Travis Texas Affidavit of Heirship for Real Property

Description

How to fill out Affidavit Of Heirship For Real Property?

Do you require to swiftly generate a legally-enforceable Travis Affidavit of Heirship for Real Property or perhaps any other document to manage your personal or business matters.

You can choose one of the two alternatives: reach out to an expert to prepare a valid document for you or draft it entirely by yourself.

First, verify if the Travis Affidavit of Heirship for Real Property is adapted to your state’s or county’s statutes.

If the document includes a description, ensure to check what it’s intended for.

- The positive news is, there’s another alternative - US Legal Forms.

- It will assist you in obtaining well-composed legal documents without incurring exorbitant fees for legal assistance.

- US Legal Forms provides an extensive array of over 85,000 state-specific form templates, including the Travis Affidavit of Heirship for Real Property and form bundles.

- We supply templates for a variety of use cases: from divorce paperwork to property documents.

- We've been in the industry for over 25 years and have maintained an impeccable reputation among our clients.

- Here’s how you can join them and obtain the needed template without hassle.

Form popularity

FAQ

An Affidavit of Heirship is a sworn statement that identifies the heirs of a deceased property owner. Good to know: By Texas law, all property owned by the deceased passes to the Heirs at Law of the deceased unless there is a valid Will or other estate plan in place stating otherwise.

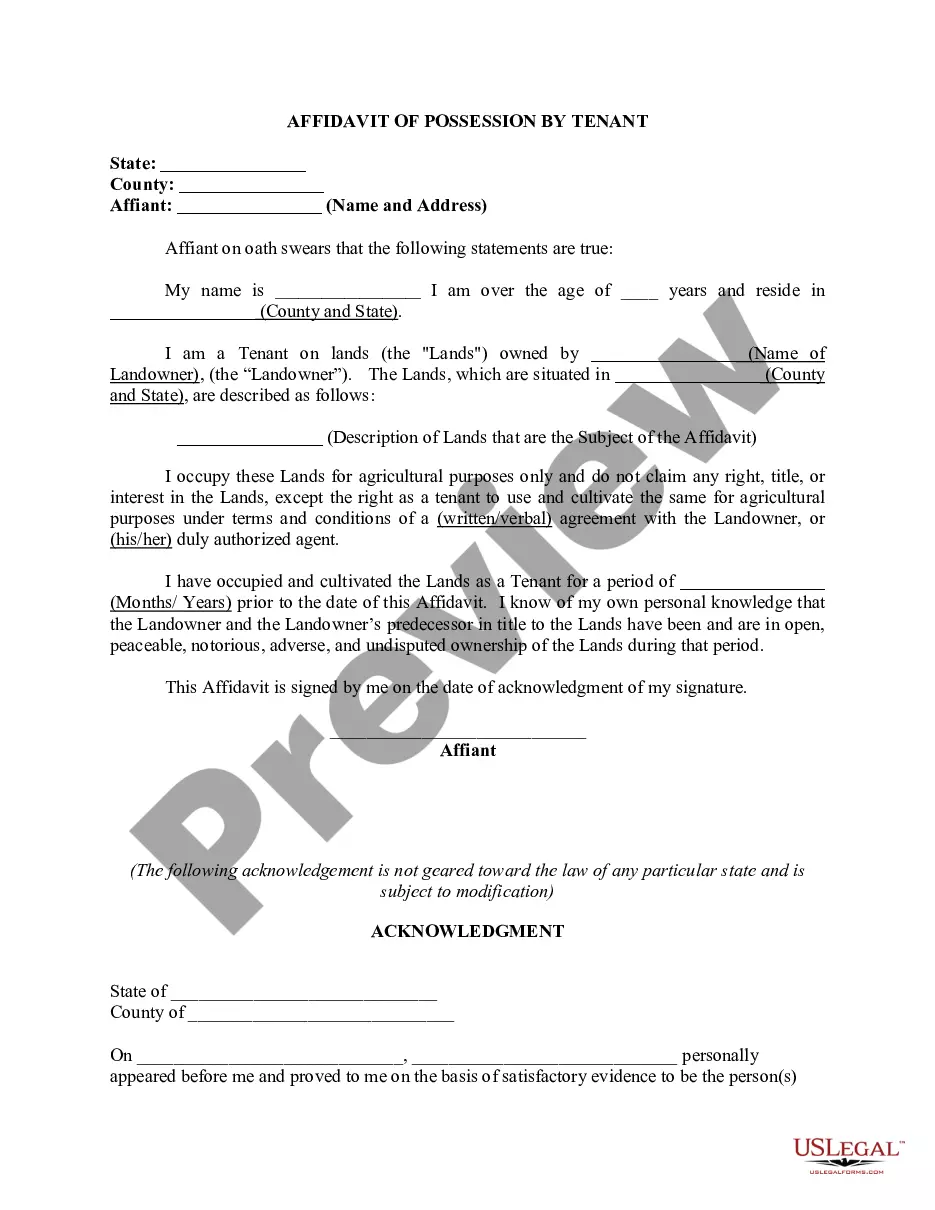

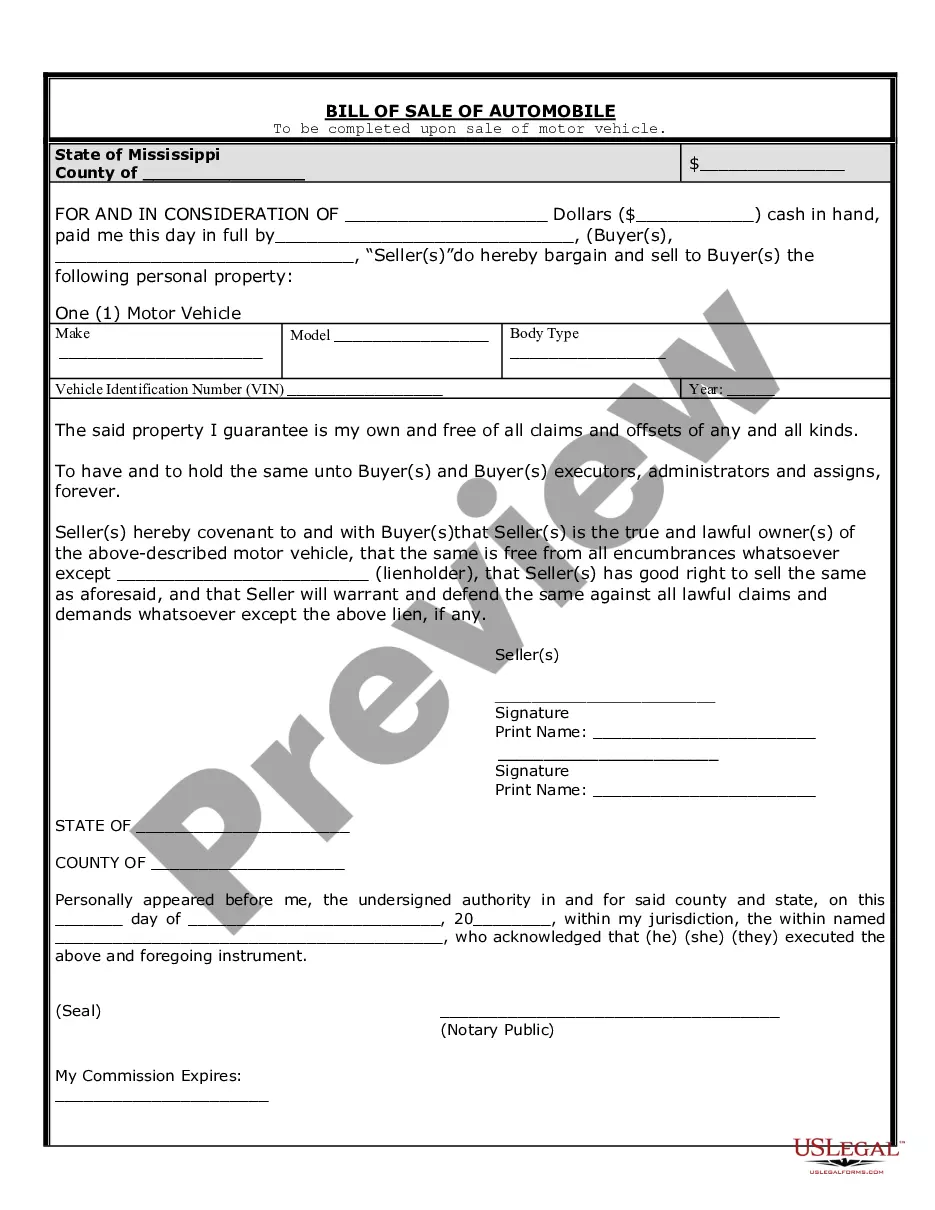

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

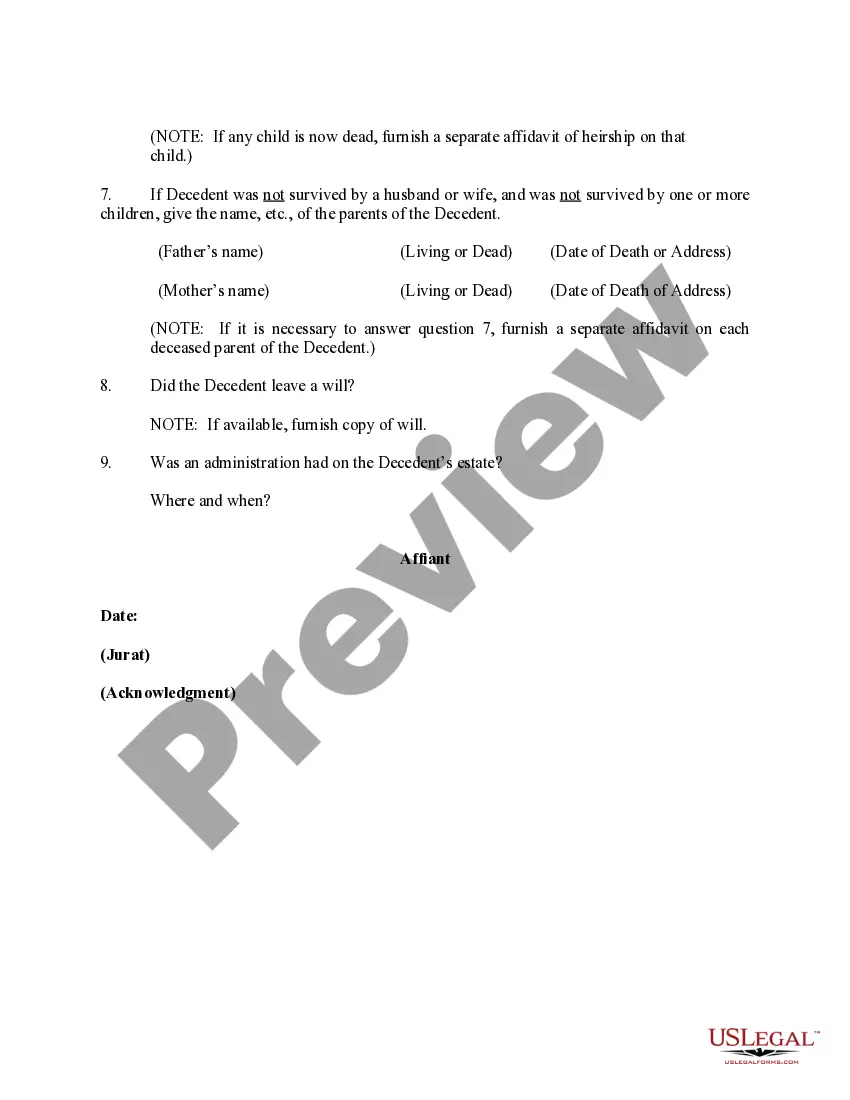

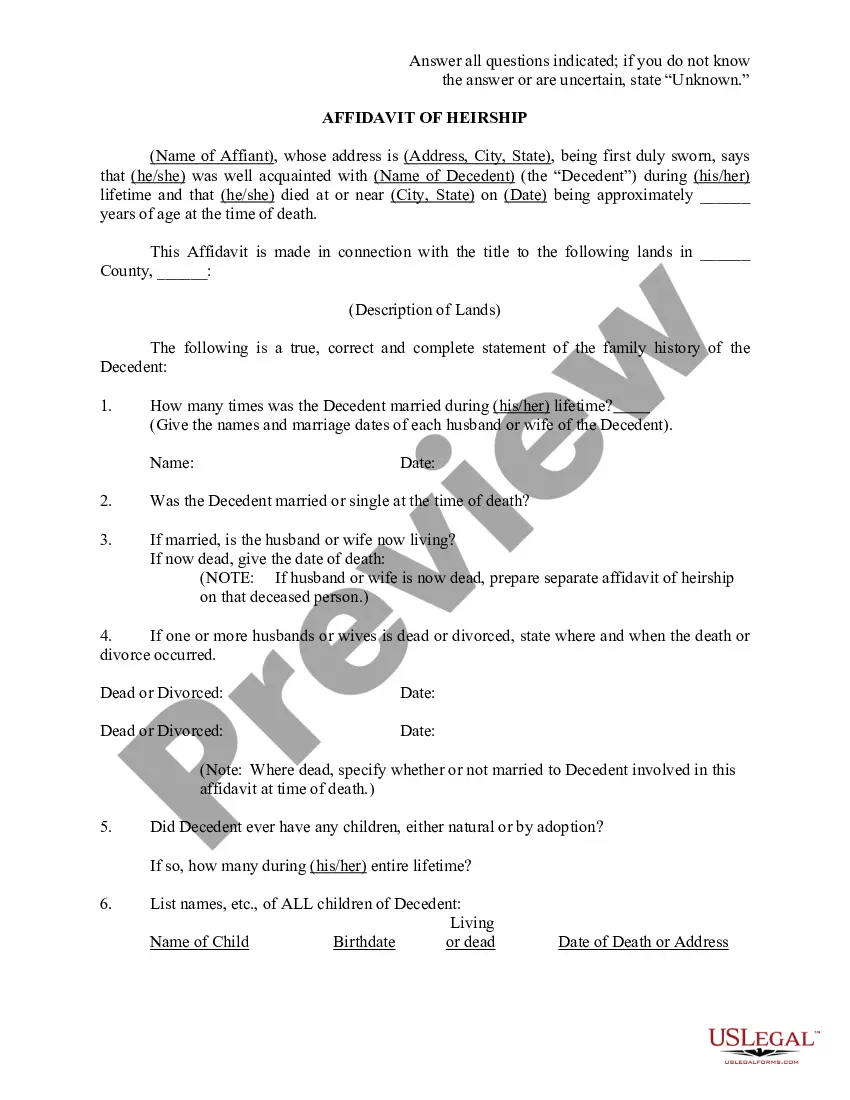

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

However, Texas Estates Code 203.001 says it becomes evidence about the property once it has been on file for five years. The legal effect of the affidavit of heirship is that it creates a clean chain of title transfer to the decedent's heirs.

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.

An affidavit of heirship can be used when someone dies without a will, and the estate consists mostly of real property titled in the deceased's name. It is an affidavit used to identify the heirs to real property when the deceased died without a will (that is, intestate).

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

Where do you file an affidavit of heirship? An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.