Wake North Carolina Form of Anti-Money Laundering Policy

Description

How to fill out Wake North Carolina Form Of Anti-Money Laundering Policy?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Wake Form of Anti-Money Laundering Policy, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Wake Form of Anti-Money Laundering Policy from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Wake Form of Anti-Money Laundering Policy:

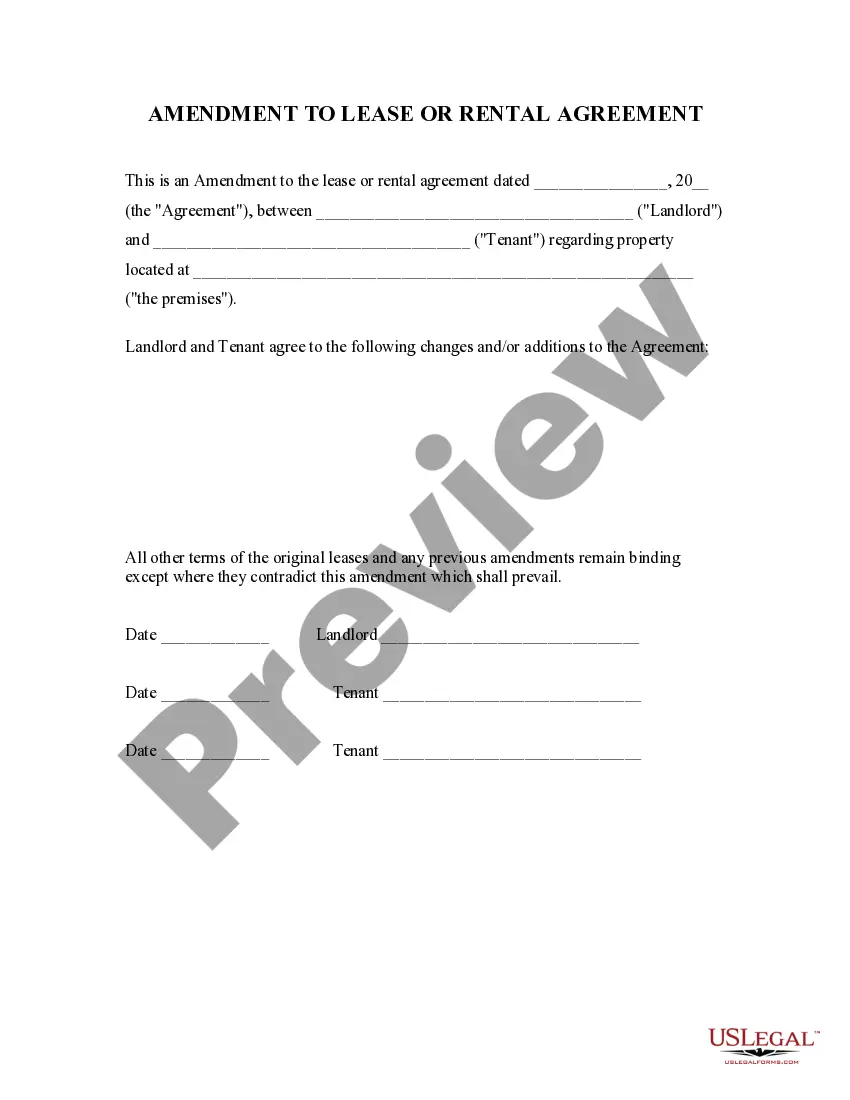

- Examine the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

What are the 5 Pillars of AML Compliance that One Should Consider? Implementation of Effective Internal Controls.Designation of a Compliance (AML) Officer.Appropriate Periodic TrainingForEmployees.Independent Testing of the Program.Customer Due Diligence.

The key 5 pillars of an AML Program are internal controls, a designated BSA officer, ongoing training, independent testing, and customer due diligence (CDD) the newest pillar.

The basic components of a BSA/AML compliance program include: Risk Assessment. Internal Controls Review. Independent Testing (Audit) BSA/AML Compliance Officer. BSA/AML Compliance Training.

Currently, institutional AML programs are based on the five pillars: internal policies, procedures and controls; designation of an AML officer; employee training; independent testing; and customer due diligence (CDD).

FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering (AML) compliance program required by the Bank Secrecy Act (BSA) and its implementing regulations and FINRA Rule 3310.

How many risk assessments are needed for a BSA Program? The core procedures in the Manual identify three key risk assessments: Anti-Money Laundering (AML) Risk Assessment, CIP Risk Assessment, and OFAC Risk Assessment.

The elements include the detection of suspicious activity, risk assessment, internal practices, AML training and independent audits.

The written BSA/AML compliance program must include the following four pillars: Internal controls; The designation of a BSA/AML officer; A BSA/AML training program; and. Independent testing to test programs.

For many years AML compliance programs were built on the four internationally known pillars: development of internal policies, procedures and controls, designation of a AML (BSA) officer responsible for the program, relevant training of employees and independent testing.

There are usually two or three phases to the laundering: Placement. Layering. Integration / Extraction.