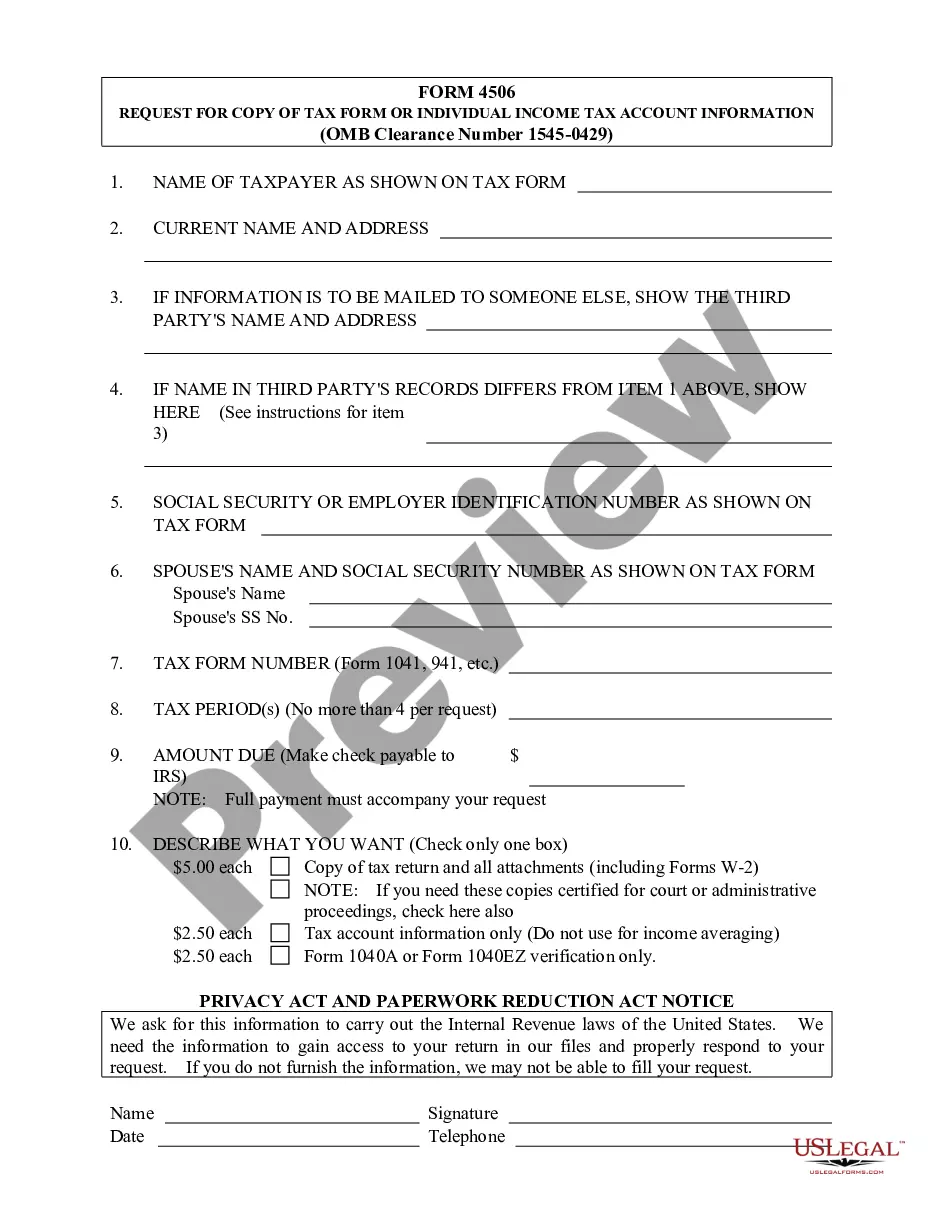

Bexar Texas Request for Copy of Tax Form or Individual Income Tax Account Information

Description

How to fill out Request For Copy Of Tax Form Or Individual Income Tax Account Information?

Laws and statutes in every domain differ from one jurisdiction to another.

If you're not an attorney, it's simple to become confused by a multitude of standards when it comes to crafting legal documents.

To evade expensive legal fees while preparing the Bexar Request for Duplicate of Tax Document or Personal Income Tax Account Data, you require a certified template applicable to your district.

That's the simplest and most cost-effective method to acquire current templates for any legal needs. Find everything with a few clicks and keep your documentation organized with the US Legal Forms!

- That's when utilizing the US Legal Forms service becomes incredibly beneficial.

- US Legal Forms is a reliable online repository trusted by millions, hosting over 85,000 state-specific legal templates.

- It's an excellent resource for professionals and individuals seeking self-service templates for various personal and business scenarios.

- All the files can be reused multiple times: once you acquire a template, it stays accessible in your account for future reference.

- Therefore, if you possess an account with an active subscription, you can simply Log In and re-download the Bexar Request for Duplicate of Tax Document or Personal Income Tax Account Data from the My documents section.

- For new users, there are a few additional steps to obtain the Bexar Request for Duplicate of Tax Document or Personal Income Tax Account Data.

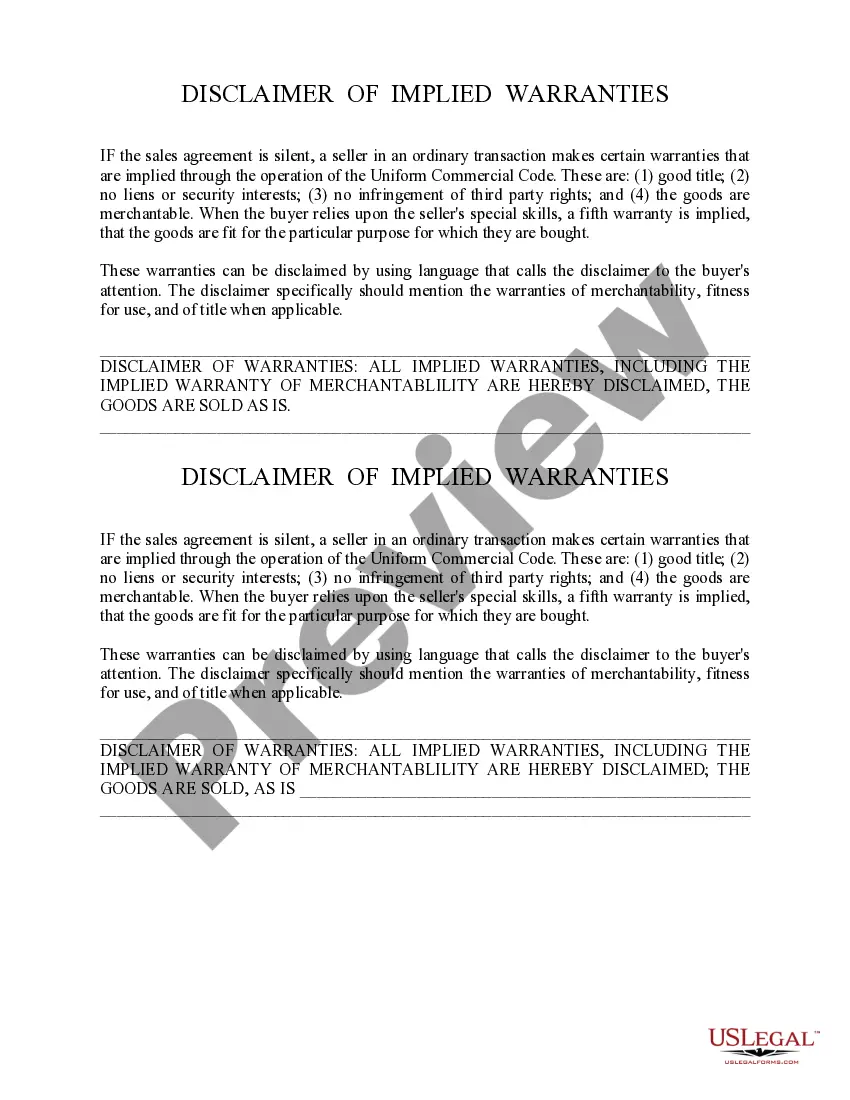

- Examine the page content to ensure you've located the correct specimen.

- Use the Preview feature or review the form description if available.

Form popularity

FAQ

Statement Instructions Complete an account search for property either by name, address or account number. Once your search has been run and your Bexar County Property Tax Account information is located, click on your account number and wait for your account page to open.

Yes. Texas law makes it the responsibility of the property owner to pay by the tax deadline, even if you do not receive the bill through the U.S. Postal Service. You can view your bill online or send an email request to TaxOffice@TravisCountyTX.gov.

You can find out how much your current taxes are and make your payment by going to the Property Tax Account Lookup application or you may request a statement by calling us at 972-547-5020 during business hours.

Property Tax and Appraisals The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

The Property Tax Lien While the state of Texas doesn't set a specific timeframe for foreclosure, Section 32 of the Texas Tax Code does grant a tax lien on all properties as of January 1 of each year until the property taxes are paid.

Texas law allows for reduced property taxes if you meet certain requirements....Claim All Texas Property Tax Breaks to Which You're Entitled Basic homestead exemption.Senior citizens and disabled people.Disabled veterans.Veteran's surviving spouse.

You may apply to the appraisal district the year you become age 65 or qualify for disability. If your application is approved, you will receive the exemption for the entire year in which you become age 65 or disabled and for subsequent years as long as you own a qualified residence homestead.

Seniors qualify for an added $10,000 in reduced property value. Additionally, all taxing districts can offer optional percentage exemptions of up to 20% of the home's value or at least $5,000. Optional percentage exemptions for seniors may also be available from taxing districts. These exemptions start at $3,000.

Effective for tax year 2019, persons with a residence homestead are entitled to a $5,000 exemption of the assessed valuation of their home. The over-65 exemption is for property owners who are 65 years of age or older and claim their residence as their homestead.

In Texas, a property owner over the age of 65 can't freeze all property taxes. However, they do have the option of applying for a tax ceiling exemption which will freeze the amount of property taxes paid to the school district.