Franklin Ohio Certificate of Cancellation of Certificate of Limited Partnership

Description

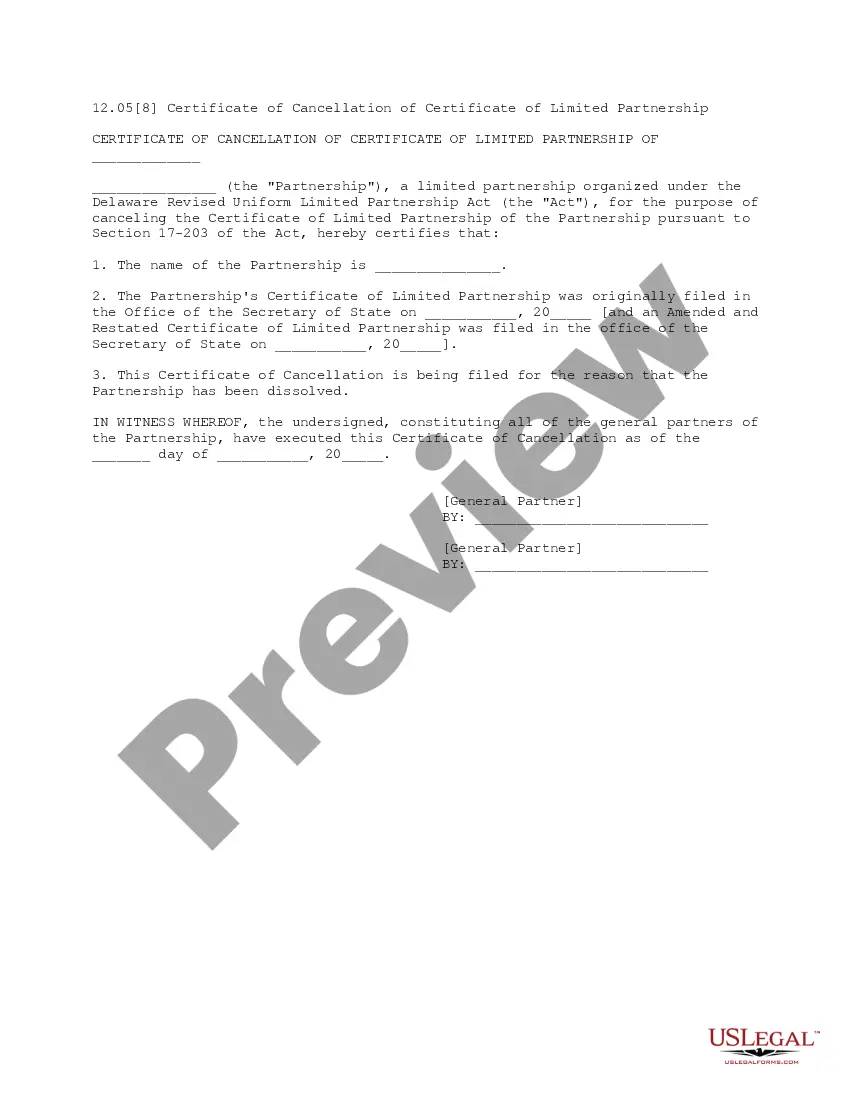

How to fill out Certificate Of Cancellation Of Certificate Of Limited Partnership?

How long does it typically take you to create a legal document.

As each state has its own laws and regulations for every aspect of life, locating a Franklin Certificate of Cancellation of Certificate of Limited Partnership that meets all local criteria can be daunting, and hiring a professional attorney can often be costly.

Many online platforms provide the most requested state-specific templates for download, but utilizing the US Legal Forms library is the most advantageous.

Select the subscription plan that fits you best. Create an account on the platform or Log In to continue to payment options. Pay using PayPal or your credit card. Modify the file format if needed. Click Download to save the Franklin Certificate of Cancellation of Certificate of Limited Partnership. Print the document or use any preferred online editor to complete it electronically. Regardless of how often you need to use the acquired document, all your saved files can be accessed via your profile by going to the My documents tab. Give it a try!

- US Legal Forms is the most comprehensive online assortment of templates, organized by states and areas of application.

- In addition to the Franklin Certificate of Cancellation of Certificate of Limited Partnership, you can find any specific document needed to operate your business or personal affairs, adhering to your county’s regulations.

- Experts validate all samples, ensuring that you can prepare your documentation accurately.

- Using the service is fairly simple.

- If you already have an account on the platform and your subscription is active, you only need to Log In, choose the required form, and download it.

- You can store the document in your profile anytime in the future.

- If you are new to the platform, there will be a few additional steps to follow before you obtain your Franklin Certificate of Cancellation of Certificate of Limited Partnership.

- Review the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the appropriate option in the header.

- Click Buy Now when you're certain of the chosen document.

Form popularity

FAQ

Once properly terminated, partners can prevent others from binding the limited partnership to new obligations or liabilities after dissolution.

Delaware Entity Dissolution Information A limited partnership can file a statement of cancellation with the Delaware Department of State, Division of Corporations. The filing will include a fee of $200. The dissolution of a limited partnership occurs when: The winding up process has been completed.

Limited partners may withdraw from a partnership in the manner allowed by the partnership agreement, or state law if there is no agreement. In states that follow the Revised Uniform Limited Partnership Act (RULPA), a limited partner has the right to withdraw after six months' notice to all the general partners.

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

When a limited partnership dissolves, it must file a Certificate of Cancellation, Form LP-4/7, with the California Secretary of State. The form should include the 12-digit file number issued when the limited partnership was formed to ensure the correct entity is dissolved.

Domestic (California) limited partnerships: To cancel the Certificate of Limited Partnership of a California limited partnership (LP), the LP must file a Certificate of Dissolution (Form LP-3) and Certificate of Cancellation (Form LP-4/7).

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

All general partners must sign the certificate of cancellation and pay a filing fee. If the limited partnership used an assumed name, the business also files a certificate of discontinuance of assumed name with the New York Department of State, Division of Corporations.

The limited partnership should notify applicable third parties about their plans to dissolve the business organization. These contracts may specify notice and termination requirements that must be followed as well as identify any remaining obligations owed to these third parties.

Domestic (California) limited partnerships: To cancel the Certificate of Limited Partnership of a California limited partnership (LP), the LP must file a Certificate of Dissolution (Form LP-3) and Certificate of Cancellation (Form LP-4/7).