This Warrant is to be used in bridge financing when the bridge investors are making a bridge loan to the company and receiving convertible notes and warrants. The warrant provides for several events subsequent to the bridge financing that fix the number of shares and exercise price for the warrant.

Maricopa Arizona Bridge Financing Warrant

Description

How to fill out Bridge Financing Warrant?

Regardless of whether you plan to launch your business, enter into a legal agreement, request an update for your identification, or address family-related legal matters, it is essential to prepare specific documentation in line with your local laws and regulations.

Finding the appropriate documents can be time-consuming and challenging unless you utilize the US Legal Forms library.

The platform offers users access to over 85,000 expertly crafted and validated legal documents suitable for any personal or business scenario. All documents are organized by state and intended use, making it easy and quick to select a copy such as the Maricopa Bridge Financing Warrant.

Download the Maricopa Bridge Financing Warrant in your preferred file format. Print the document or complete it and sign it electronically using an online editor to save time. Documents offered through our site are reusable. With an active subscription, you can access all previously acquired documents whenever necessary in the My documents section of your account. Stop wasting time searching endlessly for current official paperwork. Join the US Legal Forms platform and maintain your documents in order with the most extensive online form library!

- Log into your account on the US Legal Forms website and click the Download button next to the desired form.

- If you're new to the platform, you will need to complete a few additional steps to acquire the Maricopa Bridge Financing Warrant. Follow these instructions.

- Ensure that the template meets your specific requirements and complies with local law regulations.

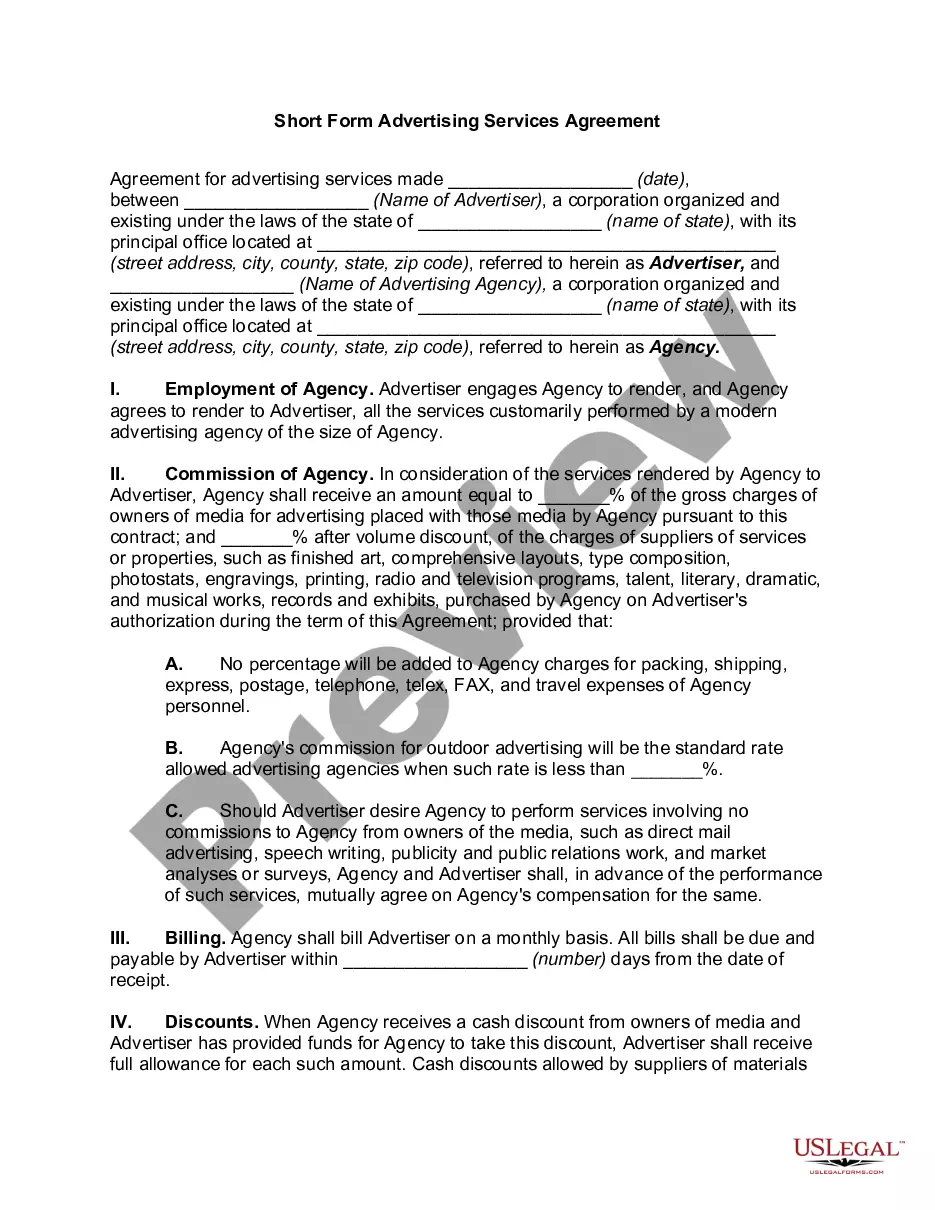

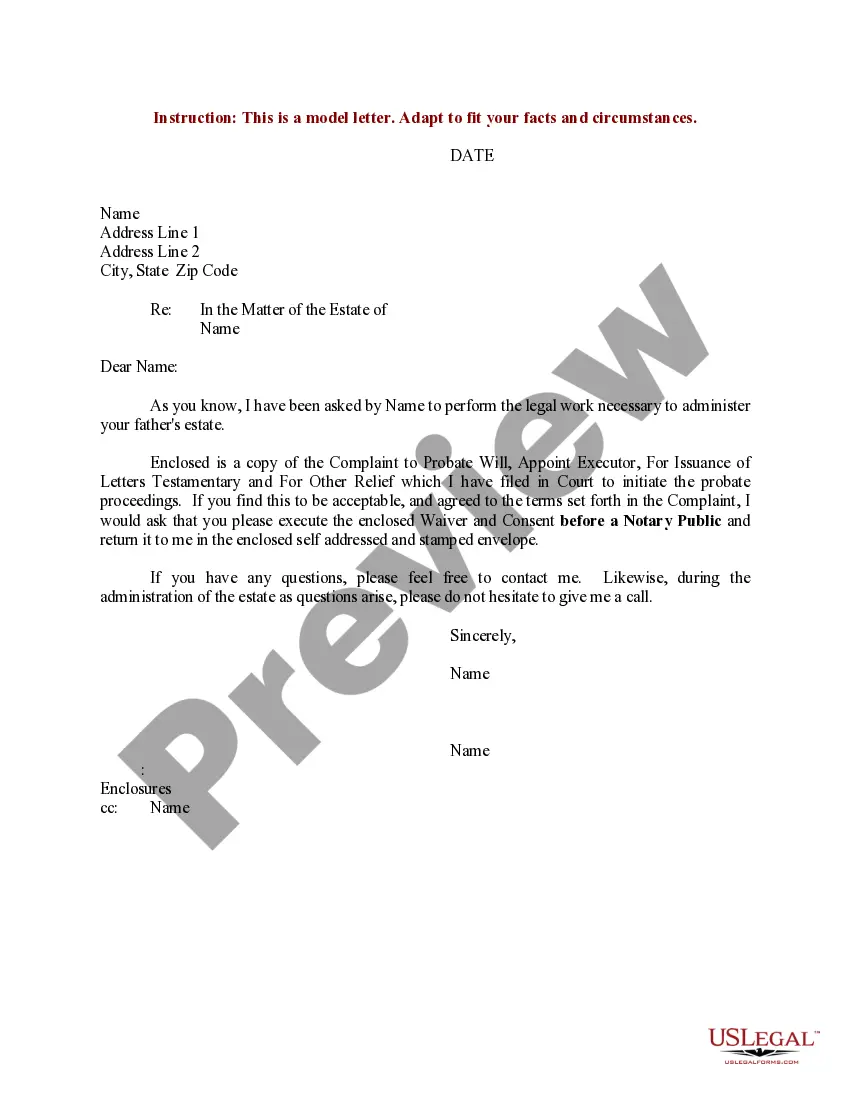

- Examine the form description and review the Preview if it's provided on the page.

- Use the search bar indicating your state above to locate another form.

- Click Buy Now to purchase the document once you find the appropriate one.

- Select the subscription plan that best fits your needs to proceed.

- Log in to your account and complete the payment using your credit card or PayPal.

Form popularity

FAQ

A bridge loan is a short-term loan used to bridge the gap between buying a home and selling your previous one. Sometimes you want to buy before you sell, meaning you don't have the profit from the sale to apply to your new home's down payment.

Bridge financing normally comes from an investment bank or venture capital firm in the form of a loan or equity investment. Bridge financing is also used for initial public offerings (IPO) or may include an equity-for-capital exchange instead of a loan.

Deferred or rolled up You pay all the interest at the end of your bridge loan. There are no monthly interest payments. Retained You borrow the interest for an agreed period, and pay it all back at the end of the bridge loan.

Equity required: Because a bridge loan uses your current home as collateral for a loan on a new home, lenders often require a certain amount of equity in your existing home to qualify, for example 20%.

Bridge financing "bridges" the gap between the time when a company's money is set to run out and when it can expect to receive an infusion of funds later on. This type of financing is most normally used to fulfill a company's short-term working capital needs.

Definition: Bridge loan is a type of gap financing arrangement wherein the borrower can get access to short-term loans for meeting short-term liquidity requirements. Description: Bridge loans help in bridging the gap between short-term cash requirements and long-term loans.

Bridge financing is a form of temporary financing intended to cover a company's short-term costs until the moment when regular long-term financing is secured. Thus, it is named as bridge financing since it is like a bridge that connects a company to debt capital through short-term borrowings.

As a condition of the bridge loan, you put up your current home as collateral. If the loan term expires and you still haven't sold your former home, there's a chance you'll be able to request an extension from the lender. However, if the extensions run out as well, the lender could foreclose on your old home.

An institution that urgently needs capital to meet its short-term obligations (e.g., working capital financing) can choose to obtain a bridge loan that serves as a form of bridge financing. It is usually issued by an investment bank or venture capital firm.

A bridge loan is a short-term loan used to bridge the gap between buying a home and selling your previous one. Sometimes you want to buy before you sell, meaning you don't have the profit from the sale to apply to your new home's down payment.