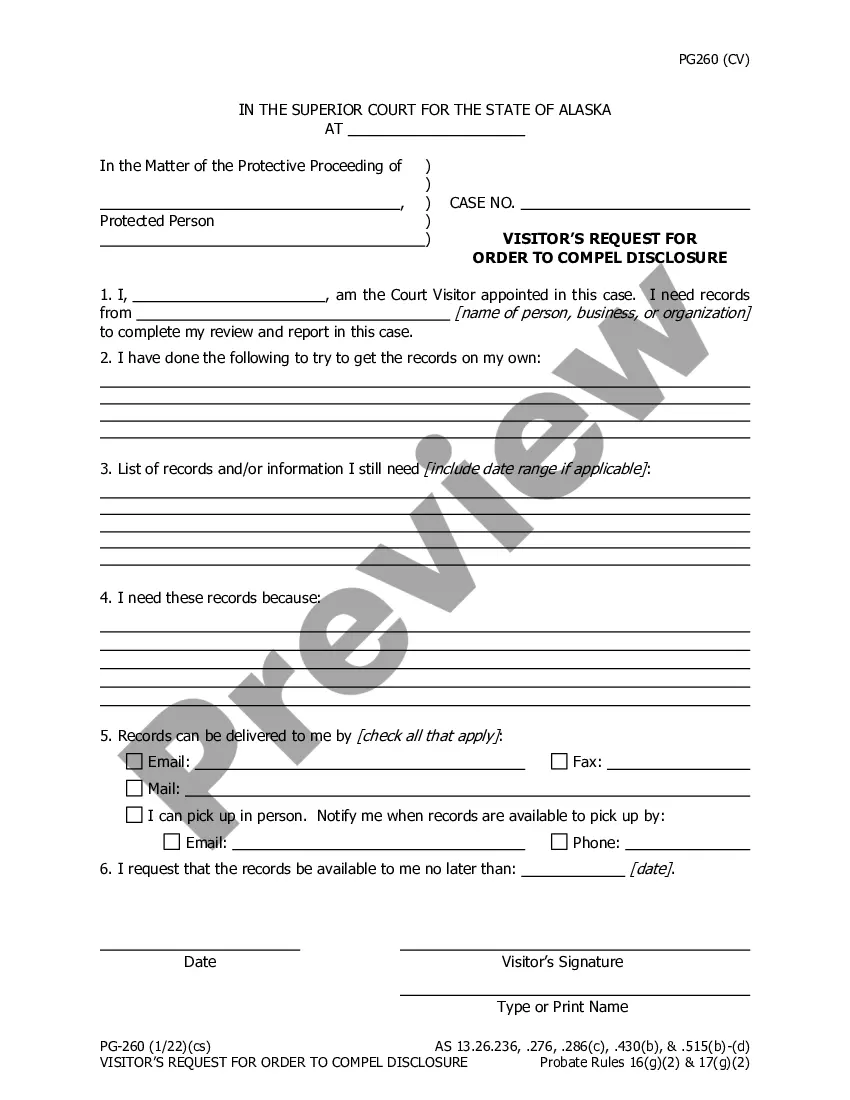

How to fill out UCC1-AD Financing Statement Addendum?

Laws and statutes in every sector differ across the nation.

If you aren't a lawyer, it's easy to become confused by numerous regulations when it comes to creating legal documents.

To circumvent expensive legal fees when preparing the Wayne UCC1-AD Financing Statement Addendum, you require a validated template applicable for your jurisdiction.

This is the simplest and most affordable way to obtain current templates for any legal needs. Find them all in a few clicks and maintain your documents in an organized manner with the US Legal Forms!

- Examine the page content to verify that you have located the correct sample.

- Utilize the Preview option or read the form description if it is available.

- Search for another document if there are discrepancies with any of your specifications.

- Click on the Buy Now button to acquire the template when you identify the right one.

- Choose one of the subscription plans and Log In or create an account.

- Determine how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it, or do everything electronically.

Form popularity

FAQ

A UCC can be rendered invalid for various reasons, including improper completion or failure to meet state-specific requirements. Mistakes, such as incorrect debtor details or missing information on the UCC1-AD Financing Statement Addendum, can jeopardize your filing. To avoid complications, double-check your documentation and consider using resources like UsLegalForms for guidance.

UCC-1 Financing Statements, commonly referred to as simply UCC-1 filings, are used by lenders to announce their rights to collateral or liens on secured loans. They're usually filed by lenders with the debtor's state's secretary of state office when a loan is first originated.

To do so you will generally need to make a trip in person down to your secretary of state's office. Once there, you will be able to swear under oath that you've satisfied the debt in full and wish to request for the UCC-1 filing to be removed.

FILING OFFICE COPY UCC FINANCING STATEMENT ADDENDUM (FORM UCC1Ad) (REV. 05/22/02) Debtor is a TRANSMITTING UTILITY. Filed in connection with a Manufactured-Home Transaction effective 30 years. Filed in connection with a Public-Finance Transaction effective 30 years.

If at any time any Grantor shall take a security interest in any property of an Account Debtor or any other person to secure payment and performance of an Account, such Grantor shall promptly assign such security interest to the Collateral Agent.

To assign (1) some or all of Assignor's right to amend the identified financing statement, or (2) the Assignor's right to amend the identified financing statement with respect to some (but not all) of the collateral covered by the identified financing statement: Check box in item 3 and enter name of Assignee in item 7a

A filing on a fixture is a standard UCC-1 financing statement recorded with a secretary of state. It includes the fixture in the description of the collateral. It's important to know it doesn't attach a lien to real estate; you have a subordinate interest to the property owner and other creditors.

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

A UCC3 is a change statement to a UCC1. It's an amendment filing to an original UCC1 financing statement that changes or adds information to the originally filed UCC1. It's a filing tool secured parties use to manage their UCC portfolio to maintain their perfected security interests.

1 should be filed with the secretary of state's office in the state where the debtor is incorporated or lives. 1 does not expire until the loan is paid in full, but in many jurisdictions including California, it must be renewed every five years.