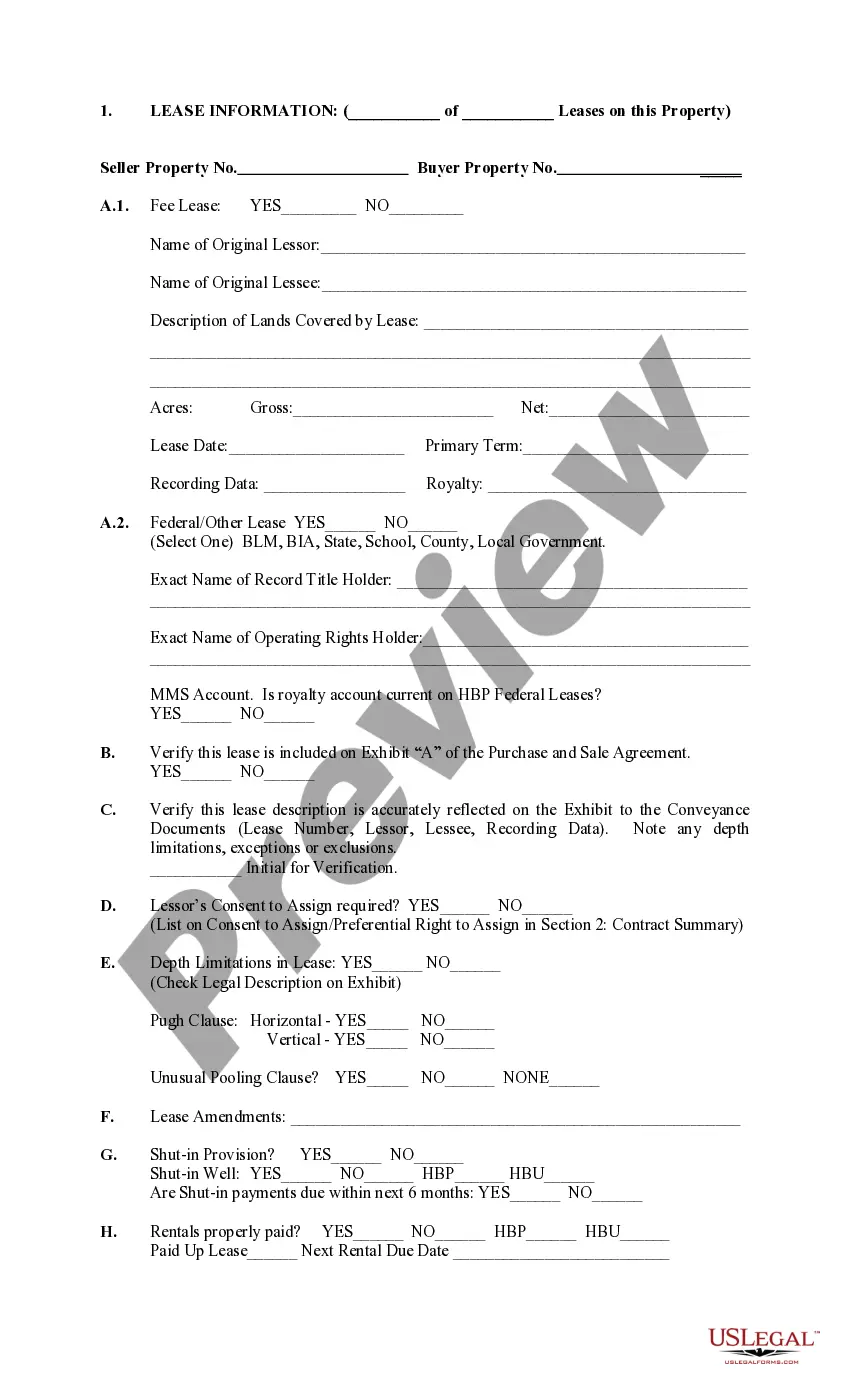

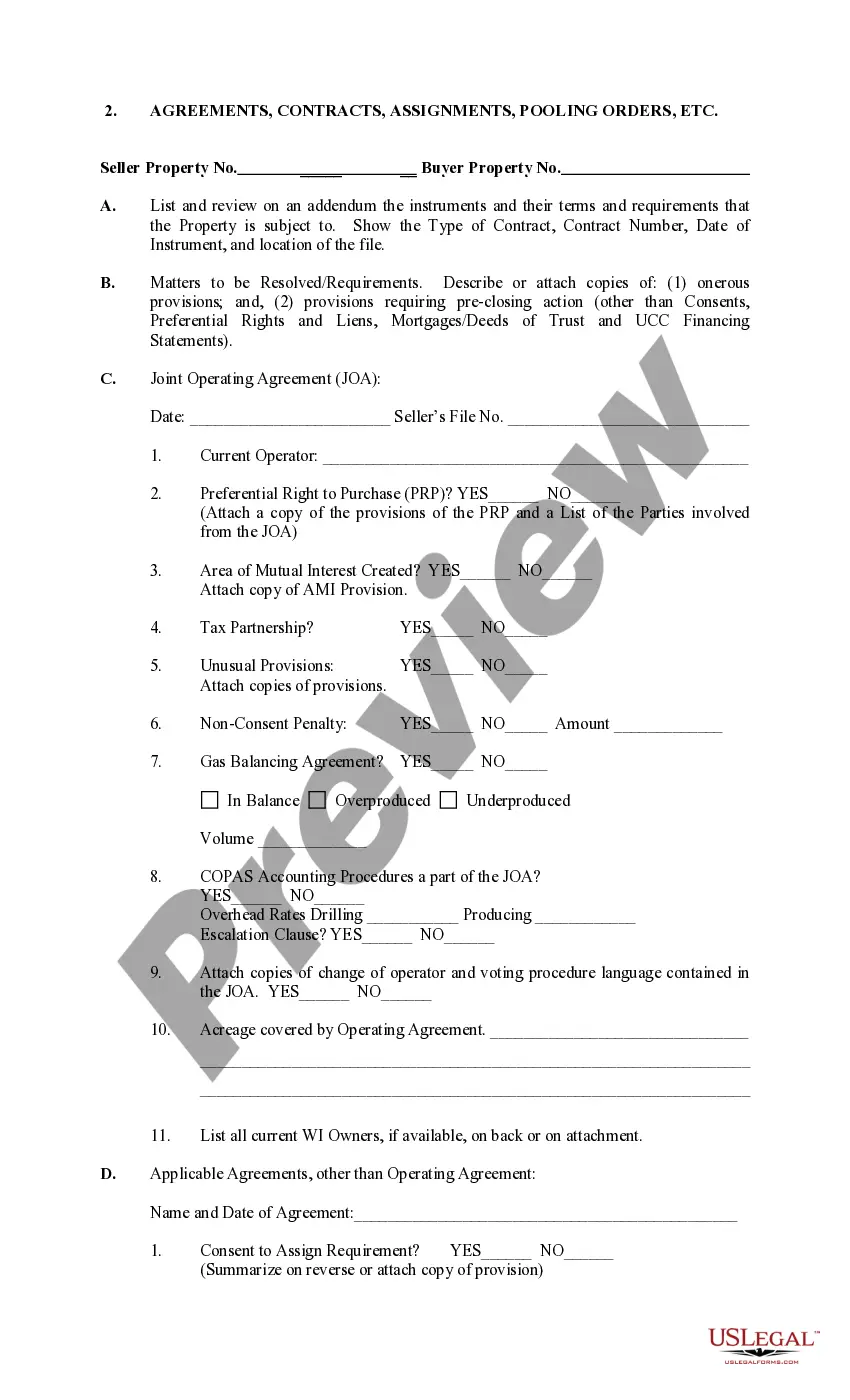

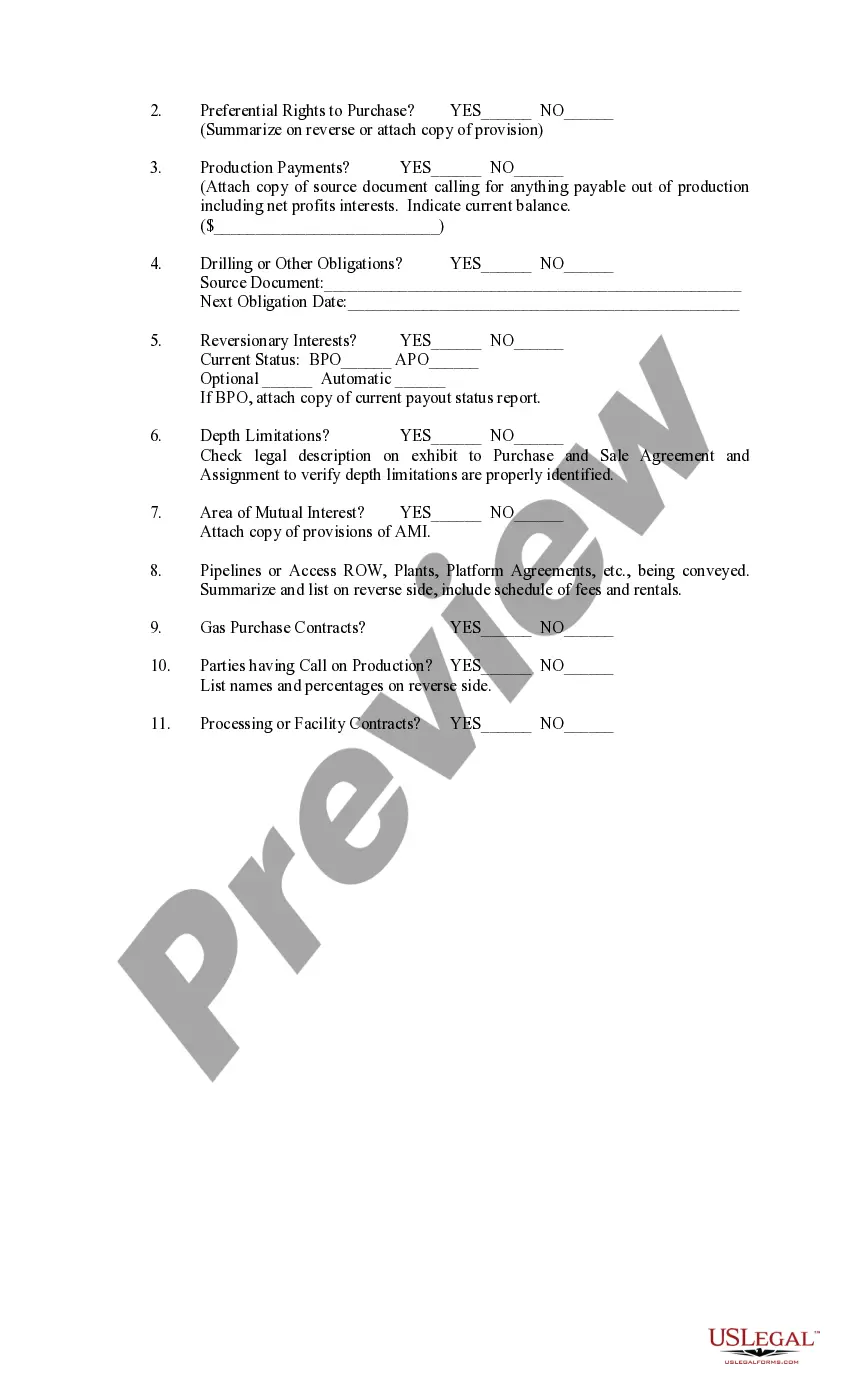

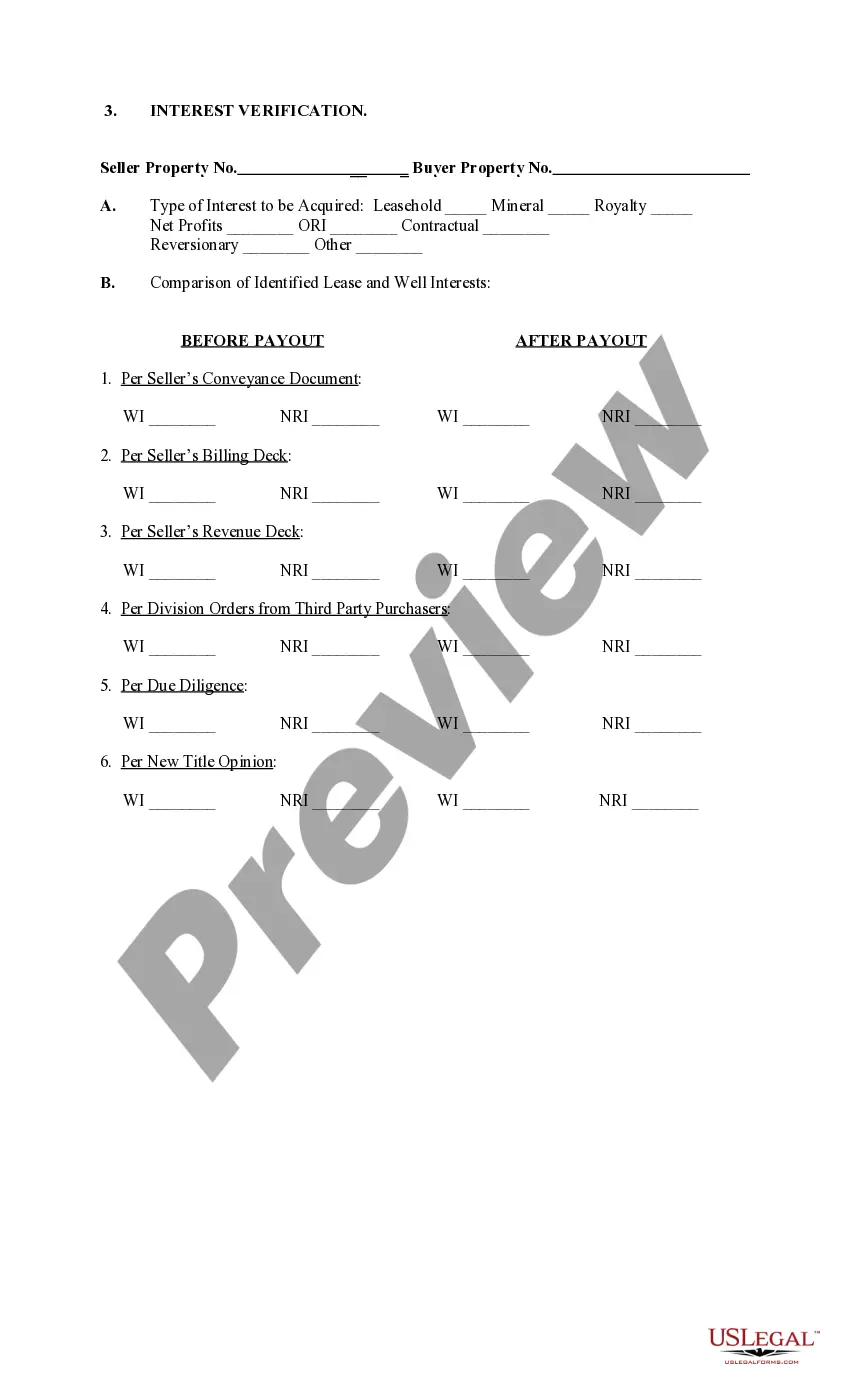

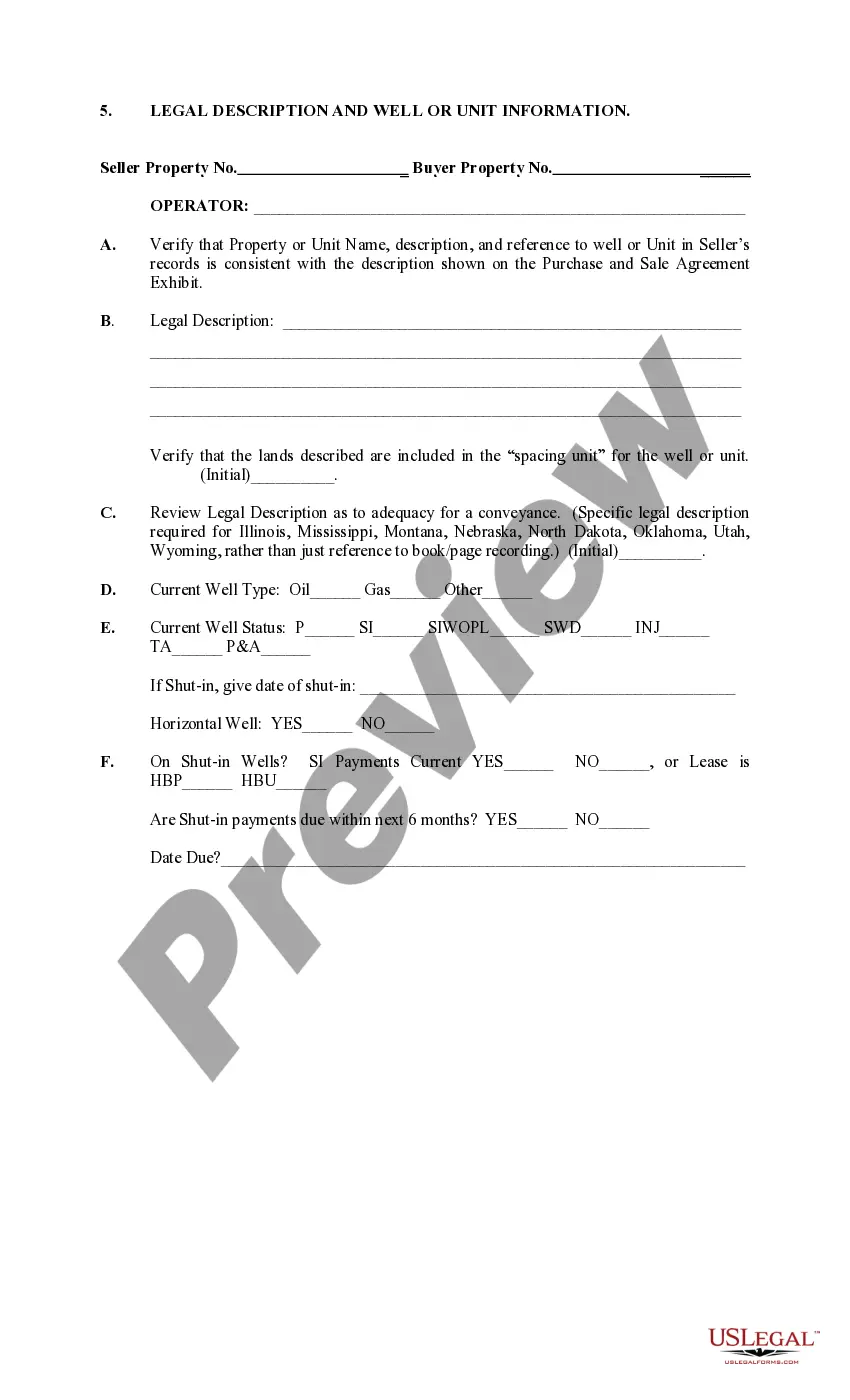

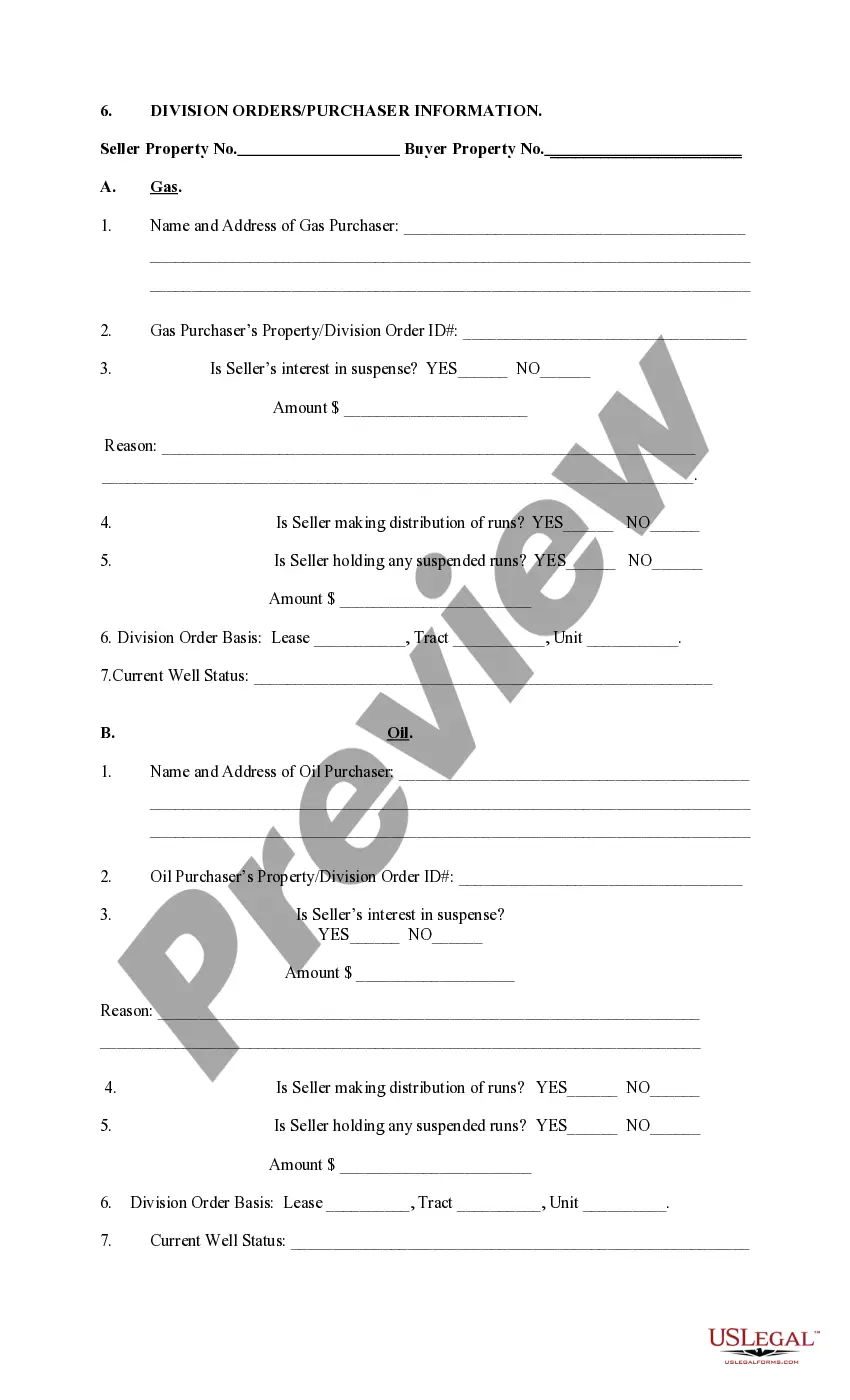

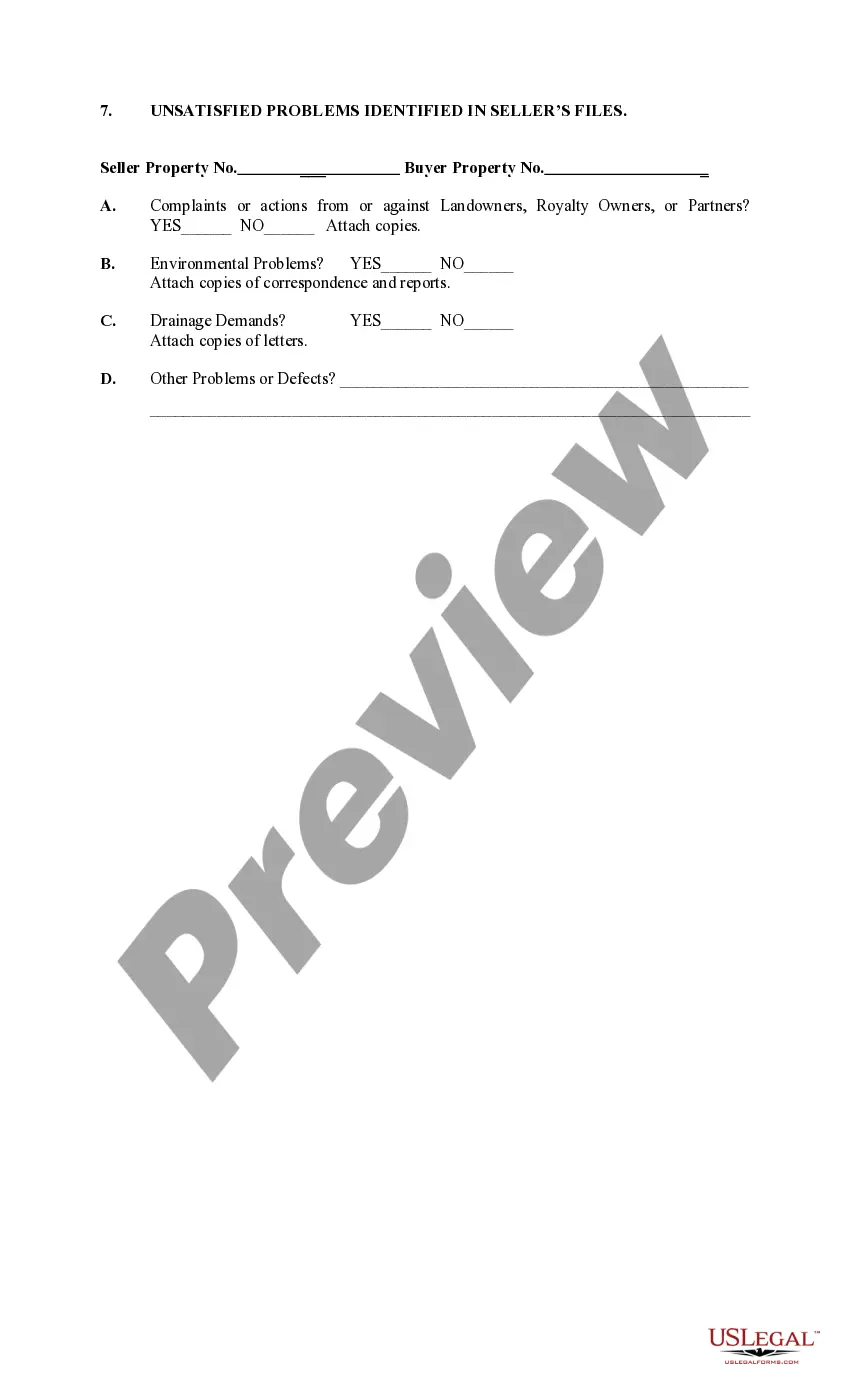

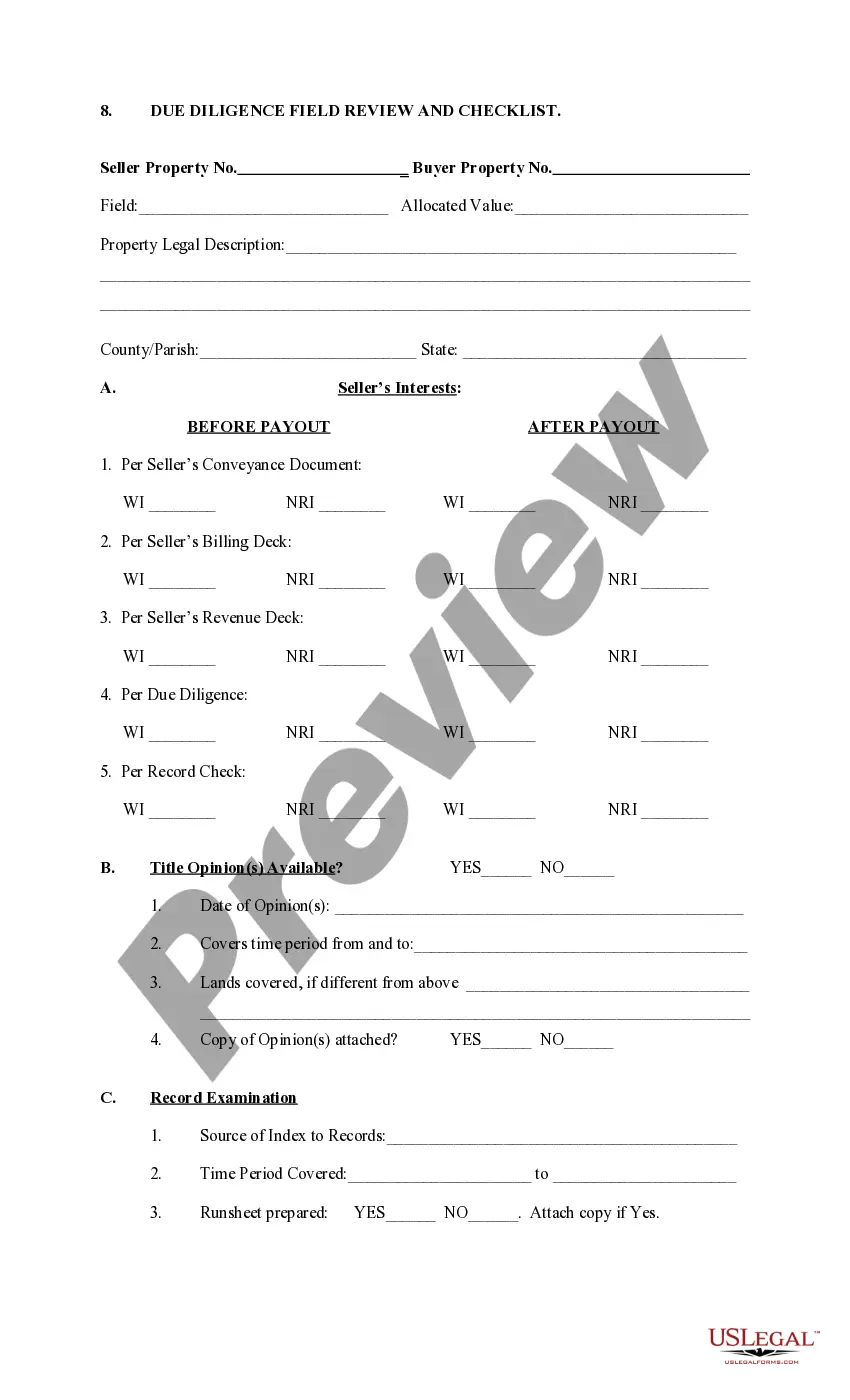

Allegheny Pennsylvania Due Diligence Review Form

Description

How to fill out Due Diligence Review Form?

A document workflow always accompanies any legal endeavor you undertake.

Establishing a business, applying for or accepting a job position, transferring ownership, and numerous other life circumstances necessitate you to prepare official paperwork that differs from state to state.

This is why having everything gathered in a single location is extremely advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

This is the simplest and most reliable method to obtain legal documents. All the templates offered by our library are professionally prepared and verified for compliance with local laws and regulations. Organize your paperwork and manage your legal matters accurately with US Legal Forms!

- On this platform, you can effortlessly find and acquire a document for any personal or business purpose applicable in your area, including the Allegheny Due Diligence Review Form.

- Finding forms on the platform is exceptionally simple.

- If you already have a subscription to our library, Log In to your account, search for the sample in the search bar, and click Download to save it to your device.

- After that, the Allegheny Due Diligence Review Form will be available for future use in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, follow this straightforward guideline to obtain the Allegheny Due Diligence Review Form.

- Ensure you have navigated to the correct page with your specific form.

- Utilize the Preview feature (if accessible) and review the sample.

Form popularity

FAQ

Form 8867 must be completed by a paid tax return preparer responsible for a taxpayer's claim of the EIC, the CTC/ACTC/ODC, the AOTC, and/or HOH filing status; therefore, there may be multiple Forms 8867 for one return or amended return.

You can pay your Pennsylvania Taxes over the Internet by choosing the type of payment you are making below: Alternative Fuel Tax - Return Payment. Corporate Tax - Estimated Payment. Corporate Tax - Extension Payment.

Form 8867 - Paid Preparer's Due Diligence Checklist interview the client, ask adequate questions, obtain appropriate and sufficient information to determine the correct reporting of income, claiming of tax benefits (such as deductions and credits), and compliance with the tax laws.

Property taxes are administered at the county level in Pennsylvania. In every county, the sum of local tax rates (school taxes, municipal taxes and county taxes) is applied to the assessed value of each property. However, each county has its own system for determining assessed value.

It is time for a reassessment in Allegheny County, and also time to mandate that reassessments occur periodically (every three (3) years) to ensure that everyone is treated the same with regards to their property taxes.

Real Estate Tax is tax collected by the City WHO IS TAXED: All owners of real estate located within the City and School District. The market value of the property is determined by the Allegheny County Office of Property Assessment. The taxes are calculated by applying the millage rate to the assessed value.

Billing: 4 asy steps to subscribe Step 1 Search for your property. You can search by entering your address or parcel ID (lot/block). Step 2 Click eBill/ePay tab. This is the third tab called TAX INFO eBILL / ePAY. Step 3 Click to Subscribe.Step 4 Complete the form.

A property's assessed value is calculated by multiplying it's market value by the county's predetermined ratio. Beginning with the 2001 fiscal year, Allegheny County's Office of Property Assessments has applied a predetermined ratio of 100%.

Pay Your Local Tax Office By check or money order sent through the mail. Online using a credit or debit card. Online using an electronic check payment (eCheck) By telephone using a credit or debit card.

A property's assessed value is calculated by multiplying it's market value by the county's predetermined ratio. Beginning with the 2001 fiscal year, Allegheny County's Office of Property Assessments has applied a predetermined ratio of 100%.