Long Beach California Short Sale Processing Document and Agreement

Category:

State:

Multi-State

City:

Long Beach

Control #:

US-RE-C-1992-1

Format:

Word;

Rich Text

Instant download

Description

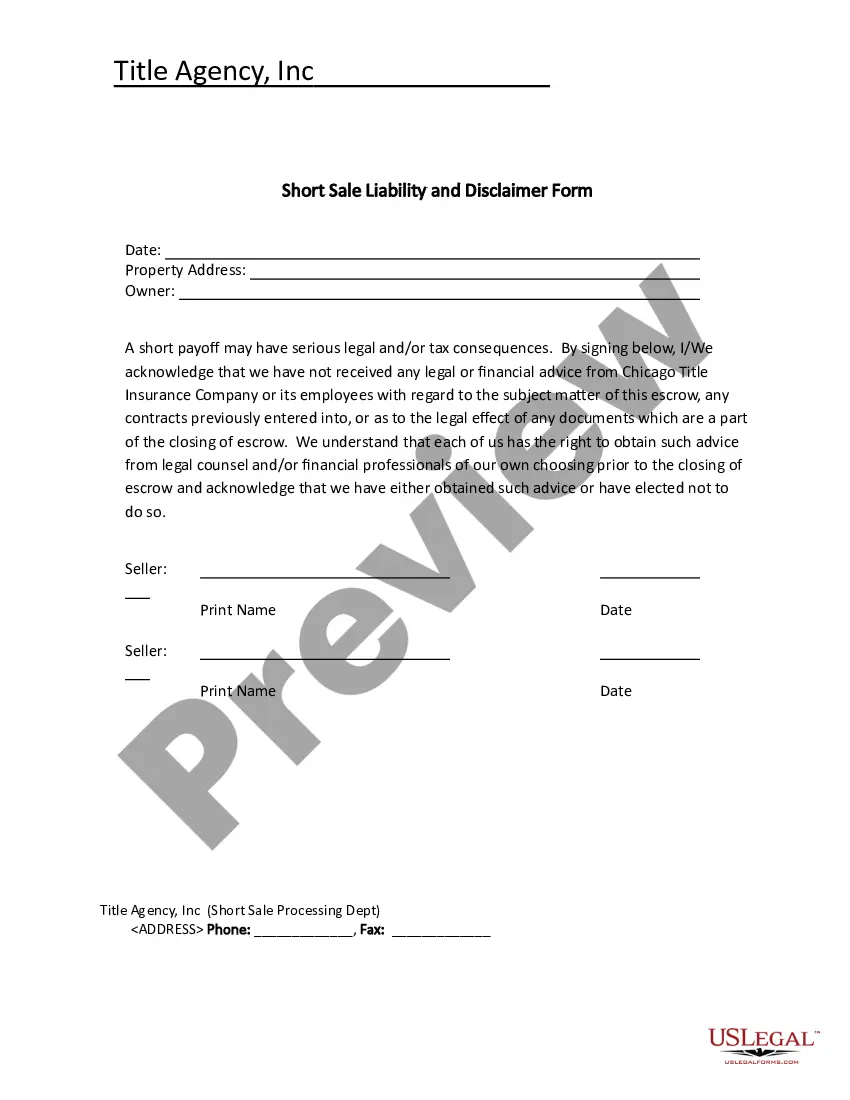

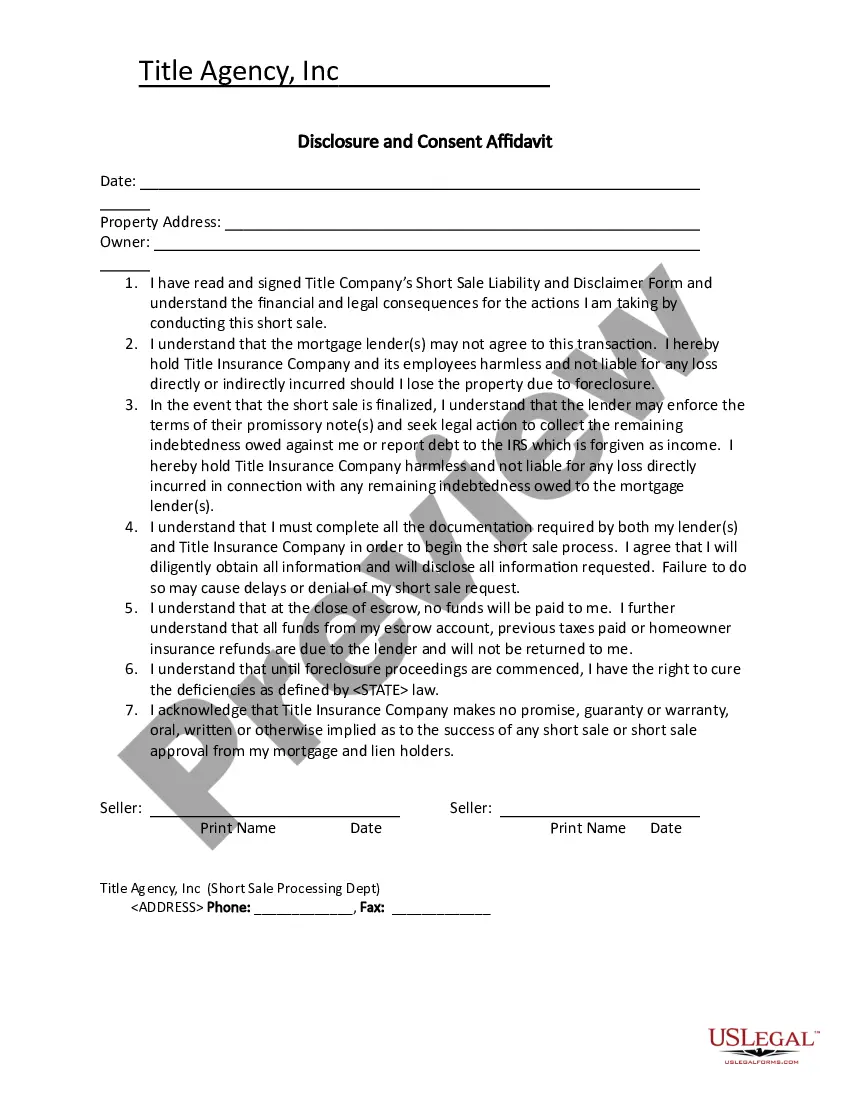

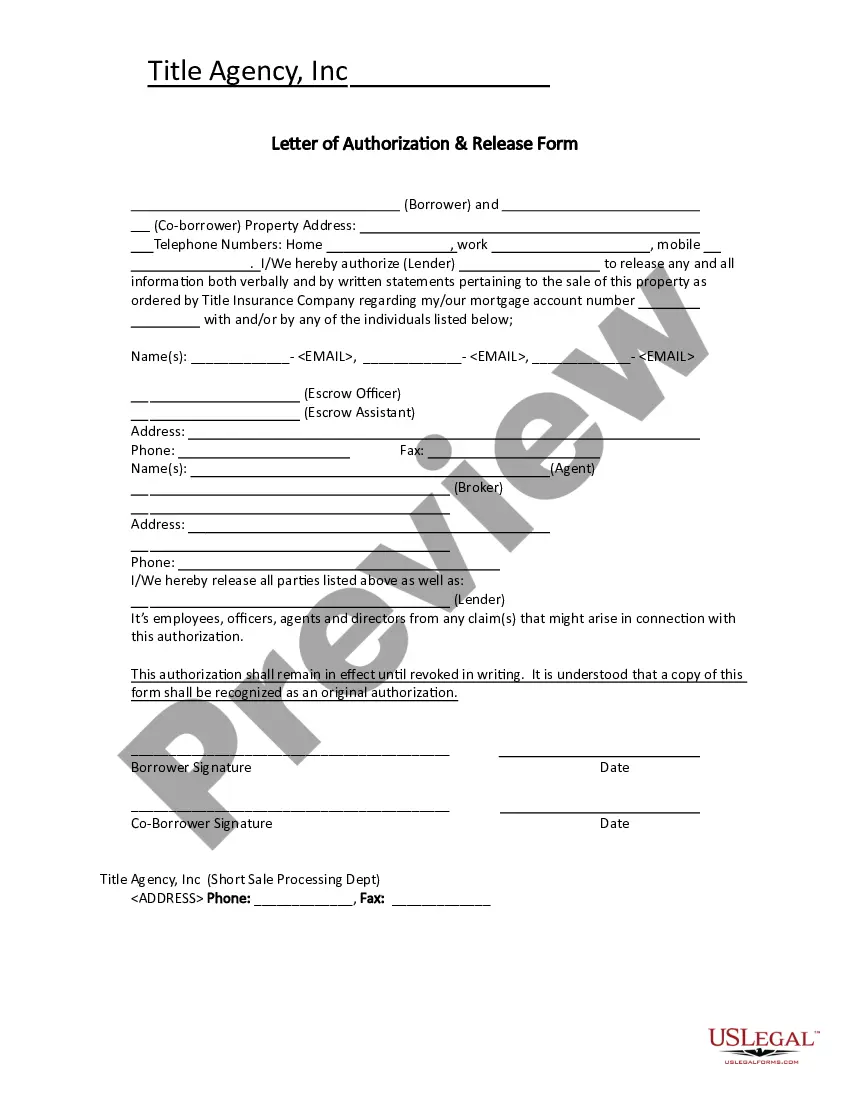

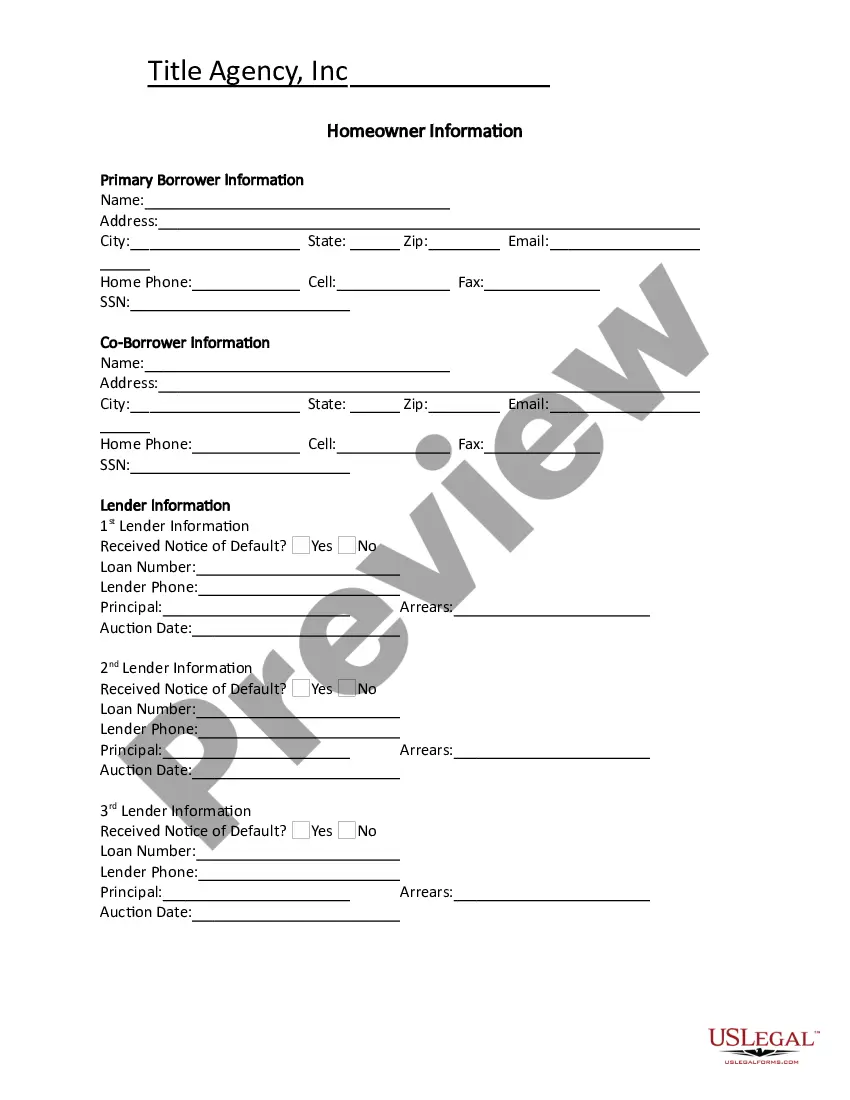

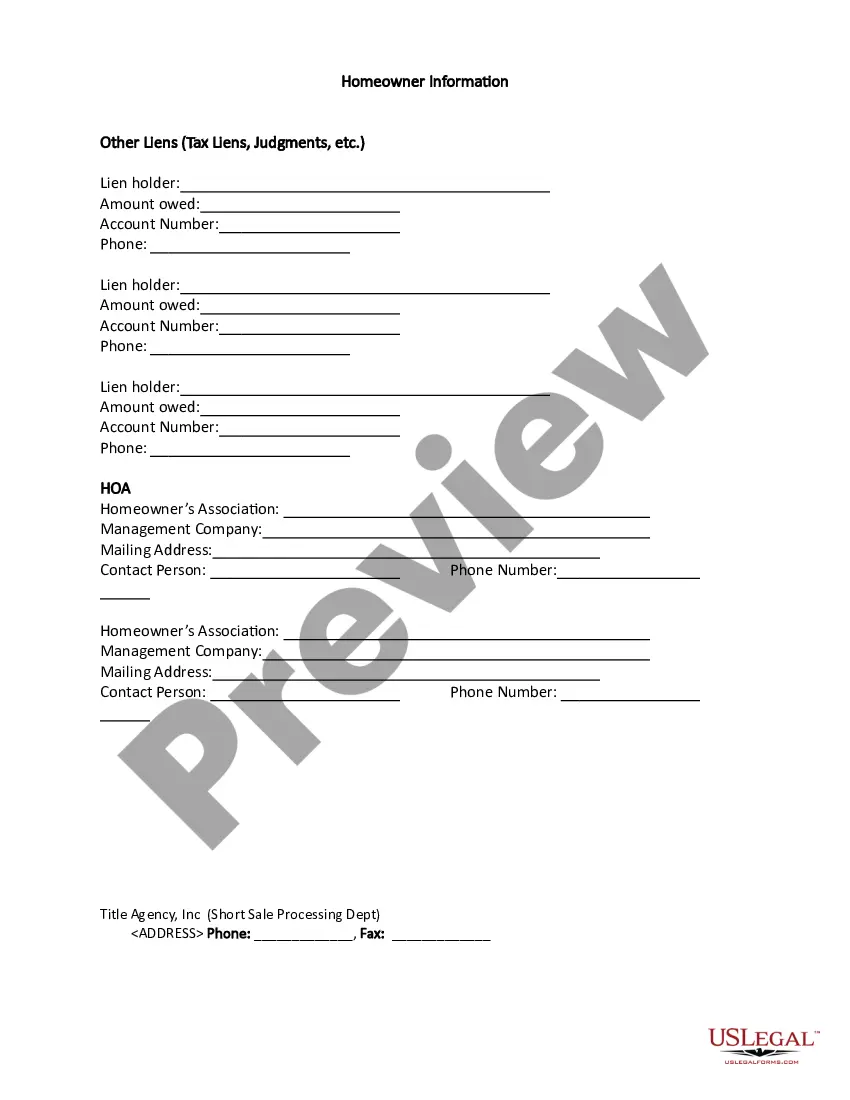

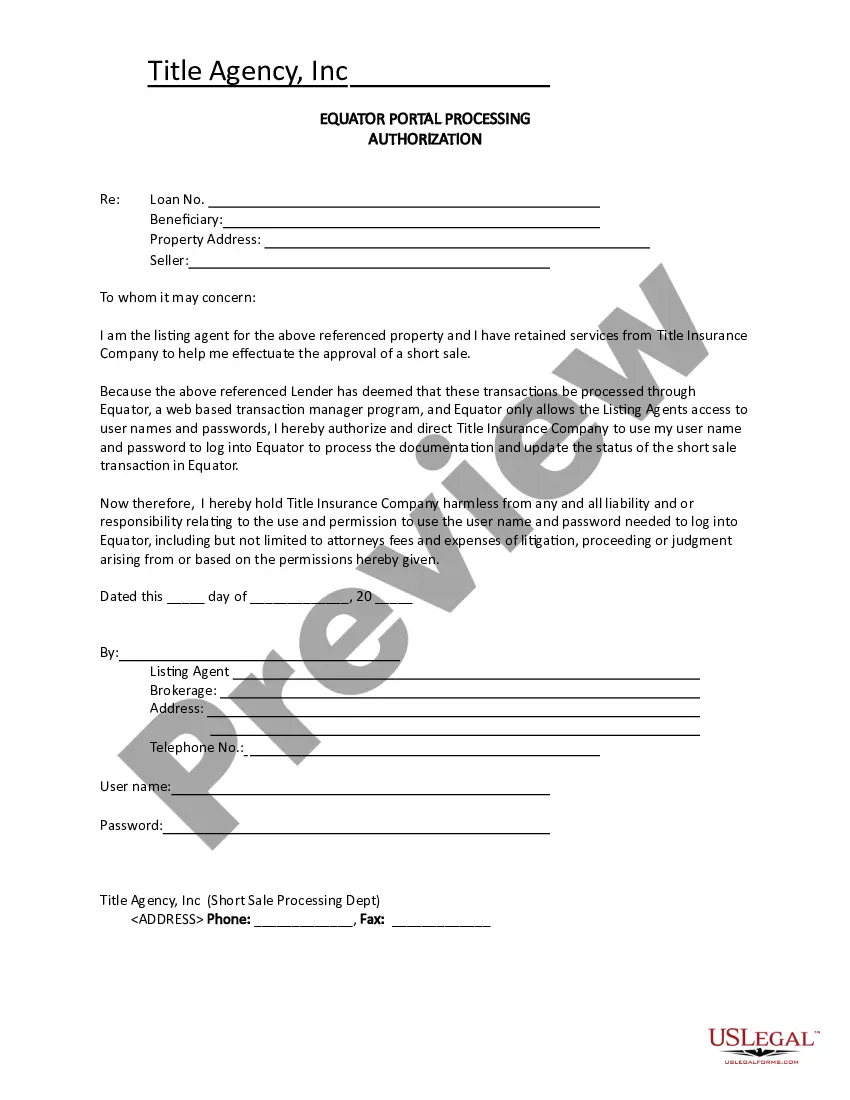

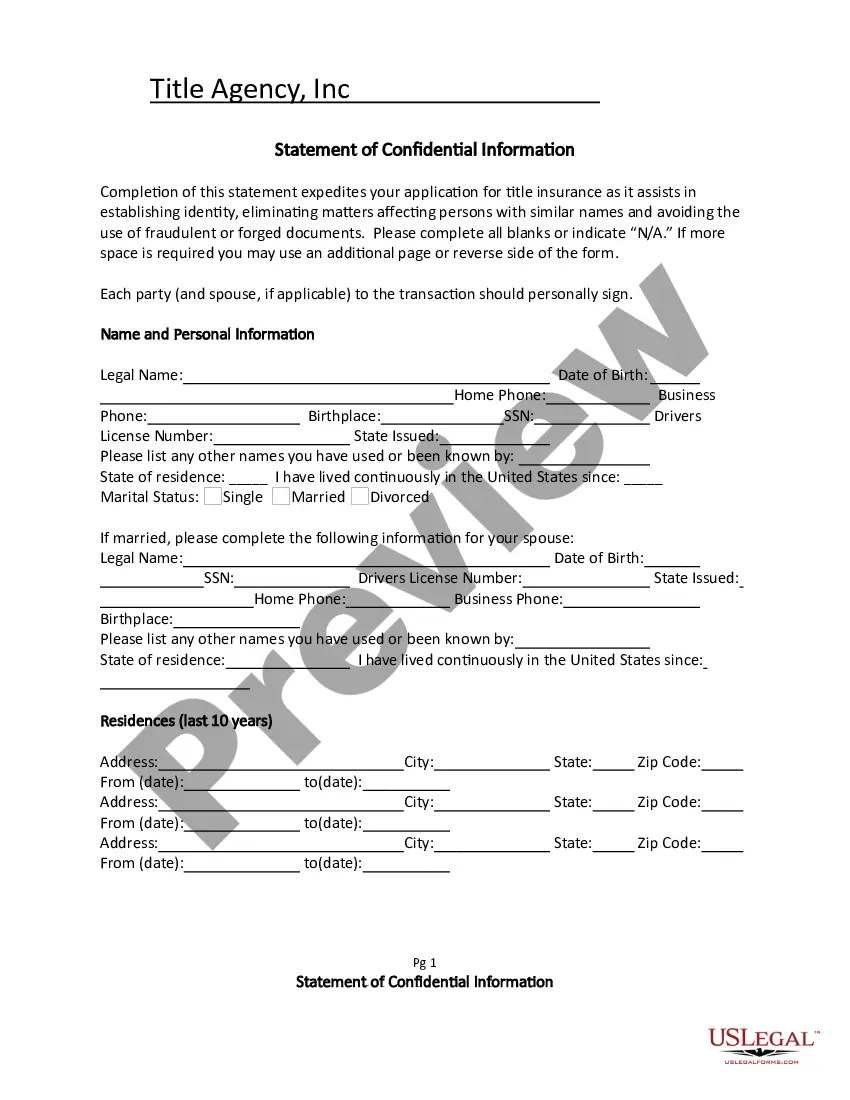

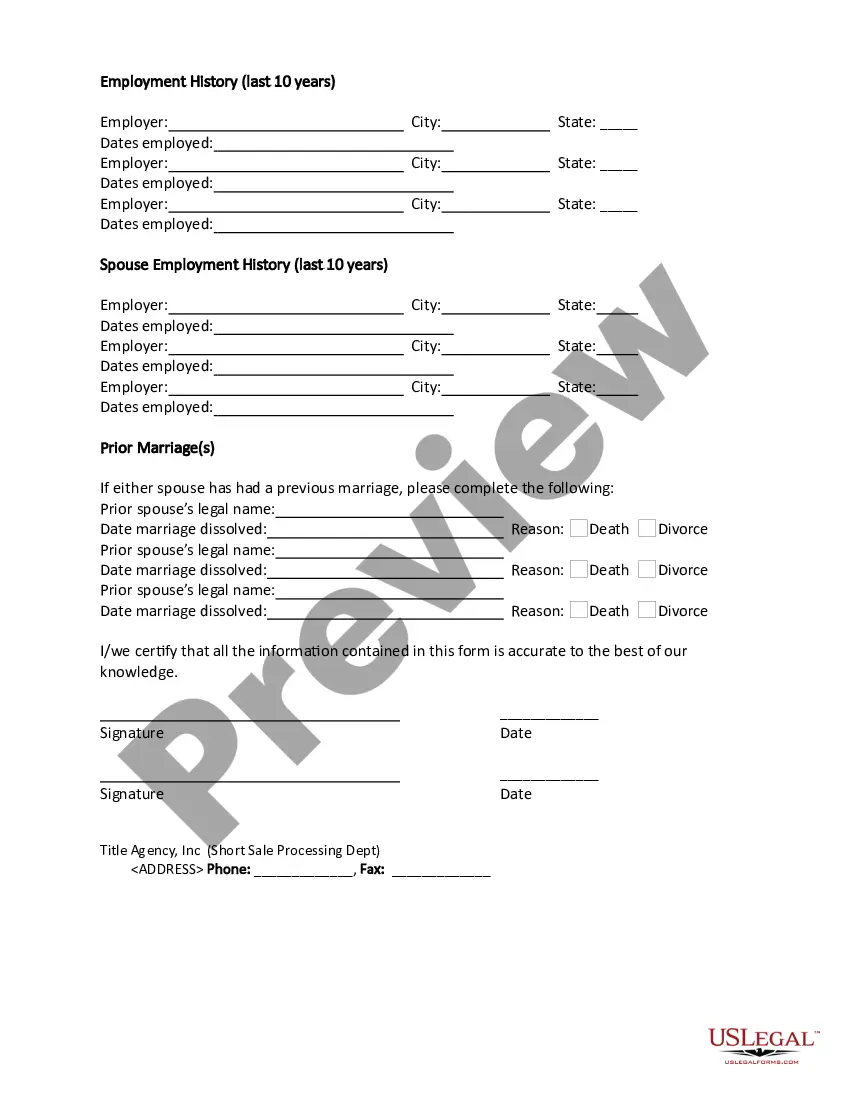

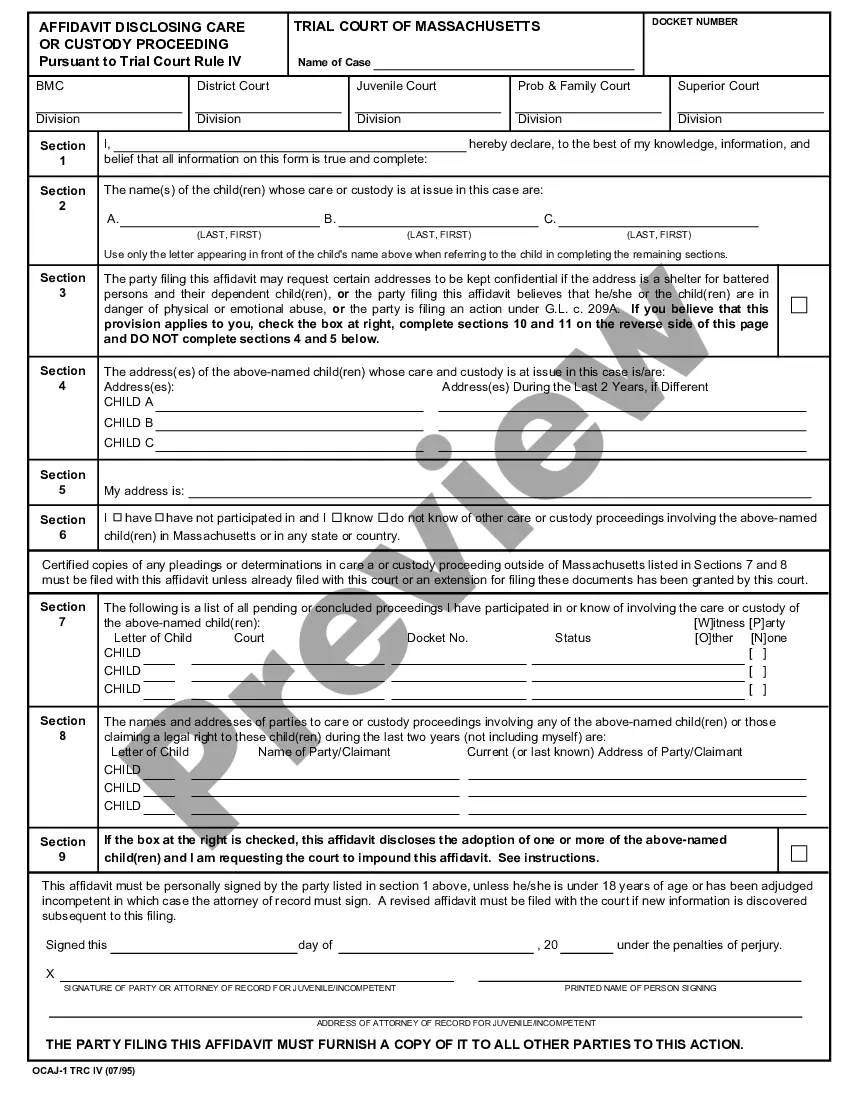

Including: Short Sale Processing Document Check List; Short Sale Liability and Disclaimer Form; Disclosure and Consent Affidavit; Letter of Authorization & Release Form; Homeowner Information; Equator Portal Processing Authorization; Statement of Confidential Information;

Free preview