Plano Texas Mortgage Entity

Category:

State:

Multi-State

City:

Plano

Control #:

US-RE-MOR-1000-3

Format:

Word;

Rich Text

Instant download

Description

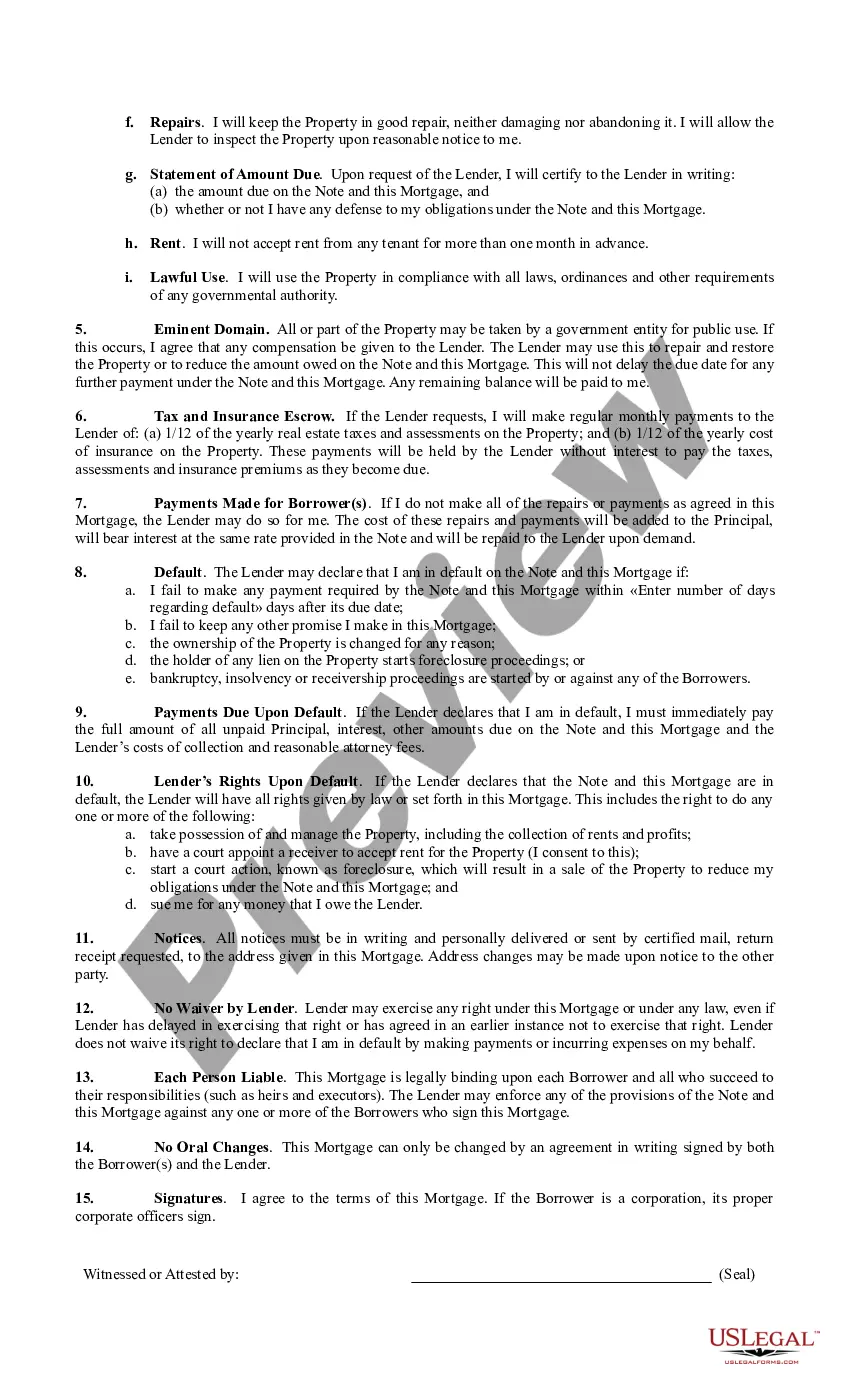

A mortgage is an agreement between you and a lender that allows you to borrow money to purchase or refinance a home and gives the lender the right to take your property if you fail to repay the money you've borrowed.

Free preview