Allegheny Pennsylvania Due Diligence Document Request

Description

How to fill out Due Diligence Document Request?

Drafting legal paperwork can be challenging.

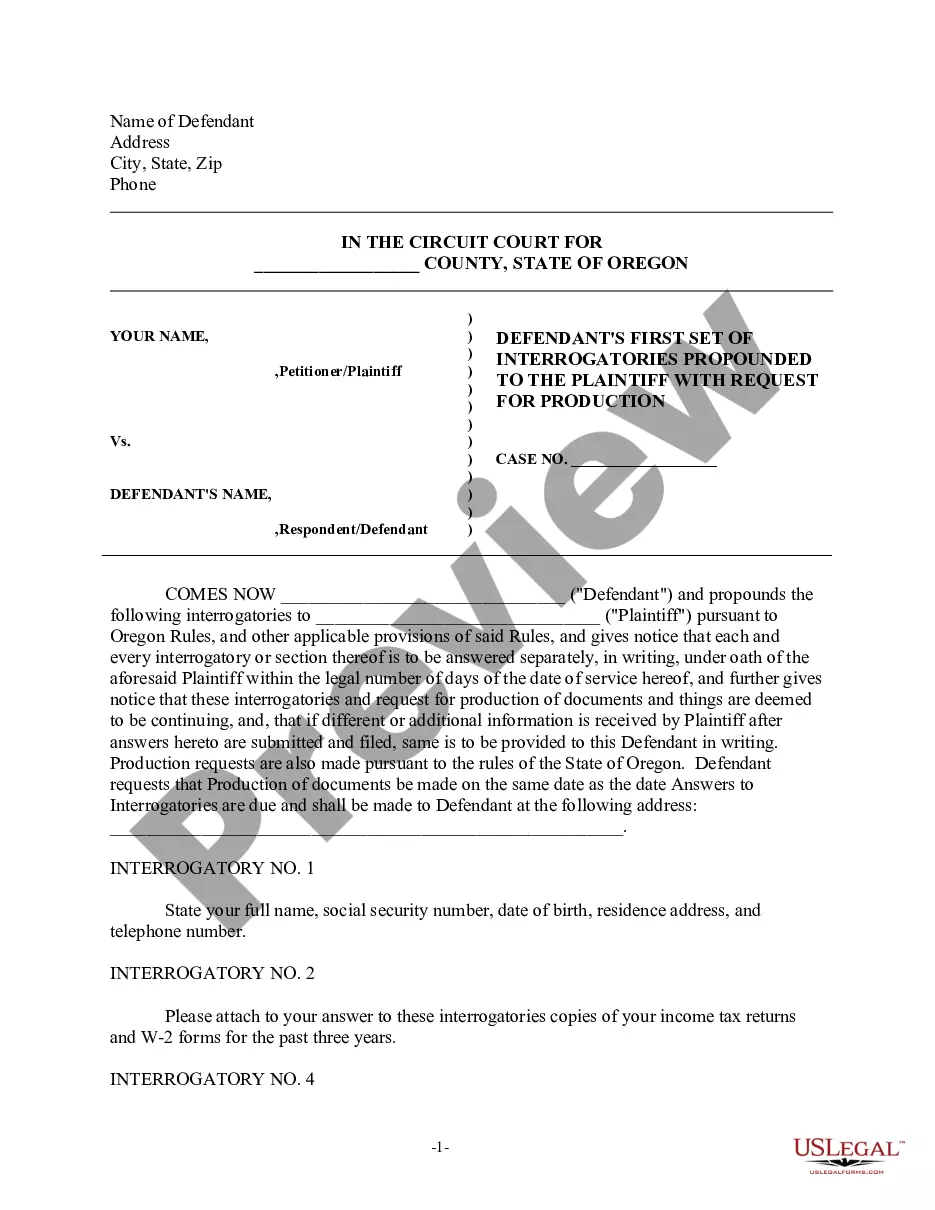

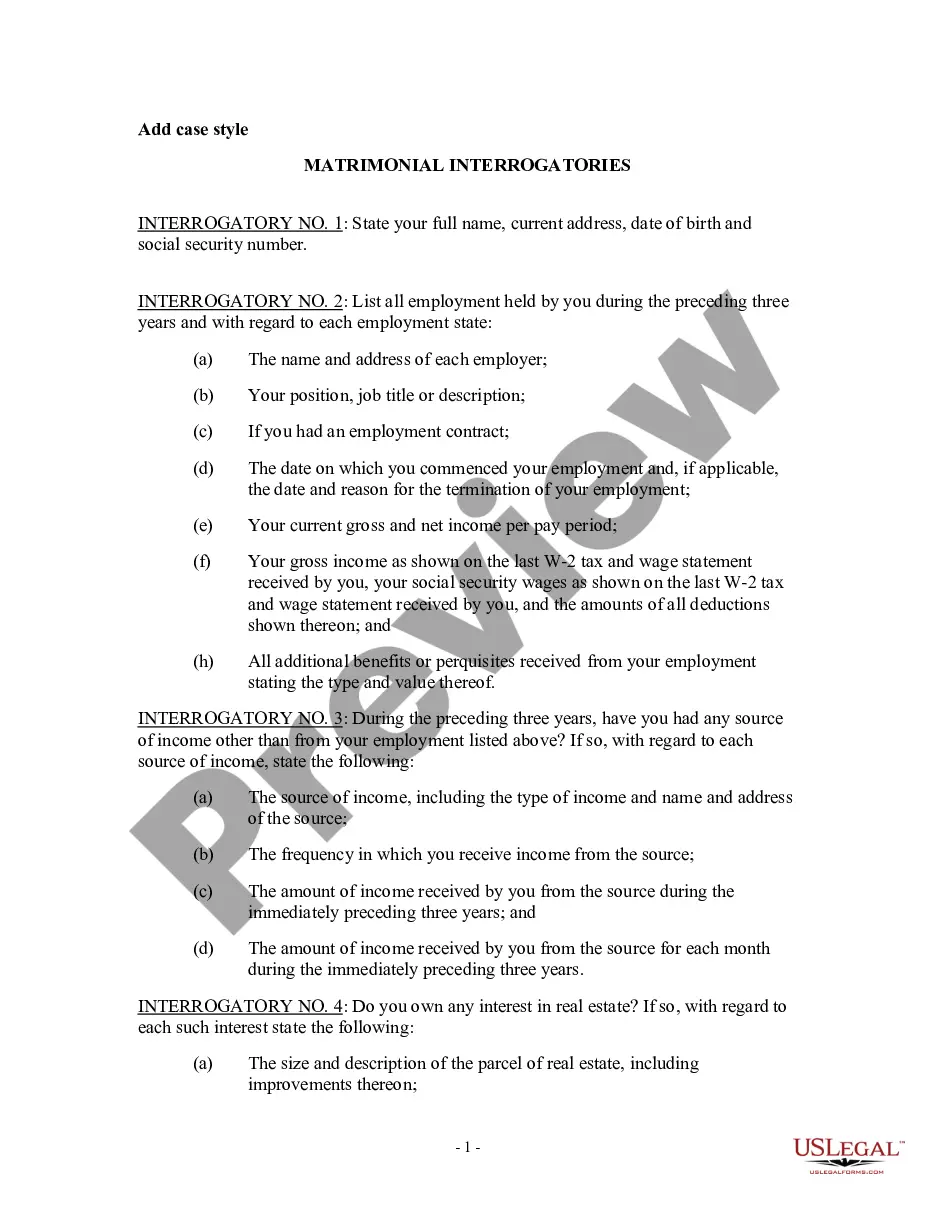

Moreover, if you choose to hire a legal expert to create a business contract, documents for property transfer, pre-marital contract, divorce documentation, or the Allegheny Due Diligence Document Request, it might end up costing you significantly.

Review the form description and use the Preview option if available, to confirm it’s the form you need.

- So what is the most sensible approach to conserve time and resources while producing legitimate documents that fully comply with your state and local laws.

- US Legal Forms is an excellent option, whether you're in search of templates for personal or commercial applications.

- US Legal Forms is the largest online repository of state-specific legal forms, offering users the latest and professionally verified documents for any scenario collected in one location.

- Thus, if you require the most current version of the Allegheny Due Diligence Document Request, you can effortlessly find it on our platform.

- Acquiring the documents takes minimal time. Those with existing accounts should confirm their subscription is active, Log In, and select the template using the Download button.

- If you haven't signed up yet, here’s how you can obtain the Allegheny Due Diligence Document Request.

- Browse the page and check for a sample available in your region.

Form popularity

FAQ

The Company shall have completed its due diligence review of Buyer and Buyer's business, including, but not limited to, with respect to all business and legal matters, to the satisfaction of the Company in its sole discretion.

The complete list of due diligence documents to be collected Shareholder certificate documents. Local/state/federal business licenses. Occupational license. Building permits documents. Zonal and land use permits. Tax registration documents. Power of attorney documents. Previous or outstanding legal cases.

Due Diligence Examples A business exhaustively examining another to determine whether it is a sound investment prior to initiating a merger. Consumers reading reviews online prior to purchasing an item or service. People checking their bank accounts and credit cards frequently to ensure that there is no unusual

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property and the board of directors.

When writing a due diligence report (what others may call an IT assessment report), keep four things in mind: Write for the target audience. Focus on the report objectives. Limit the report to information that has material impact to your company. Structure the information to be used as valuable reference material later.

A due diligence checklist is an organized way to analyze a company. The checklist will include all the areas to be analyzed, such as ownership and organization, assets and operations, the financial ratios, shareholder value, processes and policies, future growth potential, management, and human resources.

Due diligence helps investors and companies understand the nature of a deal, the risks involved, and whether the deal fits with their portfolio. Essentially, undergoing due diligence is like doing homework on a potential deal and is essential to informed investment decisions.

Due diligence is defined as an investigation of a potential investment (such as a stock) or product to confirm all facts. These facts can include such items as reviewing all financial records, past company performance, plus anything else deemed material.

Due Diligence Process Steps, Policies and Procedures Evaluate Goals of the Project. As with any project, the first step delineating corporate goals.Analyze of Business Financials.Thorough Inspection of Documents.Business Plan and Model Analysis.Final Offering Formation.Risk Management.

Sample Due Diligence Request List Formation documents and operating agreements. Detailed ownership information and member register. Details of any other investment or ownership interest in any other entity held by the company.