Travis Texas Affidavit of Heirship - Descent

Description

How to fill out Affidavit Of Heirship - Descent?

Are you searching to swiftly generate a legally-binding Travis Affidavit of Heirship - Descent or perhaps another document to manage your personal or business matters? You can choose between two alternatives: engage a legal professional to compose a legitimate document for you or construct it entirely on your own.

The excellent news is that there’s an alternative option - US Legal Forms. It will assist you in obtaining well-composed legal documents without incurring exorbitant charges for legal assistance.

If the document isn’t what you anticipated, start the search again using the search box in the header.

Select the plan that best fits your requirements and proceed to the payment. Choose the file format you prefer for your form and download it. Print it out, fill it in, and sign on the designated line. If you have already created an account, you can simply Log In to find the Travis Affidavit of Heirship - Descent template and download it. To re-download the form, navigate to the My documents tab. Using our services makes it easy to find and download legal forms. Additionally, the templates we supply are updated by legal professionals, which provides you with more assurance when handling legal matters. Experience US Legal Forms now and witness the difference!

- US Legal Forms offers an extensive collection of over 85,000 state-compliant form templates, including Travis Affidavit of Heirship - Descent and related document packages.

- We provide documents for a variety of life situations: from divorce papers to real estate document templates.

- We have been operating in the market for more than 25 years and have established a strong reputation among our clients.

- Here’s how you can join them and acquire the essential template without any hassle.

- First and foremost, verify if the Travis Affidavit of Heirship - Descent conforms to your state’s or county’s regulations.

- If the form includes a description, ensure you check its applicability.

Form popularity

FAQ

In Texas, transferring property after a parent's death without a will involves filing a Travis Texas Affidavit of Heirship - Descent. This legal document helps identify the heirs and grants them the right to the property. To simplify this process, using tools like uslegalforms can help ensure all necessary steps and legal requirements are met effectively.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

If the deceased doesn't leave a will (intestate proceeding), the estate will have no free portion and will be divided equally among the surviving spouse and legitimate children. If there are illegitimate children, they are entitled to the equivalent of ½ the share of the legitimate children.

(b) Except as provided by Subsection (c), in a proceeding to declare heirship, testimony regarding a decedent's heirs and family history must be taken from two disinterested and credible witnesses in open court, by deposition in accordance with Section 51.203, or in accordance with the Texas Rules of Civil Procedure.

Where do you file an affidavit of heirship? An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

How Much Does It Cost To Get A Small Estate Affidavit In Texas? Each county has its own filing fee schedule, so court costs can vary. If you prepare the document on your own, you should expect to pay between $250 and $400.00 in fees.

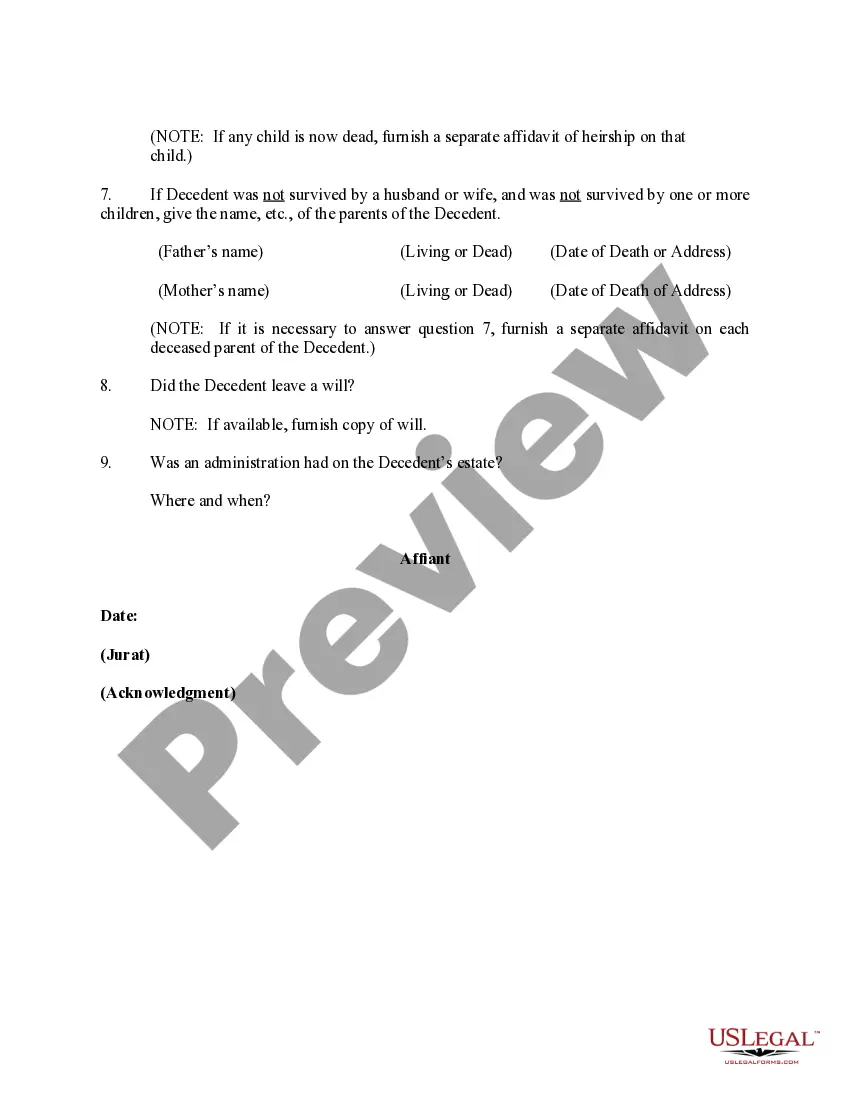

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.