Santa Clara California Deed (Including Acceptance of Community Property with Right of Survivorship)

Description

How to fill out Deed (Including Acceptance Of Community Property With Right Of Survivorship)?

Generating documents, such as the Santa Clara Deed (Including Acceptance of Community Property with Right of Survivorship), to handle your legal affairs can be a challenging and time-intensive task. Numerous situations necessitate an attorney’s participation, which also renders this job costly. However, you can manage your legal concerns independently. US Legal Forms is here to assist you.

Our platform provides over 85,000 legal documents designed for various scenarios and life events. We ensure every document adheres to the laws of each state, so you need not worry about possible legal compliance issues.

If you're familiar with our offerings and have a subscription with US, you understand how simple it is to access the Santa Clara Deed (Including Acceptance of Community Property with Right of Survivorship) form. Just Log In to your account, download the document, and modify it to fit your needs. Lost your document? No problem. You can retrieve it from the My documents section in your account - accessible on both desktop and mobile devices.

Locating and purchasing the required document with US Legal Forms is a breeze. Numerous businesses and individuals are already taking advantage of our vast collection. Subscribe now to discover additional benefits you can enjoy with US Legal Forms!

- Ensure that your document is relevant to your state/county, as the laws for creating legal papers can vary from one state to another.

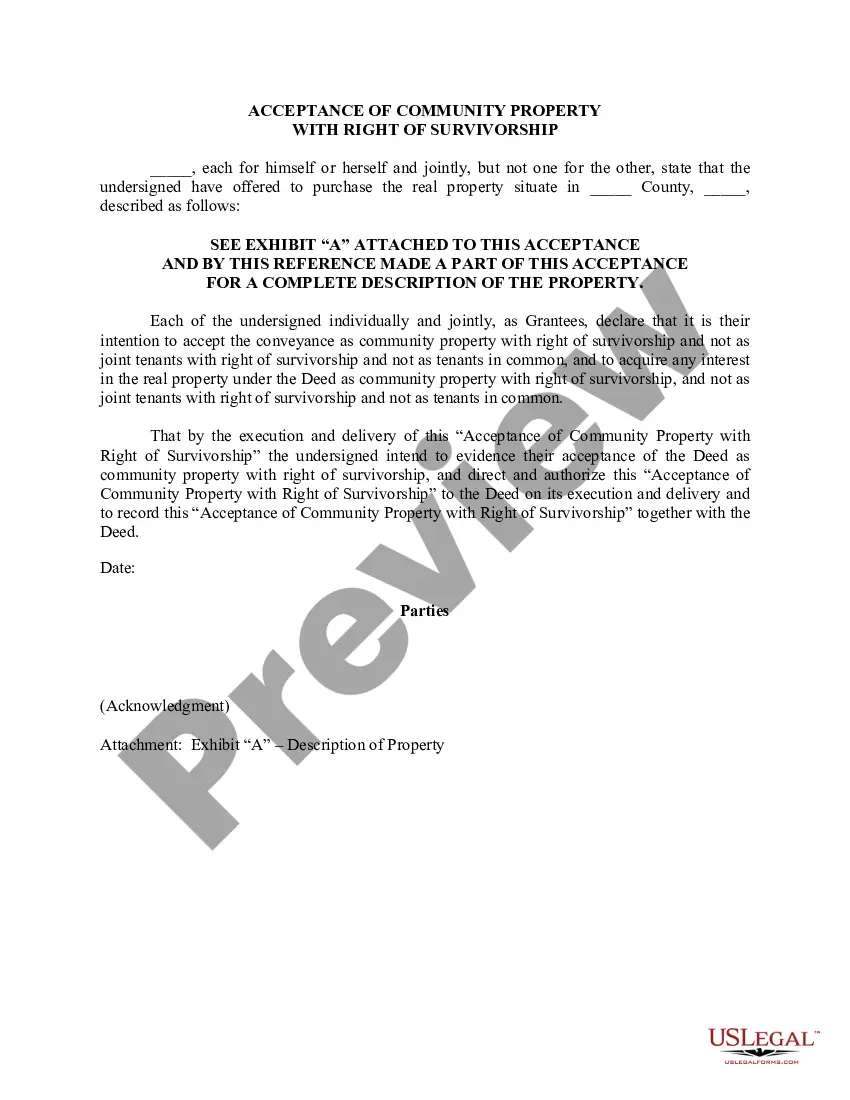

- Learn more about the form by previewing it or reading a short summary. If the Santa Clara Deed (Including Acceptance of Community Property with Right of Survivorship) isn't what you were hoping to find, use the header to seek another option.

- Log in or create an account to begin using our service and obtain the documentation.

- Everything satisfactory on your end? Click the Buy now button and choose your subscription plan.

- Select the payment method and input your payment information.

- Your template is ready to proceed. You can attempt to download it.

Form popularity

FAQ

A common form of co-ownership that includes the right of survivorship is joint tenancy. This means that if one owner passes away, their share goes directly to the surviving owners, rather than becoming part of their estate. The Santa Clara California Deed (Including Acceptance of Community Property with Right of Survivorship) typically embodies this principle, allowing for seamless transfer of property upon death.

As joint tenants, each person owns the whole of the property with the other. If one co-owner dies, their interest in the property automatically passes to the surviving co-owner(s), whether or not they have a will. As tenants in common, co-owners own specific shares of the property.

In California, the majority of married couples hold their real estate property as joint tenants with right of survivorship. Joint tenancy creates a right of survivorship, so upon the death of one party, his or her share will pass on to the remaining joint tenant(s).

Community property with right of survivorship is a legal distinction that allows two spouses to equally share assets through marriage as well as pass on assets to the other spouse upon death without going through probate.

All the joint tenants have a single unified interest in the whole property. Joint tenancy must have an undivided interests in the entire property, and not divided interests in separate parts. A joint tenancy can be created by a Will or a Deed.

The main difference between joint tenants vs community property with right of survivorship lies in how the property is taxed after the death of a spouse. In joint tenant agreements, the proceeds from the sale of a property (after the death of a spouse) would be subject to the capital gains tax.

Joint Tenancy When a joint tenant dies, his or her interest in the property is terminated, and the estate continues in the survivor or survivors.

Joint tenants own equal shares in the property and received their interest at the same time, with the same deed. Tenants in common do not necessarily own equal shares of the property and may have come to own their shares at different times.

Property held in joint tenancy, tenancy by the entirety, or community property with right of survivorship automatically passes to the survivor when one of the original owners dies. Real estate, bank accounts, vehicles, and investments can all pass this way. No probate is necessary to transfer ownership of the property.

Community property with right of survivorship is a legal distinction that allows two spouses to equally share assets through marriage as well as pass on assets to the other spouse upon death without going through probate.