Travis Texas Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit)

Description

How to fill out Affidavit As To Heirship Of (Name Of Person), Deceased (With Corroborating Affidavit)?

How long does it usually take you to prepare a legal document? Since every state has its own laws and regulations for various aspects of life, locating a Travis Affidavit concerning Heirship of (Name of Person), Deceased (With Corroborating Affidavit) that meets all local requirements can be taxing, and obtaining it from a licensed attorney is frequently expensive.

Many online platforms provide the most widely used state-specific templates for download, but utilizing the US Legal Forms database is the most beneficial.

US Legal Forms is the most comprehensive online repository of templates, organized by states and areas of application. In addition to the Travis Affidavit regarding Heirship of (Name of Person), Deceased (With Corroborating Affidavit), you can discover any particular document to manage your business or personal affairs, conforming to your county's stipulations. Professionals verify all samples for their authenticity, ensuring that you can prepare your documentation accurately.

Change the file format if required. Click Download to save the Travis Affidavit concerning Heirship of (Name of Person), Deceased (With Corroborating Affidavit). Print the document or utilize any preferred online editor to fill it out electronically. Regardless of how many times you need to access the downloaded document, you can locate all files you have ever downloaded in your profile by visiting the My documents tab. Give it a try!

- If you already possess an account on the site and your subscription is active, you simply need to sign in, choose the required sample, and download it.

- You can select the document from your profile at any later time.

- If you are unfamiliar with the platform, some additional steps will be necessary before you can obtain your Travis Affidavit concerning Heirship of (Name of Person), Deceased (With Corroborating Affidavit).

- Review the content of the page you are currently on.

- Examine the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you are confident in your selected document.

- Choose the subscription plan that fits your needs best.

- Create an account on the platform or sign in to continue to payment options.

- Complete the payment via PayPal or using your credit card.

Form popularity

FAQ

Yes, an affidavit of heirship can be contested in Texas. If someone believes the information within the Travis Texas Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) is inaccurate, they can challenge it in court. It's crucial to gather supporting documentation if you plan to contest an affidavit and seeking legal advice may offer additional clarity.

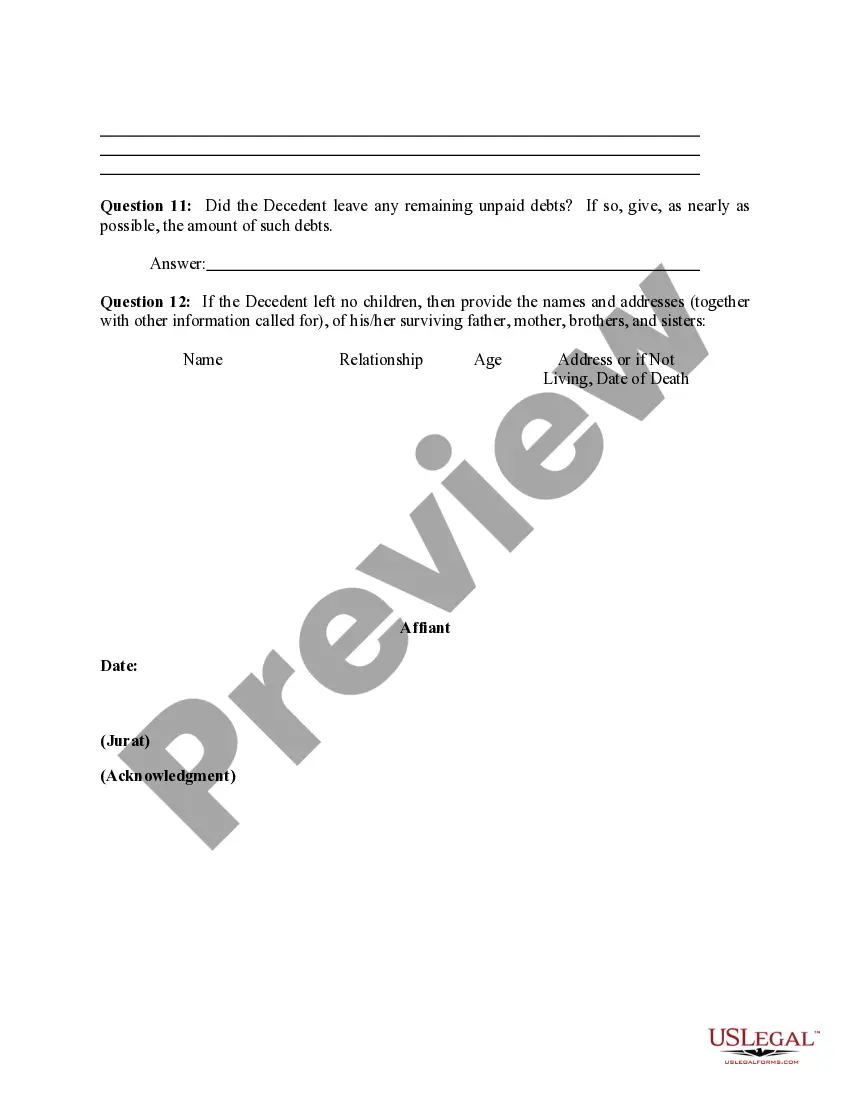

Where do you file an affidavit of heirship? An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

People who can file an application to determine heirship include the following: the personal representative of the estate, a creditor of the estate, a person claiming to be the owner of all or part of the decedent's estate, a party seeking the appointment of an independent administrator.

An Affidavit of Heirship is a sworn statement that identifies the heirs of a deceased property owner. Good to know: By Texas law, all property owned by the deceased passes to the Heirs at Law of the deceased unless there is a valid Will or other estate plan in place stating otherwise.

As joint tenants, each person owns the whole of the property with the other. If one co-owner dies, their interest in the property automatically passes to the surviving co-owner(s), whether or not they have a will. As tenants in common, co-owners own specific shares of the property.

Spouses in Texas Inheritance Law All community property will be left to your surviving spouse if all of your children are his or hers as well. But if one or more of your children are not from your surviving spouse, Texas will afford your community property to the children.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

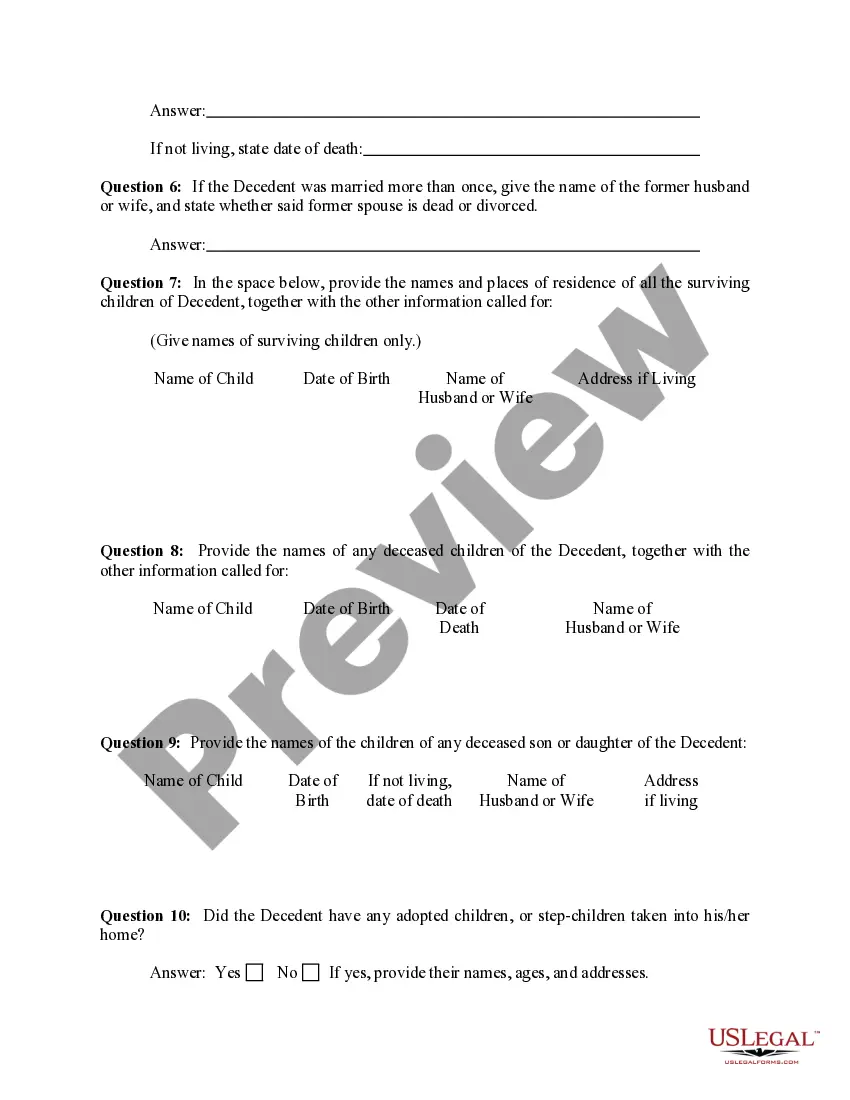

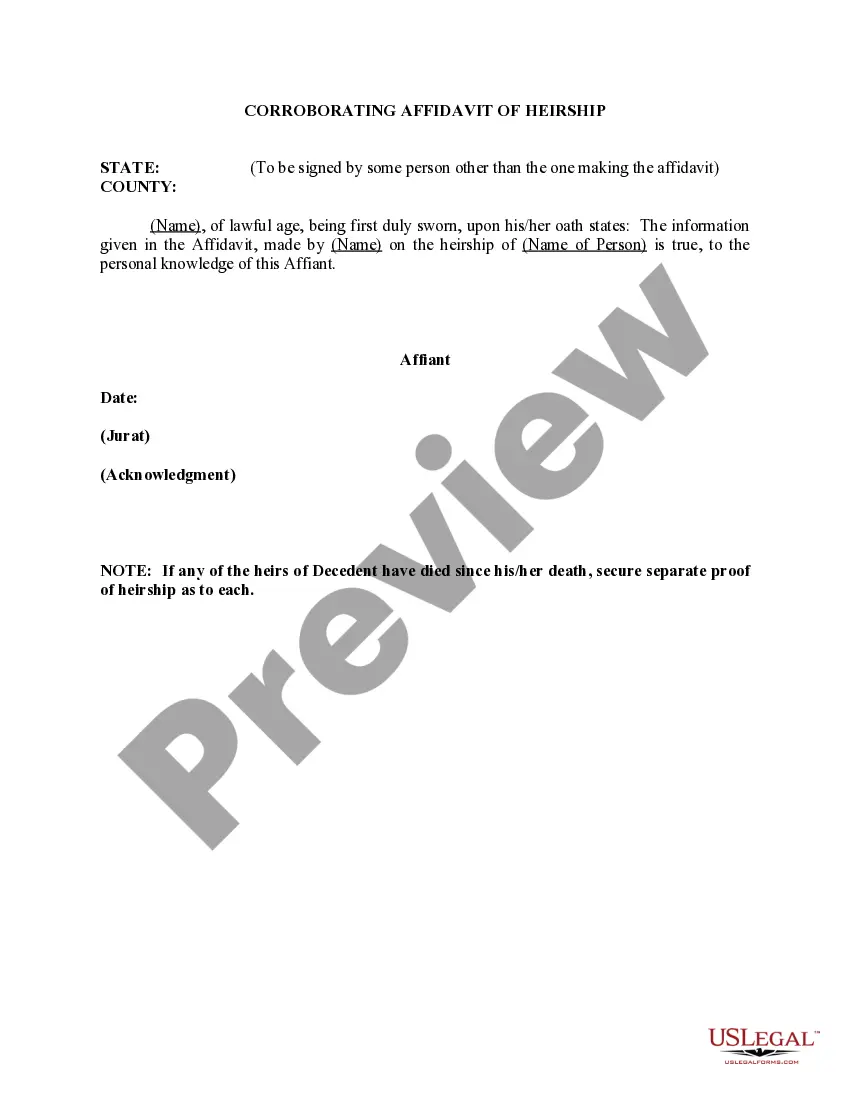

Two documents are recommended for the transfer of property after death without a Will. An Affidavit of Heirship. The Affidavit of Heirship is a sworn statement that identifies the heirs. It is signed in front of a notary by an heir and two witnesses knowledgeable about the family history of the deceased.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

An Affidavit of Heirship is a sworn statement that identifies the heirs of a deceased property owner. Good to know: By Texas law, all property owned by the deceased passes to the Heirs at Law of the deceased unless there is a valid Will or other estate plan in place stating otherwise.